Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In today’s interconnected global economy, keeping track of the Naira rate has become increasingly important for businesses, travellers, and individuals alike.

With fluctuating exchange rates impacting everything from international trade to personal finances, having access to accurate and up-to-date information is crucial.

Fortunately, advancements in technology have made it easier than ever to access real-time exchange rate data through mobile applications.

In this post, we’ll be reviewing the top 8 Naira rates apps in 2024, examining their features, user-friendliness, and reliability to help you make informed decisions in your currency transactions.

The top 8 naira rate apps in 2024 include:

NgnRates is an app that specifically focuses on providing accurate and up-to-date exchange rates for the Nigerian Naira (NGN) against various currencies, with a particular emphasis on the US Dollar (USD).

As of 2024, the app is renowned for its reliability and user-friendly interface, making it a popular choice among individuals, businesses, and investors in Nigeria.

This platform provides real-time exchange rates for the US Dollar to Naira and other major currencies such as the Euro, Pound, Yuan, and more.

It gathers these rates from a variety of sources, including the Central Bank of Nigeria (CBN), commercial banks, Bureau De Change (BDCs), and the Lagos parallel market.

This multi-sourced approach gives users a comprehensive view of different market dynamics.

In addition to real-time rates, NgnRates.com offers historical charts for the past 30 days and 365 days, allowing users to analyze trends and make informed decisions.

It also provides a currency converter tool for converting between NGN and over 60 other currencies, utilizing various market rate options.

Moreover, the platform includes a news and analysis section, providing users with insights into the Nigerian economy and currency market.

NgnRates is accessible through both web and mobile platforms, with a free mobile app available on Android and iOS devices. Its user-friendly interface ensures easy navigation and usage for all users.

However, it’s important to note that while NgnRates.com strives for accuracy, real-time rates may not always be 100% accurate due to the rapidly fluctuating nature of currency markets.

Users should also be aware that certain financial transactions on the platform may incur hidden fees, so it’s essential to review terms and conditions before using any conversion or transfer services.

Read Also:11 Things to Consider When Buying a Used HP, Dell or Mac laptop in Nigeria

Aboki Forex Currency Converter is a widely-used application in Nigeria, known for its ability to provide real-time exchange rates, primarily focused on the Naira rate.

It caters to the needs of both individuals and businesses who require accurate and up-to-date currency conversion, especially due to its inclusion of parallel market rates. With a user-friendly interface, the app is accessible even to non-technical users.

The app offers a range of features, including live currency rates for over 168 global currencies against the Naira, including the US Dollars, EUR, and GBP.

One of its distinguishing factors is its provision of parallel market rates, which give users a broader view of exchange values compared to official rates.

Additionally, the app offers offline functionality, enabling users to access basic conversion features even without internet access, and allows for unlimited currency monitoring.

The app also tracks real-time prices for major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. It also provides users with relevant financial news and analysis, ensuring they remain informed about market trends and events.

The app has several benefits, including comprehensive coverage of currency exchange rates compared to official apps, accessibility on Android and iOS devices, and multiple tools like conversion calculators and currency monitoring.

However, users should be aware of its limitations, including potential accuracy concerns with parallel market rates, legality issues for specific transactions in some countries, limited analysis compared to dedicated financial platforms, and potential privacy concerns related to data collection.

Aboki Forex Currency Converter offers a convenient and comprehensive solution for tracking Naira exchange rates, especially with its inclusion of parallel market rates.

However, users should exercise caution and verify the accuracy and legality of rates before making any financial decisions.

Read also:35 Best Computer Engineering Project Topics for Final Year Students

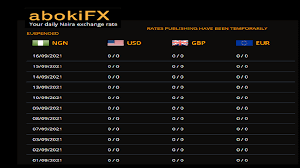

Abokifx is a widely used app and website providing real-time exchange rates for the Nigerian Naira(naira rates) against various currencies, focusing on the parallel market, also known as the black market.

