Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In the case of digital finance in Nigeria, users often ask which Palmpay or Opay is better regarding the efficiency sought from mobile payment platforms. Both have become popular but for somewhat different needs and preferences.

Many would ask at first glance, “Are Opay and Palmpay the same?” The answer is simply no; they are different entities with features that distinguish them and give them some advantage.

Opay, a company belonging to Opera Software, offers its services in transport, including food delivery, while PalmPay, which belongs to Transsion Holdings, mainly offers its services in financial transactions with rewards.

In the hotly contested discussion between PalmPay and OPay, the jostling arguments center around usability, cashback offers, and how fast a transaction can be processed.

From traditional banking to these fintech solutions, how Nigerians handle their money has changed, and thus it becomes critical to determine which platform will serve them best.

As we look a little further into the comparison guide, we will see some major key features, benefits, and possible disadvantages of each of these platforms. This will help you decide which Opay or Palmpay is better for your financial journey. Let’s dive in!

If one ask, is Opay and Palmpay the same company? The answer is no, but both are among the the popular mobile payment methods in Nigeria.

While mainly differing in their operations, the former spearheads Transsion Holdings while Opera Software operates the latter.

While they both provide services such as money transfers, bill payments, and purchasing airtime, OPay offers wider offerings that include transportation and even food delivery.

In its case, PalmPay is primarily about financial services, offering attractive cashback rewards.

Both applications are user-friendly and work with a minimal number of glitches. Yet, someone will like OPay because of its simplicity, while another will find PalmPay more comfortable because of its various features.

Read Also – How to Fix “Why Can’t I Login My Palmpay Account” Problem in Nigeria

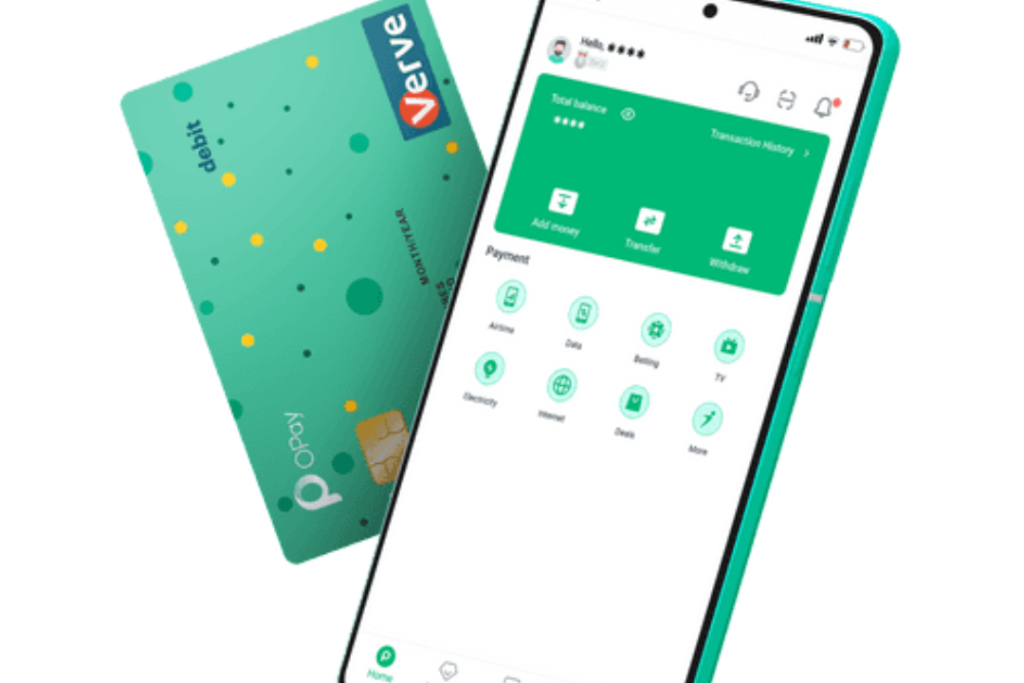

OPay, officially known as Opay Digital Services Limited, is a Fintech company based in Lagos, Nigeria. It was established in 2013.

OPay attracts the attention of big investors by providing accessible financial services, including payments, transfers, savings, and loans.

Indeed, with its funding amounting to approximately 570 million dollars, OPay has emerged as one of the big-time players within the Nigerian Fintech space, hosting millions of users and an entrenched agent network.

