Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Getting extra cash when you need it shouldn’t come with stress or compromise. That’s where Halal Pesa steps in. It’s a Shariah-compliant mobile loan service that helps you get money fast, without interest, and in line with Islamic finance principles.

If you’re a student, a small business owner, or just dealing with a tight budget, Halal Pesa offers a smart and ethical way to borrow. But how exactly do you access it?

In this guide, you’ll learn everything you need to know about Halal Pesa loans, from how it works, who can apply, how to apply, and what makes it different from regular loans.

Halal Pesa is a new service launched by Vodacom in collaboration with Amana Bank.

It’s designed to help M-Pesa customers save money in a safe way while also supporting religious and social activities. With Halal Pesa, customers can earn benefits that comply with Sharia law.

This service expands financial options and encourages saving among those who follow Sharia law. It’s the first digital financing product of its kind, developed through a partnership between M-Pesa and Gulf African Bank Ltd.

Right now, it’s focused on financing and will include saving features in the future.

Read also: Sudan in the Middle of Internet Crisis: 14 Million Internet Users in the Dark

A Halal pesa loan is a type of loan that doesn’t involve charging interest. It’s based on Sharia law, which says you can’t make money just by lending money. Instead, you can only make money by investing in things like assets or trading.

Read also: 16 Questions You Should Ask your Solar Installer

Halal Pesa was created with Muslim customers in mind. Many of them avoid other lending options because they follow Shari’ah law, which doesn’t permit borrowing money where interest is involved.

Halal Pesa offers a solution that aligns with these beliefs. Instead of traditional loans with interest, they provide a lending service that complies with Shari’ah law, giving their customers peace of mind when it comes to their finances.

Read also: Top 15 Digital Marketing Agencies in Lagos 2025.

Halal Pesa is a financing option available to all M-PESA users, regardless of their religious affiliation.

That is, even if you’re not a Muslim, as long as you’re an Mpesa user, you can access the Halal Pesa loan.

The steps to follow when activating Halal Pesa on your mobile phone using the Halal Pesa USSD Code “*334#” include:

These simple steps will help you activate Halal Pesa on your M-PESA account and gain access to its financial services.

Read Also: Apple’s Worldwide Developers Conference Set for June 10, 2025

You can also register for Halal Pesa using the Halal Pesa Mobile app available on both the Google PlayStore or Appstore.

Here’s a step-by-step guide on how to register:

Remember, you can sign up for or activate more than one M-PESA line to use Halal Pesa. But, if you do this, your Halal pesa loan limit might change because Halal Pesa will split it between your different phone numbers that are registered with the same ID.

Read also: Okash Loan App Download

Let’s talk about the minimum and maximum loan limits for using Halal Pesa. It’s important to understand how much you can request and what to expect as a first-time or repeat customer.

Halal Pesa has specific rules regarding the minimum and maximum amounts you can receive, as well as what happens if you need to request more or if you need additional funds.

The smallest amount of money you can get through Halal Pesa is 1,000 Kenyan shillings.

If you’re new, the most you can get is 15,000 Shillings, but if you’ve borrowed before, it could be up to 20,000 Shillings, depending on your borrowing history.

In a situation where your borrowing limit is 15,000 shillings and you borrow only 1,000 Shillings at first but later realize you need more.

You can’t ask for more money until you’ve paid back the 1,000 Shillings plus the interest for borrowing it. Also, you can only have one loan at a time.

Read also: Shika Loan App: How to Apply

To increase your limit, there are a few things you can do or factors that Halal Pesa will consider before granting a loan limit increase. They are:

Halal Pesa looks at these things to decide if they can raise your credit limit or if you’re eligible for a loan limit increase.

Read also: How to Get Safaricom Faraja Loan

Unlike conventional loans, which charge interest on the amount lent to a borrower, there is no interest rate on Halal Pesa loans. They don’t charge any interest on loans lent to customers.

The loans are normally on a risk-sharing, profit-sharing model where both the lender and borrower stand to incur the risk and profits of the investment.

This is in line with Islamic principles that ban the collection of interest on loans. The loaning rate of profit is normally lower than that for conventional loans, hence making it more affordable to the borrower.

Halal Pesa loans have a list of requirements for loan granting. They include;

The process of applying for this loan is pretty easy, and borrowers will be asked to fill in general information about themselves and their finances, along with proof of identification and income.

Another important condition of the Halal Pesa loan is collateral/security. Collateral can be in the form of a guarantor who takes responsibility in case the borrower defaults on their loan.

The borrowers may provide asset-based collateral, such as a car or property, to secure the loan. This condition exists to minimize the risk of default and ensure that borrowers are committed to paying back the loan.

Halal Pesa loans also comprise a repayment schedule that mentions the loan tenure and amount to be repaid. The time for repayment would extend from a few months up to several years based on the loan amount and the borrower’s financial capacity.

One can have various options for repayments as a borrower: weekly, bi-weekly, or monthly.

Halal Pesa won’t charge you extra if you’re late with your payment.

But if you haven’t paid back what you borrowed by day 31, they’ll change things up. Instead of just the original amount, you’ll have a new deal with a 5% extra charge.

Let’s say you borrowed KES 1,000 and were supposed to pay back Ksh 1,050 after 30 days.

