Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In the bustling digital landscape of Kenya, the spread of loan apps has changed access to credit for millions of individuals and businesses across the country.

These loan apps in Kenya have become integral tools in addressing various financial needs, offering swift and convenient solutions at the touch of a screen.

In this article, we’ll be reviewing the top 20 loan apps in Kenya in 2025, shedding light on their features, benefits, and their Eligibility Criteria.

Loan apps in Kenya are mobile applications designed to facilitate the borrowing of money directly from one’s smartphone or mobile device.

These apps use technology to streamline the loan application, approval, and disbursement processes, making it convenient for users to access credit anytime, anywhere.

Users can apply for loans through these apps by providing basic personal information and consenting to data access for credit assessment purposes.

Loan amounts, interest rates, and repayment terms vary among different apps, catering to various financial needs and preferences.

Many loan apps in Kenya also offer features such as flexible repayment schedules, instant loan approvals, and low or no collateral requirements, making them popular among individuals and small businesses seeking quick and accessible financing solutions.

These instant loan apps or fast loan apps are getting more common in Kenya, especially during urgent situations. Safaricom’s M-pesa stands out as the pioneer of mobile money transfer and loan services in the country.

Its success has encouraged Kenyan banks and other financial entities to develop their own instant mobile lending apps, with some even forming partnerships with them.

A recent study conducted by Enwealth Financial Services and the Strathmore University Social Security Study Group revealed that only about 24% of Kenyans set aside savings for emergencies. The majority of individuals rely on alternative financial institutions for such needs.

Below are some of the top-rated and most trustworthy loan apps available in Kenya.

These apps provide a dependable means of accessing quick cash through M-Pesa without exorbitant borrowing costs or stringent credit score checks.

These selections for money lending apps were curated considering customer feedback, accessibility of loans, customer service quality, interest rates, and transparency in lending practices.

In April 2020, M-pesa Africa began its operations in seven countries, including Kenya through Safaricom.

The M-pesa app by Safaricom is widely used in Kenya for mobile loans. Mshwari is a mobile banking service that offers both savings and credit facilities.

M-Shwari loans range from Ksh. 1,000 to Ksh. 1 million and are exclusively available to Safaricom customers with a registered line.

The maximum loan amount you can get depends on your credit history. The interest rate for these loans is 9% annually, along with a one-time fee of 7.5% and an additional 1.5% excise duty levy.

On the other hand, Mshwari provides fair interest rates for deposits. It offers 3% yearly interest for deposits ranging from Ksh. 1 to Ksh. 20,000, 5% for deposits between Ksh. 20,000 and Ksh. 50,000, and 6% for deposits exceeding Ksh. 50,000.

Read also:Vooma Loan: How to Apply

M-Shwari loans work a bit differently compared to Safaricom’s Fuliza service. Fuliza is mainly for borrowing money instantly, while M-Shwari provides both saving and borrowing options.

With Fuliza, you have to pay back what you borrow within 30 days from when you get the money.

Also, there are extra charges like interest and fees that get taken from your M-Pesa account when you use Fuliza.

