Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In recent years, mobile loan apps in Kenya have revolutionized the financial landscape of the Country.

These apps offer quick, convenient, and accessible loans to individuals and businesses, bypassing the traditional banking system’s lengthy processes and requirements.

In this article we’ll be reviewing the 15 best mobile loan apps available in Kenya, detailing their features, benefits, and the borrowing process.

In Kenya, mobile loan apps enable individuals to borrow money directly from their smartphones. These applications streamline the process of requesting, getting approved for, and receiving loans without the need to visit a bank.

Users provide some personal information on the app, which then evaluates their credit to determine eligibility and loan amount. Different apps offer various loan sizes, interest rates, and repayment periods to meet diverse needs.

These apps are convenient because they provide flexible repayment schedules, rapid approvals, and often do not require collateral. They are popular among individuals and small businesses needing quick access to funds.

Safaricom’s M-Pesa was the pioneer in this space in Kenya, setting a precedent that other banks and financial institutions have followed by developing their own loan apps or partnering with existing ones.

Research indicates that many Kenyans do not save for emergencies, making these loan apps a crucial resource for obtaining quick cash when needed.

Read also: 15 Best Loan Apps in Nigeria with Low Interest Rate

An instant loan or mobile loan app is a digital platform that allows users to apply for and receive loans quickly through their smartphones.

These apps are designed to streamline the borrowing process, enabling users to:

Users can apply for loans by providing personal and financial information directly through the app.

The apps typically use algorithms and data from users’ smartphones and mobile money transactions to assess creditworthiness, resulting in rapid approval times.

Once approved, the loan amount is disbursed almost instantly to the user’s mobile money account, such as M-Pesa.

Most mobile loan apps do not require traditional forms of collateral, relying instead on alternative data to determine credit risk.

These apps often offer flexible repayment terms, which can be tailored to the user’s financial situation.

Overall, instant loan or mobile loan apps provide a convenient, fast, and accessible way for individuals to obtain credit without the need for lengthy bank procedures or extensive paperwork.

Some of the best instant loan mobile apps in Kenya include:

M-Shwari is a product of a collaboration between Safaricom and NCBA Bank. It’s integrated into the M-Pesa platform, making it widely accessible to M-Pesa users.

M-Shwari offers loans ranging from Ksh 100 to Ksh 50,000 with a one-month repayment period at an interest rate of 7.5%.

Its Key Features include:

KCB M-Pesa is another product leveraging the popularity of M-Pesa. It was created through a partnership between Safaricom and KCB Bank.

It provides loans of up to Ksh 1,000,000, repayable in one to six months.

Its Key Features are:

Tala is a pioneer in the mobile lending space, known for its user-friendly interface and quick loan disbursement.

Loans range from Ksh 500 to Ksh 30,000, with flexible repayment periods.

The Key Features of Tala include:

Read also: AI Now A Versatile Technology, Says Olubayo Adekanbi

Branch offers personal loans ranging from Ksh 250 to Ksh 70,000. The app uses smartphone data to evaluate creditworthiness, ensuring a quick loan approval process.

Its Key Features include:

Zenka provides instant loans up to Ksh 30,000 with a repayment period of up to 61 days. The app offers the first loan interest-free for new customers.

The Key Features of Zenka include:

Timiza is an Absa Bank Kenya product that offers loans up to Ksh 150,000. The app also provides other financial services like insurance and bill payments.

Its Key Features include:

Read also: Legit Online Loan Apps in South Africa

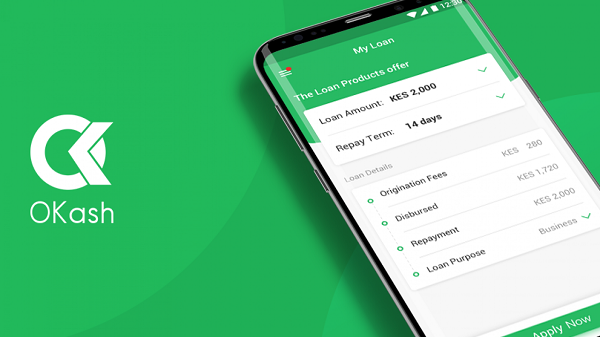

Okash, backed by Opera Software, provides loans ranging from Ksh 500 to Ksh 50,000.