It offers live rates for US Dollars, EUR, GBP, and other major currencies, along with African currencies. Users can access historical data, news articles, and analysis related to the Nigerian economy and currency market.

The app features a currency converter, offline mode, and is available on Android, iOS, and web platforms.

The benefits of Abokifx include instant access to parallel market rates, user-friendly interface, transparency, and additional features like news and analysis.

However, controversies and concerns arise due to the legality of operating in the parallel market, questions about rate accuracy, volatility, and occasional technical issues impacting reliability.

It’s important to know that the app is not officially endorsed by the Central Bank of Nigeria and is not affiliated with any financial institution, so users should exercise caution and consider the risks before relying solely on Abokifx for their foreign exchange needs.

CBNRates is the official mobile application of the Central Bank of Nigeria (CBN) designed to provide transparent and readily accessible information about the official Naira exchange rates.

The app offers real-time and historical data on official exchange rates for various currencies against the Nigerian Naira(naira rates). It covers major currencies like US Dollars, EUR, GBP, and others listed by the CBN. Users can convert between any two listed currencies based on the official rates.

CBNRates app also offers offline functionality, allowing access to previously downloaded rates even without internet connection. Its simple and user-friendly interface makes it easy to navigate and understand, making it accessible to a wide range of users.

Additionally, the app is free to use, with no subscription fees or hidden charges.

The benefits of using CBNRates include accuracy and reliability, as it provides authentic and trustworthy data directly from the CBN. It promotes transparency in the financial market by making official rates readily available.

The app offers convenient access to exchange rate information for individuals, businesses, and other stakeholders. Its offline capability ensures users can access rates even in areas with limited internet connectivity.

Furthermore, the app is free and easy to use, with no financial barriers or complex procedures involved.

However, the app is limited to official rates and does not cover parallel market rates or exchange rates offered by commercial banks. It primarily focuses on rate information and conversion, lacking advanced features like analysis or news.

In conclusion, CBNRates is a valuable tool for individuals and businesses seeking accurate and reliable information about official Naira exchange rates. It is available for free on both the Google Play Store and Apple App Store.

Rea Also:How to Apply for UIF in South Africa 2024

Afriex is a fintech company that focuses on facilitating international money transfers, with a particular emphasis on transactions between Africa, Europe, and North America.

They offer fast and secure transfers, competitive exchange rates, and a multi-currency e-wallet for holding and exchanging various currencies, including US Dollars, EUR, GBP, and several African currencies.

For businesses, Afriex provides features like bulk payments, expense management, and virtual accounts. They claim to offer interbank rates with no markups, potentially saving users money compared to traditional banks or money transfer services.

The app do not charge sending or receiving fees for personal transfers, and 90% of transactions are completed within minutes.

Afriex provides a user-friendly mobile app for convenient money management and transfers, and claims to use industry-standard security measures to protect user data and transactions. However, they have some limitations.

They primarily focus on transfers between Africa, Europe, and North America and do not serve all countries globally. As a relatively new company established in 2014, they may lack the same brand recognition or track record as larger financial institutions.

Some user reviews mention occasional issues with customer service or technical glitches. Afriex is headquartered in London, UK, with offices in Nigeria, Kenya, South Africa, and other countries.

They have partnered with various financial institutions and regulatory bodies to ensure compliance and security. Afriex has received funding from prominent investors, suggesting confidence in their business model.

Overall, Afriex offers a potentially cost-effective and convenient solution for international money transfers, especially for users transferring funds between Africa, Europe, and North America.

However, it is essential to research and compare features, fees, and security practices before choosing any money transfer service.

Read also:Glovo: The Food Delivery Company Creating a Stir

Nairametrics is a Nigeria-based financial news and information platform, offers extensive coverage of the Nigerian economy, capital markets, and business sectors, and also encompasses insights into world currencies and their influence on the Nigerian financial system.

It provides real-time exchange rates for the Naira against major world currencies, including the US Dollars, EUR, GBP, and others. They also offers insightful commentary and analysis on global economic trends and their influence on the Naira exchange rate.

