Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In Kenya, the Zenka loan app is now among the most sought-after loans. This fintech business provides fast cash to clients that qualify for it.

Traditional loan application processes often involve lengthy paperwork and approval times, leaving individuals in urgent need of cash stranded. However, with the advent of mobile loan apps like Zenka, accessing quick loans has become easier and more convenient than ever before.

Zenka loan app is designed to provide instant access to funds directly from your smartphone. Whether it’s for emergencies, unforeseen expenses, or simply bridging financial gaps between paychecks, Zenka Loan offers a hassle-free solution.

With its user-friendly interface, transparent terms, and speedy approval process, Zenka has revolutionized the way people borrow money.

The nice part about Zenka Loan is that you can use “Kabambe” (button phones) or any iOS, Android, or iPhone device to apply for the loan you want.

In this article, we’ll walk you through the process of applying for a Zenka loan via the app and SMS and how to check your Zenka loan limit. Please read carefully and continue!

Read also – 8 Best Apps to Save in Dollars in Nigeria 2024

For Kenyans who meet the requirements for the loans, mobile lending has taken over. Zenka is one of many platforms that provide quick loans to eligible people and companies.

Zenka is a smartphone platform that provides low-interest loans with flexible repayment arrangements to its subscribers nationwide.

Even though Zenka loans are typically for short-term personal use, they can be used for a variety of purposes. While Kabambe customers can choose to use the USSD code, iPhone, iOS, and Android users can also benefit from the Zenka Loan app.

Zenka is a mobile loan app that provides convenient access to instant loans directly from your smartphone. With Zenka, users can apply for loans within minutes, making it an ideal solution for urgent financial needs.

The app offers a streamlined application process, allowing users to register, apply for loans, and receive funds quickly and efficiently.

Key features of Zenka loan app include:

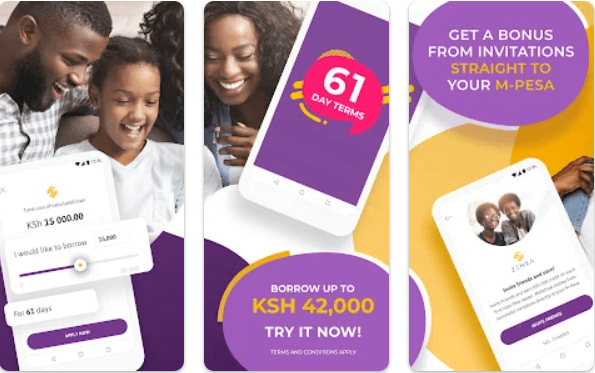

Zenka Loan offers fast approval and disbursement of loans, enabling users to access funds within minutes of applying.

Users can borrow varying amounts based on their needs and eligibility, with loan limits adjusted according to repayment behavior.

They provide clear and transparent terms for loans, including interest rates, fees, and repayment schedules, ensuring users understand the cost of borrowing.

The app features a user-friendly interface that makes it easy to navigate and apply for loans, even for users with limited technical knowledge.

Zenka prioritizes the security and privacy of users’ personal and financial information, employing robust encryption and data protection measures.

Overall, Zenka offers a convenient and reliable solution for individuals seeking quick access to funds for emergencies or other financial needs.

With its fast and efficient loan process, transparent terms, and user-friendly interface, Zenka stands out as a trusted mobile loan provider.

The Zenka loan app operates similarly to other internet lending services. But what sets Zenka apart are the cheap interest rates, speedy loan disbursement, and flexible repayment arrangements.

You can apply for the loan you want and return it with interest when it’s due by using any of the loan application techniques we go over in the following topics.

Read also – Latest on How to Borrow Data on Glo

Prior to becoming eligible for a Zenka loan using any of the available application options, you need to fulfil the following conditions and criteria:

Read also – Latest on How to Borrow Data on Airtel

You can use any of the following channels to apply for a Zenka loan:

1. Using Zenka loan app

2. Using SMS

One of the best-rated apps on the Apple and Google Play Stores is the Zenka loan app. It has 500K downloads, more than 14,000 favorable reviews, and 4.2 star ratings.

Users may easily navigate around the app because of its pleasant and user-friendly UI. Most importantly, downloading and installing the app on your phone only requires a small amount of data. This indicates that its size is portable (MB).

You may quickly and stress-freely apply for loans and repay them with the Zenka loan app!

