Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

The Reducing Balance Method calculates total interest for housing or mortgage loans based on the outstanding loan amount after repayments. It’s preferred over a fixed interest rate and is used for overdrafts and credit cards.

Customers benefit as they pay less interest over time since it’s based on the remaining loan amount. Interest decreases with each installment, as the balance reduces. The depreciation rate percentage applies to the reducing balance of an asset.

Here’s the formula: Interest for each installment = Applicable interest rate * Remaining loan amount.

For example, if a customer takes a housing loan for ₦40 million at 10% interest, with a monthly EMI of ₦38,601, the first month’s interest is ₦33,333, and ₦5,268 goes towards the principal. The remaining balance is ₦39,94,732 at the end of the first month (₦40,00,000 – ₦5,268).

In the second month, 10% interest is charged on the reduced balance of ₦39,94,732, making the interest ₦33,289. The remaining ₦5,311 goes towards the principal, continuing until the loan is fully repaid.

Also read: Full List of Genuine Loan Apps in Kenya

Annually, reducing loans adjusts principal and interest, despite monthly EMI payments. This method isn’t favorable for borrowers because lenders charge interest on the previous year’s outstanding balance, even as the principal reduces monthly.

It’s less common compared to monthly reducing loans, where each EMI reduces the principal, affecting the interest calculation. Vehicle, home, and personal loans often use monthly reducing cycles.

The daily reducing method calculates EMIs based on the outstanding balance daily, though most payments are made monthly. This method is akin to a monthly reducing balance in practice. However, it offers advantages for loan prepayment.

For instance, if your EMI is due on the 10th and you prepay on the 15th, the daily reducing balance reflects the reduction immediately. In contrast, monthly reducing cycles consider prepayments only with the next EMI.

Borrowers benefit most from the daily reducing method, with lower outgo compared to annual reducing cycles, which incur nearly double the interest. Loan cost depends not only on the interest rate but also on how frequently the balance is reduced. Longer-term loans magnify this effect.

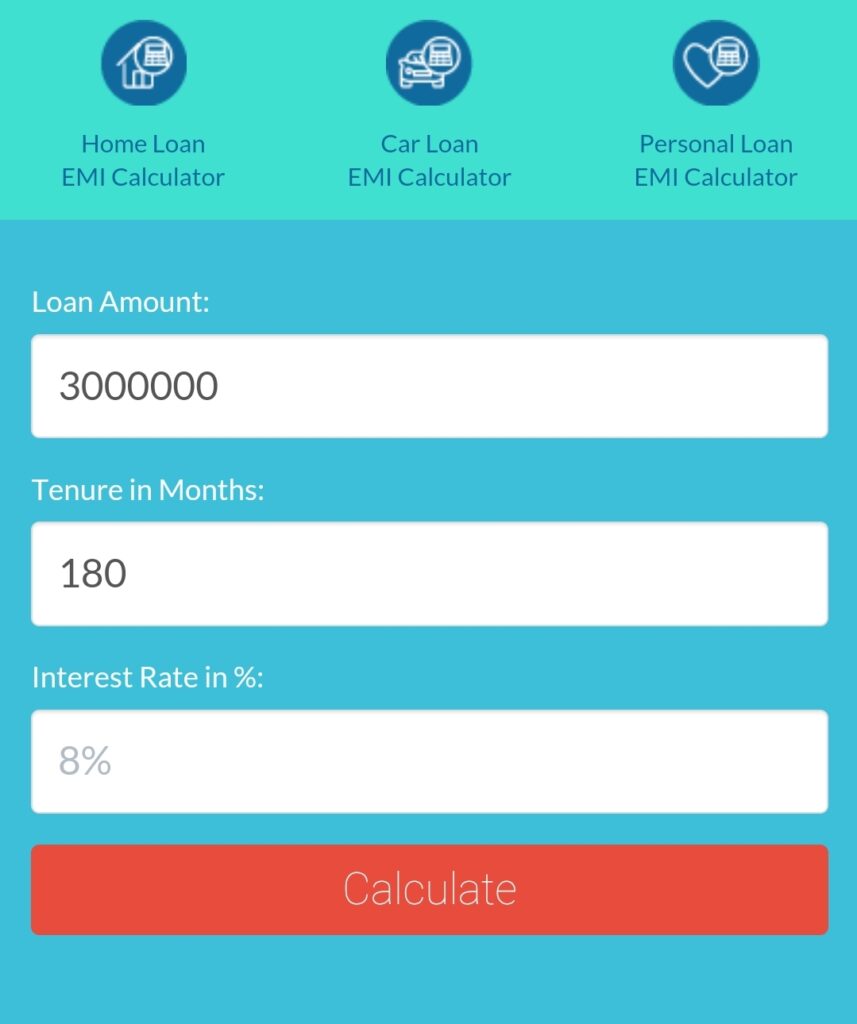

You can use online EMI calculators to estimate your monthly reducing balance EMI by entering details like Interest Rate (%), loan amount, tenure (in years), and the reducing balance frequency (daily, monthly, or annually).

Also read: Stawika Loan App: How to Download and Apply for Stawika Loan

The Reducing Balance Method offers several significant advantages:

While the Reducing Balance Method has many benefits, there are a few drawbacks:

Understanding how to calculate loan interest is crucial for tracking your loan’s progress and determining the total interest payment. This knowledge is especially valuable when comparing loan options like the Reducing Balance Method and Fixed Interest Method, aiding informed decision-making based on individual circumstances.

While the Reducing Balance Method generally offers more advantages over Simple Interest, its terms and conditions vary by lender, highlighting the importance of thorough evaluation before committing to a loan.

A flat interest rate is calculated on the entire loan amount throughout the loan tenure, without considering reduced outstanding balances due to EMIs. This often leads to a higher effective interest rate. It’s common for personal and vehicle loans.

On the other hand, reducing the balance rate calculates interest on the outstanding loan amount monthly after EMIs, resulting in a lower effective interest rate. This method is prevalent in home loans, mortgage loans, credit cards, and overdraft facilities.

Both types have pros and cons. Flat rates offer stability but can lead to higher effective interest rates. Reducing balance rates has lower effective rates due to reduced outstanding balances from monthly repayments but may incur heavy depreciation initially.

It’s advisable to compare overall loan costs using an EMI calculator to determine the best option for you.

The formula for reducing the balance interest rate calculation is:

Interest payable (each installment) = outstanding loan amount × interest rate applicable for each installment.

With each installment, the principal amount decreases, impacting the effective interest rate.

Although reducing balance rates may seem higher initially, they decrease over time as EMIs are paid. In contrast, flat rates calculate interest based on the original loan amount, leading to higher effective interest rates. Comparing a reducing balance interest calculator and a flat rate interest calculator can clarify these differences.

In conclusion, understanding the intricacies of loan interest calculation is paramount for making informed financial decisions. The Reducing Balance Method offers advantages over Flat Interest Methods, especially in terms of lower effective interest rates over time.

However, it’s essential to carefully evaluate the terms and conditions offered by lenders and compare the overall cost of loans using tools like EMI calculators.

By doing so, borrowers can navigate through different loan options more effectively and choose the most suitable one based on their financial needs and circumstances.

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).