The platform publishes news articles and reports covering global events that could impact the Nigerian economy and the Naira, such as fluctuations in oil prices, currency wars, or global trade policies.

Additionally, it offers guidance and analysis for investors seeking opportunities in the Nigerian market, often considering the impact of global economic conditions and world currencies.

Nairametrics also provides comprehensive data and charts on global economic indicators, including world currency performance, inflation rates, and central bank policies.

The platform emphasizes understanding the interconnectedness of the Nigerian economy with global markets, explaining how changes in world currencies like the US dollar can affect the Naira through factors like import prices, foreign investment, and global oil prices

However, while Nairametrics covers world currencies, its primary focus remains the Nigerian economy and the Naira. It serves as a valuable platform for Nigerians and investors seeking to understand the complex interplay between the Naira and world currencies.

In addition to its website, Nairametrics offers a mobile app for iOS and Android devices, providing access to real-time rates, news, and analysis on the go.

The platform also hosts events and webinars featuring financial experts and analysts, discussing global economic trends and their impact on the Nigerian market.

Read also:Apple Music Gets fined $538 million by EU

Xe is known for its popular currency converter app and website, offering a comprehensive suite of tools and services for individuals and businesses navigating the vast landscape of world currencies.

Xe provides real-time exchange rates for over 130 world currencies, including major fiat currencies, precious metals, and cryptocurrencies.

Users can track exchange rate fluctuations over various timeframes (daily, weekly, monthly, yearly) to understand historical trends and make informed decisions.

Additionally, users can set up personalised alerts to receive notifications when exchange rates reach a specific threshold, ensuring they capitalise on favorable opportunities.

The platform is customisable, allowing users to select their preferred currencies and display preferences for a personalised experience.

In addition to its currency converter, Xe facilitates international money transfers to over 170 countries in over 65 currencies, offering competitive exchange rates and transparent fees. Users can choose between bank deposit, cash pickup, or mobile wallet delivery for flexible and convenient transfer solutions.

Transfers are completed quickly and securely with industry-leading security protocols in place. Xe caters to individuals and businesses of all sizes, accommodating large transfer amounts for high-value transactions.

Xe also offers additional features such as a margin calculator to estimate the potential foreign exchange risk and cost associated with international transactions, currency news and insights to stay informed about global economic and financial news impacting currency markets, and multilingual support for a diverse global audience.

Overall, Xe-Converter and Money Transfer serve as valuable resources for travelers looking to convert currencies on the go, track exchange rates, and budget effectively for international trips.

Also for businesses seeking to make international payments, manage foreign exchange risk, and streamline global operations. Individuals who want to send and receive money abroad conveniently, send remittances, or invest in foreign assets can also use it.

Currency Converter Plus, available for both Android and iOS devices, is a popular mobile application designed to assist individuals and businesses in tracking and converting various currencies. It caters to the needs of users who require seamless access to world currencies.

The app offers live currency conversion with real-time exchange rates for over 160 currencies, including major and minor ones. It also provides offline functionality, enabling users to access conversion rates even without an internet connection, which is particularly useful for travelers or areas with limited connectivity.

Additionally, users can convert multiple currencies simultaneously for easy comparison and track exchange rate including naira rates fluctuations over time through historical rate charts.

The app includes a built-in calculator for performing calculations alongside currency conversions, as well as live rates displayed in status bar and home screen widgets.

Moreover, Currency Converter Plus supports Bitcoin and other cryptocurrencies, allowing users to stay updated on the ever-evolving crypto market.

It also provides support for tracking precious metals prices such as gold, silver, palladium, and platinum alongside currencies. It has a user-friendly interface, making it accessible to users of all technical backgrounds.

Currency Converter Plus is known for its accuracy and reliability, utilizing reputable sources for exchange rates to ensure precise conversions. The app offers convenience by allowing users to convert, track, and analyze currencies on the go, even in offline mode.

