Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Kenya pioneered digital lending more than a decade ago, and online money lenders in Kenya have played a critical role in financial inclusion. The sites have made credit available to unbanked people and small businesses when access via conventional banks seems outside their reach.

Currently, the majority of the best online money lenders in Kenya are mobile-phone-based apps like M-Shwari, Tala, and Branch, with new entrants still transforming the lending space.

If you’re searching for the best loan apps in Kenya, you’ll find both trusted names on the list of licensed digital lenders in Kenya as approved by the Central Bank of Kenya (CBK), as well as a list of unregulated digital lenders in Kenya that continue to attract users despite the risks.

In this 2025 update, we introduce you to 15 instant loan platforms Kenyans utilize—whether to meet emergencies, pay school fees, or fund business. You will discover what differentiates each of these lenders, how much money they lend, their interest charges, and qualification requirements, so you can make the most informed decisions and avoid being in the wrong hands. Let’s dive in!

When Kenyans refer to most popular online money lenders in Kenya, a number of things become evident as to why millions download them:

It’s the combination of speed, convenience, affordability, and trust that keeps bringing Kenyans back.

Read Also – Full List of Genuine Loan Apps in Kenya

Let’s now go through the Top 15 Online Money Lenders in Kenya one at a time and highlight what each one has to offer:

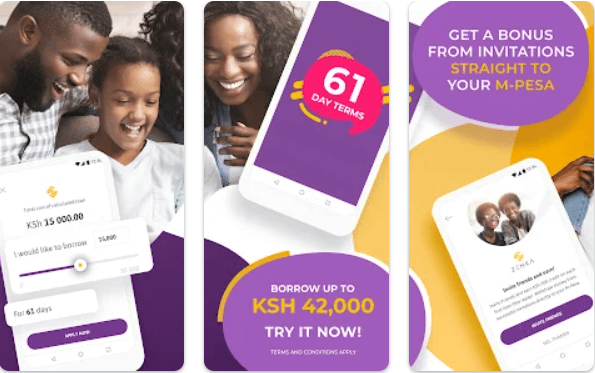

Zenka is one of the most popular online lenders in Kenya with loans from KSh 500 to KSh 30,000, just in case your pocket’s as empty as mine feels. First-time customers get 61 days to repay in two payments—just right for splitting that emergency into bite-sized pieces.

Interest varies from 9% to 39% on every loan, and to top it off, there’s an easy one-off processing charge (KSh 45 to KSh 5,800) and a 1% per day late charge if you fall behind.

How to apply:

This blend of simplicity, flexibility, and availability makes Zenka one of Kenya’s best loan apps.

