Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

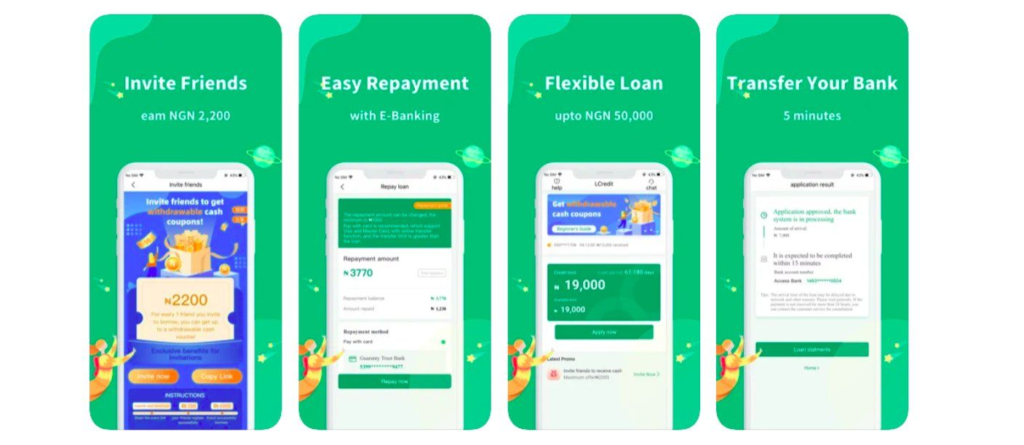

Lcredit loan, one of the loan apps in Nigeria, Lcredit, provides quick cash to people without requiring any kind of security or guarantors. Not only can users of the lcredit loan app obtain loans, but they can also earn extra money by referring new users to the programme.

You don’t need to go to the branch office or go through lengthy procedures to receive an immediate loan with the Lcredit loan app; you can get one anytime, anywhere. To borrow money using the Lcredit loan app, follow these simple and quick steps.

This post will walk readers through the Lcredit loan application process in detail and explain how to apply for a loan without requiring collateral.

see also – EU Begins Investigations on Apple, Meta and Google

The Lcredit loan app was developed by CASHIGO International Limited to make it simple for anyone to obtain secured loans without the need for collateral or documentation.

After the corporation gives its consent, receiving the money takes less than five minutes. Because they may earn extra money every time they invite a new user to join up for the programme, users of the Lcredit lending app like using it.

In the Google Play Store, the lcredit loan app has received over 70,000 good reviews and over 1 million downloads. You must register your information on the Lcredit lending app in order to access loans through it.

The LCredit Loan App in Nigeria that provides fast loans to users without requiring them to provide any documentation or pledge valuable assets as security. Once users complete the verification process, the loan app promises to provide loans to users. Before granting a loan, the Lcredit lending app employs a machine learning tech algorithm to examine user data with the assistance of the bank verification number (BVN).

Any consumer utilising Lcredit’s platform to apply for a loan can have their credit score evaluated by the company using the BVN. The following are made possible by this algorithm:

see also – Loan Calculator and How to Use it

The following are just a few of the many benefits that users of the Lcredit loan app will experience:

Although the Lcredit Loan App has numerous advantages, using it to obtain a loan has certain drawbacks as well. These drawbacks include:

One of the loan apps that has extremely few requirements is the Lcredit loan app; to begin the loan application process, you simply need to enter a few facts. To be eligible for a loan from Lcredit, you must:

Applying for a loan from Lcredit is simple and only requires you to follow the instructions on your Android device using the app.

The following are the procedures to apply for a Lcredit loan:

see also – Easy Loan: How to Easily Apply

Make sure you read the policy, terms and conditions, and external evaluations from reliable websites as well as those on Google Play.

It should be noted, nevertheless, that the LCredit Loan App was taken down from the Google Play store due to breaking certain guidelines.

Additionally, at the time this report was written, the LCredit Loan App was not available on the Google Play Store, despite what their website says.

It’s not a good signal to click the button because it downloads the software automatically without requiring you to install it from the Google Play store. However, here’s how to download it if you’re still interested.

Initially, you need to download the app or register on the website.

The webpage will serve as an illustration;

see also – All You Need To Know About Digital Gift Cards in 2024

Repaying loans with the Lcredit loan app can be done in three ways:

Using a bank transfer

To repay your debts via a bank transfer using the Lcredit loan app, follow these steps:

Using the debit card

Using the Lcredit loan app, you can use your debit card to repay your loan if you have one. Take the actions listed below:

Using the Bank

Using the instructions listed below, you can pay using your bank on the app.

Google Play Protect deleted the Lcredit loan app from its store after finding privacy violations. The Lcredit loan app accesses user data and takes use of the potential to spread false information about users. A few days after a user takes out a loan, the app typically threatens and sends disparaging messages to the contacts of the user.

A large number of individuals reported the app and urged Google to remove it because of the offensive messages. Google removed the Lcredit loan app from the Google Play Store in order to safeguard customer privacy and information. However, the parent business of the app is attempting to fix the problem.

see also – How to Redeem a Gift Card in 2024

Lcredit states that the interest rate on a loan with a duration of 91–180 days ranges from 0.1% to 1%. They made it quite evident that their yearly interest rate ranges from 36% to 300%. Every day, this interest is computed.

For instance:

The payment conditions for a 91-day loan include an origination charge of 39% and interest of 2.7%. With a 3,000 principal loan, the origination charge would be 1,174 NGN, the interest would be 81 NGN, and the total amount owed would be NGN 4,255.

Depending on your credit score, you as a client or borrower from Lcredit Loan may be eligible for a loan of N5,000 to N50,000. The loan offer varies based on the client. In comparison to a customer with a lower credit score, the customer with a higher credit score will receive a larger amount.

The lcredit Loan App is a mobile application that provides quick and convenient access to personal loans.

Anyone who meets the eligibility criteria, typically including being of legal age, having a stable income, and meeting credit requirements, can apply.

You can download the lcredit Loan App from the App Store (for iOS) or Google Play Store (for Android) and follow the installation instructions.

Typically, you’ll need to provide identification documents, proof of income, and sometimes additional documents depending on the loan amount and type.

The process usually involves downloading the app, creating an account, filling out the loan application form, uploading required documents, and waiting for approval.

Approval times can vary but are often quite quick, sometimes within minutes or hours, depending on the completeness of your application and other factors.

Loan amounts typically range from a few hundred to several thousand dollars, depending on your income, creditworthiness, and other factors.

Interest rates and repayment terms vary depending on factors like loan amount and duration, but you’ll typically find competitive rates and flexible repayment options.

lcredit considers applications from individuals with varying credit histories, but approval and terms may differ based on creditworthiness.

Yes, lcredit employs industry-standard security measures to protect your personal and financial information, ensuring it remains confidential and secure.

In conclusion, the lcredit Loan App offers a convenient and efficient solution for accessing personal loans. With a simple application process, competitive interest rates, and flexible repayment terms, it caters to a wide range of borrowers.

Whether you have excellent credit or are working to improve it, lcredit provides opportunities for financial assistance.

Your personal information is safeguarded through robust security measures, ensuring privacy and peace of mind. Download the app, apply for a loan, and experience the ease of obtaining financial support tailored to your needs with lcredit.

You can check out other useful content by following us on X/Twitter: @siliconafritech.

Instagram: @SiliconAfricaTech.

Facebook: @SiliconAfrica