Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

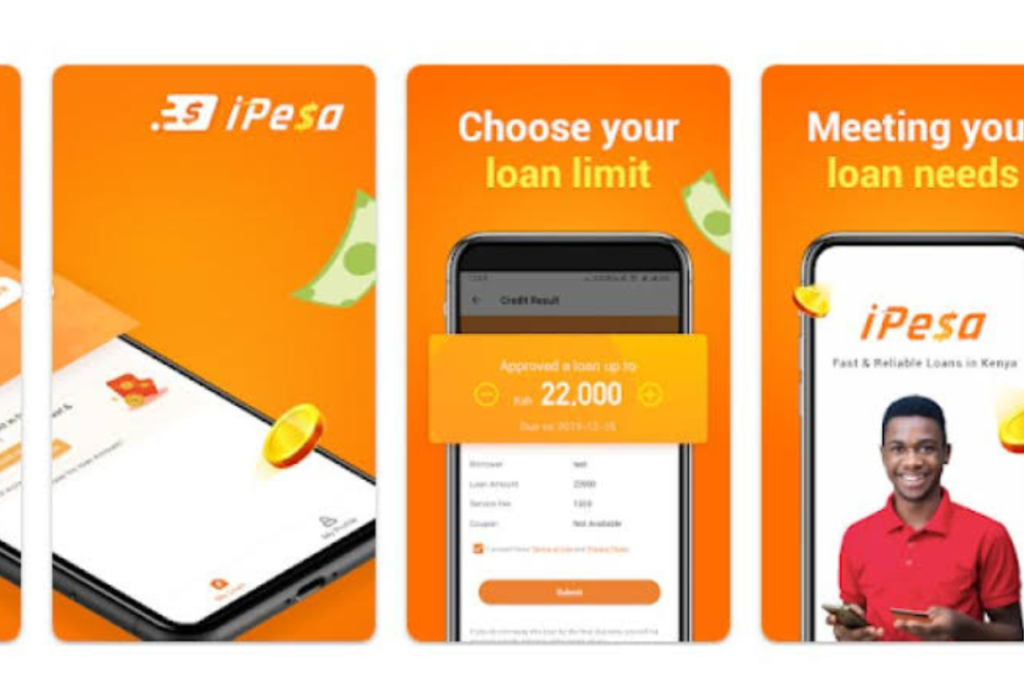

In today’s digital age, you may easily manage your finances owing to services such as iPesa, which bridges the gap between credit loans and M-Pesa, Kenya’s top mobile money network.

iPesa is an excellent way for M-pesa consumers to bridge the gap between credit loans and themselves. But how may this service be accessed? If you’re wondering, “How do I get a loan with iPesa?” Do not worry; we will walk you through everything step by step.

In this article, we will look into how to get the iPesa credit loan to M-Pesa, how to pay the iPesa loan, and other important things to know to navigate the iPesa loan application.

Ipesa Loan App is a leading Kenyan FinTech startup that offers quick, unsecured, and mobile loans to people and businesses. The company was launched in 2016 and has since evolved to become a significant player in Kenya’s lending market.

Ipesa has earned a reputation for giving fast and convenient loans that are available. The iPesa lending app is available for Android and iOS devices. You can apply for a loan with iPesa from anywhere, at any time. The application is simple and takes only a few minutes to finish.

The system uses a machine-learning algorithm to determine your creditworthiness, as do the majority of lenders in the country. It examines your device’s messages and other data to estimate your ability to repay loans on time. If you are uncomfortable with this service viewing such sensitive information on your smartphone, you should not apply for financing.

Related – iPesa Loan App: How to Download and Apply For Loan

To get the iPesa-credit loan to M-Pesa, you have to download the iPesa loan app, which is available on both the Google Play Store and App Store. Follow these steps to download the iPesa app:

Now, over to applying for the iPesa – Credit Loan to M-Pesa, follow these steps:

To be able to apply for iPesa-Credit Loan to M-Pesa, you have to pass these eligibility criteria and meet these requirements:

Read Also – Shika Loan App: How to Apply

It will be determined by both your repayment history and the loan’s cost. Depending on the situation, iPesa charges a 12% APR and 0% service fee.

When several circumstances are considered, iPesa may impose a 15% interest rate for 14 days. You solely must bear any M-Pesa transaction fees linked with withdrawal and reimbursement.

For short-term credit, the iPesa loan payment must be made within 91 days, and for long-term credit, within 180 days. You can extend your limit by paying early. If you borrowed Ksh 500 for 180 days at a rate of 12% APR. The interest rate will be as follows:.

