Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

With the advent of FinTech, borrowing money has become easier, and Moniepoint is one of the most front-facing in this regard here in Nigeria. If you’re pondering how to borrow money from Moniepoint, this is the right place.

Many people ask, “Can I borrow money from Moniepoint?” The answer is yes. Moniepoint has streamlined its services to make borrowing money easy.

Knowing exactly how to borrow money from the Moniepoint App could be just what you need, either to cover an unexpected expense or perhaps because you need some extra cash to get you through the end of the month.

This guide will walk you through each step to process the request so extra funds can be accessed right when you need them. We will also discuss any code to borrow money from Moniepoint and how you can manage the process online.

MoniePoint is the leading digital financial services platform in Nigeria. It offers customers a wide spectrum of financial solutions.

As a product of Moniepoint Limited, duly licensed by the Central Bank of Nigeria, MoniePoint offers mobile money services to address financial needs.

These range from mobile money transfers and bill payments to airtime recharge, loan, and cash withdrawal services, to mention but a few.

MoniePoint dispenses its services through a large network of agents and partners across Nigeria to ensure that customers can easily access fast, secure, and convenient financial transactions.

It is known for its user-friendly ease of use and takes pride in delivering its services to customers with reliability and efficiency.

The innovations that MoniePoint has brought to the financial services sector in Nigeria have attracted a large number of awards and recognitions, thus sealing the company’s position as a leader in this area of digital financial services.

Focused on delivering exceptional customer experiences, MoniePoint continues to raise the bar in terms of standards of excellence for the financial services industry in Nigeria. So, if you are curious about how to borrow money from MoniePoint, continue reading.

Read Also – Moniepoint: From a Small Startup to an Online Payment Giant

Yes, you can borrow from MoniePoint. MoniePoint gives qualified borrowers access to short-term loans and allows them to obtain loans without paperwork or collateral.

With only a mobile phone and an internet connection, you can easily use Moniepoint for a lending service, in contrast to traditional financial institutions, which have many bottlenecks and strict requirements.

It offers short-term loans with flexible payback options, low interest, no embarrassment, and no hidden fees, which attracts people and small enterprises.

All you need to get a loan from Moniepoint is a registered number, an account, and a reliable means of identification. You can apply for your loan via the Moniepoint website or the mobile app. If approved, you will have cash immediately.

MoniePoint uses advanced technologies to check on creditworthiness and determine whether one is qualified for a loan or not.

When wondering how to borrow money from MoniePoint, one should check the requirements for the loan before applying to borrow on MoniePoint. There are eligibility criteria and information to be provided that a borrower must comply with, accompanied by some documents. The general requirements for the loan are:

The following information and documentation shall also be required of the borrower when applying for credit facilities on MoniePoint:

With the knowledge of these, you will be well-armed to apply without stress for a loan from MoniePoint.

Also Read – Moniepoint Customer Care Number & How to Resolve Moniepoint Bank Issues

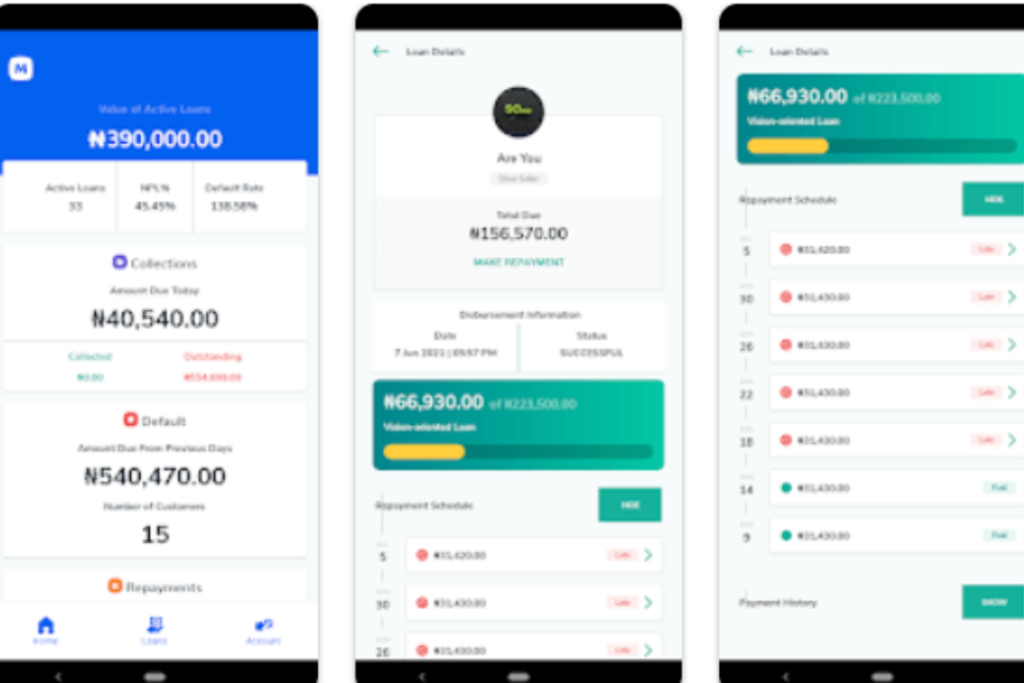

In Nigeria, MoniePoint is among the most well-known digital banking services. One can obtain loans as part of a banking solution. Here is a step-by-step process on how to borrow money from MoniePoint app:

Note: Any person borrowing must understand clearly the loan terms and conditions, including interest rates and repayment.

Read Also – CBN Orders Kuda, Moniepoint, OPay and Palmpay to Stop New Account Openings

If you are wondering or asking “Can I borrow money from MoniePoint and how much you can borrow? MoniePoint is a loan platform that offers loans from N2,500 to N500,000 exclusively for qualified individuals and small businesses in Nigeria.

You are, however, entitled to the sum you can borrow, depending on factors such as your credit score, history of repayment of loans, and the level of your income.

MoniePoint deploys a unique credit scoring system in assessing loan applications to determine how much loan and interest rate you qualify for.

It just means that the better your credit history and the more stable your income stream, the larger your potential loan amount can be.

MoniePoint loans are flexible and short-term, hence they can be anywhere from 14 – 180 days, depending on the loan amount and tenure you select. Now, you can easily make repayments to your loans through the following channels below:

Here’s a step-by-step guide for you to repay your loans:

Please note that timely repayment is very important. If one fails to pay on time, additional charges—in the form of late payment fees and default charges—will be levied. Ensure on-time repayment of the loan to avoid any extra costs.

Also Read – Moniepoint, Kuda and Others are Facing Regulatory Issues

The interest rates that Moniepoint charges for its loans are based on the amount of money a customer wishes to borrow, their credit score, and the repayment schedule or plan a customer chooses. By considering these factors, borrowers can know or project what interest rate they are charged.

Interest rates for personal loans at Moniepoint usually range from 5% to 20%. Small enterprise business loans are mostly single-digit between 2.5% and 10%.

These interest rates are what borrowers should expect to pay, depending on their circumstances. Please carefully read the loan terms and conditions to determine what applies to you regarding the interest rate.

Moniepoint is majorly app-based, giving users ease through its user-friendly platform for managing their financial needs.

Unlike some other financial services, Moniepoint doesn’t have a particular USSD code to borrow money from Moniepoint. Rather, every loan application or other transaction is manageable with utmost ease directly in the app.

Download and update to the new version of the Moniepoint app on your device to ensure a smooth experience.

Also Read – Moniepoint Commemorates IWD with Call for Applications into 4th Edition of Women in Tech Programme

The process of borrowing money through Moniepoint’s website is comparable to using the app. Provided there is internet access, download the Moniepoint app and follow the in-app steps in applying for a loan.

The digital platform provides the convenience and comfort of managing your finances from the comfort of your space. You can easily apply for a loan by following the prompts on the app and have the funds disbursed to you in little time.

Moniepoint has instituted an online borrowing process so user-friendly that you can sort your financial needs anywhere and anytime. With Moniepoint, managing your finances couldn’t be easier.

Moniepoint’s website advertises loan approval in 24-72 hours. As such, compared to traditional lenders, who would probably take days or even weeks to clear a loan, it describes them as rather fast.

Remember that their website’s time frame is more of an estimate. Many factors drive the actual approval time of your loan. These may include:

With these factors in mind, you can probably assess the potential time frame for Moniepoint loan approval.

Read Also – CBN Orders Kuda, Moniepoint, OPay and Palmpay to Stop New Account Openings

You can quite conveniently lend money with the MoniePoint app, but you may find some errors at times. Here is how you will troubleshoot these types of problems:

By following these steps, you should be able to troubleshoot most of the common issues and get seamless experiences in borrowing through the MoniePoint App. If the problem persists, contact MoniePoint’s support.

Moniepoint considers all types of borrowers, irrespective of their credit score. However, the loan amount for people with poor credit scores may be lower, while the interest rate might be higher.

Moniepoint provides loans from N2,500 to N500,000, depending on your creditworthiness and other factors.

Yes, loan repayment terms could be extended, but Moniepoint charges extra fees with interest in such cases.

Yes, Moniepoint has in place encryption and other safety measures to secure your personal and financial information.

Borrowing with the Moniepoint app in Nigeria is quite easy. Therefore, following our step-by-step guide on how to borrow money from MoniePoint app, you will be able to acquire the loan you need easily and fast.

If you have ever wondered, “Can I borrow money from Moniepoint?” or “What is the code to borrow money from Moniepoint?”, our guide has all the answers. We’ve got you, whether you use the Moniepoint app or borrow money online.

Please feel free to leave your comments below and share your thoughts. Do not forget to follow us on Facebook at Silicon Africa, Instagram at Siliconafricatech, and Twitter at @siliconafritech for more tips and important updates.