Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Mobile banking has become integral to the daily routines of many consumers. All Nigerian banks now have mobile apps that makes transaction and banking easy.

According to a recent survey conducted by Mastercard, a global payments and technology platform, ninety-one percent (91%) of Nigerians report using digital channels like banking apps and websites for their financial transactions.

The appeal lies in the convenience that mobile banking provides. With smartphones being carried everywhere by consumers, a mobile banking app enables them to efficiently manage various financial tasks at any time. Essentially, it serves as a bank in your pocket or purse.

Despite many individuals feeling uneasy about their savings levels, mobile banking presents useful tools for tracking expenses, establishing savings objectives, and ensuring financial stability. Additionally, it enhances banking accessibility for individuals without nearby branches and facilitates quick loans for those in need.

Now, let’s delve into a couple of Nigerian bank apps in this article.

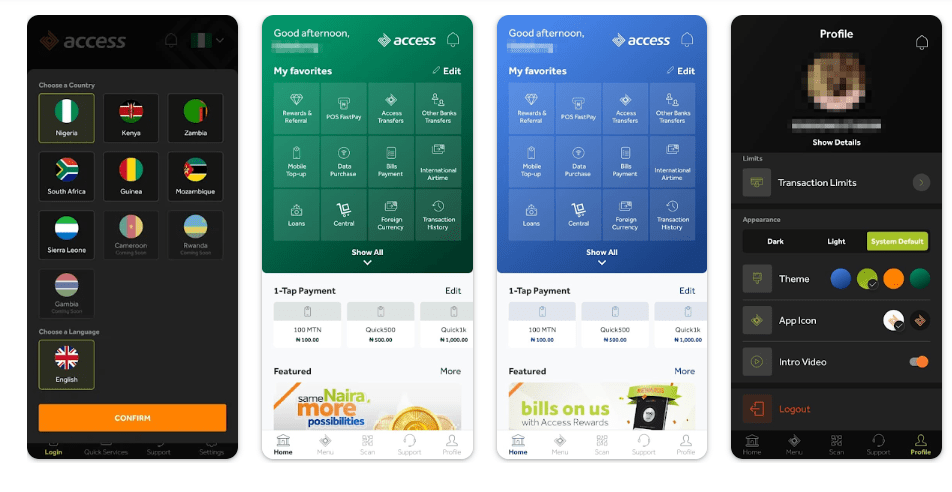

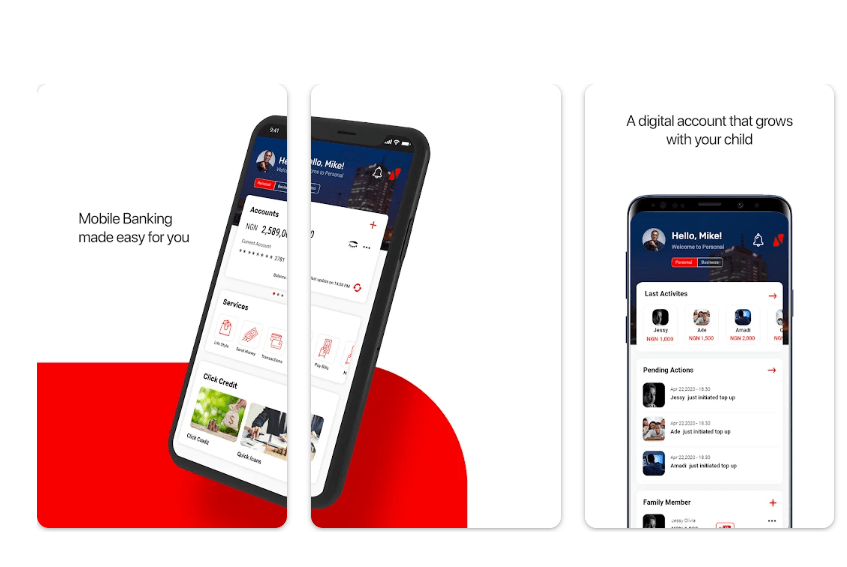

Access Bank’s app has garnered mixed reviews. A notable portion of users appreciate its responsiveness, especially in handling failed transactions due to network issues. However, some users express dissatisfaction with recent updates, citing concerns such as transaction history discrepancies, the need for additional account management features, and debit card issues.

