Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Life can bring unexpected financial problems and you might need a little extra money. Maybe an emergency bill arises, your car needs repair, or you have a great opportunity that you don’t want to miss.

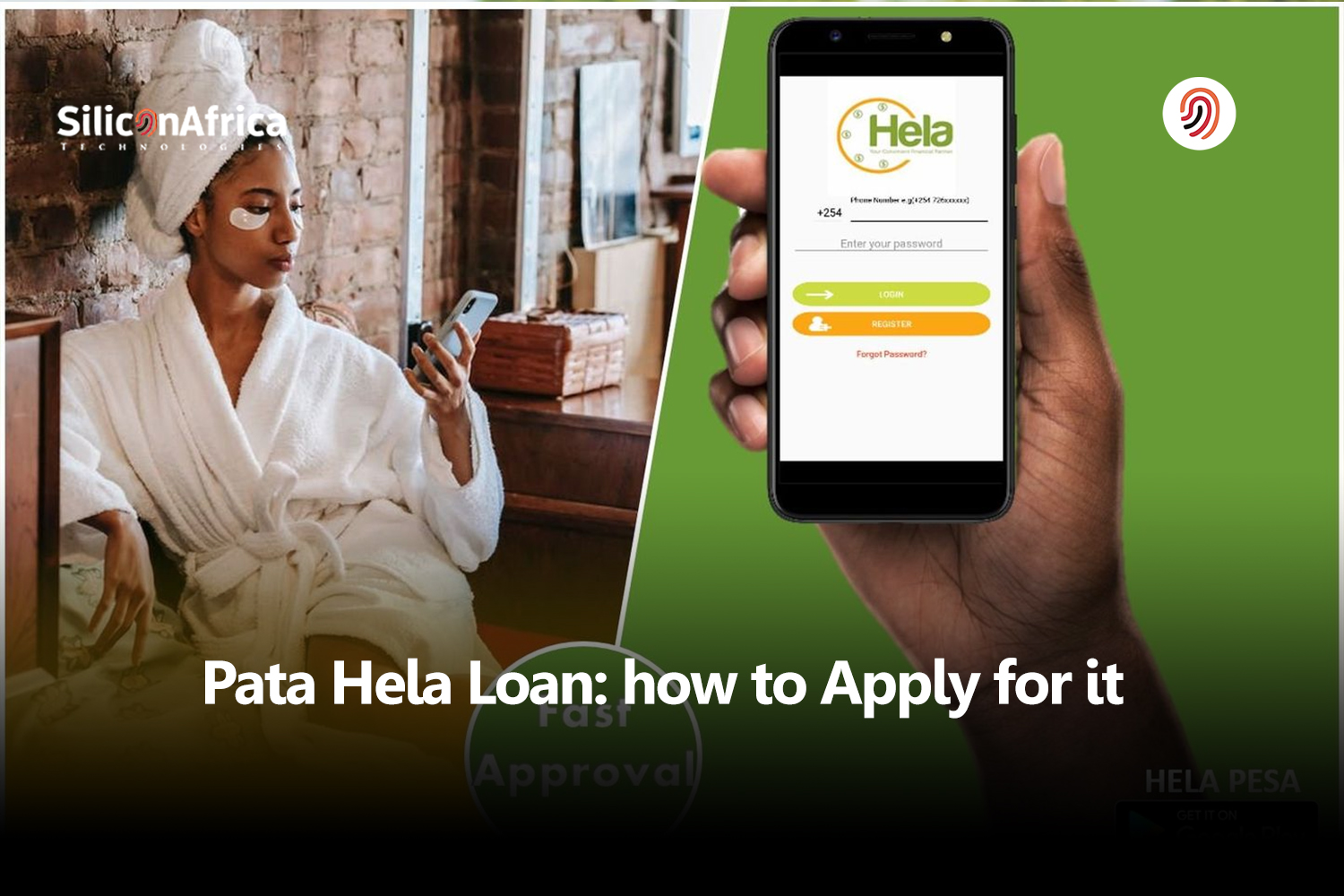

For whatever reason, if you are looking for an instant cash solution, then Pata Hela app is the answer you were looking for.

Pata Hela Loan is a mobile lending platform that has recently gained popularity in Kenya. It provides fast loans through M-pesa but should it be trusted or avoided like any other app?

In this article, we will delve into every aspect of the Pata Hela loan app that you need to know, including what it is, how it works, and what steps you need to take to apply for a loan.

So, whether “Pata Hela” is a name you have overheard people talking about on the streets or stumbled upon the “Pata Hela loan app” as you scrolled through your phone, keep reading to know if this app will be your financial hero!

