Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Customers can access loan services through the Kenya Commercial Bank’s (KCB) mobile wallet programme, Vooma Loan. With over 100,000 downloads and a 3.5 out of 5 star rating on Google Play, the Vooma app is accessible on both the App Store and Google Play Store.

This is a comprehensive how-to guide for obtaining a Vooma loan. One of Kenya’s fastest mobile loan options is provided by KCB. You can quickly access loan amounts between Kshs 1,001 and 300,000 using Vooma Loan. To get started, simply register for KCB mobile banking.

You may exchange your Simba points for fantastic prizes each time you borrow. Find out more about the KCB Vooma loan app’s features and operation. Learn how to download files, obtain loans, withdraw money from Mpesa, transfer money to banks, view vooma loan limit, vooma loan interest rate and much more in this article. It is the financial industry’s newest and greatest thing.

In this article, we’ll delve into the world of Vooma Loans, exploring how they work, understanding Vooma Loan limits, and examining the interest rates associated with these loans.

Read also – Hustler Fund Loan and How to Apply

Customers of the KCB Bank Group can access loans, transfer money to other VOOMA users, and access bank accounts and other mobile wallets like M-PESA and T-Kash through the Vooma loan app and service.

The Vooma loan app may be found on the Play Store and App Store. At the time of writing, 10,000 Android phone installs had been recorded. Android versions 4.1 and above can use it.

To activate your account, just download the Vooma loan app using the steps below or dial *844#. Then, follow the on-screen instructions.

Read also – Why is my M-shwari Loan Limit Zero in 2025?

Using Vooma loan app, you can complete the following transaction:

Read also – Loan Calculator and How to Use it

A valid national ID or Kenyan passport, together with a registered mobile phone number (Safaricom, Airtel, or Telkom), are needed in order to access the Vooma App.

The following conditions must be met in order for you to be eligible for a Vooma loan.

Loan amounts on Vooma range from KSh1,000 to KSh300,000, with a one-month payback duration and a processing fee of 7.02% for each 30-day loan.

Vooma Loan offers borrowers a predetermined maximum borrowing threshold known as the “Vooma Loan limit.” This limit varies for each individual and is determined based on factors such as creditworthiness, repayment behavior, and income level.

It ensures responsible lending practices while meeting the diverse financial needs of users. By analyzing these factors, Vooma assesses the borrower’s risk profile and determines an appropriate loan limit, providing access to funds that align with the borrower’s financial capacity and needs.

Additionally, Vooma Loan interest rates refer to the cost of borrowing funds through the platform. These rates may vary depending on factors such as the loan amount, repayment period, and the borrower’s creditworthiness.

Vooma aims to offer competitive and transparent interest rates that are clearly communicated to borrowers upfront. This transparency enables borrowers to understand the cost of borrowing and make informed decisions about loan repayment.

By providing customizable borrowing options, flexible repayment terms, and competitive pricing, Vooma Loan empowers users to access affordable financing solutions that meet their financial goals effectively.

Read also – Here are the Top 6 Crypto Exchanges Nigerians Can Use for Buying/Selling Bitcoin in 2025

To check your Vooma loan limit and interest rate, you can follow these steps:

1. Open the Vooma app on your mobile device.

2. Log in to your Vooma account using your credentials.

3. Navigate to the section within the app that provides information about your loan limit and interest rate.

4. Here, you should be able to view your current loan limit, which indicates the maximum amount you can borrow from Vooma. Additionally, you can view the interest rate associated with your loan, which determines the cost of borrowing funds through the platform.

5. If you are unable to find this information within the app, you can reach out to Vooma customer support for assistance. They should be able to provide you with details about your loan limit and interest rate.

6. Alternatively, you may also be able to check your loan limit and interest rate by logging in to your Vooma account on their website, if available.

7. By understanding your loan limit and interest rate, you can make informed decisions about borrowing and budgeting for loan repayment effectively.

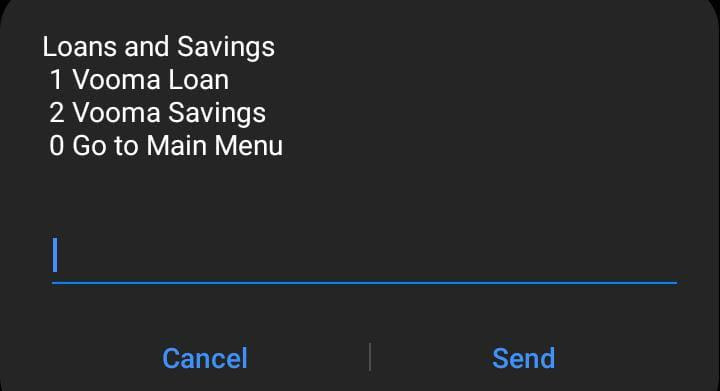

To apply for a Vooma Loan via USSD, follow these steps:

1. Dial the Vooma Loan USSD code: *844#.

2. Select the option for loans or Vooma Loans from the menu.

3. Follow the prompts to provide the required information, such as your ID details, loan amount, and repayment period.

4. Review the terms and conditions presented.

5. Confirm your loan application.

6. Wait for a confirmation message indicating whether your loan application was approved or declined.

7. If approved, the loan amount will be disbursed directly to your mobile money account.

8. Use the funds for your intended purpose and ensure timely repayment to maintain a positive borrowing relationship with Vooma.

