Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Banking in Nigeria has grown more convenient and accessible as a result of industry-wide innovations. Gone are the days when an account holder would spend hours in the banking hall to make a transfer

With the introduction of USSD codes making transactions is now quick and effortless. One such innovation is the FCMB Transfer Code, a unique set of digits allowing FCMB customers to transfer funds conveniently from their accounts.

This article aims to provide an understanding of the FCMB Transfer Code, also known as the FCMB Code for Transfer, along with other USSD codes available for managing FCMB accounts.

Whether you’re looking to send money to family or friends, pay bills, or check your account balance, understanding these USSD codes can streamline your banking experience with FCMB. So, let’s delve into the world of FCMB USSD codes and make banking simpler and more accessible for everyone.

FCMB introduced a USSD transfer code, which allows consumers to effortlessly access banking services from their smartphone without having to visit a real bank. It is compatible with any smartphone and does not require an internet connection.

This adaptable code enables users to complete a variety of actions, including bill payments, airtime purchase, money transfers, balance queries, and even starting new accounts. Its security is enhanced by being linked to the phone number associated with the account.

Customers can use the FCMB transfer code by dialing *329# from their mobile phones and following the prompts on the screen.

Related – Full LIst of Opay USSD Codes & How to Use Them 2024

The FCMB mobile transfer code allows you to do a wide range of transactions without the requirement for an internet connection. As long as you have a working phone and an FCMB account, you’re set!

Here are some of the advantages of using the transfer code for FCMB:

As an FCMB customer, you can effortlessly register for the FCMB transfer code and conduct numerous banking operations via your mobile phone. Here are the steps to follow:

It is critical that customers keep their PIN secure and do not share it with anyone. Customers should also check that they have enough airtime on their mobile phones before entering the USSD code, as network charges may apply.

Read Also – Heritage Bank Code for Transfer and Other Banking Transactions

Activating the FCMB USSD code is a straightforward process that requires clients to meet specific conditions. These prerequisites include:

Using the FCMB transfer code is straightforward once you fulfill the requirements. It is advisable for feature phone users, while smartphone users may find the dedicated app more optimal.

With that said, let’s explore the various functions available with the FCMB transfer code and learn how to execute them.

To conduct a transfer with the FCMB USSD code, the customer must have a bank account with any Nigerian bank. It doesn’t have to be FCMB; as long as they have the 10-digit NUBAN account number, you’re fine.

If you have never utilized FCMB’s USSD code before, the initial step in making a money transfer is to dial *329#. Then, follow through the setup procedure to connect your account to your phone, allowing it to make transactions smoothly.

If you’ve previously set up USSD banking on your SIM card, you can just call *329*Amount*Account Number#. That will immediately transfer the requested money to the supplied account number.

Before we go any further, it’s important to remember that airtime transactions made with FCMB’s USSD transfer code fall into two categories. There are two choices: “airtime purchase for self” or “airtime purchase for others.”

Buying airtime for “self” refers to purchasing airtime for the phone number associated with your FCMB account. To make it work, simply call *329*Amount#, and your line will be credited with the amount.

In most circumstances, however, you desire to buy airtime for numbers other than your own. To make this work, dial *329*Amount*Phone Number#, and FCMB will magically credit the supplied phone number with the amount.

It is important to know that the necessary quantity for the airtime will be debited from your account, and you can only purchase airtime for Nigerian phone lines.

Many people utilize the FCMB transfer code primarily for balance inquiries. While it offers quick access to your account balance, be aware that it comes with a fee of around NGN7 per inquiry.

Considering this cost, exploring alternatives such as the bank app, ATM, or FCMB’s online banking might be more cost-effective.

