Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

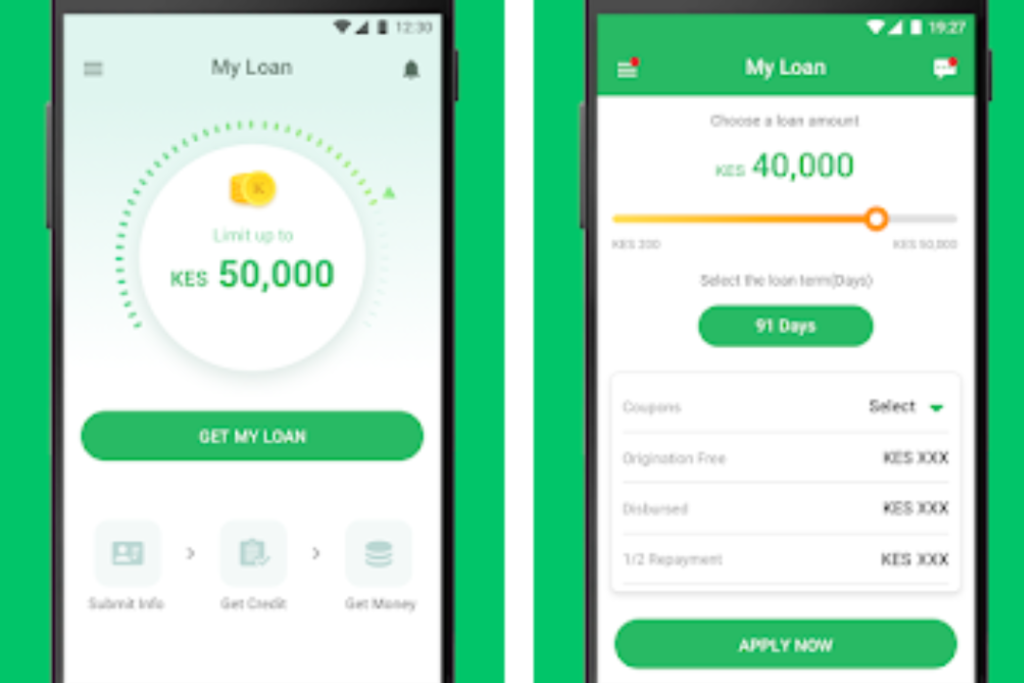

If you have to pay unexpected bills, it may happen at the worst times. Maybe your car needs a repair or an essential appliance quits on you. For any reason, a short-term loan can provide some temporary financial relief. This is where the Okash loan app steps in. Marketed as a safe and reliable service, Okash allows you to apply for a loan directly from your smartphone.

If you are an Android user and are interested in getting the Okash app, you can do it easily. All you need to do is go to the Google Play Store and start downloading it. However, the Okash Loan app download for iPhone users won’t be possible because there isn’t an official Okash app in the App Store yet. But there are still options available.

This article will cover the details of the Okash Loan app download, the Okash loan app download for iPhone users, and everything about the Okash loan app today! So, what are you waiting for? Get support when you need it with the Okash Loan App today. Download it now and manage your finances better!

OKash is a microlending platform provided by Blue Ridge Microfinance Bank Limited. It provides registered users with rapid, collateral-free loans as long as they match the standards.

OKash was one of the subsidiary services that Opera Pay (OPay) provided to consumers as part of the O universe. OFood, OBUS, and ORide are among the other services available. In case you’re curious about how OKash got started, it was first introduced in Kenya in 2018 and then extended to Nigeria and other African countries.

OKash offers loans around the clock, and the entire process is completed online. Loan amounts vary from NGN 3,000 to NGN 500,000. Simply download the smartphone app, complete the prerequisites, and submit your information.

When your OKash loan application is approved, the requested amount will be paid into your bank account.

Related – iPesa Loan App: How to Download and Apply For Loan

Okash Loan App is a smartphone application that allows clients to apply for loans quickly. Some of the features covered are:

High-interest loans without collateral have a cost. Before you can receive a loan, you must meet certain standards.

1. The requirements are as follows:

2. A legitimate email address.

3. An Android smartphone.

4. You must be aged between 20 and 55.

5. You must reside in Kenya, Nigeria, or other African countries

6. A valid identification card (ID) is necessary.

7. Bank information such as:

8. Provide a consistent source of monthly income as well as the grounds for your borrowing.

NOTE: You will need to provide a referee’s contact information, as well as your work and marital status.