It uses advanced algorithms to assess creditworthiness, ensuring fast and secure loans.

The Key Features include:

Stawika is designed to offer instant loans based on the user’s financial habits. Loans range from Ksh 500 to Ksh 50,000, with a flexible repayment period.

It offers these Key Features:

HF Whizz, by HF Group, offers loans to both individuals and businesses. It integrates seamlessly with M-Pesa and provides loans up to Ksh 50,000.

It offers these key features:

Read also: Latest Update on How to Apply for Emergency KCB Mpesa Loans in 2025

Saida offers personal loans ranging from Ksh 600 to Ksh 25,000. The app evaluates users’ creditworthiness using their smartphone data and mobile money transactions.

The loan app offers these key features:

iPesa provides instant loans from Ksh 500 to Ksh 50,000 with a repayment period of up to 61 days. The app focuses on transparency and customer service.

Its key features include:

Utunzi offers loans tailored to meet short-term financial needs, with amounts ranging from Ksh 500 to Ksh 50,000. The app emphasizes quick and efficient service.

The key features of Utunzi loan app include:

Read also: LemFi Gets Approved for Remittance Services in Kenya

Zash Loan provides loans up to Ksh 50,000, with a focus on quick disbursement and customer satisfaction. The app evaluates creditworthiness using mobile data.

Its Key Features include:

PesaPap, by Family Bank, offers a range of financial services, including instant loans.

Users can borrow up to Ksh 50,000 with flexible repayment options.

Key Features of Pesapap includes:

Kashway offers loans from Ksh 1,500 to Ksh 50,000, with a focus on quick and easy access to funds. The app ensures secure and confidential transactions.

The Key Features of Kashway loan app include

Read also: Google AI Helps Teachers Reclaim Time For Their Passions

Instant loan apps in Kenya offer numerous benefits, making them popular among users. Here are some of the key advantages:

One of the most significant benefits is the speed at which loans are processed and disbursed. These apps can approve and transfer funds within minutes, making them ideal for emergencies.

Users can apply for loans anytime and anywhere using their smartphones. There is no need to visit a bank or fill out lengthy paperwork.

Most instant loan apps do not require collateral, making it easier for individuals without assets to access credit.

The application process typically involves minimal documentation. Many apps use mobile data and transaction history to evaluate creditworthiness.

These apps offer a range of loan amounts and repayment terms, allowing users to choose options that best suit their needs.

Instant loan apps have significantly improved financial inclusion by providing access to credit for people who might not qualify for traditional bank loans, including those in remote areas.

Mobile loan apps are applications that allow users to apply for and receive loans directly through their smartphones, bypassing traditional banking processes.

Users download the app, register, and apply for a loan. The app evaluates their creditworthiness using phone and mobile money transactions data, then disburses the loan to their mobile money account.

Loan amounts typically range from Ksh 100 to Ksh 1,000,000, depending on the app and the user’s creditworthiness.

Loans are usually approved and disbursed within minutes to a few hours after application.

Interest rates vary by app, ranging from 4% to 15% per month.

No, most mobile loan apps do not require collateral. They use alternative data to assess credit risk.

Loans are typically repaid via mobile money platforms like M-Pesa, either in installments or as a lump sum by the due date.

Failure to repay on time may result in additional fees, increased interest rates, and negative reporting to credit reference bureaus.

Reputable apps are transparent about their fees, but it’s crucial to read the terms and conditions to understand all charges.

Yes, many mobile loan apps cater to users with limited or poor credit histories by using alternative data to assess creditworthiness.

The advent of mobile loan apps in Kenya has significantly improved financial inclusion, providing quick and easy access to credit for millions of people.

These apps offer a wide range of loan amounts and repayment terms, catering to different financial needs.

Whether you’re looking for a small personal loan or a larger business loan, these 15 mobile loan apps provide reliable and efficient options to meet your financial requirements.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.