If you can’t pay by day 31, they’ll add 5% to the original amount you borrowed. So, if your original loan was Ksh 1,000, you’ll have to pay back Ksh 1,100 by day 60.

If you still can’t pay by then, they won’t add any more charges to what you borrowed initially.

Read also: Update on LAPO Loans: How to Apply, Eligibility Requirements and Loan Packages

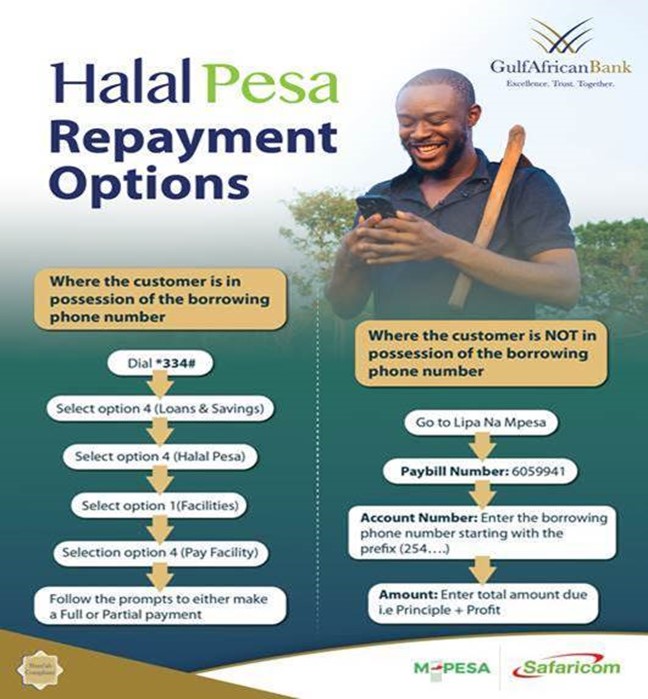

If you owe money to Halal Pesa, you have 30 days to pay it back, either in full or in part. To repay your Halal Pesa loan:

Halal Pesa is a way to get money from Safaricom and the Gulf African Bank without paying interest. Instead, they charge a small profit margin.

You can borrow from Ksh 1,000 to Ksh 20,000 and repay it within 30 days with a 5% profit margin. This option is open to anyone who is registered on M-PESA.

Read also: Okolea Loan: How to Apply and Access it

Halal pesa is different from other lending platforms in the following ways:

Read also: Lend Plus Loan App: How to Apply

If you want to stop using Halal Pesa, here’s what you need to do:

Read also: Letshego Loan Requirements

While using Hala pesa, you can choose to join, ask for money, check how much you can ask for, see how much money you have left, pay back money, or decide to leave the service

This means you decide to join or sign up for Halal pesa. It’s like saying, “Yes, I want to be part of this service.”

With this option, you can ask for money from Halal Pesa. It’s like sending a request for someone to give you money.

This lets you check how much money you’re allowed to ask for from Halal Pesa. It’s like finding out the maximum amount of money you can borrow.

This allows you to check how much money you have left in your Halal Pesa account. It’s like checking your bank balance to see how much money you have.

If you’ve borrowed money from Halal Pesa, this option lets you pay it back. It’s like returning the money you borrowed.

This means you choose to leave or stop using Halal Pesa. It’s like saying, “I don’t want to be part of this service anymore.

Read also:15 Frequently Asked Questions About Netflix in Nigeria 2025

If you need support or help with any things concerning Halal pesa loan, or habe enquires to make, you can reach out through various channels. You can call either 100 or 200.

Alternatively, you can contact them via Twitter by sending a message to @Safaricom_Care or @SafaricomPLC. Another option is to reach out on Facebook by messaging @SafaricomPLC.

If you prefer email, you can send your queries to customercare@safaricom.co.ke. Additionally, you can visit any Safaricom Shop for assistance.

Anyone who has signed up for M-PESA can become a member of Halal Pesa.

When you borrow money from the Gulf African Bank with Safaricom, they add a fee of 5% to what you borrowed. Let’s say you borrow at least Ksh 1,000. After 30 days, you have to pay back the Ksh 1,000 plus Ksh 50 extra, making it a total of Ksh 1,050.

Yes, if you have multiple SIM cards registered under your ID, you can activate Halal Pesa services for each of them. But the total limit you’re allowed will be shared among all those phone numbers.

No. Only one facility can requested at a time.

The minimum amount allowed is Kshs.1000. One cannot request for an amount less than this.

You can check your balance using the Halal Pesa mini-app or by dialing *347# on your phone. Just select the “Check Balance” option, then enter your correct M-PESA PIN when prompted.

The maximum loan limit is Ksh.15,000 (first-time customers) & Ksh.20,000 (repeat customers) subject to the customer’s qualifying limit

Repay your facility on time and Increase usage of your Mpesa mobile wallet.

In conclusion, accessing a Halal Pesa loan is a straightforward process that offers a range of convenient services tailored to meet your financial needs.

By opting in, using request and repayment facilities, and keeping track of your balance and limits, you can effectively manage your finances while adhering to Halal principles.

Whether you’re in need of immediate funds or planning for future expenses, Halal Pesa provides a reliable and accessible solution for accessing Islamic-compliant financing.