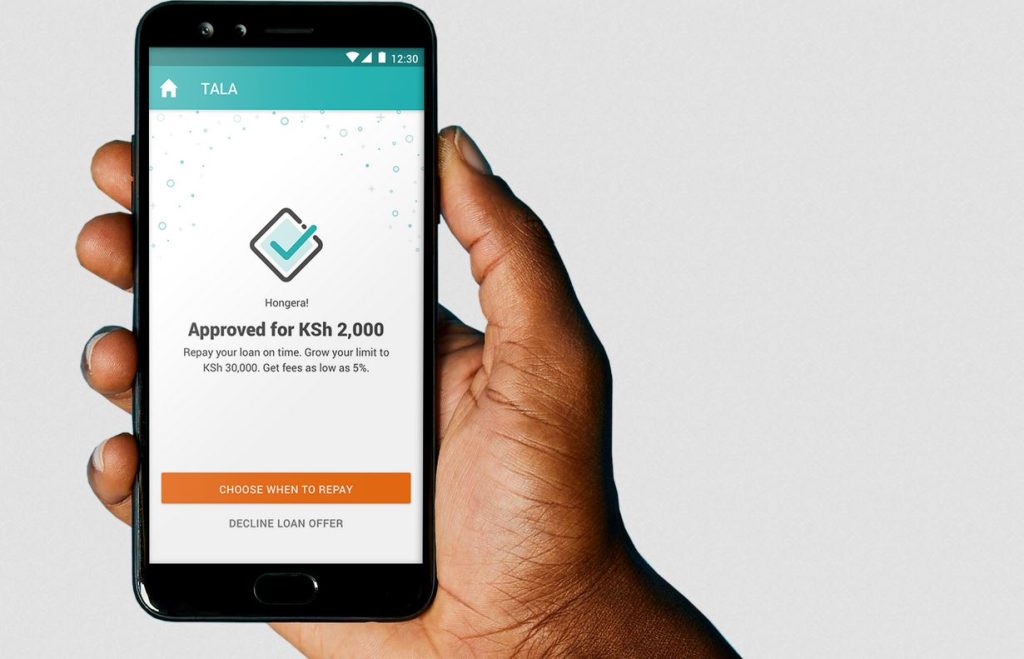

Tala is a very old online money lender in Kenya, highly regarded for its honesty and trust with clients. The initial loans are between KSh 1,000 and 5,000, rising up to KSh 50,000 for return customers. Interest ranges from 0.3% to 0.6% per day, with the highest APR of 109.5% to 219%. Remarkably, there is no fee processing charge, and you get full cost breakdowns before you commit.

How to apply:

Because it is simple and dependable, Tala always ranks among the top loan apps in Kenya.

Also Read – Full List of Fake Loan Apps in Kenya 2025/2026

Branch is among the world’s best online money lenders in Kenya, especially for bigger requirements. Loans from KSh 250 to KSh 300,000 with interest per month from 2% to 18%, depending on your credit history

How to apply:

Branch is one of the best online lenders in Kenya, appreciated for high limits and flexible terms.

Okash is also well-liked by Kenyans as a means of quick cash from one of the leading loan apps in Kenya. The loan can be up to KSh 500,000 depending on repayment history. Although stiff interest may not always be openly promoted, users report higher-than-average rates, making it best for urgent, short-term needs.

How to apply:

Okash is a licensed digital lender in Kenya, so it’s regulated but expensive—only for genuine emergencies, not for borrowing in the usual way.

Senti is a newer, more convenient app that’s carving out its niche among Kenya’s money lenders online—and not just for loans. You can borrow as low as KSh 1,500, and even pay bills or buy airtime within the app—streamlining credit and utility payments on one platform.

How to apply:

While interest rates aren’t explicitly listed yet, Senti’s convenience makes it one of the best loan apps in Kenya for people juggling tight budgets and daily bills.

Read Also – How to Get Safaricom Faraja Loan

M-Shwari is one of the oldest and most trusted online money lenders in Kenya that is directly incorporated into M-Pesa. It provides short-term loans of KSh 100 to KSh 50,000, which comes in handy when your account balance reads “0.00.” The loan accrues an interest of 7.5% each 30 days, with repayment deducted automatically from your M-Pesa.

How to apply:

M-Shwari stands out because of its ease and wide accessibility—any Safaricom customer using M-Pesa can qualify.

The Hustler Fund is a government-backed loan facility designed to empower Kenyans at the grassroots. It offers loans ranging from KSh 500 to KSh 50,000 for individuals, with interest at 8% per year, the lowest you’ll find in digital lending. The repayment period is 14 days, and partial repayments are allowed.

How to apply:

The reason Hustler Fund stands out is the interest rate is low and it is not discriminatory, because even those with no credit history can use it.

Fuliza is not a regular loan—fuliza is an M-Pesa overdraft facility. If you have insufficient balance, Fuliza pays the shortfall automatically so your transaction can go through. You receive up to KSh 70,000 depending on your limit. Charges are a 1% access fee plus a daily maintenance fee (KSh 5–30) until repayment.

How to apply:

Fuliza is adored because it’s convenient, instant, and a part of daily transactions. No paperwork, no stress.

Also Read – 21 Loan Apps That Will Give 500k Loan to First Timers in Nigeria

KCB M-Pesa is yet another trusty lender in Kenya that is run jointly by Safaricom and Kenya Commercial Bank (KCB). The lender offers loans from KSh 50 to KSh 1,000,000, which is higher than other applications. The loan has an interest of 7.5% per month, and it is usually to be repaid within 30 days.

How to apply:

KCB M-Pesa is highly rated because of its higher limits and instant access, hence preferred for both small emergencies as well as major financial needs.

Timiza was launched by ABSA in 2018 to provide instant and soft loans. The app allows the users to take a loan instantly, with a monthly interest of 6.17%. Timiza also offers other services apart from loans, including the purchase of airtime, ordering a taxi, forex checking, and even access to insurance cover.

