Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Turn your living room into a cinema by unraveling M-Kopa’s TV Loan program in Kenya

Have you ever wanted to watch your favorite shows and movies on a new TV but were prevented by the expensive initial cost? If you live in Kenya, you might be interested in the M-Kopa TV loan project, which allows you to watch TV on your television.

This article delves deeper into this financial choice, studying all of the fine print so that you may decide if it is right for you.

We will learn about the M-kopa TV loan and the M-kopa TV loan requirements that must be completed, and we will walk you through the step-by-step M-kopa TV loan application process.

So sit back, learn something new, and maybe turn your living room into your mini-theater!

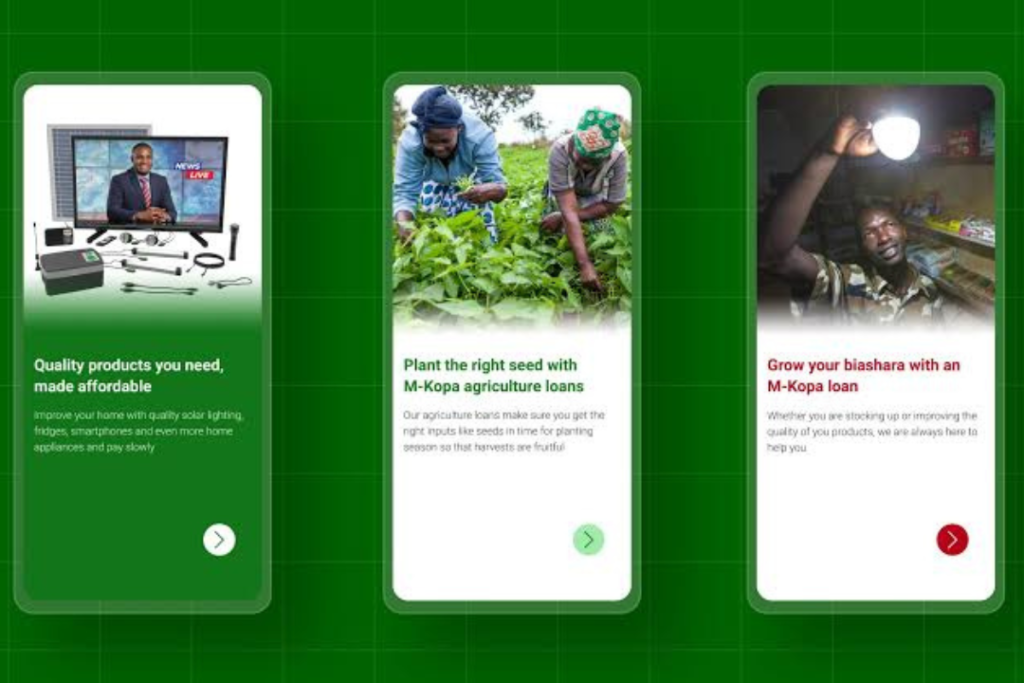

According to Wikipedia, M-Kopa (M for mobile and Kopa for borrow) is an African-connected asset finance platform that provides underbanked customers in Africa with access to basic products such as solar lighting, televisions, fridges, cellphones, and financial services.

M-Kopa’s commercial operations began in 2012 and are headquartered in Nairobi. Currently, the company operates in Kenya, Nigeria, and Uganda.

M-Kopa TV Loan is a financial service offered by M-Kopa. It allows clients to purchase television sets on a pay-as-you-go basis.

The novel strategy aims to make contemporary technology more accessible to low-income people, particularly in rural areas where conventional funding may be constrained.

M-KOPA allows more individuals to enjoy entertainment and instructional content by breaking the cost down into affordable installments and using mobile payment infrastructure, increasing its users’ quality of life.

Related – Watu Credit Loan App: How to Apply

M-Kopa is a company that delivers off-grid solar energy solutions and exceptional items to African clients. One of their offerings is M-Kopa TV, which provides clients with access to television content even in areas where there is no reliable power. M-Kopa TV loans function as follows:

Customers select the M-Kopa TV package offer that interests them, which typically includes a television, solar panel, battery, and a satellite dish for accessing TV channels.

Rather than paying the complete amount upfront, clients pay a deposit, followed by monthly payments over a tough and quick period. This makes the product even more affordable and accessible to individuals who may lack the financial resources to purchase it outright.

After making a deposit, consumers make recurring installment payments over time (usually weekly or monthly). These payments are typically done using mobile money services, which are widely used in many African countries.

The M-Kopa TV system uses solar electricity, which is converted into energy by the solar panel included in the package deal. The solar panel charges the battery during the day, storing power for usage when there is no solar.

The M-Kopa TV system provides clients with access to television channels via a satellite dish. This allows individuals to watch a wide range of programs, including news, entertainment, and instructional content, in areas without traditional energy infrastructure.

Customers have the entire possession of the M-Kopa TV set after paying all installments in full. This means that they will no longer incur any additional costs and may continue to use the product as long as it is still functional.

M-Kopa TV Loan Requirements in Kenya typically include the following:.

