Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

FNB loan calculator is a useful tool for potential borrowers when thinking about a FNB personal loan.

These tools are intended to provide an approximate loan amount that a person may be eligible for, along with a possible repayment schedule.

Utilize a FNB loan calculator by entering several parameters, such as the required loan amount and anticipated repayment period. Using FNB loan calculator app, one can ascertain:

The highest loan amount that qualifies, up to R300,000, A customized predicted interest rate that may begin as low as 10.25%, Alternatives for the payback period, with lengths of up to sixty months.

FNB loan calculator based on salary provide a clear visual depiction of prospective financial commitments, enabling people to make well-informed decisions.

Calculators should be utilized as the first stage in the borrowing process since they are impartial guides that reflect a snapshot depending on the entered parameters.

It is crucial to realize that the preliminary estimates provided by the online calculator may not match the actual terms of the loan, which will be decided following a formal application process.

In this article, we will examine all you need to know about the FNB loan calculator, what it is and how to use it. Let’s get right in.

see also: Africa Fintech Summit Releases Nigeria Fintech Marketing Outlook 2024

One of the “big five” banks in South Africa, First National Bank (FNB) is the oldest bank in the country, having originated as the Eastern Province Bank in 1838.

FNB, which has a long history in banking and finance, offers a wide range of services, such as personal loans, savings accounts, and transactional banking.

FNB is a well-known loan provider that serves both individual and business clients by fusing modern financial services with traditional banking traditions.

First National Bank, or FNB, also provides a selection of FNB loans calculators to its clients in South Africa, catering to their diverse financial requirements.

Offering a simple and expeditious application procedure, FNB presents itself as an easy option for anyone in need of financial support.

The loans have a predetermined payback plan, variable interest rates, and the ability to purchase credit life insurance for further security.

With a personalized FNB loan calculator, FNB hopes to enhance your lifestyle and assist you in realizing your specific objectives.

You can effectively manage your costs and create a budget by using the FNB loan calculator, which provides you with the precise amount of your monthly installment.

Once you use the FNB loan calculator, you will have complete knowledge about your loan application.

Because the FNB personal loan has a fixed interest rate, you, as a valued customer, are shielded from potential interest rate increases during South African recessions.

Choose flexible loan terms that work best for your spending plan and aim to pay off the loan in no more than 60 months (5 years).

If you already have a FNB account, the personal loan will increase your eBucks Reward Level and provide you with additional bank perks.

Additionally, if you already have a FNB account, applying for a loan through the app or online banking is simple.

If your application is accepted, you will have quick access to the funds, which you are free to use anyway you see fit.

You can pay for schooling, remodel your house, pay off debt, purchase the automobile of your dreams, and accomplish anything else that is essential to you.

Applying for a personal loan from FNB is simple; just stop by the branch that is closest to you right now to speak with someone in person.

see also – Top 12 Budget-Friendly Android Phones in Nigeria

The FNB Loan Calculator accommodates a wide range of loan types and amounts, allowing users to customize their calculations based on their specific borrowing needs and preferences.

By inputting relevant details such as loan amount, interest rate, and repayment term, users can obtain accurate estimates of their monthly repayments, helping them budget effectively and plan for future financial obligations.

The FNB Loan Calculator provides transparent and clear information about the total cost of borrowing, including interest charges and the total repayment amount. This empowers users to make informed decisions about their borrowing options.

The FNB Loan Calculator is easily accessible online through the FNB website or mobile app, making it convenient for customers to perform loan calculations anytime, anywhere.

see also – Easy Loan: How to Easily Apply

The FNB Loan Calculator serves as a valuable tool for financial planning, enabling users to assess the affordability of potential loans and determine the most suitable repayment terms for their budget.

By experimenting with different loan scenarios using the FNB Loan Calculator, users can compare multiple loan options and evaluate their respective costs and benefits.

This helps users make well-informed decisions and choose the most cost-effective borrowing option.

Understanding the monthly repayment obligations associated with a loan helps users manage their budgets more effectively.

By incorporating loan repayments into their financial plans, users can ensure that they allocate sufficient funds for loan repayments while meeting other financial commitments.