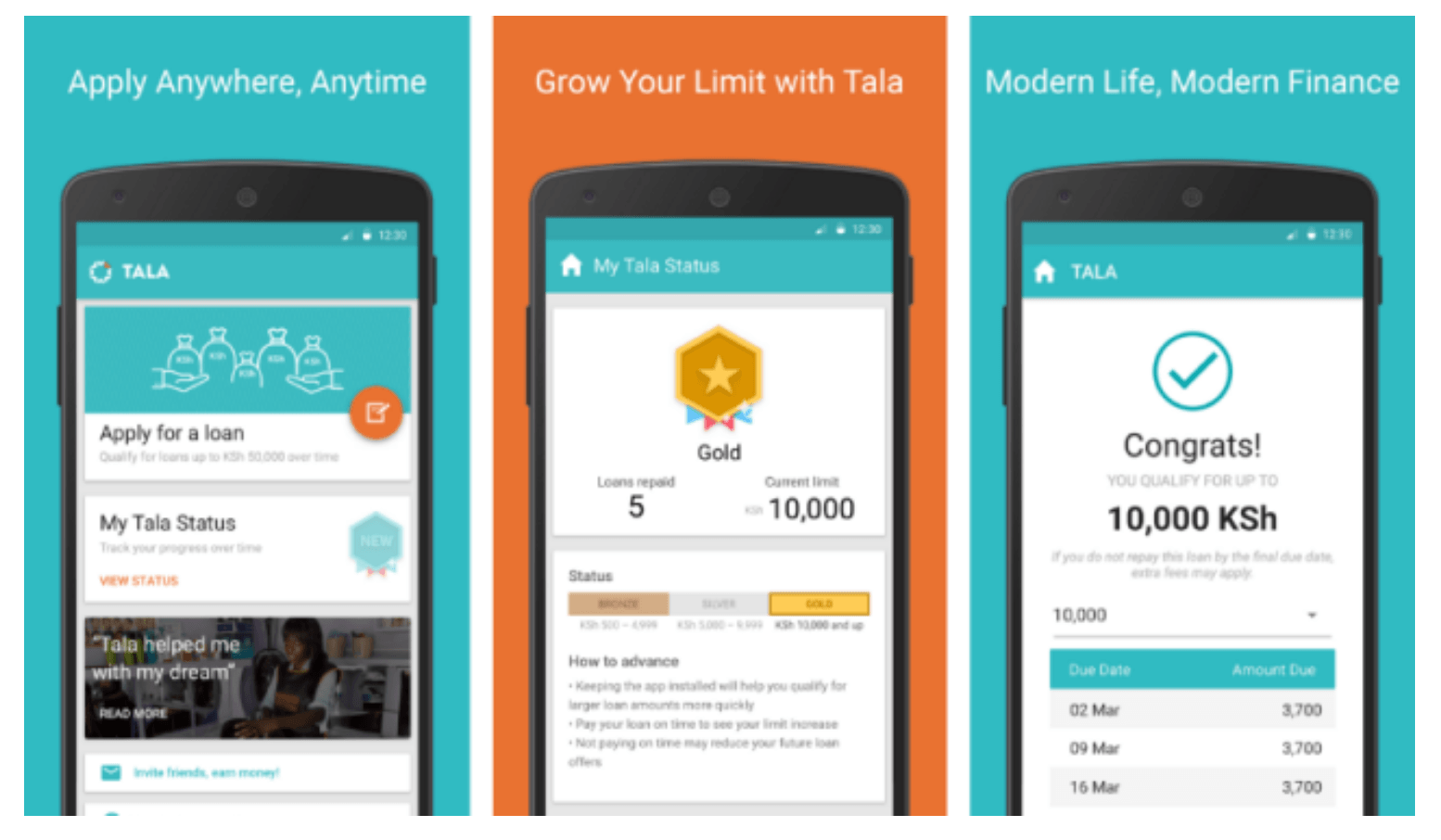

Tala stands out as one of the top loan apps in Kenya that doesn’t rely on credit history. People really like it and download it a lot, giving it great ratings. You can borrow up to KSH 50,000 whenever you need it once you’re approved.

Getting started on the app is also easy. Simply go to the Google Play Store and download the Tala app. Sign up, and the app will check your details before sending the money to your M-Pesa account.

When it’s time to pay back, you can do it all at once or bit by bit using Mpesa Xpress or Pay bill 851900.

Read also:Sprints, Egyptian Based Edtech Startup, Set to Move into 10 New Markets, Secures $3 Million Fund

KCB M-Pesa is one of the top loan apps in kenya and is now super easy for registered M-Pesa users to use.

You don’t even need to fuss with downloading or installing anything – it’s already there on your phone this is as a result of its partnership with M-pesa.

Getting a loan is a piece of cake. Just tap on the KCB Mpesa button in the loans and savings section and type in how much you need. No need for any extra sign-ups or giving out personal info.

When you get a loan through KCB M-Pesa, the money flows straight into your M-Pesa account, making it one of the top choices for online M-Pesa loans in Kenya.