Read Also – Meta Loan App: How to Download and Apply For a Loan

The Okash Loan App is a convenient resource for qualified borrowers in Kenya, Nigeria, and other African countries to access fast and easy credit. Below is a step-by-step guide on how to download the app, based on the type of device you use:

As of now, you cannot download the Okash Loan App from the Apple App Store. We suggest that you visit their website or contact their customer service for any information about iOS compatibility.

If you complete these procedures correctly, you will be taken to the OKash loan dashboard.

Also Read – Kashway Loan App: How to Apply

Several factors contribute to the safety of the Okash Loan App. However, it’s well worth mentioning that user security and privacy are given utmost precedence via several measures carried out with the aid of its crew. Here are a few vital points:

It is expected that Okash implements encryption protocols to protect personal statistics from unauthorized right of entry for the duration of transmission and storage.

The app will best ask for vital permissions required to function, minimizing the opportunity of gaining access to inappropriate private data for your device.

By analyzing Okash’s privacy policy, users can gain an advantage and knowledge of the way the enterprise manages their private data. This consists of information about what types of facts are accumulated, the functions for which they’re widely used, and whether or not they can be shared with outside events.

Okash might introduce security measures that include aspect authentication or PIN/password safety to keep away from unauthorized accounts.

Safeguarding personal privacy is important for Okash, and making sure compliance with applicable statistics, safety legal guidelines, and rules in the regions of operation falls within that scope.

Consistently updating the app can display continuous endeavors to solve protection weaknesses and beautify common safety measures.

Despite the benefits that monetary apps convey, customers must be vigilant and weigh in on potential risks, which include information breaches or private data misuse. Prioritizing analyzing opinions, conducting research, and sharing the best-required details when utilizing those offerings is exceptionally endorsed.

To apply for the Okash loan, follow the steps below:

Read Also – Branch Loan App: How to Download It

Okash interest rates range from 0.1% to 1% every day, with an annual percentage rate of 36.5%, and a one-time origination cost of N1,229 to N6,000 in Nigeria.

In Kenya, Okash App charges 14% interest for loans that take 14 days to return and 16.8% for loans that take 21 days to refund. Delay or late loan repayment incurs a daily rollover fee of 2% of the loan amount.

Okash offers several benefits compared to traditional lenders like banks. Here’s how it can be an attractive option:

Overall, Okash provides a convenient and potentially faster solution, especially for smaller, unexpected expenses.

Here are some of the risks associated with Okash loans:

If you think about taking an Okash loan, you must understand these risks. You want to cautiously study the phases and situations of the loan before borrowing any cash.

You might also take a look at other sources of funding, like banks or credit unions, which might offer decreased interest prices and more flexible reimbursement phrases.

Also Read – How to Download the Zenka Loan App

If you fail to pay your Okash loan within the time frame specified, you will be in default. This will cause your name, phone number, and ID to be submitted to any of the credit reference bureaus.

To have your information deleted from the CRB database, repay your loan plus any fines that have accrued since the default date. Then notify Okash so that they can forward your information to CRB for clearance. This process could take up to a week.

You can contact the Okash loan service staff using the following information:

Are you running low on funds? The OKash lending app may be the solution. This excellent app for your Android smartphone allows you to receive a loan without having to go to the bank or do any office work. Decisions are made immediately, so you will know where you stand in no time.

It’s important to note that OKash is presently only available to Android users. If you own an iPhone, investigate several lending options.

However, if you are an Android user, using the OKash loan app may be a helpful start toward obtaining the financial resources you seek. Keep in mind that it is always best to borrow with caution and carefully consider the loan terms before making any commitments.

It varies by individual, so please confirm that your information is correct and that you are applying using your mobile device. You may be eligible for a hefty loan.

OKash loan repayment procedures are simple. You can access the loan repayment page directly from your dashboard. Fill up your account information and pay with your debit/credit card.

If you do not repay, you will default. If you have not yet repaid the Loan amount and fees by the end of the Rollover Period, you will be in default.

As part of the loan application verification process, they may contact your emergency contact information. If you default on your loan and do not return their calls, they may contact your emergency contacts for debt collection.