Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

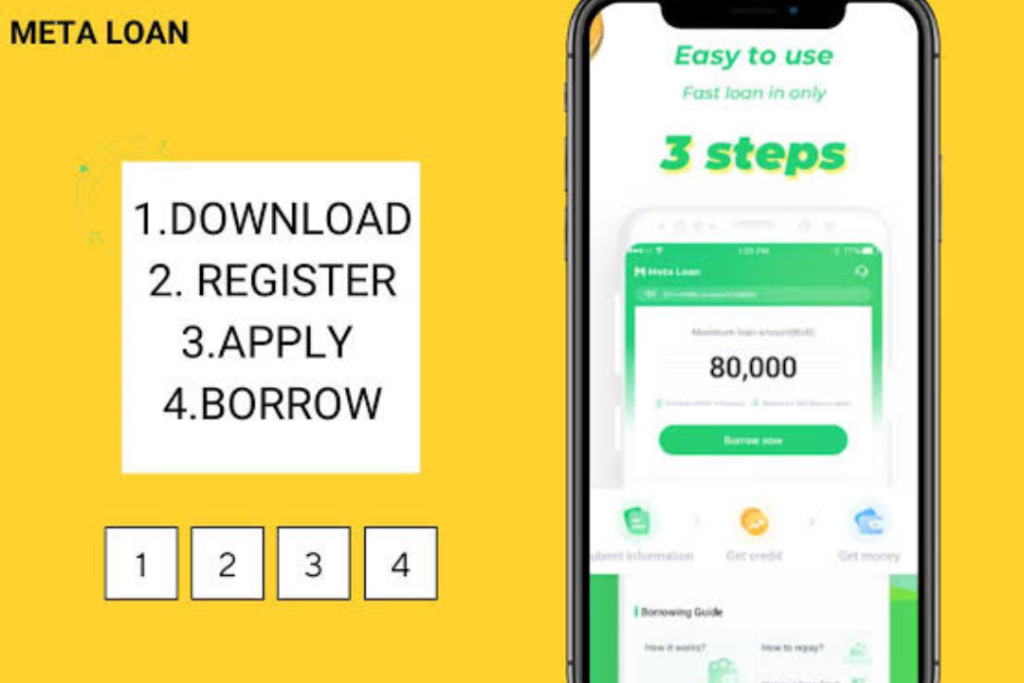

Unexpected bills can hit hard, leaving you short on cash. If you want a quick and easy solution to bridge the gap, check out the Meta Loan App. Meta Loan is a mobile loan lending application designed to provide many individuals with a simple, secure, and flexible way to apply for loans with a tap of their smartphone.

This mobile application permits you to apply for a loan immediately from your phone, casting off the problem of prolonged applications and conventional paperwork.

In this article, we’ll walk you through downloading the Meta Loan, Meta Loan registration, and applying for a loan. So ditch the long lines and mountains of paperwork; we’re going to provide you with a way to navigate the Meta Loan App and find out if it can be your financial answer. Let’s get started!

The Meta Loan app is a mobile loan service based in Nairobi, Kenya. This app enables users to access low-interest loans without requiring a credit score. It is a simplified application and approval platform, making the borrowing experience secure and easy, allowing the borrower quick and easy access to the needed funds.

The app has no credit score requirement, and offers competitive interest rates and additional reading terms, easing the borrower’s access to financial resources.

Meta is ideal for those who need a loan without having to worry about documentation or collateral. It’s also ideal for people who need immediate cash to cover an unexpected or urgent need.

The app is best suited for customers who have a consistent income and can return their loans on time. It’s also perfect for people who can’t receive a bank loan because they have no credit history or a low credit score.

Related – Payday Loan Business: Find out How Payday Loan Works

When a user downloads and goes through with the Meta loan registration, it collects biodata. This includes personal information such as your name, phone number, email address, and M-pesa transaction messages.

The app then utilizes this information to calculate the user’s credit score, which is used to calculate the loan limit. Once your loan is authorized, the Meta app will transfer the funds to your M-Pesa account in 1 minute.

In terms of security, your information is protected. How? The data is transferred over a secure HTTP connection and is not shared with anybody other than the lenders.

Meta is not suitable for those who have been blacklisted on CRB or are behind on other loan applications, as they may be ineligible to apply.

This app is also not suited for people seeking substantial loans, as the highest loan limit is Ksh 80,000. It is also undesirable for people who do not have a consistent source of income and cannot afford to return the loan on time.

According to customer reviews, late loan repayment individuals have experienced repeated harassment calls and invasions of privacy.

Read Also – Tala Loan Limit

To qualify for the meta loan, you must:

To be eligible, an individual has to be a resident of Kenya in terms of conforming to the regional rules, making verification easier, and giving the lender a legal guarantee.

Potential clients can receive a loan if they are aged between 18 and 60, meaning that every applicant is probably of legal age to sign a contract and has a job thus reducing the probability of not receiving the lender’s money due to age.

One of the criteria is to demonstrate a steady income source. The goal of this criterion is to ensure the capability of repaying the loan. This could be a wage from an employer, a business owner’s gain, or a stable profit from an investment that could secure the sustainable inflow of resources to cover the loan.

Here’s a more detailed breakdown of the potential advantages of Meta Loan and some additional points to consider before using their service:

With so many choices available, it might be difficult to know where to begin. Fortunately, registering for a Meta loan is simple.

So, how do you get started with meta loan registration? The first step is to open an account by installing the Meta lending app. This is a straightforward operation that takes only a few minutes.

You’ll need to supply some basic information, such as your name, email address, and phone number. After you’ve registered an account, you’ll be able to begin exploring loan alternatives.