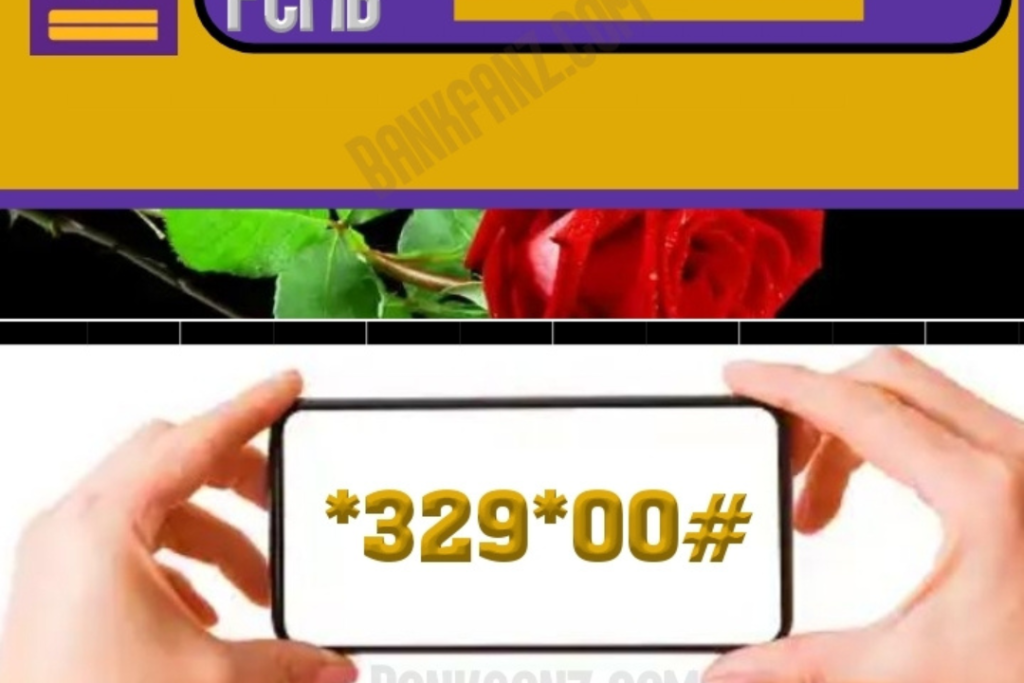

To check your FCMB account balance, dial the USSD code for account balance, *329*00#, from your phone. Dial the FCMB balance code from the phone number associated with your FCMB account. Follow the procedures carefully, and your account balance will be presented.

Also Read – Access Bank Transfer Codes For Money Transfers and Bill Payments 2024

Banking transactions should be simple and quick to perform. What could be better than a quick, simple, and secure method for accomplishing this?

To register and begin transactions, use the FCMB online banking code *329# from any phone type. Below is a table of Other FCMB USSD codes that you should know.

| Function | USSD codes |

|---|---|

| Topping up your phone number | *329*Amount# |

| Topping up another phone number | *329*Amount*Mobile number# |

| Transfer funds | *329*Amount*Account number# |

| Checking balance | *329*00# |

| Registering/resting pin/creating transaction code | *329*0# |

| Buying data for another phone | *329*1*Mobile Number# |

| Paying for DStv or GOtv subscription | *329*2*Amount*Smartcard Number# |

| To block a debit card, go to “Self-Service” and then “Block Card”. | *329# |

| Blocking account: Select “Self-Service” then select “Block Account” | *329# |

| Linking BVN: Select “Self-Service” then select “Link BVN” | *329# |

| Statement of up to six months: Select “Statement” followed by “Full Statement.” | *329# |

| Viewing your previous five transactions immediately: Select “Statement” then “Mini Statement.” | *329# |

| Paying your electricity bills | *329*3*Amount*Meter No# or *329*3*Amount*AccountID# |

Your FCMB code for transfer has a daily transfer restriction that is automatically established. The FCMB mobile banking code allows you to enhance your daily limit.

To accomplish this, you must create a transaction code that allows you to transfer up to 500,000 naira per day.

Here are the methods for creating your daily limit for FCMB USSD code:

Read Also – Code to check BVN 2024

If you believe your FCMB Bank USSD code has been compromised, you can disable it by following the steps outlined below:

If you have already blocked your FCMB Bank USSD code and want to unblock it, follow the instructions below:

Like any other technology, transfer codes can sometimes be problematic, and customers may encounter issues that prevent them from using the service. If you encounter any issues using the FCMB USSD code, consider the following troubleshooting tips:

If FCMB transfer code users face any of the issues highlighted on this page, they can troubleshoot them using the techniques outlined above. By doing so, clients may secure the success of their transactions and continue to benefit from the convenience of FCMB codes for transfer

Managing your FCMB account while on the go is made easy with the FCMB Transfer Code. Users can effortlessly transfer money and carry out other banking operations straight from their mobile phones by dialing the FCMB USSD Codes.

This service makes banking easier by enabling users to access their FCMB account from anywhere at any time. The FCMB Code for Transfer gives you access to the power of banking, whether you’re paying bills, transferring funds, or checking balances.

Accepting these USSD codes guarantees efficiency and security in managing your FCMB account in addition to streamlining financial duties.

The FCMB Transfer Code is a USSD code that allows you to transfer funds from your FCMB account to other accounts within or outside FCMB. The code is *329#, and to use it, you need to dial the code on your registered phone number and follow the prompts on your screen.

Yes, you can transfer funds to other banks using the FCMB Transfer Code. After dialing *329#, select the option to transfer to other banks, enter the bank name, account number of the recipient, and the amount you wish to transfer.

The USSD code for checking your FCMB account balance is *329*00#. Dial the code on your registered phone number, and your account balance will be displayed on your screen.

To recharge your phone using the FCMB USSD code, dial *329*amount# on your registered phone number. For example, if you want to recharge N500, dial *329*500#. Your phone will be credited with the amount, and you will receive a confirmation message.

Yes, you can use the FCMB USSD code to pay bills. Dial *329#, select the option to pay bills and follow the prompts on your screen to complete the transaction.