Read Also – Leja Loan: How to Access it

The application process for an M-Kopa TV loan allows low-income families to easily obtain television pleasure. The M-Kopa TV loan application process is outlined in detail below:

One can apply for an M-Kopa TV loan by visiting the company’s website or visiting one of its physical locations. M-Kopa’s website contains all of the information about their products and services, including the sorts of TVs that are eligible for financing.

After deciding to receive an M-Kopa TV loan, select the TV model that best meets your needs and budget. When making a decision, consider the screen size, screen characteristics, and pricing of the desired TV model.

To complete an application form, you will need to include your personal information, such as your name, address, contact information, and income, as well as an identity document, such as a national ID or passport. The form can be filled out online or in person.

Before signing the loan agreement, make sure you understand and are aware of all of the terms and conditions associated with the M-Kopa TV loan. Please carefully review the payment plan, interest rates, and any other loan-related costs or fees.

Depending on whether you submit your application online or in person, you may be required to provide additional paperwork to support it. Do not proceed until you receive a green light.

Wait for M-Kopa to process and approve your loan application after you’ve submitted it and all the necessary papers. This process may take a few days, during which M-Kopa will confirm your information and complete any necessary checks.

Once your financing is authorized, you will receive an M-Kopa TV with a solar power system. You will also be given instructions on how to set up the TV and use the pay-as-you-go service.

To continue enjoying M-Kopa TV services, make sure to make your monthly payments on time. In Kenya, mobile money services such as M-pesa are widely used for payments.

After you’ve set everything up and paid all of your payments, you can start enjoying your M-Kopa TV and exploring other entertainment alternatives.

By following these procedures and meeting the qualifying requirements, you can experience the benefits of buying a TV through M-Kopa’s unique financing scheme.

M-Kopa TV loans offer hundreds of benefits. Let’s look at these benefits:

It allows customers to shop for television in tidy installment payments, making it more affordable for low-income homes.

Having a television at home demonstrates that you can benefit from watching information, academic programs, and amusement, which is certainly helpful to both humans and homes.

M-Kopa provides payment plans that allow clients to choose charge schedules that are compatible with their financial situation.

By making regular payments on the TV loan, consumers can accumulate excellent credit rating information, which can also help them obtain unique economic opportunities in the future.

Television may help people improve their livelihoods by providing information on agricultural methods, fitness training, and job prospects, among other things.

Owning a television may empower people by providing access to knowledge, entertainment, and opportunities for personal and professional growth.

A home with a television may have a higher quality of life since it provides entertainment options for rest and promotes family bonding through shared viewing.

Overall, the M-Kopa TV loan provides an opportunity for Kenyans and households to obtain a television at a cheap cost, which may help them improve their quality of life and expand their access to information and entertainment.

Also Read – KCB Mpesa Loan Limit

By applying for an M-Kopa TV loan, you commit to making repayments on time, either on the due date or earlier, as you desire.

The repayments, which can be made daily, weekly, or monthly, will be used to offset your loan until it is completely completed within the time frame provided in the agreement.

You must recognize that the loan’s terms and costs were previously disclosed and/or discussed with you via the Digital Channel.

M-KOPA’s cooperation with Safaricom makes it simple for you to pay your daily bills and electricity consumption credits. Make your payments with the pay bill number 333222.

The M-Kopa TV loan limitations for a consumer may vary according to their credit score, payback history, and loan terms.

Normally, M-Kopa determines the loan limit by undertaking an affordability assessment to ensure that consumers can comfortably repay the loans without experiencing financial difficulty. The limits could also depend on the cost of the TV model chosen by the customer.

Thus, anyone considering qualifying for an M-Kopa TV loan can contact the company directly or visit their website for further information on loan limits and eligibility conditions.

Read Also – Halal Pesa loan: How to Access it

In the case of M-Kopa TV loans, it is viable to provide households with the leisure and records they can’t have the funds for in some other way, yet there are some downsides to keep in mind:

It’s critical to cautiously weigh these factors and know whether or not the M-Kopa TV loan aligns with your monetary state of affairs and priorities.

M-Kopa’s TV loan application in Kenya helps households afford modern entertainment. By enabling customers to pay in easy installments, it increases the possibility of many families having access to superior television programming.

This type of financing is quite innovative, as it enables common Kenyans to own a TV without putting too much financial pressure on themselves. M-KOPA’s TV loan offers more people the chance to be informed, entertained, and connected to the world.

We hope that you find this information useful in making the right choices about your entertainment. Feel free to leave a nice comment.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

If you fail to meet your contractual responsibilities, including staying current on your Credit Payments, M-Kopa may deactivate your Product (including exercising a seller’s lien as applicable under this credit sale agreement) until you catch up on your Credit Payments

One 24-inch television with an M-KOPA 600 bundle costs KSH 65,499 (USD 655). To fully own the product, a consumer pays a deposit of KSh 5,49 (USD 55) and a daily rate of KSh 100 (USD 1) via M-PESA Pay Bill Number 333222 for 600 days.

M-Kopa will activate the product once you make initial payment, and then anytime your account has a positive credit balance.