Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

PEP makes the loan acquisition process exceptionally seamless. You can apply for a Pep loan online or at any nearby Pep Money outlet without any paperwork. Loan amounts range from as little as R1,000 to as much as R50,000.

This flexibility allows you to access emergency funds instantly or opt for a larger loan with a repayment period of up to 24 months. Take the first step towards securing your loan by applying for a Pep loan today! In this post, I will show you how. You only have to keep reading.

Also read: Wonga Loan and How to Apply

To ensure swift approval and deposit of the loan amount into your bank account, it’s crucial to note the following:

Applying for a loan at Pep is incredibly straightforward, offering you two convenient options: online or at a physical store. Upon completing your application, you’ll receive progress notifications and the final loan offer.

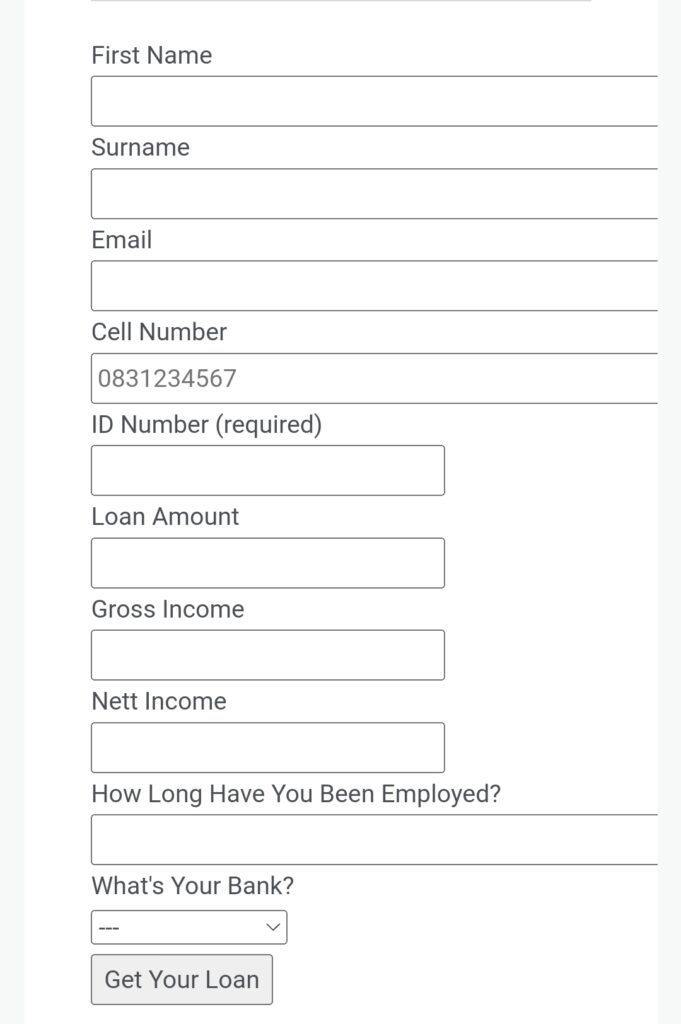

Money Mall’s partnerships with various loan providers in South Africa streamline the process, ensuring quicker access to online loans. Start your application by entering your details in a form that looks like the one below:

Also read: Edu Loan: How to Apply and Get it

Several factors influence Pep loan interest rates. Here are some key considerations:

In conclusion, Pep offer a seamless and accessible solution for individuals seeking financial assistance. With flexible loan amounts, convenient application options, and quick approval processes, Pep ensures that customers can access the funds they need when they need them.

Additionally, the partnership with Money Mall and the availability of various insurance options further enhance the borrowing experience, making it easier for customers to manage their loans responsibly.

Whether it’s an emergency expense or a planned investment, Pep provide a reliable financial resource for South African citizens. Apply today to experience the convenience and efficiency of Pep loans.

Also read: Capfin Loan Application: How to Access Capfin Loan

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech