Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

The world has become more tech-driven than ever, and we can hardly get by without the use of technology. From how we interact, work, and even manage finances and when you are low on cash, many companies are willing to loan you a substantial amount of money without meeting you face-to-face and such a company is Kashbean.

Many Kenyans are jumping on this new financial evolution to get by daily. You too can get on this train of financial freedom by using the Kashbean loan app. Imagine a quick loan at your disposal when you need it.

You also get to repay at your convenience. But how does this work? You download the app and that is almost like 50% of all you need to do. In this article, we will explore how you can make the most of this loan app to get cash when you need it.

In Kenya, Kashbean is a popular mobile loan lending app with a sizable user base. By providing personal loans through its platform, Kashbean enables people to easily handle unforeseen financial obstacles.

Kashbean’s main goal is to close the credit access gap, serving both self-employed and employed people nationwide.

Also Read – Build it Material Loan: how to Get a Loan to Build

One of the distinguishing features of Kashbean is its transparency and accessibility. Here are other key advantages that users can expect using the loan app:

Kashbeam offers loan amounts ranging from KSh800 to KSh50,000, with flexible repayment periods spanning from 7 to 90 days. This may sound great to borrowers as it allows them to tailor their loan options according to their specific needs and repayment capabilities.

Kashbean makes the loan application process simple and eliminates the need for extensive paperwork or credit history checks.

Residents aged 18-60 with a stable income source can apply online via the mobile app, ensuring convenience and efficiency.

Kashbeam is licensed and regulated by the Central Bank of Kenya, so rest assured that there are no shady dealings.

Kashbean adheres to stringent regulatory standards, providing users with assurance regarding the safety and security of their financial transactions.

Nothing sounds good to a borrower than no hidden charges. Kashbean prioritizes transparency in its lending practices, ensuring that users are fully aware of the associated costs.

There are no hidden fees, and borrowers have a clear understanding of the interest rates and borrowing costs upfront.

Also Read – How to Apply For a Fundi Loan

To borrow from Kashbean, you need to have some material and documentations handy to aid your application process

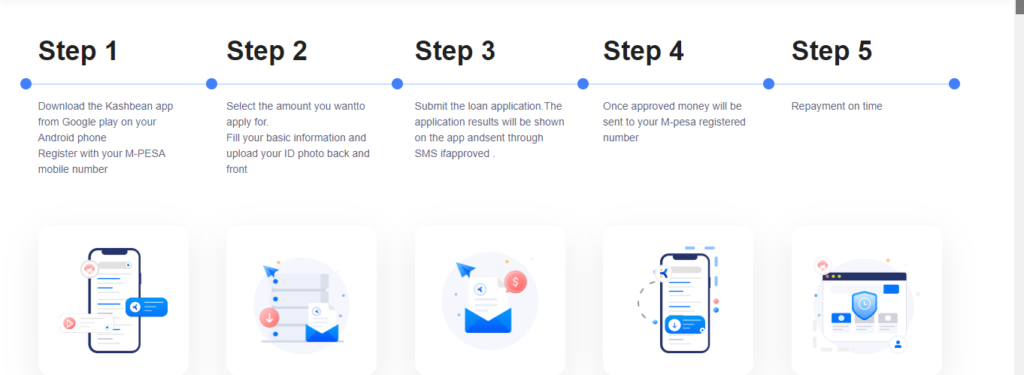

With Kashbeam, getting a loan hasn’t been simpler. You can get a loan by following these steps:

Also Read – How to Apply for Specta Loan

To keep their borrowing connection with Kashbean positive, borrowers are urged to make their loan repayments on schedule. There are several handy ways to make repayments, including internet transfers or M-Pesa payments.

You can use the phone number you borrowed as the Account Number to transfer the loan amount to our M-Pesa Paybill number 733555 to repay your KASHBEAN.

Kashbean is the go-to app you should use in Kenya if you need fast loans. Kashbean’s user-friendly software, transparent terms, and quick payouts make handling financial emergencies simple.

On the path to financial stability and empowerment in Kenya, Kashbean has your back, regardless of unforeseen bills or pressing costs.

If you find this article on Kashbean loan application helpful, kindly leave a comment and follow us on our social media handles for more updates.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

Upon loan approval, the funds are transferred immediately to your M-Pesa account, guaranteeing quick access to the borrowed amount.

Starting at Ksh 500, loan amounts can go up to Ksh 50,000 over time, contingent on your repayment history and other variables.

As long as you make your loan payments on time, your loan limit may rise. But how much of an increase there is depends on several things that Kashbean takes into account. While they encourages careful borrowing and repayment , Kashbean is unable to guarantee the precise date or amount of the increase.

Kashbean evaluates loan applications based on a number of criteria, such as your credit score, financial history, and loan goals. Inconsistencies in your application or other pertinent criteria could have been the reason your application was rejected.

Please check your M-Pesa account balance to see if Kashbean has credited you. If your loan application has been accepted but you have not received them yet, you can contact Kashbean’s customer service at cs@kashbean.com for help and clarification in the event of any delays or problems.

Yes, a credit history is not necessary for Kashbean to approve a loan. You can apply for a loan online through the Kashbean app if you are a resident of Kenya between the ages of 18 and 60 and have a reliable source of income.

Yes, there are no penalties if you pay back your Kashbean loan early. Kashbeam recommends early repayment to improve your borrowing relationship with them and possibly result in future increases in loan limits.