If you’re within your loan limit, you can ask for loans through the KCB app or Safaricom’s M-pesa platform more than once a day.

But remember, you need a Safaricom sim card to get KCB M-Pesa loans. Just look into your phone’s SIM toolkit and open up the M-Pesa menu to borrow money or use the loans via the M-Pesa or KCB mobile apps.

Branch International created the Branch loan app. This app is amongst the top loan apps in Kenya and uses technology to understand if you can pay back money you borrow and give loans specifically for you.

With this app, you can borrow as little as Ksh500 and up to Ksh.30,000. You don’t have to fill out lots of forms to get a loan.

Instead, Branch accesses how you use your phone and your data to see how you handle money. This helps more people get loans, even if they haven’t borrowed before.

Besides giving out loans, Branch also helps with saving and budgeting. It has savings plans called Flexi Savings and Target Savings, which give you interest rates of 9% and 15% every year, respectively.

Branch is like a bank on your phone where you can borrow money easily. The Branch loan app is great for paying for fixing your car, improving your home, or medical bills. T

he interest rate is low, starting from 1.7%, but it can change based on how you repay your loans. And you can choose to pay back the loan in a flexible time frame of 9 to 52 weeks, depending on how much you borrowed.

Read also:How to Get Safaricom Faraja Loan

Absa Bank Kenya Plc, previously known as Barclays Bank Kenya Limited, offers a mobile banking service called Timiza.

This service lets you borrow money instantly, transfer funds, and buy insurance using your mobile phone. It is also one of the fast loan apps in kenya.

Even if you don’t have access to the Timiza app, you can still register and apply for loans by dialing *848#.

Unlike other loan apps, Timiza not only provides loans of up to Ksh 150,000 to people with bad credit but also allows you to pay bills, purchase insurance, and top up your airtime.

The loans from Timiza come with a monthly interest rate of 1.56%, a 5% origination charge, and a repayment period of 30 days. If you miss loan repayments, your loan term will be extended by one month, but you’ll be charged a 5% fee based on your remaining debt.

The iPesa loan app lets you borrow money from as little as Ksh. 500 to as much as Ksh. 50,000 with no extra fees. You have between 91 to 180 days to pay it back, with an interest rate ranging from 36% to 72% per year with no extra fee when you get the money.

All you need to do is download the iPesa app, sign up with your M-Pesa number, and ask for a loan. If you pay back on time, you can increase your borrowing limit to Ksh. 50,000.

iPesa is also a fast way for Kenyans to get money quickly without having to deal with CRB approval hence one of the top loan apps in Kenya.

To qualify for an iPesa loan, you need to be at least 18 years old and have an active M-Pesa account.

The application process is easy and fast, and you’ll know right away whether your request is accepted or not. iPesa makes it simple for people in Kenya to get money for personal or business needs.

Read also:Top 15 Mobile Loan Apps in Kenya For Instant Loan

Zenka offers a fast loan that you can get within 61 days by paying a one-time fee, which can be between 9 to 30%. With Zenka, you can borrow anywhere between Ksh. 500 to Ksh. 20,000, which is handy for different money needs you might have.

Another cool thing about Zenka is its Flexi option. If you’ve been good at paying back your loans on time and have a good credit history, you can extend your loan repayment period for up to 12 months.

Lots of people in Kenya use the Zenka app to get loans sent directly to their M-Pesa accounts. And guess what? Your first loan through Zenka is completely interest-free, and there are no extra service fees. You just need to pay back the amount you borrowed within 61 days.

Getting started is easy. You can download the Zenka app from their website, the Google Play Store, or the App Store. After you fill out the application form and register, you’ll have the loan in your account in less than five minutes.

LendPlus is a company that uses technology to offer personal loans ranging from Ksh500 to Ksh30,000 hence one of the top loan apps in Kenya.

You can borrow money for five to thirty days, and the interest you pay is 2% per day. This might seem like a lot, but if you need more time to pay back, you can extend the loan.