Access Bank is recognized for its competitive loan options, tailored to suit various financial needs. The application process is streamlined, offering salary advances, personal and business loans with competitive interest rates, and quick processing times. Additionally, the bank facilitates eNaira, Foreign Exchange Currency (FCY) transfers, QR, and cardless payments.

While many users find the app’s interface user-friendly, recent changes have led to complaints about the inability to disable specific accounts and challenges in selecting the preferred account order. Nevertheless, the app boasts a responsive design for mobile devices.

Access Bank maintains robust security measures, including biometric features, encryption protocols, multi-factor authentication, device fingerprinting, data encryption, and in-app security tips, to safeguard user data and transactions.

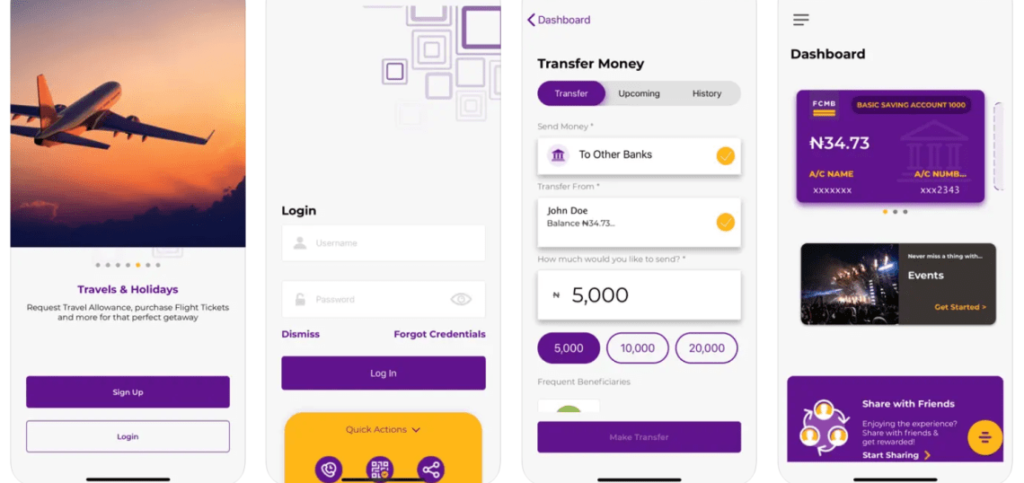

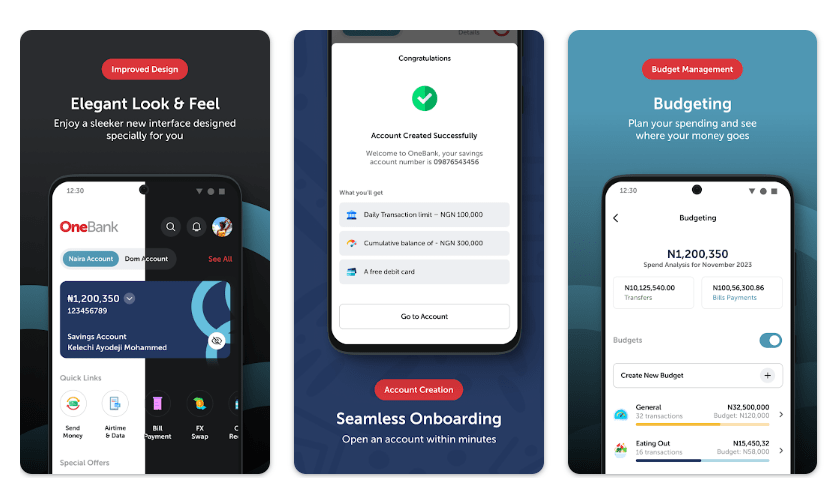

Reviews of the FCMB app reveal some frustration among users, citing reliability issues, delays in account opening, and app crashes during transactions. Some users find the app unreliable for business purposes and encounter challenges with online banking registration. Additionally, there are suggestions for a more intuitive user interface.

