Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In an era of digital transactions and increased security, integrating your National Identification Number (NIN) into your bank account has become a vital step. This detailed article seeks to demystify the process by explaining why it’s necessary and providing a step-by-step breakdown of how to link NIN to a bank account.

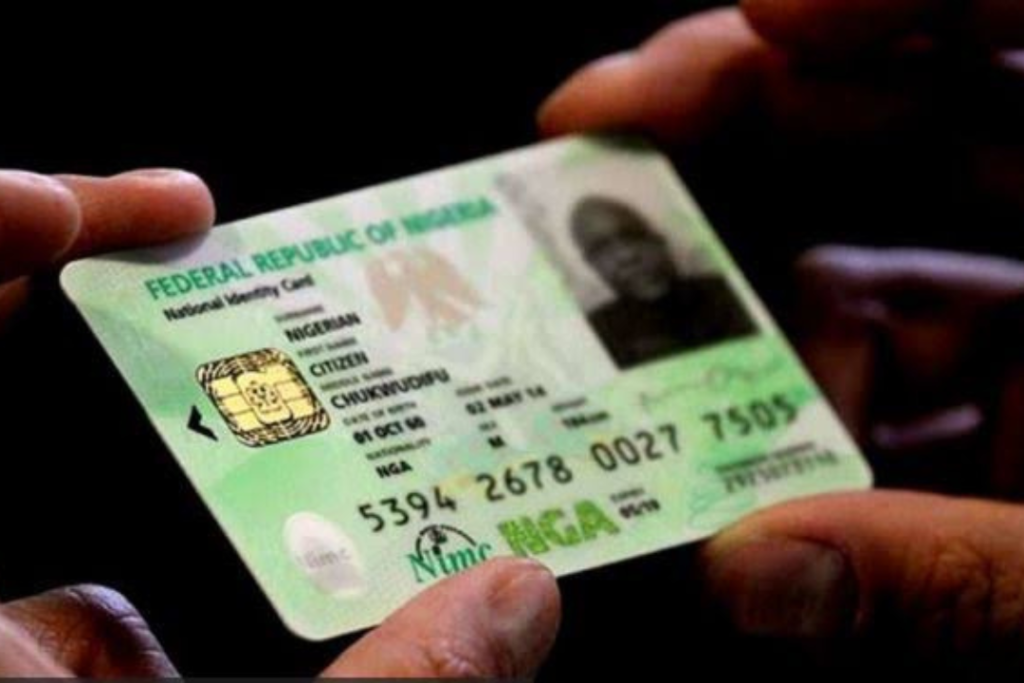

As financial institutions comply with legal requirements to improve client identity and security, linking your NIN to your bank account has emerged as a critical step. Your NIN, a unique identifying number provided by the government, is an important factor in ensuring accurate and reliable identification.

In this article, we will go over the practical methods for linking your NIN to your bank account. Whether you’re a seasoned digital user or are new to these processes, this comprehensive guide will bring you through the necessary steps in an easy-to-understand manner.

From accessing the appropriate channels to submitting the necessary information, we’ll make sure you understand every step. Let’s dive in!

Linking your NIN to your bank account is critical for a variety of reasons, the most important of which is to improve security, streamline processes, and promote financial inclusion.

Before we begin, let’s explain why tying your NIN to your bank account is so important:

Prevention of Fraud: Linking your NIN ensures that the bank has a verified identity associated with your account, reducing the risk of fraudulent activities like identity theft or unauthorized access.

The Central Bank of Nigeria (CBN) has directed all banks to guarantee that customers’ NINs are connected to their accounts. Noncompliance may result in limitations on certain banking services.

Linking your NIN to your bank account provides an added degree of security to your financial transactions, lowering the danger of identity theft and unlawful access.

Once your NIN is linked to your account, you’ll have constant access to banking services such as online transactions, withdrawals, and fund transfers.

Related – Latest Ways to Link NIN with your Major Bank Account 2025

In response to a recent regulation from the Central Bank of Nigeria (CBN), bank customers around the country are expected to link their National Identification Number (NIN) to their accounts.

The CBN circular, dated December 1st, 2023, emphasizes the need for this connectivity, particularly for Tier 1 accounts that require valid identification or proof of address. While some banks have set a deadline, others have yet to announce one.

To help people with this process, these are the processes that link NIN to bank accounts:

Before you Start:

The SMS linking process:

Within a few minutes of joining successfully, you should receive a confirmation SMS from your bank. The notice will normally state that your NIN has been associated with your account.

See this: Top 10 Tech Certifications for 2025

Before you Start:

The Internet Banking NIN Linking Process

See: Tookeez, a Moroccan Fintech Startup Secures $1.5 Million Funding from Azur Innovation Fund

You can link NIN to your bank account by sending an email. Here’s everything you need to know:

1. Compose an email: Compose an email to your bank’s customer support email address or your specialized account officer’s address (if available). This information can be found on the bank’s website or in your bank statements.

2. Subject line: Make it clear what your email is about. Consider “NIN Linking Request – [Your Account Name].

3. Email’s body: Make a courteous request in the email body to link your NIN to your bank account. Include the following details:

4. Send an email: Send the email after you have examined the information to ensure its accuracy.

While going to your bank branch is still a possibility for connecting your NIN to your bank account, it is not the most recommended technique. It might be time-consuming and require waiting in queues.

If you opt to visit your bank in person, you normally need to perform the following:

Read Also – 70 Million Accounts in Danger of Being Blocked by Banks Because of NIN Linkage

There is no universally acknowledged method for determining whether your NIN is linked to your account in Nigeria. However, most banks offer several means for confirming the linkage. Here are some general options:

For the most recent instructions on NIN linkage verification, please visit your bank’s website or contact them directly.

Also Read – 4.2 Million Lines not Linked to NIN Disconnected by MTN

Here are some tips and considerations to take when linking your NIN to your bank account:

By following these tips, you can ensure a secure and smooth process when linking your NIN to your bank account.

Read Also – Latest ways to Generate virtual NIN in Nigeria 2024

This is an important step to ensure regulatory compliance and enhanced security for your finances. However, encountering issues during this process can be frustrating. Here are some troubleshooting steps you can take:

Double-check that your NIN information is accurate and matches your bank records exactly. Even a minor typo or misspelling can cause the linkage to fail.

Consider the possibility of temporary glitches with the bank’s system. Trying again later might resolve the issue. You can also contact your bank to confirm if they are experiencing any ongoing maintenance or technical difficulties.

If the problem persists, reach out to your bank’s customer support for further assistance. They have the expertise to investigate the issue and provide specific guidance tailored to your situation. Their contact information can be found on your bank’s website or mobile app.

By following these steps, you should be able to resolve any issues you encounter while linking your NIN to your bank account.

According to Nigerian government directives, it is mandatory.

If you have many bank accounts, you can link your NIN to them all.

If you fail to link your NIN to your bank account, you may face limits or limitations on your financial services.

While timeframes can vary, it is best to finish the connection process as soon as possible to avoid any trouble.

Some banks may provide online platforms or mobile apps for NIN linking, however, it is recommended that you visit a branch for help to ensure correctness and security.

Linking your NIN to your bank account is an important step towards financial stability. This detailed tutorial outlines the necessary steps for successfully linking your National Identification Number to your bank account.

By following the guidelines on how to link NIN to a bank account, you maintain regulatory compliance and increase the security of your financial transactions. Taking the time to complete this process protects your identity and makes for a more secure banking experience.

Stay educated and proactive to ensure a smooth integration of your NIN with your bank account, resulting in a safer and more efficient financial future.