Its features such as offline access and historical charts, may require a paid subscription in certain versions of the app.

While generally reliable, live rates might not always reflect real-time market fluctuations, so users should exercise caution and verify rates with other sources before making financial transactions.

Additionally, users should prioritize downloading the app from official app stores to avoid potential security risks.

Read Also:How to Check KCSE Timetable Online in 2024

Several factors influence the exchange rate of the Naira against other currencies. Here are some of the most significant factors:

High inflation rates can lead to a decrease in the value of the Naira relative to other currencies. This is because higher inflation erodes the purchasing power of the Naira, making it less attractive to investors.

Changes in interest rates set by the Central Bank of Nigeria (CBN) can affect the Naira’s exchange rate. Higher interest rates often lead to an increase in demand for the Naira as investors seek higher returns on their investments.

Government policies, particularly those related to fiscal and monetary policy, can impact the Naira’s exchange rate. For example, policies that encourage foreign investment or reduce government spending may strengthen the Naira.

Nigeria’s trade balance, which is the difference between its exports and imports, can also influence the Naira’s exchange rate. A trade surplus (more exports than imports) can lead to an increase in the value of the Naira, while a trade deficit (more imports than exports) can lead to a decrease in value.

Read Also:How to Open an M-Pesa Account in 2024

Political stability or instability can affect investor confidence and, consequently, the value of the Naira. A stable political environment is generally seen as positive for the Naira’s exchange rate.

Global economic conditions, including factors such as economic growth rates, currency values, and commodity prices, can also impact the Naira’s exchange rate. For example, a slowdown in global economic growth may lead to a decrease in demand for Nigerian exports, which could weaken the Naira.

Read Also:South Africa Goes Hard After Spam Callers

Speculation by investors can also affect the Naira rate. If investors believe the Naira will weaken in the future, they may sell it in anticipation of a lower exchange rate, which can put downward pressure on its value.

The amount of external debt owed by Nigeria can also impact the Naira’s exchange rate. A high level of debt may lead to concerns about the country’s ability to repay its debts, which can weaken the Naira.

Read Also:Nigerian Phone Numbers and their Corresponding Networks 2024

Natural disasters and conflicts can disrupt economic activity and impact the Naira’s exchange rate. For example, disruptions to oil production due to conflicts or natural disasters can reduce Nigeria’s export revenue, which can weaken the Naira.

These factors are interconnected and can influence each other, making it essential to consider a broad range of factors when analysing the Naira’s exchange rate.

Using a Naira rate app is crucial for individuals and businesses who deal with currency exchange involving the Nigerian Naira. These apps provide real-time and accurate exchange rates, enabling users to make informed financial decisions, plan international travel, and track currency performance over time.

When selecting a Naira rate app, consider factors such as the app’s accuracy, user interface, coverage of currencies, and additional features such as historical data and conversion tools. Reading user reviews and testing the app’s functionality can also help you determine if it meets your needs.

Many Naira rate apps offer a free version with basic features, while some may require a subscription or in-app purchases for access to premium features or ad-free experiences. It’s essential to check the app’s pricing structure and determine if the additional features justify the cost.

The exchange rates provided by reputable Naira rate apps are typically sourced from reliable financial institutions and are updated frequently to reflect the current market conditions. However, users should be cautious of apps that rely on outdated or inaccurate data sources and verify exchange rates independently if necessary.

Most Naira rate apps prioritize user data security and employ encryption and other security measures to protect sensitive information. However, users should always exercise caution when sharing personal or financial details and ensure that they download apps from trusted sources to avoid malware and phishing attempts.

The top eight Naira rate apps in 2024 are essential tools for businesses, travelers, and individuals who need accurate and up-to-date currency exchange information.

Whether you’re looking for real-time rates, historical data, or advanced currency conversion tools, these apps have you covered.

With their reliable data sources and user-friendly interfaces, these apps are must-haves for anyone dealing with Naira conversions.