Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Thanks to SmartCash, borrowing money has never been easier. If you’ve been wondering how to borrow money from SmartCash, this guide is here to help.

SmartCash provides an easy and direct way for people to access money whenever needed in Nigeria. You might wonder, “How can I borrow money from SmartCash?” or “Can I borrow money from SmartCash Bank?”

The answer is Yes, and it’s a lot simpler than you may imagine. With just a few steps and a specified code to borrow money from SmartCash, you will get the financial support you need in no time.

Be it a sudden expense or a planned purchase, SmartCash is always there to help. In this article, we will guide you through the process and ensure that you understand each step of borrowing money from SmartCash bank.

SmartCash is a Payment Service Bank that seeks to fill the financial gap in Nigeria by bridging banks with unbanked communities and empowering them with financial services tailored for Nigerians.

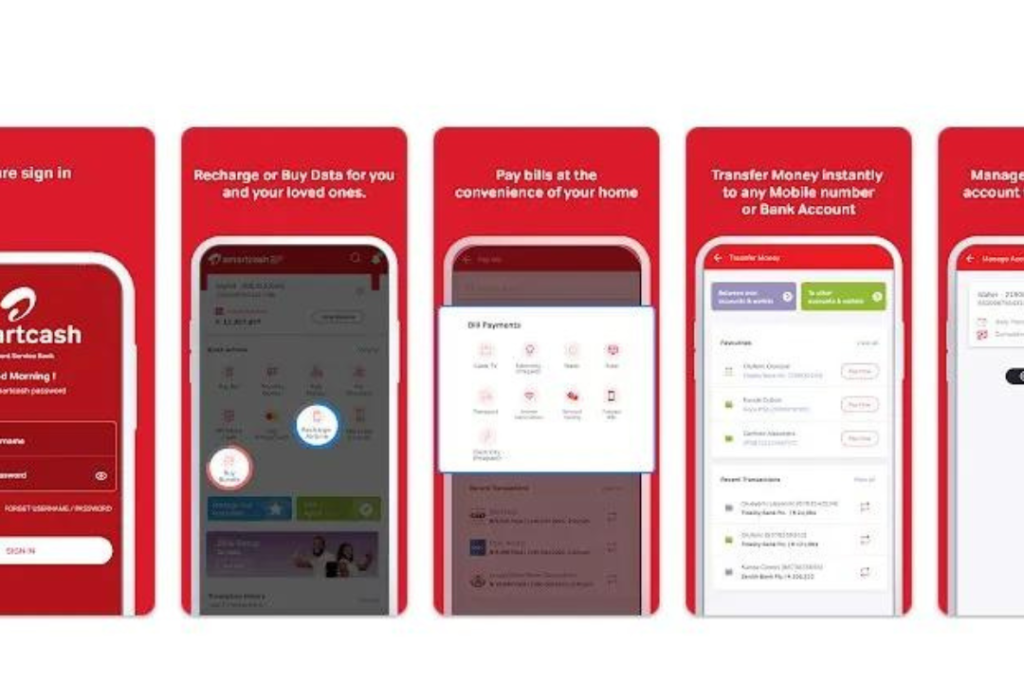

Users can send and receive money, pay bills, buy airtime, borrow money, and manage their finances through user-friendly interfaces.

With a huge agent network that extends to the remotest areas, SmartCash focuses on financial inclusion, empowering people and driving economic growth.

SmartCash is leveraging technology and customer-driven behavior to change the financial landscape in Nigeria by making banking more accessible and convenient for all.

Read Also – How to Borrow Money from Stanbic Bank in Nigeria | A Step-by-Step Guide

If you wonder, “Can I borrow money from SmartCash?” Sure, you can!

SmartCash is a hassle-free and straightforward loan service that offers fast cash. Through SmartCASH, one can borrow for emergency expenses, bridge a financial gap, or achieve personal or business ambitions.

SmartCash loans have features that make them flexible and accessible:

Whether you are an employee, a businessman, or an entrepreneur looking to borrow money from SmartCash, SmartCash has the means to help you do so.

You do not need a bank code to borrow money from SmartCash, as the platform is friendly and convenient. Apply online, and the rest is on SmartCash.

Now, what are you waiting for? Go ahead and make an application request today on SmartCash for a loan and relish their loan ease.

Before one can even consider how to borrow money from SmartCash in Nigeria, he is usually required to fulfil the following conditions:

These may vary slightly depending on the specific loan products and policies that SmartCash PSB has in place. It’s always best to contact them directly to get all the accurate details.

Also Read – How to Borrow Money from Fidelity Bank in Nigeria | A Step-by-Step Guide

If one desires a fast and sure way of getting financial support, SmartCash offers an accessible avenue. Here is a step-by-step guide on borrowing money from SmartCash and the answer to “How can I borrow money from SmartCash?”

First, sign up to create an account on SmartCash. Click the “Register” button after launching the application.

You will receive a registration form to fill in your details, such as name, email, phone number, and password. Please fill in the details correctly, as incorrect information may lead to flaws in creating your account.

After registration, SmartCash will send you a verification link to your email or phone number. Once you submit the form, you will receive a verification link to your email address or phone number. Click on it to activate your account. This step is crucial in ensuring that no one else can access your account.

After verifying your account, click on “Apply for Loan” to proceed for loan application. Fill out a form for a loan application that will include personal and financial details such as income, employment information, bank account details, etc. This will give SmartCash the factual information to establish your creditworthiness.