However, you have to cover the interest that adds up on the amount you borrowed.

When you get a loan from LendPlus, you don’t have to pay any extra fees for starting or processing the loan. This makes it simpler to get the money you need in an emergency.

LendPlus is run by Aventus Technology Limited, which is part of the Aventus Group, a company based in Lithuania. Andrejus Trofimovas is the CEO of Aventus Group and also owns LendPlus. Originally, his brother Igoris Trofimovas had the largest share of LendPlus through PeerBerry, which funded the loans, owning 50% of it.

However, Igoris sold all his shares to Andrejus in 2022. Now, Andrejus owns most of LendPlus, while Vytautas Olšauskas and Ivan Butov each own 25% of the shares.

Read also: Binance Saga: Nigeria Demands Top 100 Users’ Data from Binance

Zash Loan app is a service provided by Zillions Credit Limited Company which offer personal loans ranging from Ksh500 to Ksh50,000, and they don’t require a high credit score.

Zash stands out as one of the top loan apps in Kenya because it’s reliable and quick to provide emergency loans. They charge a 1% daily interest rate, which is quite low compared to others.

What makes Zash special is their approach to fees. They use coupons to give borrowers benefits. During loan applications, redeemable coupons can increase the loan limit. And when repaying, coupons can reduce the loan amount.

If you can’t repay on time, Zash offers extensions without charging any extra interest during that grace period. But, if you miss payments without informing Zash, there are penalties.

For the first 15 days after the due date, there’s a 2% penalty on the unpaid amount. After that, it increases to 3%.

Okash is a mobile app where you can quickly get loans without having to offer any collateral. They use a special computer program to decide if you’re likely to pay back the money.

If you qualify, you can borrow up to Ksh. 60,000 and pay it back within 14 days. The interest rates they charge are fair and won’t break the bank.

To get started, you need to download the Okash app from the Google Play Store and sign up. Once you’re in, the app will look at your information to figure out how much you can borrow and how long you have to pay it back.

They’ll charge you an annual interest rate of 14%, which is pretty standard. Okash helps you out with fast loans through their app. You just need to download it, sign up, and you’re good to go!

Read also:14 Global Telecommunication Trends in 2025

Vooma Loan is a service offered by KCB Bank Kenya that lets people who already have a bank account with them borrow money quickly using their mobile phones.

You can apply for and handle loans through the KCB App or by dialing a USSD code (*522#).

They decide if you can get the loan fast, and you can pay it back in different ways and timeframes, depending on what suits you. You can borrow anything from KES 1,001 to KES 300,000, and pay it back in as little as one day or up to a year.

To qualify for Vooma Loan, you need to have had a KCB Bank account for at least six months and have a good history with them. You also have to be signed up for mobile banking.

The good things about Vooma Loan are that it’s convenient, quick, and you have options for managing your loan. But it’s important to make sure you meet the requirements, find out about interest rates from the bank, and only borrow what you can afford to pay back.

Kenya’s Hustler Fund started on November 30, 2022, with a plan to offer its people a yearly fund of Ksh. 50 billion for at least five years. This is to make it easier for them to get money when they need it. Each person can borrow up to Ksh. 50,000.

To get a loan, you can either download the Hustler Fund app from the Google Play Store or dial *254# on the Safaricom network.The app checks if you’re suitable for a loan and gives you options for how you can pay it back based on different information.

Besides just lending money, the Hustler Fund also helps borrowers with growing their businesses, giving them advice on how to be successful entrepreneurs.

Read Also:Apple’s Worldwide Developers Conference Set for June 10, 2025

Opesa is a popular mobile loan app in Kenya. It’s famous for giving people instant loans without needing any collateral. With Opesa, you can borrow up to Ksh 30,000, and you don’t have to worry about strict repayment rules.

Opesa also teaches users how to manage their money better, which can boost their credit rating. The app is easy to use, making it simple and fast to apply for a loan.

Once approved, the money goes straight into your mobile wallet without any delay.

Patron stands out as one of the instant loan apps in Kenya for individuals dealing with poor credit scores, aiming to cover small, everyday expenses.

