Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

With Polaris USSD Code, the banking at Polaris Bank is easy and accessible for everyone. It is a special service, through which, customers can carry out various transactions right from the mobile phone without necessarily accessing the internet.

Whether you want to transfer money or open a new account, Polaris USSD Code for Transfer and Polaris USSD Code for Account Opening have been designed to make your time with the bank easier.

Ever fancied sending money to friends or family in just a few touches of your phone? That’s precisely what the Polaris USSD code does for you: quick, safe, and from the comfort of your home or while on the go. Opening a new account has also never been made easier; all you need is your mobile phone and just some minutes of your time.

This article will walk you through the key features available on the Polaris USSD code, guiding you into the ease of transfers and account opening. Get set to experience the power of banking at your fingertips!

Established by the Central Bank of Nigeria (CBN) on September 21, 2018, Polaris Bank commenced operations on the same day, acquiring the assets and assuming certain liabilities of the defunct Skye Bank.

With a network of over 224 branches nationwide, the bank prioritizes delivering exceptional customer experiences, leveraging state-of-the-art Information Communication Technology (ICT).

By emphasizing ICT solutions across various service delivery channels such as mobile banking, ATMs, POS, and online platforms, Polaris Bank plays a crucial role in the Nigerian banking sector, offering customers simple, convenient, and secure banking services.

As a company that prides itself on offering virtual transactions, Polaris Bank has upheld its commitment by providing various USSD codes for a range of transactions, including money transfers, account opening, and purchasing airtime and data bundles.

We will focus on the USSD codes specifically for money transfers and account opening. It’s worth noting that having a Polaris Bank account is a prerequisite for conducting transactions using these codes.

See also: Latest Guide on How to Apply for a Union Bank Credit Card

The USSD code for Polaris Bank is *833#. This indeed is a force and convenient tool created to give quick access to banking services on any mobile phone. With 833#, customers can open an account without visiting a branch. It makes the onboarding process faster and more accessible for new users.

The code also enables the recharging of airtime such that customers can have their phones instantly topped up by dialing the code from their devices. To be able to send airtime to another number, one simply needs to dial 833AmountRecipient’s Number#.

The Polaris Bank USSD code, *833#, supports all major mobile networks in Nigeria and does not require access to the internet; as such, it has become one of the easiest options for mobile banking.

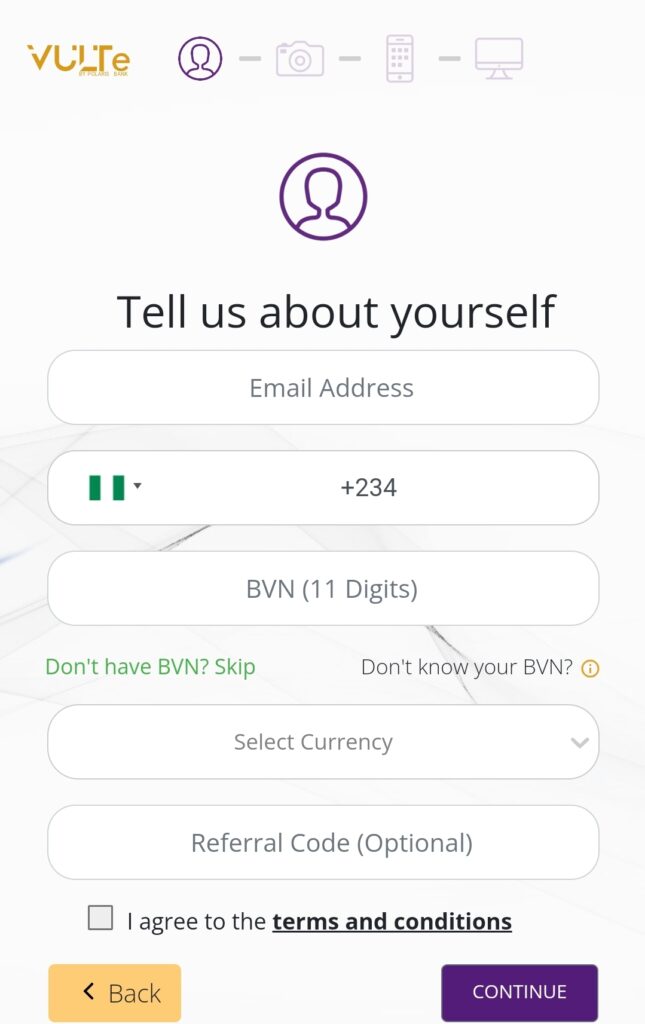

To instantly open a Polaris Bank account from the comfort of your home or wherever you are, follow these steps:

To open a Polaris Bank account, you can use these other options:

To transfer money to Polaris Bank via USSD code, follow these steps:

The advantage of this method is that it doesn’t require an internet connection, and you can use it multiple times within the daily transaction limits.

See also: Updated List of All Ecobank USSD Codes for Banking Transactions

Using the Polaris Bank USSD code, *833#, has a number of advantages for its customers in terms of convenience and security when performing various banking transactions right on your mobile phone. Following are the key benefits:

Is the transfer code for Polaris Bank not going through? For such issues, try contacting customer care for prompt assistance. Here are a few ways you can reach the customer care department of the bank.

Physical address: 3 Akin Adesola Street, Victoria Island, Lagos

You can log onto the official website of Polaris Bank and click the live chat option at the bottom left corner of your screen to connect with an agent.

Email: yescenter@polarisbanklimited.com

Call: 0706-202-1807 0700-POLARISBANK), 08069880000, 01-4482100, 01-2799500

USSD codes have revolutionized the banking system in Nigeria by providing a hassle-free way to access essential services without the need for internet connectivity.

In essence, these codes, offered by Polaris Bank and many other banks, are powerful tools that empower individuals to control their finances conveniently and securely.

With these codes, users can manage their banking needs effectively, ensuring they remain in charge of their financial affairs regardless of their location within the country.

If you find this article helpful, kindly leave a comment and follow us on our social media handles for more updates.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

To open a Polaris Bank Account through USSD, dial *833#, and follow the on-screen instructions to input some personal information like full name, date of birth, and possibly BVN. On completion of this, your account number will be sent to you via SMS.

Yes, Polaris Bank has put daily transaction limits on USSD transfers. This is generally ₦20,000 per transaction and ₦100,000 per day for unregistered users. On the contrary, for registered users, the limit for transfers may be higher. Your exact limit may be confirmed by contacting customer service at Polaris Bank or visiting a branch.

Yes, for first-time users, you have to register for USSD banking with Polaris Bank by just dialing *833#, then follow through the registration prompts. You will be requested to create a 4-digit PIN that will authorize all transactions.

Yes, there might be a fee charged for transactions made through the USSD code. Usually, Polaris Bank takes a token charge for every transfer, depending on the value and whether the transfer is within Polaris or to another bank. Even inquiries like checking your account balance may attract a small fee.