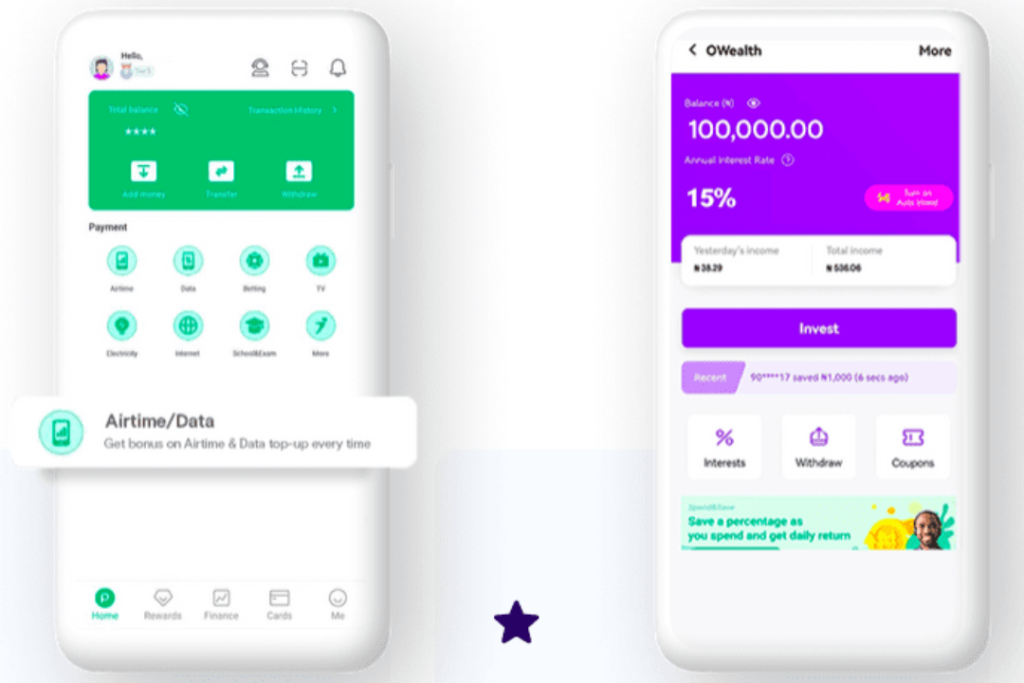

OPay is one of the leading fintechs in Nigeria that offers a wide array of financial services. Some of its key features include the following:

Pros

Cons

Also Read – How to Borrow Money from Opay App in Nigeria | A Step-by-Step Guide

PalmPay, on the other hand, is more rewarding-centric in that for every transaction, one gets points and can redeem them into discounts or merchandise.

It, too, offers similar services: bill payments and money transfers. Some find its interface a bit more complex in relation to the options available, while it has several options for rewards and features within it. It has added a sign-on bonus and debit card option.

Pros

Cons

Read Also – PalmPay Resumes Accepting New Customers

Both OPay and PalmPay are among the leading fintech platforms in Nigeria, offering different features and services that would increase banking and financial transaction usage.

Let’s compare Palmpay and Opay which is better based on a few key aspects.

From a condensed view on “Palmpay vs OPay” or Opay and Palmpay which is better, it will depend on individual needs, such as the type of services one wants or would like to be offered.

Read Also – How to Remove BVN from Opay Account Easily: Complete Step-by-Step Guide

When it comes to choosing which digital payment platform to use, the question of whether Opay or Palmpay is better always rings in one’s mind.

While both platforms have various strengths, Palmpay provides widespread coverage and a user-friendly interface; hence, it would be best for convenience.

Opay and Palmpay are opposites. The former offers a wide range of services that focus more on financial inclusion.

Nonetheless, some features are similar between Palmpay and Opay. Ultimately, the preference of Opay over Palmpay or vice versa is an issue of individuals.

For one whose eye has not been trained for flexibility and accessibility regarding finance issues, these two platforms appear similar. However, it’s the ease of service seen from one-click payments that keeps Palmpay ahead.

While both provide similar services, your choice would depend on what you want from either app. PalmPay should be considered a strong competitor due to its friendly user interface and rewarding system.

On the other hand, OPay provides the same but a bit more extensive services, which might be more attractive.

Therefore, if you have been asking, “PalmPay and OPay, which is better?” or “Are OPay and PalmPay the same?” The answer is simply no; they are different applications with different features. In reality, the choice between PalmPay and OPay will come down to the services that matter most to you.

We’d love to hear from you! Leave a comment below and follow us on Facebook @Silicon Africa, Instagram @Siliconafricatech, and Twitter @siliconafritech.

Both of these provide money transfers, bill payments, and airtime recharges. Additional services are ride-hailing and food delivery available within OPay.

Both apps apply encryption to user data and two-factor authentication to protect the users and transactions of these apps.

Both charge transaction fees, which are generally competitive, although OPay’s vary for its different services.

Both OPay and PalmPay offer customer support through the apps via chat, email, or over the phone, but the results may be inconsistent.

Yes, OPay does give cashback for daily login. PalmPay gives rewards in the form of games, and there is cashback on certain activities.

Yes, both are downloadable on Android and iOS devices, meaning you can easily access them.