Despite the app’s shortcomings, FCMB stands out for its diverse range of loan products. Once registered, customers generally appreciate the available loan options and express intentions to expand them. The bank provides various loan options with flexible repayment terms and collateral requirements for some loans.

While the latest app design receives praise for its intuitive layout and easy navigation, persistent issues like app crashes during transfer receipt sharing detract from the overall user experience. The user interface is generally user-friendly, with users appreciating its simplicity. However, there are suggestions for improvements in response times and transaction reliability.

FCMB prioritizes security by incorporating encryption and two-factor authentication to protect user information. The bank employs secure login protocols, fraud monitoring, transaction alerts, and a dedicated security team to ensure user safety.

However, concerns about the reliability of FCMB’s technology persist, urging the bank to address errors in online banking registration promptly.

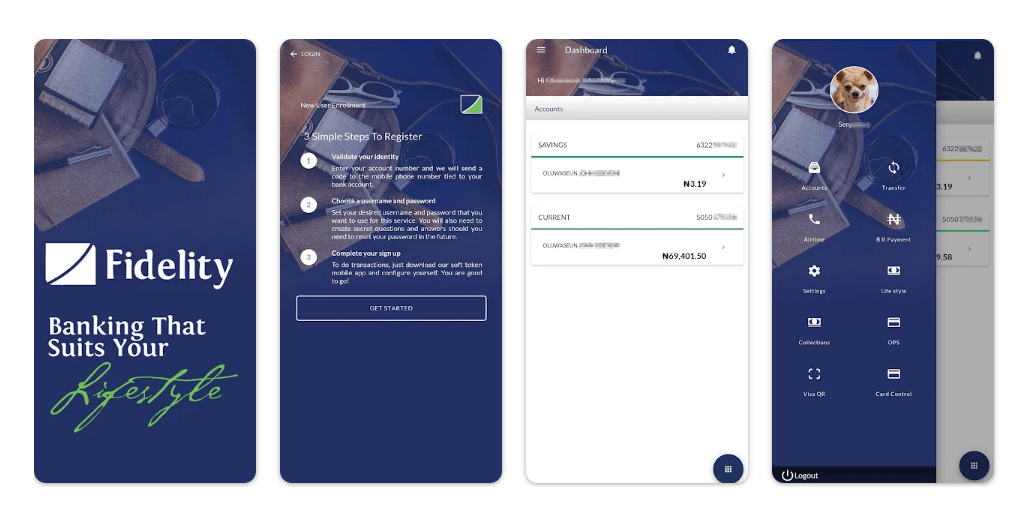

Users of the Fidelity Bank app have reported occasional delays in updating transaction history and have expressed concerns about app crashes.

Fidelity Bank offers users access to various loan products, catering to personal and business financial needs, including SME loans. They provide competitive interest rates, flexible repayment terms, and focus on customer relationships, with plans to expand loan options in the future.

While the user interface is generally well-received, ensuring app stability is crucial for an optimal user experience.

Fidelity Bank employs robust security measures, including transaction PINs and biometric authentication, to ensure the safety of user data. Additional features include secure login protocols, transaction alerts, and a dedicated security team.