To deposit money into your Vooma loan wallet, you can follow these steps:

1. Access your mobile money menu (e.g., M-Pesa for Safaricom users).

2. Select the “Lipa na M-Pesa” option.

3. Choose the “Pay Bill” option.

4. Enter the Vooma Loan pay bill number. (You may need to check with Vooma for the specific pay bill number).

5. Enter your Vooma Loan account number as the account number. This is usually your phone number registered with Vooma.

6. Enter the amount you wish to deposit into your Vooma loan wallet.

7. Enter your M-Pesa PIN to confirm the transaction.

8. Review the transaction details and confirm to complete the deposit.

9. You’ll receive a confirmation message from M-Pesa once the transaction is successful.

10. The deposited amount will reflect in your Vooma loan wallet, and you can use it for loan repayment or other transactions as needed.

To withdraw funds from your Vooma wallet to M-Pesa via USSD, follow these steps:

1. Dial the Vooma USSD code on your phone. (The specific USSD code may vary, so check with Vooma for the correct code).

2. Navigate to the option for “Withdraw” or “Transfer to M-Pesa” from the menu.

3. Follow the prompts to enter the amount you wish to withdraw and confirm the transaction.

4. You may be required to enter your M-Pesa PIN to authorize the withdrawal.

5. Once confirmed, the funds will be transferred from your Vooma wallet to your M-Pesa account.

6. You’ll receive a confirmation message from both Vooma and M-Pesa once the transaction is successful.

To withdraw funds from your Vooma wallet to M-Pesa via the Vooma app, follow these steps:

1. Open the Vooma app on your mobile device.

2. Log in to your Vooma account using your credentials.

3. Navigate to the “Withdraw” or “Transfer to M-Pesa” section within the app.

4. Enter the amount you wish to withdraw and select the option to transfer to M-Pesa.

5. Confirm the transaction details and authorize the withdrawal.

6. Once confirmed, the funds will be transferred from your Vooma wallet to your M-Pesa account.

7. You’ll receive a confirmation message within the app once the transaction is successful.

Read also – Latest way to Buy Airtel Airtime on MPesa 2025

To repay your Vooma loan via M-Pesa, follow these steps:

1. Access the M-Pesa menu on your mobile phone.

2. Select the “Lipa na M-Pesa” option.

3. Choose the “Pay Bill” option.

4. Enter the Vooma Loan pay bill number. (You may need to check with Vooma for the specific pay bill number).

5. Enter your Vooma Loan account number as the account number. This is usually your phone number registered with Vooma.

6. Enter the amount you wish to repay towards your Vooma loan.

7. Enter your M-Pesa PIN to confirm the transaction.

8. Review the transaction details and confirm to complete the repayment.

9. You’ll receive a confirmation message from M-Pesa once the transaction is successful.

10. The repayment amount will be deducted from your M-Pesa account and credited towards your Vooma loan, reducing your outstanding balance.

To apply for a Vooma loan, simply download the Vooma app from the Google Play Store, register an account, and follow the prompts to complete the loan application process within the app.

Typically, you’ll need to provide basic personal information such as your name, phone number, and ID details. Vooma may also require access to your mobile money account data for verification purposes.

Upon approval of your Vooma loan application, the funds are usually disbursed directly to your mobile money account within minutes, providing you with instant access to the loan amount.

Your loan limit is determined based on factors such as your creditworthiness, repayment behavior, income level, and other proprietary algorithms used by Vooma to assess risk.

Yes, by demonstrating responsible borrowing behavior and timely repayment, you may become eligible for higher loan limits in the future.

Vooma may charge nominal fees for loan processing and servicing. These fees are typically disclosed upfront, and there are no hidden charges or penalties.

If you’re unable to repay your Vooma loan on time, you may incur late payment fees and penalties. It’s important to communicate with Vooma and explore options for repayment extensions or alternative arrangements to avoid additional charges.

In conclusion, Vooma Loans offer a convenient and accessible solution for individuals in need of quick financial assistance. With instant access to funds and flexible borrowing options, Vooma empowers users to address their financial needs effectively.

By understanding your loan limits and the voom loan interest rates, borrowers can make informed decisions about borrowing and budgeting for repayment. Vooma’s transparent pricing structure and competitive rates ensure affordability and clarity throughout the borrowing process.

Whether it’s covering emergency expenses, paying bills, or seizing opportunities, They provide a reliable and efficient way to access the funds you need.

With personalized borrowing options and responsive customer support, Vooma strives to meet the diverse financial needs of its users while promoting responsible borrowing practices. Take advantage of today for fast, hassle-free borrowing and greater financial flexibility.