“Pata Hela” is a Swahili word that translates into English as “Get Money.” Pata Hela Loan is a type of loan issuer that provides quick cash in Kenya, typically through cellphone lending platforms such as M-Pesa. This is how Pata Hela Loan usually works.

Though Pata Hela Loans might help people in need of emergency funds, borrowers should be aware of the high-interest rates and the danger of becoming trapped in a debt cycle if not managed appropriately.

Related – Fair Cash Loan: How to Access It

Pata Hela Loan App is a financial product that allows customers to get quick and realistic loans. Here are the key characteristics and benefits:

The aforementioned capabilities are part of the Pata Hela Loan App, which aims to provide its users with a quick, simple, and dependable answer to their short-term financial needs.

Pata Hela Loan is a product offered by Kenya’s outstanding monetary institutions. Although the specific eligibility criteria and requirements of the character establishments can vary, typically, the candidates need to meet the following:

1. Permanent residency or Kenyan citizenship.

2. Age requirement (usually between 18 and 65 years old).

3. Proof of earnings or work, such as payslips or bank statements.

4. A good credit history (certain institutions may also accept candidates with bad credit, but with higher interest payments).

5. Valid identity documents (including a national ID or passport).

It may be critical to examine the specific group that provides Pata Hela Loan for their specific eligibility conditions and requirements, as these may differ.

Read Also – Watu Credit Loan App: How to Apply

You won’t find Pata Hela on the Google Play Store. Instead, it’s available through various APK file hosting sources.

The absence from Google Play raises questions, but it’s not necessarily a deal-breaker. Many apps begin in this fashion before attaining widespread acceptance.

The Pata Hela loan application is straightforward and takes only a few minutes to complete. This tutorial will take you through the entire process of applying for a loan, beginning to end.

Following these steps meticulously will demonstrate that applying for a loan with the Pata Hela app is simple. Best wishes with your loan application!

Read Also – iPesa – Credit Loan to M-pesa: How to Access It

Pata Hela does not just assign you a random loan limit, but it is determined by your creditworthiness. The more trustworthy you are, the greater your limit. Loan amounts are flexible enough to let you borrow as per your needs and repayment capacity.

If you have a good credit score and a stable income, you may be considered for a higher loan amount. Nevertheless, one should bear in mind that borrowing beyond what can be repaid may result in financial difficulties.

Pata Hela has low interest rates, which come as a surprise to many, making it easy for the borrowers to repay their loans without feeling financially strained.

The interest rate that you qualify for depends on various factors, including your credit score, income, and loan amount. Normally, borrowers with high credit scores and high incomes qualify for lower interest rates.

You can repay your loan using either M-PESA Xpress or Paybill 851900, as well as the phone number you used to sign up.

Follow these steps to pay off your Pata Hela loan:

Make sure you have enough money in your M-pesa account to pay the outstanding balance.

You can make whole or partial payments at any time before the due date. A convenient compensation plan helps you remain on top of your bills.

Also Read – *435# Loan: How to Apply for Letshego Loans

Pata Hela levies a one-time service fee ranging from 5-33 percent* of the principal amount. Payment plans might last up to 90 days. There is no minimum payback period; consumers can pay off their principal at any time after distribution.

Loans that are past due may be subject to a one-time late fee of 8% of the principal amount plus interest. There will be no further fees levied after this time. Extra terms and conditions apply.

Effective APR ranges from 85.17 to 231%. Pata Hela will never charge more than your service price. Fees do not accrue or compound.

Before applying for a loan from Pasa Hela or any other financial institution, keep the following points in mind:

Pata Hela provides a quick way to obtain loans in Kenya, but it is not without limitations. The low loan rates and simple repayment options make it an appealing alternative, although the lack of Google Play presence may be a problem for some.

Pata Hela Loan has you covered for emergencies, debts, and unanticipated expenses. With its user-friendly design and speedy application process, you will have no trouble acquiring the funds.

As a result, download the Pata Hela app and take advantage of this convenient method of borrowing money when you need it.

If you find this article helpful, feel free to leave your comments and follow us on social media.

Stay up-to-date with Silicon Africa on

Facebook: Silicon Africa.

Instagram: Siliconafricatech

Twitter: @siliconafritech.

Pata Hella is a mobile money lending platform in Kenya.

You can download the Pata Hela app from multiple APK file hosting sources.

Though it does not appear on Google Play, there have been no safety issues with it so far. Still, be cautious.

The Pata Hela loan interest rates are quite low as opposed to those of other platforms.

Customer assistance is generally responsive; however, the quality varies based on the difficulty of your query.