This user-friendly app allows you to access loans ranging from Ksh500 to Ksh7,000, with a daily interest rate of just 1%.

It also provides a reasonable repayment window of 60 days for short-term loans and 90 days for those seeking longer-term assistance.

The speed at which loan funds are deposited into your Mpesa account is impressive, making Patron an excellent choice for those in urgent need of financial aid.

Patron is led by Mikhail Lyapin, a savvy cloud technology expert hailing from Murmansk, Russia.

Murmansk holds the distinction of being the world’s largest city situated beyond the Arctic Circle, nestled in the northwestern reaches of Russia, the largest country on Earth.

Read also:How to Register your Nigerian Company in the US and UK

Mkopo Haraka is known as one of Kenya’s instant loan apps. It’s an easy-to-use phone app with the latest tech, making borrowing money simple and fast for anyone who needs cash right away.

This app helps lots of different people borrow money, letting them borrow up to Ksh 50,000 at a time.

Mkopo Haraka aims to give people safe and easy ways to get loans online or in cash while making sure customers are protected. It helps borrowers handle their money needs without trouble.

With Mkopo Haraka, you can choose to pay back what you borrow over different periods, from 91 days to a year. This means you can pick a plan that suits your finances.

It’s available to Kenyans who need to borrow anything from KSh 500 to KSh 50,000, making it a reliable option for many.

Equity Bank’s Eazzy app, like many other loan apps in Kenya, provides instant loans within 24 hours after a successful application. These loans can be sent directly to your Equity bank account, M-Pesa line, or Equitel SIM card.

You can even get the loan directly to your SIM card by dialing *247# instead of using the app. The app allows you to access credit of up to KSh3 million, with your loan limit determined by the system.

It offers a flexible repayment period of up to 12 months, with loans deducted from your account in instalments.

You can also repay your Eazzy app instant loans through your Equitel SIM card or use the M-Pesa Paybill number 247263 along with your Equity account number.

Read also:Vooma Loan: How to Apply

The PesaPap app provided by Family Bank specialises in offering salary loans to Family Bank account holders who receive consistent income from their jobs.

It’s particularly suitable for individuals with stable earnings from employment contracts. The app also allows users to access instant mobile loans for their financial needs.

Wezesha by Absa Bank, is one of the latest mobile loan apps in Kenya. This platform offers unsecured business loans of up to Ksh. 10 million, and you can expect to receive the funds within 24 to 48 hours after submitting your application.

The repayment period for Wezesha extends up to 6 years, providing flexibility for borrowers.

Read also:Okolea Loan: How to Apply and Access it

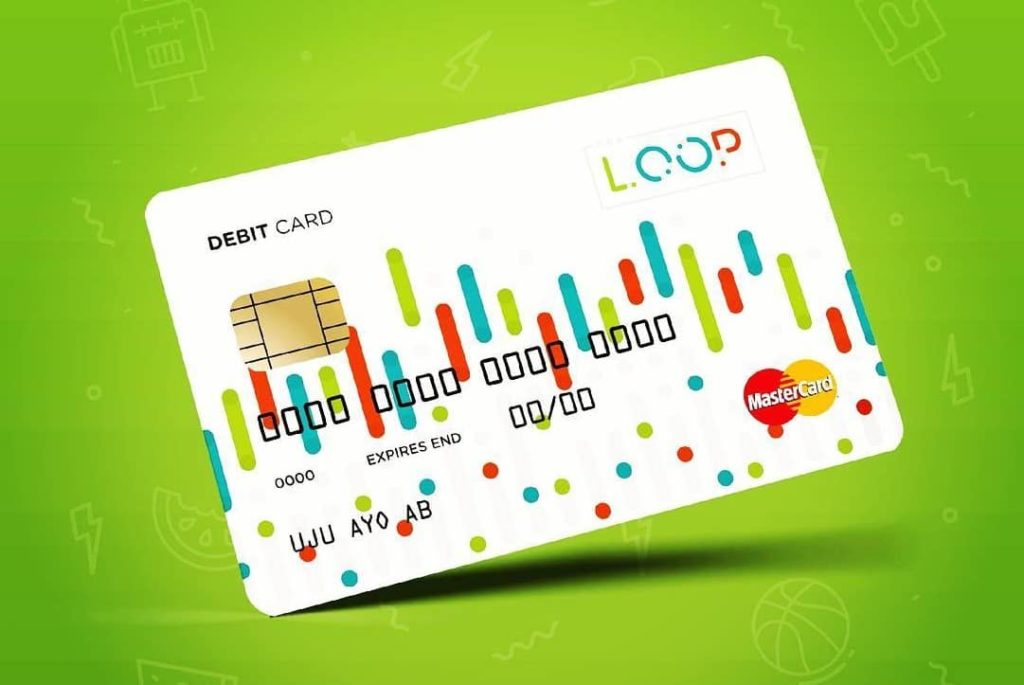

The NCBA Loop app stands out as one of the top choices for obtaining emergency loans in Kenya.

It offers NCBA Mobile Banking customers instant access to affordable loans, conveniently accessible through self-service options at any time and from anywhere.

With NCBA Loop, you can apply for personal loans of up to Ksh. 300,000 to meet your urgent financial needs.

Before you jump into applying for a loan using mobile apps in Kenya, take some time to do your homework. It’s important to be cautious because there are scammers out there pretending to be legitimate lenders just to take all your money.

Lately, there’s been a rise in these scam lenders who advertise heavily, especially on social media platforms like Facebook and YouTube, trying to appear trustworthy. Don’t fall for their tricks!

So, here are three key things to watch out for while looking for a loan app in Kenya to use::

Scam loan apps often don’t have a proper website. And if they do, there’s usually no Frequently Asked Questions (FAQs) section. This is a red flag.

Be wary if a lender asks you to pay a fee before you can access a loan. They might take your money and then tell you that you don’t qualify for any loan amount. That’s a clear sign of trouble.

Check the ratings of loan apps on app stores before you download them. If an app has a rating lower than 3.2 stars, it’s likely not a good sign. Low ratings often mean bad lending practices such as high interest rates or harassing borrowers’ relatives. Stay away from those apps!

Remember, always read customer reviews before you download any loan app and start the loan application process. It’s better to be safe than sorry.

To be eligible for fast loan approval through mobile apps, you usually need to be a Kenyan citizen or resident, have a valid national ID, be at least 18 years old, have an active mobile money account, and have a good history of repaying previous loans if you’ve taken any.

The speed of getting a loan depends on the app and factors like your creditworthiness and verification process. However, many apps offer quick or nearly instant loans, with the money transferred to your mobile money account within minutes of approval.

Mobile lending apps have different interest rates and repayment periods, with only a few offering reasonable rates and flexible repayment schedules. It’s crucial to carefully read the terms and conditions of each app to understand their rates, fees, and repayment deadlines.

The best digital platforms for instant online loans in Kenya are bank loan apps. Some of these include MCo-opCash by Co-operative Bank, Timiza app by Absa Bank, KCB mobile app by KCB Bank, Eazzy app by Equity Bank, and others offered by various banks.

The ease of getting a loan on a mobile app depends on whether you meet their requirements and agree to their terms and conditions.

You can get an immediate loan in Kenya through mobile lending apps that don’t require paperwork and have streamlined the verification process to minutes or even seconds. Simply install the app, register, and apply for a loan.

Legitimate loan apps from trusted sources like the App Store and Google Play Store keep your registration and loan details private, making them safe to use. Always download mobile loan apps from official platforms to ensure your safety.

The landscape of mobile loan applications in Kenya continues to evolve, with a multitude of options available to cater to varying financial needs.

From instant personal loans to SME-focused financing solutions, these top 20 loan apps in Kenya for 2025 offer convenience, flexibility, and accessibility to borrowers across the country.

However, while these apps provide a valuable financial lifeline, users must borrow responsibly, manage their repayments diligently, and thoroughly understand the terms and conditions of each loan.