The FNB Loan Calculator empowers users with knowledge and insight into the financial implications of borrowing, enabling them to take control of their financial future with confidence.

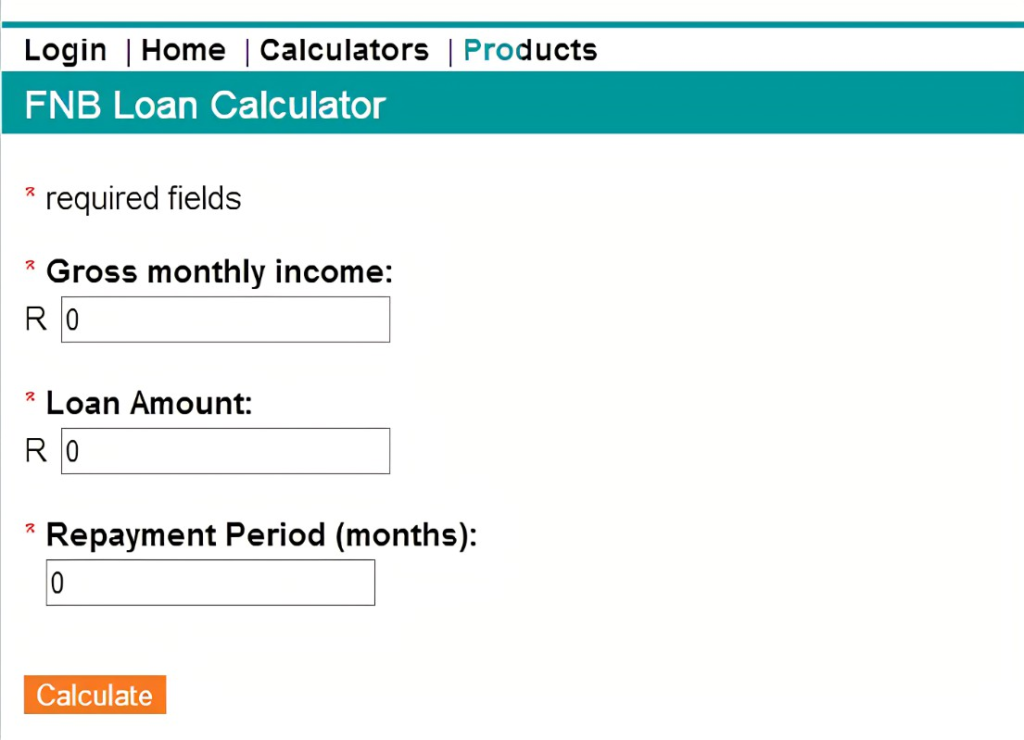

Visit the FNB website or open the FNB loan calculator app and navigate to the Loan Calculator tool.

Select the type of loan you are considering, such as personal loan, home loan, or vehicle finance.

Input the relevant loan details, including the loan amount, interest rate, and repayment term. You may also have the option to specify additional parameters such as initiation fees or insurance costs.

Once you have entered all the necessary information, the FNB Loan Calculator will generate a summary of your loan repayment details, including the monthly installment amount, total repayment amount, and total interest paid.

Take advantage of the FNB Loan Calculator’s flexibility to explore different loan scenarios by adjusting the loan amount, interest rate, or repayment term.

This allows you to assess how changes in these parameters impact your monthly repayments and total loan costs.

Armed with the insights provided by the FNB Loan Calculator, you can make informed decisions about your borrowing options.

Consider factors such as affordability, repayment terms, and total loan costs to choose the loan option that best aligns with your financial goals and circumstances.

you might also like – Google Offered 300% Hike in Salary to Retain an Employee

Using the FNB loan calculator based on salary is a straightforward process that allows individuals to estimate their borrowing capacity and potential loan repayments based on their monthly income.

Here’s how to use the FNB loan calculator based on salary:

Visit the FNB website or open the FNB mobile app and locate the Loan Calculator tool.

Select the type of loan you are interested in, such as a personal loan, home loan, or vehicle finance.

Input your monthly salary or income into the designated field. This figure represents the amount of money you earn before taxes and deductions each month.

Once you have entered your salary information, the FNB Loan Calculator will generate an estimate of your maximum loan amount based on your salary.

This figure represents the total amount you may be eligible to borrow, considering factors such as your income, expenses, and debt-to-income ratio.

If desired, you can further customize the loan calculation by adjusting parameters such as the loan amount, interest rate, and repayment term to explore different loan scenarios and repayment options.

Review the estimated monthly installment amount and total repayment amount provided by the FNB Loan Calculator to assess the affordability of the loan based on your salary and financial circumstances.

Ensure that the monthly repayments fit comfortably within your budget to avoid financial strain.

Armed with the insights provided by the FNB Loan Calculator, you can make informed decisions about your borrowing options.

Consider factors such as the loan amount, interest rate, repayment term, and total loan costs to choose the loan option that best aligns with your financial goals and salary level.

By using the FNB loan calculator based on salary, individuals can gain valuable insights into their borrowing capacity and make informed decisions about their financial future.

‘Whether you’re planning to finance a major purchase, consolidate debt, or cover unexpected expenses, the FNB loan calculator empowers you to navigate the borrowing process with confidence and clarity, ensuring that you choose a loan option that fits your budget and financial goals.

see also – Loan Calculator and How to Use it

Using an FNB loan calculator is indeed a recommended approach when considering taking out a personal loan. Here’s why it’s the right way:

An FNB loan calculator provides insights into the affordability of a personal loan by estimating monthly repayments based on factors such as loan amount, interest rate, and repayment term.

This helps borrowers assess whether they can comfortably manage the repayments within their budget.

By using the calculator, borrowers can plan and budget effectively for their loan repayments. They can experiment with different loan scenarios, adjusting parameters like loan amount and repayment term to find a repayment plan that suits their financial circumstances.

The calculator allows borrowers to compare different loan options offered by the bank. By inputting details of various loan products, borrowers can evaluate the total cost of borrowing, including interest charges and fees, and choose the most cost-effective option.

Using the calculator empowers borrowers to make informed decisions about their borrowing needs.

By gaining clarity on loan terms, costs, and repayment obligations, borrowers can choose a personal loan that aligns with their financial goals and preferences.

FNB loan calculators provide transparency in the loan application process.

Borrowers have access to clear and accurate information about loan repayments, helping them understand the terms and conditions associated with the personal loan before committing to it.

Using the calculator is an effective and prudent way to take out a personal loan. It enables borrowers to assess affordability, plan their finances, compare loan options, and make informed decisions, ultimately ensuring a smoother and more transparent borrowing experience.

The FNB loan calculator is a tool provided by First National Bank (FNB) that helps users estimate loan repayments based on factors such as loan amount, interest rate, and repayment term.

You can access the FNB loan calculator online through the FNB website or mobile app. It is typically found in the “Tools” or “Calculators” section of the website or app.

The calculator can be used to calculate various types of loans, including personal loans, home loans, vehicle finance, and business loans.

Users input details such as the loan amount, interest rate, and repayment term into the calculator. Based on this information, the calculator generates estimates of monthly repayments, total repayment amount, and total interest paid.

The calculator provides accurate estimates based on the information input by the user. However, actual loan terms may vary depending on factors such as creditworthiness and prevailing interest rates.

Yes, the calculator allows users to compare different loan options by inputting details of each loan scenario and comparing the resulting estimates of monthly repayments and total loan costs.

Yes, users can use the calculator to assess affordability by inputting their monthly income and expenses along with the loan details. The calculator estimates whether the loan repayments fit within the user’s budget.

In conclusion, the FNB loan calculator serves as a valuable tool for individuals navigating the borrowing process.

By providing accurate estimates, facilitating comparison shopping, and enabling users to assess affordability, the calculator empowers borrowers to make informed decisions about their financial future.

Whether considering personal loans, home loans, or vehicle finance, the FNB loan calculator offers transparency and clarity, helping users plan and budget effectively.

With its accessibility and user-friendly interface, the calculator enhances the borrowing experience, ensuring that borrowers can select loan options that align with their needs and financial goals.

You can check out other useful content by following us on X/Twitter: @siliconafritech.

Instagram: @SiliconAfricaTech.

Facebook: @SiliconAfrica