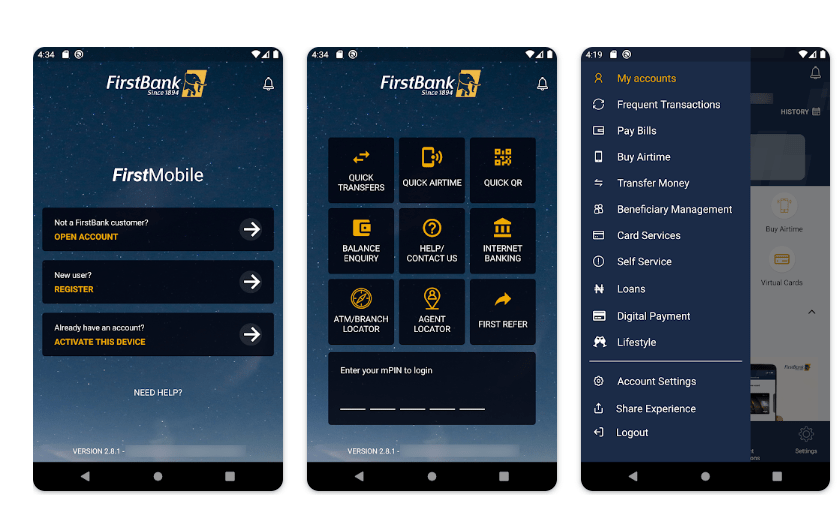

Users of the FirstMobile app from First Bank encounter challenges with the transaction history functionality, citing inaccuracies and difficulties in tracing transactions. Some also face issues updating the app through the designated store. Additionally, occasional login problems and transaction delays have been reported, with suggestions for improvements in response times.

First Bank offers various loan options with a straightforward application process. Users have access to personal and business loans, including salary loans, personal loans, and SME loans, through the app. The bank provides a diverse range of loan products tailored to different needs, with strict eligibility criteria.

The FirstMobile app is generally commended for its ease of use and well-organized website. However, users request an in-app update option to enhance the overall user experience. While the app’s interface is visually appealing, addressing occasional lagging and optimizing navigation would contribute to an enhanced user experience.

First Bank prioritizes robust security measures, including multi-factor authentication, biometric login, transaction limits, and real-time fraud prevention. However, users stress the importance of consistent app updates to address potential vulnerabilities, reflecting the bank’s commitment to investing heavily in security infrastructure.

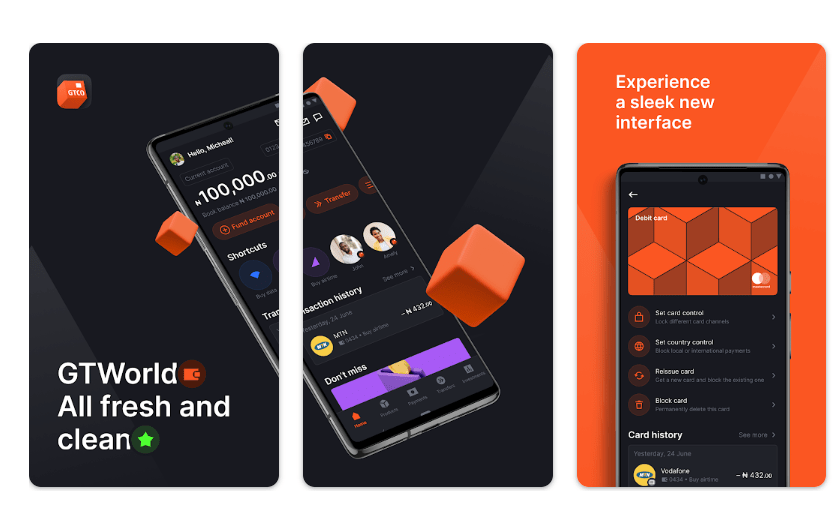

GTWorld users have expressed concerns about changes in the login flow and potential difficulties accessing funds due to recent updates.

The GTWorld app offers an extensive loan portfolio for both individuals and businesses, featuring competitive rates and flexible repayment options. It prioritizes digital loan applications to streamline the process.

While users have positively received the new UI/UX update, they stress the importance of maintaining simplicity in the app’s design.

GTCo implements robust security measures, including multi-factor authentication, biometric login, secure in-app messaging, and fraud monitoring tools. The bank invests significantly in cybersecurity, regularly updating security protocols and conducting awareness campaigns.

Users have reported issues with transaction history accuracy and occasional login difficulties. Additionally, there are privacy concerns regarding the visibility of account balances during transactions.