Follow these steps to get the Zenka loan app from any store of your choice:

To apply for the loan you want, download the Zenka loan app and complete these steps:

Your loan application will be examined, and if it satisfies the management team’s standards, it will be granted. A few minutes later, your loan will be transferred immediately to your bank account or mobile money transfer app.

This approach has the advantage of giving you complete control over your loan application and giving you access to capabilities that enable the app.

You can use the SMS method to apply for a Zenka loan if you don’t have a smartphone. This is a simple, fast solution that doesn’t require an internet connection.

Here’s how to use this technique in application:

Read also – Latest SASSA SRD Contact Channels for Quick Help

The lowest amount you can often borrow from Zenka is Ksh 500, and the maximum is Ksh 30,000 or even Ksh 80,000.

In the interim, your eligibility and the application process you choose will mostly determine how much you can access.

You can access between Ksh 500 and Ksh 10,000 using the Zenka USSD code or SMS. Moreover, Ksh 500 and 30,000 (80,000) for the loan application for Zenka.

Take the following actions to increase your Zenka loan limit:

Consistently making timely repayments on your existing Zenka loans can demonstrate your creditworthiness and responsible borrowing behavior.

Using Zenka frequently and repaying your loans promptly can help build trust with the lending platform, potentially leading to a higher loan limit.

Zenka may gradually increase your loan limit over time as you build a positive borrowing history, even with m-pesa.

The quantity of money borrowed has a major impact on the Zenka loan interest rate, which is frequently thought of as the processing cost. It does, however, vary from 9% to 29%.

It is important to note that there is no “interest rate” required of first-time borrowers. There is no processing charge there.

Generally, Zenka aims to provide transparent and competitive interest rates to its users. However, it’s essential to note that the specific interest rate applicable to your loan will be communicated to you during the application process.

Zenka typically provides clear and upfront information regarding the interest rates, fees, and other charges associated with borrowing through the app.

This transparency allows borrowers to make informed decisions and understand the total cost of borrowing before accepting a loan offer.

Read also – VULTe: Up to N100 Million Available to Expand Your Business

The Zenka loan has a 61-day repayment period. and installment payments are accepted. It might be 61 days if the first payment is made during the first 30 days and the last payment is made before the next 31 days.

Repaying your loan can be done via;

Here are some ways to contact this amazing lending platform:

Phone Number: @020 765 08 78.

Email: support@zenka.co.ke.

Social media:

The Zenka Loan App is a mobile application that offers instant loans to users directly on their smartphones.

You can download the Zenka Loan App from the Google Play Store for Android devices or the App Store for iOS devices.

Simply download the Zenka Loan App, register for an account, and follow the prompts to apply for a loan within minutes.

Eligibility criteria may include being a registered user, having a valid ID, and meeting the app’s creditworthiness standards.

Loan amounts vary depending on factors such as your credit history and repayment behavior. Zenka typically offers loans

ranging from small amounts to higher limits for repeat borrowers.

The interest rate for loans on Zenka varies and is communicated clearly during the application process. It is advisable to review and understand the terms before accepting a loan offer.

With Zenka’s streamlined process, eligible users can receive loan approval and disbursement within minutes of applying.

Yes, Zenka may offer loan extensions or refinancing options, subject to the app’s terms and conditions.

Zenka may charge nominal service fees or interest rates on loans, which are communicated upfront to users.

Yes, Zenka employs robust security measures to safeguard users’ personal and financial information, ensuring privacy and confidentiality.

You should now be fully aware of how to use their mobile app and SMS to apply for a Zenka loan. Depending on your needs and preferences, you can choose between the two convenient methods.

Zenka loan app offers a convenient and accessible solution for individuals seeking quick access to funds through its mobile loan app. With its transparent terms, user-friendly interface, and speedy loan approval process, Zenka has become a trusted platform for borrowers in need of financial assistance.

By providing clear information about interest rates, fees, and repayment schedules upfront, Zenka empowers users to make informed borrowing decisions. Whether it’s covering unexpected expenses or managing cash flow gaps between paychecks, Zenka strives to simplify the borrowing experience and provide peace of mind to its users.

With Zenka loan app, accessing quick loans has never been easier, ensuring that individuals can meet their short-term financial needs with confidence and flexibility.

Moreover, you can use any of the techniques based on the phone type you are using. Always make sure you are borrowing no more than you can afford to pay back. I wish you luck!