Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Do you need a quick loan to help you kick start your freelance writing business in Kenya? Perhaps you need quick M-Pesa loans to see you through the trying time. Online loans in Kenya via Mpesa are a simple and popular way of obtaining money without needing to visit a bank.

I understand, sometimes you simply do not have money. That is why many Kenyans turn to such instant mobile loans when they require fast cash—be it for internet bundle payments, clearing a bill, or repairing some unexpected emergency.

It’s simple to do so, and in most cases, all you need is your phone, ID, and an operational M-Pesa line.

In this guide, I will walk you through some of the best loan apps in Kenya online with no common collateral or waiting period. Due to the emergence of online loans in Kenya using M-Pesa without collateral, getting money has never been quicker or easier.

Whether it’s an emergency bill or a little kick-start, these emergency loans Kenya online can be your saving grace. Let’s demystify the best source you can count on in 2025.

Online loans in Kenya via Mpesa are digital loans that you can apply for and receive through your phone using the Mpesa platform.

This is so convenient, making it easy and convenient to borrow. You don’t have to line up in banks or provide piles of documents.

All this is done on your phone with the money being deposited into your Mpesa account. The loans are mostly collateral-free, thus accessible to many people.

Read Also – List of 15 Online Business that Pays Daily for Students in Nigeria

Kenya is the pioneer of mobile money, and M-Pesa is such a brand name. The convenience of sending money and receiving it in seconds has made M-Pesa popular.

Online loans via M-Pesa capitalize on the convenience. People love quick and easy loans. These loans cater to immediate money needs of regular Kenyans—school fees, medical bills, emergencies, or funds to venture into business.

Here are the list of Online loans in Kenya via Mpesa:

KCB M-PESA is a loans and savings product offered only by KCB Bank to M-Pesa clients. You must be a registered and active Safaricom M-pesa client.

The loan duration is one month and comes with an interest of 7.35%. The product is ideal for clients seeking handy and easily accessible Online loans in Kenya via Mpesa through their phones.

Branch was the first to launch a loan application in Kenya, and because of that, it remains the most downloaded app up to now; over 10 million. Currently, with a rating of 4.5 from more than 500,000 reviews, Branch has survived the test of time to offer Kenyans’ best loan services.

It offers loans from 250 shillings to 100,000 on time periods of 4 to 52 weeks. Its interest rates vary between 17% to 35% depending on various aspects like the loan type, payment history, and Branch’s cost of lending.

It does not charge late or rollover fees, and no collateral is required for you to qualify for the loans. If you are looking for established and credible online loans in Kenya via Mpesa, Branch is your go-to.

Also Read – 10 Places You Can Get Remote Tech Jobs and Earn in USD as a Nigerian

Tala loan app was also among the first pioneers of the instant loan market in Kenya.

It has over 10 million Google Playstore downloads and the highest rating in the industry; 4.7/5.

Here’s what’s wonderful about Tala.

Considering its overall rating from over 400,000 reviews, Tala might just as well be declared Kenya’s best mobile loan app.

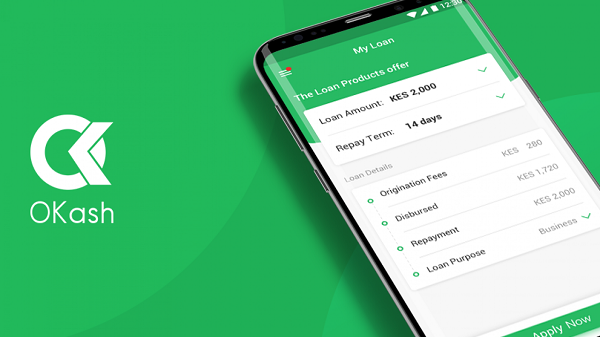

Close on the heels of Tala in terms of downloads is Okash, which has over 5 million downloads. Okash is a trailblazing and aggressive player in the micro-lending space.

As an Opera Group product, it is continually seeking ways to provide fast, easy, and secure loan services. It won the Best Mobile loan app at the Digital Tech Excellence Awards in December 2019.

Founded in 2018, it is among the top loan apps in the nation, with over 1.5 million customers. Some of its most thrilling promotions are;

Okash interest rates are 36% per annum, and a charge of 2% per day is charged for delayed payment.

iPesa makes it easy to get loans anytime and from anywhere. It boasts an astounding average rating of 4.4 that is equivalent to 88% of its reviewers believing that it’s the best loan app.

But in fact, what does the iPesa loan app provide? Loan amounts from Ksh 500 to Ksh 50,000 Kenyan, repayment terms from 91 days to 180 days, and a service fee of 36%.

The last part literally translates to the fact that you will pay back 1,000 + 1,000 * 0.36 = 1,360 if you take a loan of 1000 shillings after 180 days. Like other loan apps, iPesa scans your phone for information, including your SMS, especially M PESA messages, to know you and determine a credit score.