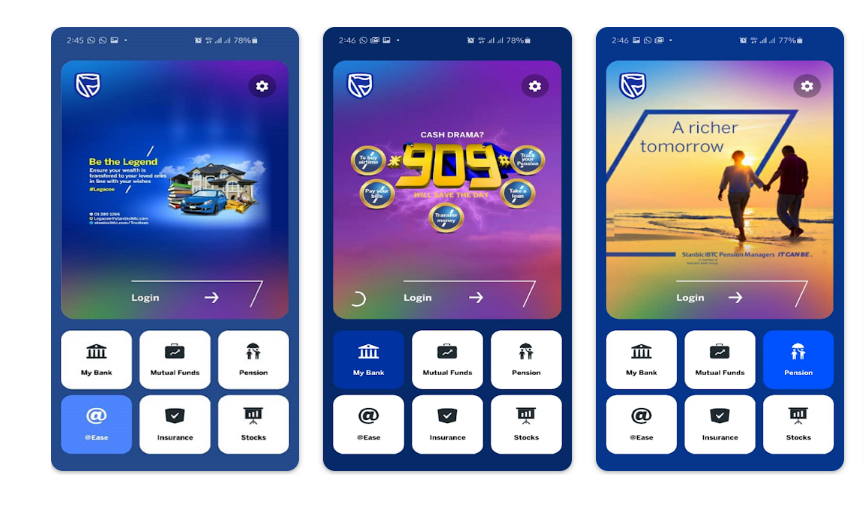

Stanbic IBTC stands out for its innovative approach to lending, offering loans without collateral or guarantor requirements, thereby enhancing financial accessibility. The bank provides various loan options, including mortgages, car loans, and student loans, with a focus on corporate and investment banking, as well as personal and business loans tailored to high-net-worth individuals.

While the app has seen positive developments, users express a desire for more customizable transaction history and improved transaction receipts.

The bank employs multi-layered security measures, including biometric login, transaction confirmation, and real-time fraud detection, to ensure the security of user accounts and transactions.

Sterling Bank app users have noted occasional difficulties in navigating menus, suggesting improvements for better user-friendliness. Other concerns include inconsistent customer service experiences, a limited ATM network compared to larger banks, and occasional app crashes and bugs.

Sterling Bank offers a variety of loan products, including salary and personal loans, with plans to expand options in the future. Additionally, the bank provides agricultural loans with competitive rates and flexible repayment terms, focusing on supporting small businesses and entrepreneurs.

While the user interface is generally well-designed, enhancing navigation fluidity would further improve the user experience.

Sterling Bank prioritizes user data protection with robust security measures, including real-time transaction monitoring and secure authentication.

The bank emphasizes sustainability and green banking initiatives, upholding strong corporate governance practices and actively participating in social development projects.

Users have reported difficulties with the app’s interface, login process, and transaction-related issues, suggesting areas for improvement.

UBA provides easy access to salary, personal, and business loans, offering a diverse range of products to cater to various needs. The bank prioritizes fast loan processing times and focuses on financial inclusion and underserved markets.

While the UBA app features a modern and visually appealing interface, the recent complete overhaul has led to negative user feedback. Clear communication and maintaining a seamless user experience are emphasized. Additionally, the interface can sometimes feel cluttered with promotional offers.

UBA has a Pan-African presence across 20 countries and is known for its strong focus on mobile banking and payments. It offers innovative products like Leo, the virtual chatbot assistant.

UBA employs strong authentication measures, real-time fraud detection, transaction alerts, and maintains a dedicated security team to ensure the safety of user transactions and data.

Users of the Wema Bank app have encountered occasional login difficulties and have suggested improvements to enhance the app’s speed.

Wema Bank provides a range of loan options through its app, catering to various user needs. It targets niche markets such as young professionals and SMEs, offering innovative products like the ALAT Salary Top-up, flexible repayment plans, and competitive interest rates.

The app features a visually appealing user interface, with enhanced speed to ensure a seamless user experience.

Wema Bank prioritizes security, implementing multi-layered authentication processes and encryption protocols to safeguard user information. The bank invests significantly in cybersecurity measures, conducting regular security audits and penetration testing to ensure the integrity of its systems.