Select the loan amount and term that best fit your needs. SmartCash offers people flexible tenures, sometimes even from days to months. Therefore, one should choose the one that would burden them less according to their capabilities.

Fill out the form for your loan application. Then, select the amount and repayment duration of your choice. Finally, press “Submit” to send in your application. SmartCash scrupulously reviews it to check your creditworthiness.

Smartcash disburses the loan cash straight to your bank, subject to approval. You will have the funds in your bank account minutes after approval.

Follow these through to help you borrow some money from SmartCash and answer the question, “How can I borrow from SmartCash?

If you are wondering how to borrow money from SmartCash or asking how I can borrow money from SmartCash, you can also use the USSD code. The code to borrow money from SmartCash is *939#.

Using this code, one can access different services offered by SmartCash right from their mobile phone. Just dial *939#, and you will be prompted to start your loan request.

Ensure your phone number is linked to your bank account and registered with SmartCash.

Through this USSD code, you can be assisted in applying for a loan anywhere and at any time without the internet and a bank branch. Many people find this to be incredibly convenient.

Read Also – How to Borrow Money from Zenith Bank in Nigeria | A Step-by-Step Guide

This is a step-by-step procedure on how to use this code to borrow money from SmartCash: To borrow money from SmartCash, do the following easy steps:

Now, wait as SmartCash runs through the processing of your application and disburses the loan funds to your account.

Note: Please ensure that you are registered on SmartCash and eligible to use their services so that you can access the loan service. Note the interest rates and repayment terms before taking a loan. You can also check the best loan apps in Nigeria with low interest.

Below are steps that will easily enable one to use the *939# code to borrow money from SmartCash and gain money quickly and conveniently.

The time it may take to secure a loan from SmartCash depends on various factors. Generally, if the application submitted to the lender is approved, a disbursement will happen within some hours or at least a day or two. Among the factors are the loan amount, creditworthiness, and efficiency in the application process.

In case one wants to know how to borrow money from SmartCASH Bank and again worried about the time taken to get a loan approved, then here are the general steps usually followed:

If you promptly provide all the documents and information required, that would be quick. However, if additional verification is needed, then it might take a little longer. Generally, you can get your loan within 24 to 48 hours of approval.

Also Read – How to Borrow Money from Union Bank App in Nigeria | A Step-by-Step Guide

The interest rate that a SmartCash loan commands and the associated repayment terms are governed by various parameters such as the loan amount, loan duration, and the borrower’s credit profile.

However, according to the latest disclosure, rates have been charged for different products and risk profiles of the customer. That said, the following points prevail:

SmartCash charges customers competitive interest rates that vary from 2% to 5% per month for different products and risk profiles of customers.

The loan repayment terms are variable and mostly run from a month to a year. The duration is usually decided by the borrower based on their financial feasibility.

The method of repayments is monthly, which includes a portion as interest and another for the principal amount.

Repaying money borrowed from SmartCash is very easy. The steps are as follows:

To avoid late fees and penalties, pay the entire amount owed by the deadline. If you experience any challenges along the way, contact SmartCash customer service.

Also Read – How to Borrow Money from MTN App in Nigeria | A Step-by-Step Guide

If you are stranded on how to borrow money from SmartCash bank or even using the code to borrow money from SmartCash, the following steps will help fix the error. Below are some common errors and their possible solutions:

Before requesting a loan, one must ensure that they meet all of SmartCash’s requirements.

Keep your details as updated as possible. Most of the applications are rejected due to discrepancies in information.

Make sure one is not applying for more when he’s eligible for less than that. You can contact customer service if there are doubts regarding the limit from SmartCash.

If you make a loan application on the SmartCash app, ensure it is always up-to-date. Older versions may be buggy or miss new features essential to support your loan application process.

Ensure you have a reliable internet connection while submitting your online loan application. Poor connectivity might lead to errors during the application.

If at all one has any pending loans and debts connected to SmartCash, clear them before applying. A non-payer can be disqualified for new credit.

If you follow the above steps and face issues, contact SmartCash customer support. They shall help you and assist you with the application process for the loan. You can reach them by calling, emailing, or visiting their main website.

Do this, and on completion, you will borrow money from SmartCash and be assured of success in fixing any issues that come your way while applying for it.

Yes, SmartCash does consider non-salary earners, but only with alternative proof of income, such as business income, investments, or any other sources of income. SmartCash looks at your creditworthiness based on your general financial situation, not on whether you are employed or not.

You would have to check the eligibility criteria given in the SmartCash app or website. Next, it will keep your age, income, credit score, etc. Also, you may check out their online loan simulator to learn about your loan eligibility amount and tenure.

Of course, you can pay off your loan ahead of schedule, but before doing so, refer to your loan agreement in case of an early repayment fee. Repaying your loan before the due date will save you on interest charges and be equally great for your credit score.

Missing your payment will likely incur late fees and penalties and hurt your credit score. Further actions that SmartCash may take include reporting the default to credit bureaus, making it harder for you to get credit in the future. If you are having trouble repaying the loan, call SmartCash’s customer support to discuss possible options.

Borrowing with SmartCash in Nigeria is not difficult, as this article will let you know. Whether you are asking “how to borrow money from SmartCash,” “how can I borrow from SmartCash,” or looking for the code to borrow from SmartCash, it’s all covered.

Now that you know how to borrow money from SmartCash Bank, why not give it a try?

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).