Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

If you have questions like, “Can I borrow money from Kuda Bank?” The answer is yes. Are you curious in response to your query about how can I borrow money from my Kuda account? Say you are in an emergency or need that extra cash to help you survive a day or more before the next paycheck; Kuda has your back on this.

You can get a loan using the Kuda app by merely tapping your screen. This detailed guide will explain how to borrow money from the Kuda App, outlining the eligibility criteria, the application process, and some helpful tips toward a seamless borrowing experience.

By the end of this article, you will have seen how to borrow money from Kuda and maximize your account. Let’s get into the step-by-step approach to applying for a loan through one of Nigeria’s most innovative digital banks.

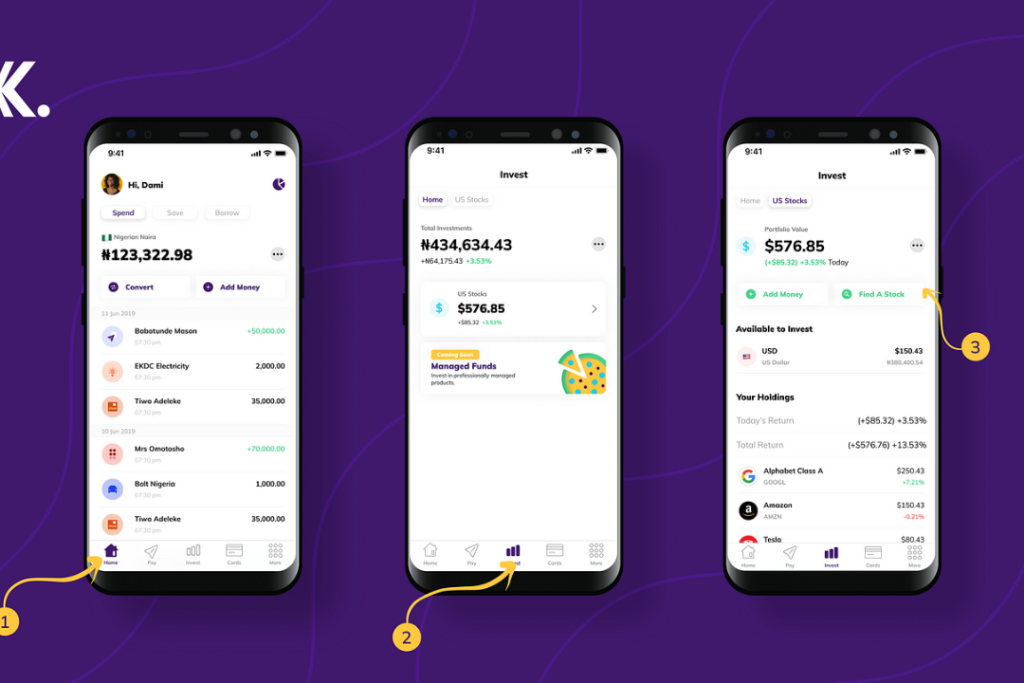

Kuda is a digital bank designed for ease and safety in managing finances. The user-friendly app allows easy opening of bank accounts, flexible loans, bill payments, fund transfers, and management of savings accounts.

Kuda Bank provides ease of transactions with debit cards and low service fees.

It would help if you were above 18 years, had a valid means of identification, a smartphone, an active phone number, and an email address.

Download the app and sign up with a valid ID to access Kuda Bank’s services.

Kuda Bank allows users to enjoy smooth and secure banking. With the bank’s focal points being digital innovation and ease of use for its customers, it attracts many who want ease and flexibility when handling their finances.

Read Also – How To Login On Kuda With Email, Phone Number, Password

Kuda Bank can give you cash through their loan feature—Kuda Overdrafts. This product allows one to pull out money over the available balance up to a predetermined limit.

The overdraft limit shall be driven individually, depending on the activity one has and continued transactions.

Unlike traditional loans characterized by complex and cumbersome approval processes, Kuda’s overdrafts are designed to be fast and easy.

Interest shall be paid on the facilities granted, and every deposit made into your account shall repay this automatically.

This simplified repayment relieves one from the troubles of the scarcity of funds, which has, in turn, burdened his life.

At Kuda Bank, they pride themselves on transparency, and no fee shall be debited from your account without knowing what it is for because all charges are specified in the app.

Finally, the answer to this question, “Can I borrow money from Kuda Bank?” is yes. In essence, the overdraft feature in Kuda Bank is very convenient and flexible to the user in borrowing; hence, it offers a sure way of getting money over such times.

Anyone who is in desperate need of money and is unsure of how to borrow money from Kuda app can quickly obtain the appropriate amount by using the Kuda app.

The platform provides an extended benefit where users can decide the monthly payment schedule.

Having a guarantor can help increase the chance of availing the desired amount; however, checking whether the lender requires a guarantor is always good. One should also ask if collateral is needed.

The following are specific requirements for using the Kuda Bank app for borrowing:

These requirements ensure a streamlined process for borrowers seeking financial assistance through Kuda Bank.