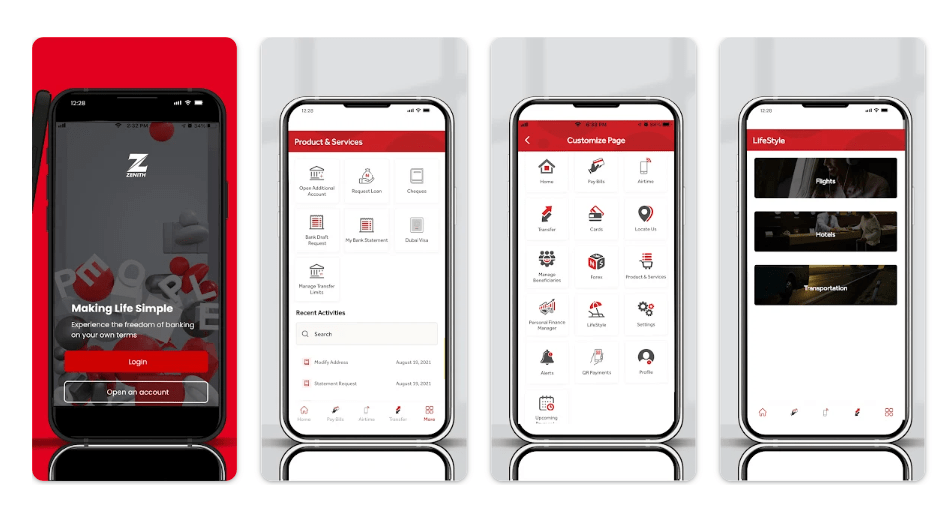

Users have reported issues with beneficiary lists, reduced transfer limits, and difficulties in the login process. Additionally, there are complaints about poor customer service experiences, inconsistent app performance, and strict account maintenance fees.

Zenith Bank provides a variety of personal, business, and mortgage loans with competitive interest rates, primarily for prime customers, and follows stringent loan approval processes.

The recent UI/UX update received mixed reviews. While some users appreciate the innovation, others call for improvements in functional clarity.

Zenith Bank prioritizes cybersecurity, implementing measures to protect users’ data from fraudulent activities. The bank has established a robust security framework to enhance user security.

1. What are some common challenges faced by users of Nigerian banking apps?

Users often encounter issues related to beneficiary lists, reduced transfer limits, login difficulties, poor customer service, app performance inconsistencies, and strict account maintenance fees.

2. Which Nigerian banks have the highest number of app downloads?

Zenith, UBA, GTCO, FirstBank, and Access Bank have over 5 million app downloads each on the Google Play Store, while Wema Bank (ALAT), Sterling, Stanbic IBTC Bank, Fidelity, and FCMB have 1 million plus downloads.

3. How do Nigerian banking apps fare in terms of user experience (UX) and user interface (UI)?

Overall, Nigerian banks perform reasonably well in UX/UI, with none receiving less than a 3.2 rating out of 5.

4. Which Nigerian banking app is rated the highest among users?

Based on the analysis, the Access Bank mobile app emerges as the highest rated, with a rating of 4.4 out of 5.

5. What types of loans do Nigerian banks typically offer through their mobile apps?

Nigerian banks typically offer a range of personal, business, and mortgage loans with competitive interest rates, primarily for prime customers, and follow stringent loan approval processes.

In summary, users of Nigerian banking apps encounter similar challenges across the institutions reviewed, including issues with beneficiary lists, reduced transfer limits, login difficulties, poor customer service, app performance inconsistencies, and strict account maintenance fees.

Zenith, UBA, GTCO, FirstBank, and Access Bank all boast over 5 million app downloads on the Google Play Store at the time of this review, while Wema Bank (ALAT), Sterling, Stanbic IBTC Bank, Fidelity, and FCMB have 1 million plus downloads.

In terms of UX/UI, Nigerian banks generally fare well, with none receiving less than a 3.2 rating out of 5.

Based on the analysis, the Access Bank mobile app emerges as the highest rated, with a rating of 4.4 out of 5.