500 x 12% = Ksh. 60

Hence, you will pay 500 + 60 = Ksh. 560

Repaying an iPesa loan is a simple process that guarantees prompt repayment of borrowed funds. Here’s a guide to help you manage the payback process efficiently:

Repayment Examples

Following these procedures will allow you to efficiently manage and repay your iPesa loan while maintaining financial responsibility and a good credit history. Remember that late loan repayment incurs a daily rollover fee of 2% of the borrowed amount.

Also Read – Okash Loan App Download

There are various benefits to utilizing iPesa for credit loans, but among many others, the most popular and finest ones are:

The iPesa loan application process has been streamlined for speed and simplicity. You may complete the entire process in a few minutes and do not need to submit any paperwork.

Simply enter your basic information, and you will receive a loan decision within 24 hours. There is no need to go to the bank or fill out any onerous documents. Everything is done online, so you can apply for a loan from the comfort of your home.

In terms of interest rates, iPesa loans are among the best options in the business. You can get loans with interest rates as low as 1.5% per month, which means you’ll save money on interest if you choose these loans and pay them off soon.

Low-interest rates make iPesa loans an attractive choice for consumers looking to consolidate debt. Consolidating your debt into a single low-interest loan will save you money and help you become debt-free faster.

One of the most appealing aspects of the iPesa Loan is the lack of any hidden fees. There will be no surprises when it comes to the amount you will pay each month. There are no origination or prepayment fees, nor are there any hidden expenditures.

You will only be charged for loan interest and a processing fee. The processing fee is a minor fee that covers the expense of processing your loan. It’s simply KSh 1,000 and will be added to your loan amount once.

iPesa Loan provides adjustable repayment choices to match your specific demands. You can select a term ranging from one month to 36 months, allowing you to choose the payback time that best matches your budget.

If you need more time to repay your loan, you may choose a longer period, but you can choose a shorter term if you want to pay it off sooner. Furthermore, additional payments can be made at any moment to help you repay your debt faster. The iPesa Loan allows you to repay it on your own time and terms.

Another significant advantage of an iPesa loan is the ability to get funds within 24 hours. Once authorized for a loan, the funds will be transferred to your M-Pesa account within 24 hours.

This means you can utilize the money right now rather than waiting weeks or months. This is a significant benefit, particularly if you require it for an emergency or unexpected expense. iPesa Loan can provide you with the funds you require when you need them.

You may also count on iPesa Loan to provide you with 24-hour customer assistance. If you have any questions regarding your loan or the application procedure, simply call customer care.

The customer support team is there to assist you in any way possible, including answering loan-related questions, assisting you through the application process, and giving any additional assistance that may be required. They are available via phone, email, and chat, and will assist you in any way that is most convenient for you.

Read Also – Tala Loan app: How to Apply for a Loan

iPesa allows you to borrow anywhere from Ksh 500 to Ksh 50,000. However, it is important to note that to qualify for a greater loan limit, you must:

iPesa occasionally gives coupons to loyal customers (those who pay their loans on time after borrowing), among other incentives. To stay up-to-date on their loan offers, follow them on Facebook (iPesaKenya).

You can contact iPesa customer support in either of the following ways:

iPesa offers a very useful solution of credit loans that are directly transferred to your M-Pesa account, making the whole borrowing process easier. To get an iPesa loan, you need to just download the app, register, and then follow the provided instructions.

Repayment is also simple – just make sure that your M-Pesa account has enough money on the due date and iPesa will automatically take off the loan amount as well as any fees that may be applicable.

With iPesa you will never find it easier to borrow or repay through M-Pesa which gives a quick remedy for those who need hassle-free financial aid.

If you find this article helpful, kindly comment and give us a follow on our social media handles.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

To acquire an iPesa loan, you must first download the app and sign up using your M-Pesa number. They will issue you a one-time password to help you validate your information. After registering, you can see your loan limit and apply for one.

Following a successful application, the iPesa loan is disbursed to your MPESA account in a matter of minutes. You will receive two texts from MPESA and iPesa informing you that your loan has been disbursed.

If you mistakenly overpay your loan, please contact the iPesa customer care team. You will then have to wait 15 days for iPesa to put the additional monies back into your account.

If you return your loan but do not receive a confirmation message from iPesa, please contact iPesa customer service. They normally resolve the issue within a few hours and notify you via SMS.

Third parties cannot access your data and personal information since iPesa encrypts them. iPesa claims not to divulge your information unless you fail to repay your loan, despite several reminders.