Also Read – How to Fix “I Can’t Login My Kuda Account” Problem in Nigeria

To start borrowing from Kuda or find out how to borrow from Kuda Bank, you will first have to set up an account with Kuda Bank. Setting up a Kuda Bank account to borrow is pretty straightforward and only involves a few steps;

Kuda Bank may request further information or documentation to verify your identity or creditworthiness.

Kuda, popularly called Nigeria’s first mobile-only bank, gives a hitch-free way to easily strut financial landscapes. This includes money borrowing. Below is a step-by-step guide on how to borrow from the Kuda App:

Note: Kuda Bank is mandated to request more information or documentation to identify yourself or establish your creditworthiness. Additionally, loan terms can change depending on several factors.

Read Also – Moniepoint, Kuda and Others are Facing Regulatory Issues

Kuda Bank gives a flexible loan option regarding interest rates and periods for customer satisfaction.

The Kuda overdraft has an interest of 0.3% each day on the borrowed amount once activated until it is fully repaid.

Take, for example, a loan of N20,000, which attracts an interest of N60 daily, totalling up to N1,800 in interest over 30 days. You will end up paying back N21,800 to Kuda.

Loan tenor: 90 days, approximately three months. The loan matures thirty days after it is disbursed.

This puts you in service where the three months can elapse immediately in repayment, though with a one-month grace elapsing after the money has been expended.

The ease with which one can repay, as stated above, is what makes Kuda overdraft flexible and manageable for meeting short-term financing needs.

Kuda makes it easy for one to pay his or her loan repayment due with the following two convenient options:

You can set up automatic repayments to deduct them from your Kuda account on the due date. Therefore, you will never miss any repayment, hassle-free for those who prefer hands-off.

You can also initiate this right from within the app or any other bank’s mobile or internet banking and make the repayment amount available for Kuda to pick up.

This alternative provides room for more hands-on management of finances.

One can make a timely repayment to avoid late fees, negative effects on one’s credit score, or further litigation.

Timely return fosters a good relationship with the bank, making one continue to qualify for loans from the same institution.

Set reminders on your phone or calendar so you don’t miss a repayment. Even turn on alerts and other notification services that most banking apps, including Kuda, have.

A;lso Read – Kuda Bank Introduces Loans for Salary Earners after Hitting New Record

There should be a couple of things to consider if you are unable to borrow from Kuda Bank:

Ensure you meet Kuda Bank’s loan eligibility criteria, including minimum age and income requirements and a good credit score. You can check your credit score online for free on various platforms.

In case your credit score is bad, get it in order. Pay up outstanding debts and stay clear of new credit inquiries. You will stand a better chance of getting the loan if the eligibility criteria are met and your credit score is fine.

You can contact Kuda Bank’s customer support in the first instance of any issues you’re facing concerning borrowing from them. You can contact them via their phone number, email, or in-app chat.

Tell them in detail what the problem is, or you will see an error message that you can describe or Take a Screenshot of it. Their customer support will usher you through troubleshooting to lead you to the Solution.

Ensure all your personal information and documents are accurate and up-to-date. All your names, addresses, and other personal information should tally with those on your ID and other identification documents.

Secondly, ensure you have attached all the necessary documents, including proof of income and employment. If there is an error or omission in the information, update it and resubmit your loan application.

If this occurs with the Kuda Bank app or website, restart or refresh the browser. Then, consider whether your device’s operating system and browser are current.

Have a good internet connection next. If it doesn’t work, try getting onto the App/website from another device/browser.

Recognize the terms and circumstances of each loan package Kuda Bank offers before reapplying. Be sure to understand the percentage charged in interest, the period of repayment, and other fees attached to the loan.

Secondly, understand the repayment schedule and the consequences of late repayment. If you have further questions or are concerned, contact Kuda Bank customer support for further clarification.

Follow these steps to troubleshoot; in the end, you might fix what went wrong when borrowing money from Kuda Bank. Always be patient and insistent; do not feel ashamed to ask for help.

One is instantly or near-instantly approved for a loan on the Kuda App. The amount caters to your bank account opened with Kuda Bank upon approval.

Yes, you can repay your loan early on Kuda App without penalties or fees. Just tap the “Repay” button and select the amount you want to repay.

Failure to pay your loan attracts a late fee penalty upon default. In addition, defaulting on loan repayment affects your credit score, and getting credit in the future becomes very challenging.

Currently, there is no USSD code by which one can apply for a loan or do any transaction on Kuda Bank. Being an absolute digital bank, Kuda Bank has provisions for all its loans to be applied through its mobile app, which one can download on the Google Play Store and Apple App Store.

It’s easy to borrow from Kuda Bank. You can borrow money whenever you need it with the help of this advice. You will not have to worry about how to borrow money from Kuda Bank.

Whether you are wondering, “Can I borrow money from Kuda Bank?” or “How can I borrow money from my Kuda account?”, this guide has covered you.

Was this helpful? Please let us know in the post’s comment section and share your experience. Do not forget to follow us on social media for more Tips and Updates: