Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Zash is the go-to loan app for Kenyans who need urgent funds. Life moves fast, and sometimes money problems can hit us out of nowhere. That’s where the Zash Loan App comes in handy. It’s like your instant fix for money worries.

Fortunately, with loan apps like this, you can easily access cash to get going. All you need to do is download the app, fill in the necessary information, and there you have it—instant cash in your account.

But what makes Zash a preferred choice among borrowers? How does it ensure transparency, accessibility, and security in this age of digital lending?

This blog post will answer all your questions about the app. Let’s get started.

Zash Loan app is a digital lending platform owned by KopaKash Limited. It’s a downloadable mobile app that helps Kenyans get quick personal loans when they’re hit with a rough patch financially.

You can borrow money through the app for a short time, between 91 days and a whole year, depending on how much you need.

Zash does not require that you have a good credit history or valuable collateral to put up as security to get a loan.

It’s all done right from your mobile phone, making it easy and convenient for anyone who needs quick loans

Everyone has different financial needs, and that is why there are a lot of quick loan apps out there. But just like with the others, you might experience some pros and cons using the Zash loan app.

In the table below, we explore the benefits and downsides of using the Zash loan app so that you can choose a loan tailored to your needs.

| Pros | Cons |

|---|---|

| Transparency: With Zash, you will always be aware of the interest and fee schedule. They guarantee that customers are aware of all costs related to their loans, including interest rates as of right now. Additionally, nothing is hidden from you during the application procedure; all the details are provided. | Long application Process: Some users may find Zash’s registration process a bit onerous because it asks for a lot of information, including a photo and several contact details. |

| High quota and low interest fee: Zash offers loan limits between Ksh. 800 and Ksh. 50,000. They also provide a range of flexible repayment choices. | Low loan limits: Zash might not be the ideal choice for you if you require a sizable sum of money. Their loan limitations are smaller than those of other mobile lending applications on the market, which can reduce your borrowing ability |

| Simple to use: Anyone with a steady income between the ages of 18 and 60 can apply for a loan directly from their mobile device with Zash. | Only appropriate for emergency loans: Zash is great at giving you immediate cash in times of need, but it might not be the best option for more substantial or ongoing financial need. You may need to check into alternative lending platforms if you are hoping for more loan possibilities with greater flexibility. |

| Safe to use: Zash recognizes the importance of your security. They make sure that all of your personal information is safe when utilizing the app. |

To qualify for a loan through Zash, you must meet the following criteria:

Before you can apply for a loan on Zash, you must meet certain requirements. They include the following:

Usually, Zash loan limits range from Ksh800 at the minimum to Ksh50,000 at the maximum.

With a maximum annual percentage rate (APR) of only 25%, Zash makes sure that its customers do not have to pay unnecessarily high-interest rates throughout their loans.

Also, Zash maintains a charged interest rate cap of 20%. It is crucial to remember that several variables, including current market rates, can affect interest rates.

As a result, the interest rate that is applied to your loan can also change.

Penalties will be imposed on customers who miss their payment dates. A penalty of 2% per day will be applied for the first fifteen days of late payment.

The penalty rate rises to 3% each day if the payment is not received within the next fifteen days.

All outstanding debt amounts will be rounded up to the nearest shilling for ease of calculation and payment.

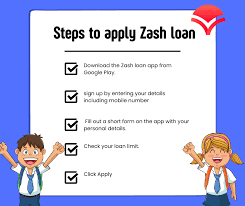

To apply for the Zash loan, you must first download the app.

Go to the Google Play Store on your Android device and search for the Zash loan app. Click on ‘Install’ to download and install the app on your device.

Once installed, open the app and follow the process outlined below:

Your application may be declined due to one or more of the following reasons:

You can repay your Zash loan through M-PESA or via the bank. Let’s consider both channels here:

You can transfer or deposit the loan amount to the following bank details:

In periods when friends and family cannot help with financial problems, relying on loans can be the best option.

What’s even better is not having to go through the long queues at banks just to get the urgent funds you need.

Downloading is like visiting the bank, but this time, you’re not going anywhere. Rather, you get access to money in the comfort of your couch or while you are on the move.

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).

Residents aged 18 to 60 with a stable source of income can apply online anytime and anywhere.

If you forget your password, go to the login page and click on “Forget password.” Input the mobile number you registered with and enter the verification text provided. Submit the information.

You will receive a verification code (OTP number) via SMS. Input the code and choose a new password of your choice. Submit the new password to complete the process.

Applying for a loan on Zash is simple. Follow these steps:

Download the Zash app from the Google Play Store on your Android phone.

Register the application with your M-Pesa number.

Choose the desired loan amount from the loan application options available.