So, if you make large transactions regularly, you are likely to get high loan limits and vice versa.

Read Also – 7 Apps To Make Money Online In Nigeria As A Student In 2025

A Wakanda Credit product, Kashway loan application has been downloaded more than 1 million times from Google Playstore. It has a huge market share in the Kenyan micro-loans market with a strong 4.4 rating and most clients being satisfied with their services.

Kashway offers loans ranging from Ksh 2,000 to Ksh 10,000, whose loan limit increments are based on repayment history. When you take the loan, upon disbursement, you receive less than what is approved since part of it goes towards an origination fee. The loan application offers a 14-day loan tenure and levies interests between 21% and 32%.

Although the majority view Kashway as being convenient, you need to note its very high-interest rate charged on short terms and costly penalties on late payments.

Rated 4.2 by more than 93,000 users, Zash Loan, also known as KopaKash, is among Kenya’s most downloaded mobile loan applications with more than 1 million Google Play downloads.

Some of its features include the loan amount from Ksh 500 to Ksh 50,000, the loan period duration from 7 to 90 days, speedy application process turnaround, and your data protection.

As long as you are between 18 years and 60 years old and have a national ID, you are eligible for a loan application through the Zash loan, and you can get the money within minutes.

But if you fail to repay on time, you are also charged 2.5% per day late fee. This is a compound interest that can be quite costly within a short time. In case you fail to meet the repayment deadline but later settle your loan, you are free to take another loan after seven days.

Founded in 2018 Zenka loan app has been the first to provide easy and fast loan services to Kenyans. Its aggressive marketing has seen it become popular as a leading loan app in Kenya with over 1 million Google Play downloads.

It carries a high rating of 4.1 from over 66,000 reviewers, which means that the majority of people find its services worth recommending. In order to access the services of Zenka loan, you must be older than 18 years.

The application charges a one-off processing fee between Ksh 45 and Ksh 870. The amount of the loan that can be awarded ranges from Ksh 500 to Ksh 30,000, and you have 61 to 180 days to repay your loan in full.

Zenka has an interest rate of 70 to 224% per annum. For example, a loan of 1000 shillings for 61 days will have an annual percentage rate of 180%. Therefore your repayment will be 1000 + 1000 * 61/365 * 180% = Ksh 1,300

Also Read – 15 Tech Remote Jobs In Nigeria

Yet another leading loan app that has crossed over 1 million downloads on Google Play Store is CashNow, owned by Payloan Investments. The only requirement to get a loan from CashNow is to be a regular Mpesa user and an ID card holder.

The loan is between Ksh 2,000 and Ksh 50,000, depending on the credit history and score of the borrower. CashNow interest rates are between 5% and 30%, and repayment is done within 14 days.

Late payment attracts a 2% daily rollover charge for some time, and then they refer your name to the CRB. CashNow has over 14,000 reviews and a 4.0 average rating, so it is an excellent choice in our top loan apps in Kenya list.

M-Shwari Loan is a micro-credit M-Pesa facility offered in partnership with NCBA Bank that enables you to borrow money through your phone. They charge a one-off fee of 7.5% deducted from each loan.

Eligibility, You will meet the following requirements:

Before applying for online loans in Kenya via M-Pesa, there are several key things that you need to consider in order to avoid unnecessary debt or dealing with unreliable loan providers. Below is a brief guide that will allow you to make a well-informed decision:

Also Read – 10 Best Tech Sales Jobs in Nigeria

Below are some helpful tips for managing your loans online in Kenya using M-Pesa in order to stay debt-free, increase the loan limit, and enjoy a good credit record:

Getting online loans in Kenya from Mpesa is one of the fastest ways to get emergency funds. You don’t need to wait in a bank queue, you don’t need guarantors, and you definitely don’t need to worry when life surprises you with surprise bills.

All these apps, including Tala, Branch, and KCB Mpesa, have made it possible for people with a phone and a line to pay school fees, replenish business, or even pay rent—instantly.

In case you’ve wondered where to start, this list gives you alternatives for small and big amounts, whether you need online loans Kenya via Mpesa collateral-free or quick online loan Kenya wide.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

Can I get online loans in Kenya using M-Pesa without collateral?

Yes, there are some sites that offer collateral-free loans based on your mobile phone usage history and credit score.

How can I obtain an online loan via M-Pesa?

Go to your M-Pesa menu, tap Loans and Savings, choose a loan service like KCB M-Pesa, select the amount, and follow prompts to receive cash instantly.

How can I repay an online loan via M-Pesa?

You can pay back through the M-Pesa menu by selecting Loans and Savings, Pay Loan, or through using the lender’s Paybill number and entering your borrower ID.