Also Read – Branch Loan App: How to Download It

Applying for a loan with Meta Loan is a simple and digital process, available through their specialized mobile app.

Here are the steps to apply for a loan with the Meta loan app, highlighting some key details:

Transparency is crucial for the borrower to obtain a clear grasp of the costs associated with his loan. Borrowers can enter into contractual financial commitments without any knowledge-based restrictions thanks to detailed information on interest rates, specifically an annual percentage rate of 48%.

Borrowing money under such specified circumstances allows the borrower to fulfill his commitments to repay the amount plus accrued interest without incurring additional expenditures or hidden fees.

Whether borrowing amounts ranging from KSh 800 to KSh 50,000 and agreeing to durations of 7 to 90 days, the borrower can assure that his reimbursing premium is determined by the specified APR and precisely negotiated contract parameters.

For example, if a borrower takes out a KSh20,000 loan for 91 days, the costs payable can be calculated as follows:

Read Also – How to Download the Zenka Loan App

Your Meta Loan repayment is intended to be as simple and uncomplicated as the borrowing process. Meta Loan understands the value of simplicity in financial transactions and provides many user-friendly loan repayment options.

M-PESA, Kenya’s popular mobile money service, is one of the most common ways to repay your loan. Paybill number 4023507 allows you to conveniently make payments. This transaction’s account number is the M-PESA phone number that you registered when you applied for the loan. This integration with M-PESA makes repayment simple and convenient.

Follow these simple steps to repay your loan with Meta Loan.

Additionally, you can also choose to repay through the Meta Loan app. The app includes an M-PESA Express option, which simplifies the payment procedure directly from your phone.

Meta offers loans starting at Ksh 500 and going up to Ksh 80,000. The repayment duration ranges from 91 days to 365 days. To grow your loan limit consider following these steps:

By completing these procedures and displaying responsible financial behavior, you can gradually increase your Meta Loan Limit. Just remember to use credit wisely and avoid incurring more debt than you can comfortably repay.

Read Also – Sterling Bank USSD Code for Transfer and Loans

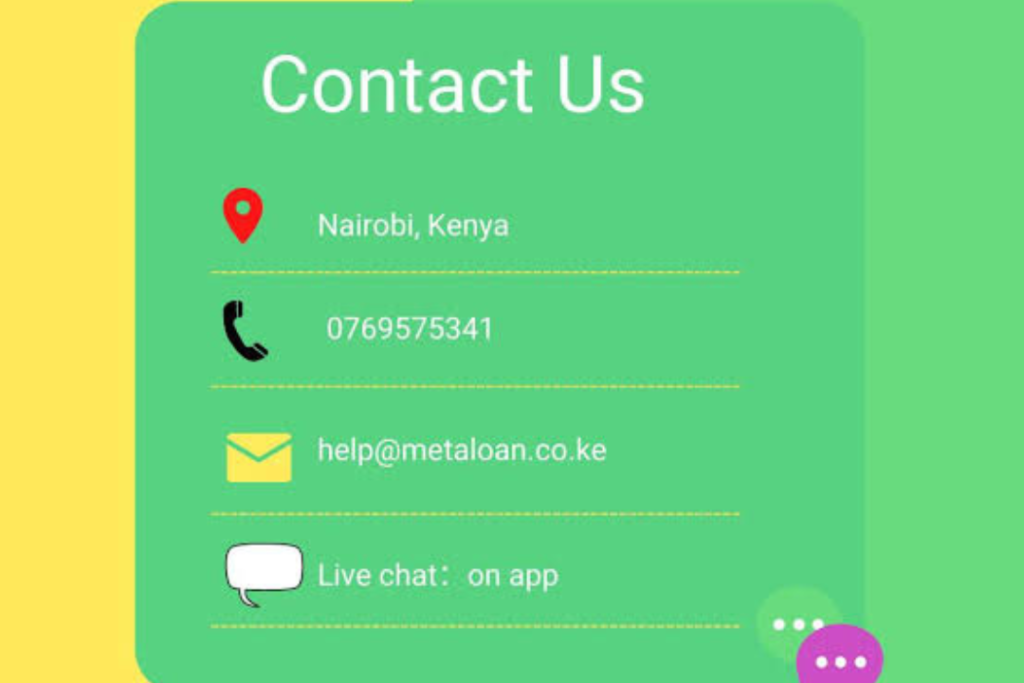

Meta Loan offers a variety of ways to contact their team for inquiries, support, or feedback.

Meta Loan is dedicated to offering responsive and comprehensive customer service, assuring a seamless experience for all users.

Meta Loan App makes it simple to apply for short-term loans. By installing the Meta Loan App and completing the simple registration process, you receive access to problem-free loan applications.

Using the Meta loan app to get a loan is both convenient and environmentally friendly. Whether you need a budget for emergencies or unexpected needs, Meta Loan has you covered.

Just a few taps on your smartphone and you’re on your way to obtaining the financial assistance you seek. Trust Meta Loan for a hassle-free borrowing experience that prioritizes your comfort and financial well-being.

Yes, your records are safe with Meta. data is delivered to Meta via a stable HTTPS connection, and Meta no longer shares data with anyone without your permission, save the Lenders.

To apply for a mortgage using the Meta Loan app, you normally need to provide identity documents such as your national ID card, passport, or driver’s license. Depending on the loan size and requirements, you may also be required to provide proof of earnings, such as pay stubs or bank statements.

Yes, Meta Loan considers applicants with a variety of credit scores. While a low credit score may affect the loan terms and interest rates given, it does not automatically exclude you from qualifying.

The time it takes to acquire a mortgage decision varies depending on numerous aspects, including the completeness of your data and the verification process. However, in many cases, you can expect to receive a pick within a few hours.