Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Imagine a world where financial security is just a click away. With Tala loan options, that world can be your reality. But let’s be honest—applying for a loan can feel too unsure, like stepping into unknown territory.

That’s why we’re here to provide trustworthy, transparent guidance on everything you need to know about Tala loans.

Join us as we break down the essentials, helping you navigate the details confidently and clearly, so you can take that important step toward a more secure financial future.

Tala is a lending app by Tala Mobile that is available for download through the Google Play Store. It is highly popular, with over 5 million downloads and an impressive 4.4 out of 5 star rating.

Tala, which has its headquarters in California, serves the Kenyan market (though it is also available in other countries like the Philippines) by offering financial services and enabling mobile device access to credit.

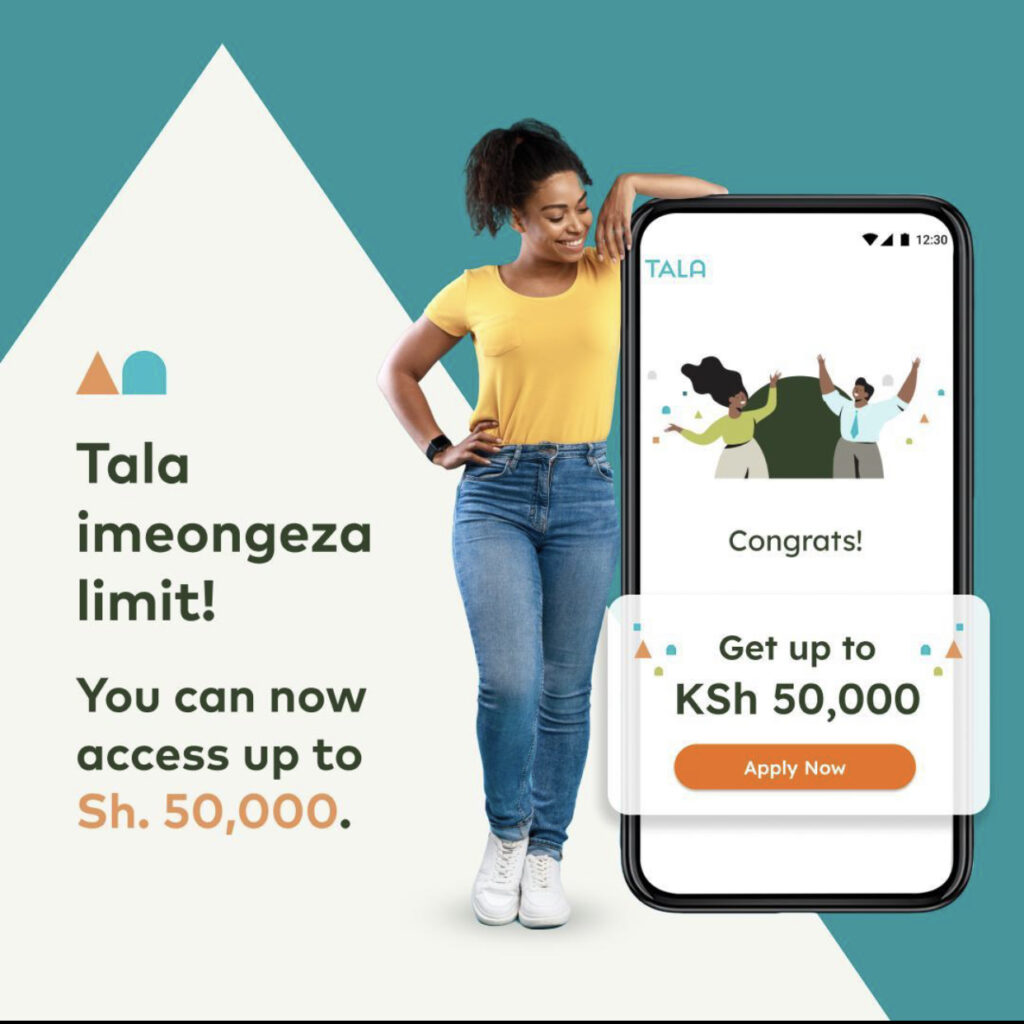

The app provides low-cost loans with a simple repayment schedule. M-pesa is used to dispense loans, with Kshs. 50,000 is the maximum amount offered.

Tala, formerly known as Mkopo Rahisi, underwent a makeover and rename. The most recent version has features like viewing your credit limit and reading success tales from other users.

When you download Tala, you will be required to scan your M-Pesa SMS and submit other information for identity and credit verification. This ensures a swift loan approval process.

Also, read: Can I Get a Business Loan Without Collateral in Nigeria?

Tala offers three loan limits:

Additionally, Tala charges a flat service fee for each loan:

Aside from using the app, you can connect with Tala using SMS by drafting a message about your loan emergency or any other queries and sending it to Tala’s SMS number 21991. Otherwise, here are the steps to apply for a Tala loan using the app:

Read: FNB Temporary Loan: how it Works and how to Apply

Your loan limit is established by an automatic algorithm that takes into account multiple aspects when you apply for a Tala loan.

Credit history, repayment patterns, and other information gathered throughout the application process are some of these variables.

Your precise loan limit will be displayed on the Tala app after your application is complete. The maximum amount you can borrow using the Tala platform is indicated by this limit.

The best approach to increase the amount of your Tala loan is to make consistent early or on-time payments. You might prove to Tala that you are a reliable borrower by acting responsibly and paying back your loan on schedule.

It is important to keep in mind that Tala considers a variety of factors when determining the maximum amount that can be borrowed, even though making your loan repayments on time may benefit you.

Therefore, there is no guarantee that your loan limit will increase or by how much, even if you have a history of making your loan payments on time.

Tala charges an 8% fee on your outstanding balance and grants you an additional 14 days to make your repayment if you fail to pay within 7 days of the due date.

If you do not pay back the loan within the 60-day grace period following the due date, Tala Loans will have no choice but to report your information to the Credit Reference Bureau. A CRB blacklist could make it more difficult for you to get loans from other lenders.

See this: 25 Fast Growing DTC Startups & Companies to Watch

For over a decade, millions of Kenyans have relied on Tala get over financial challenges in their daily lives. Tala offers Ksh 50,000 in monetary limitations that are constantly rising. Daily minimum interest rates start at 0.3%.

Please ensure the phone number you use matches the one you provided when registering for the Tala app. Use the USSD code *846# to dial.

You must apply using the app to be eligible for a Tala loan.

Customers in Kenya who have previously used Tala can contact support through the app. If you are not a customer yet, please send an email to hellokenya@talamobile.com.

This Tala loan review highlights how Tala provides a convenient and user-friendly option for accessing quick financial support.

If you’re dealing with an unexpected expense, needing extra cash to cover bills, or looking for a short-term loan solution, Tala offers a straightforward application process through its mobile app, making it easy for users to apply and get approved swiftly.