How to apply:

iPesa is among Kenya’s quickest-emerging mobile lending apps, providing between Ksh 500 and Ksh 50,000 loans. The loans have an APR of 12%, and the payback period ranges between 91 to 180 days. The website is fast and simple to navigate for anyone who has a Safaricom line.

How to apply:

Read Also – How to Apply for NewCredit Loan

Zidisha works differently from most mobile loan apps. Instead of providing loans directly, it matches borrowers with private lenders who fund the loans. New users receive a test loan, after which they can have their limit raised to Ksh 1,128,681. Borrowers only pay a 5% service fee to cover administration and transfer fees, which is among the lowest-cost loan websites.

How to Apply:

Utunzi offers mobile loans ranging from Ksh 500 to Ksh 1,000,000 with repayment terms ranging from 91 days to 36 months. The loans come with an APR of 12% plus a 12% interest and an account management fee of Ksh 400. Thus, it is a reliable option for small and high financial needs.

How to apply:

Berry is a fast-paced mobile loan app that provides loans of Ksh 500 to Ksh 50,000 to clients with an active Safaricom number and National ID. The app reviews your account to generate a repayment timeline suitable for your requirements, with affordability and convenience being the considerations.

How to apply:

LendPlus is another trusted online money lender in Kenya that offers between KSh 1,000 to KSh 50,000 loans of 61 to 90 days duration. The loans bear an interest rate of 2.2% and above, which, compared to most other instant loan apps, is very reasonable.

The platform doesn’t require guarantors or collateral, and disbursement is immediate through M-Pesa and is perfect for individual and small business use.

How to apply:

This blend of convenience, affordability, and speed makes LendPlus one of the best loan apps in Kenya.

Also Read – Lend Plus Loan App: How to Apply in 2025

The Central Bank of Kenya (CBK) stepped in after many years of complaints of harassment, sneaky charges, and usurious interest rates. As of 2025, over 126 digital lenders have been licensed. Some of the firms on this list include Tala, Branch, Zenka, KCB M-Pesa, M-Shwari, Timiza, and Hustler Fund.

Listing on the CBK list means the lender complies with the regulations that protect consumers: open charges disclosure, reasonable treatment in collection, and secure handling of customer data. When borrowing, always confirm if your app is on this list of licensed digital lenders in Kenya.

You can check the full list anytime on the official website of CBK.

This is where things get nasty. And there’s also a roll call of illegal online lenders in Kenya – apps that are not licensed by CBK. They resort to bullying debt collection, like spamming your friends or threatening to shame you online.

Kenyans online typically put up stories of bullying. One Redditor actually called them “digital shylocks.” The risk isn’t really the interest rate; it’s also your data.

They have access to your contacts, call logs, and SMS.

If you’re applying for a new loan app, always check first if it’s licensed. Avoid unregulated lenders except in the worst situation.

When you’re financially stuck, you want speed and affordability. Here is a quick guide to the top loan apps in Kenya:

So, whether you’re a student in Nairobi needing fare, or a mama mboga in Kisumu needing stock, there’s an app for you.

Read Also – Is Kopesha Loan App Legit or Fake?

Kenya is one of Africa’s fintech hubs. Several reasons explain the growth of online money lenders:

This convergence has made Kenya the world’s case study in digital finance.

The Pros and Cons of Online Lending in Kenya

The key is achieving balance between convenience and prudence.

Also Read – Best Online Loans in Kenya Via Mpesa

Below are valuable suggestions to choose the best online money lender:

By doing so, you are protected against fraud and debt problems when you access funds you need.

Yes. Tala, Branch, and Okash apps, for example, do not greatly rely on CRB checks but on your phone data, transaction history, and payment history to determine creditworthiness.

Hustler Fund is also the cheapest at 8% per year, which is more cost-saving than other phone lenders.

Most loan apps such as Zenka, Tala, and Timiza send money via M-Pesa immediately after having your loan application approved. This usually takes under 5 minutes.

Yes, one can borrow from several apps, but it’s not recommended since it can easily result in debt traps and repayment complications.

Kenyan online money lenders have facilitated easy access to fast loans through apps such as Zenka, Tala, Branch, LendPlus, and Okash. They offer quick credit through M-Pesa, facilitating emergency or small business requirements.

Check interest and terms before borrowing to prevent debt stress. Used judiciously, such online money lenders in Kenya continue to be a go-to solution for instant and flexible credit.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.