Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Well, the holiday season has come and gone, leaving many of us with fond memories and unfortunately depleted bank accounts, which leads to the thoughts of “are there loan apps you can trust this 2026″.

Perhaps you still remember when you spent way too much on gifts and celebrations, thinking I’d worry about the consequences later. But now that the New Year has begun, it is time to face the music and get our finances back in order.

Let’s say you have to get your savings back, invest in some new venture, or cover sudden expenses; quick and reliable funding is vital.

That’s where trusted loan apps come in – and with so many options available, knowing which ones are trustworthy is important.

So, with that said, we have crawled the market to present the top trusted loan apps to watch out for in 2026. All these loan apps were carefully vetted based on their credibility, transparency, and customer-centric approach.

Just imagine applying for a loan from the comfort of your home and having that money drop into your account within minutes. Sounds cool, right? Now let’s find out:

When it comes to loan apps, you want to be able to trust them. You are sharing sensitive financial information and promising to pay a loan back.

So, what sets the top trusted loan apps apart? Let’s dive in and find out the most common elements that make any loan app trustworthy.

A good loan app will be transparent in stating the interest rates, fees, and repayment terms. You should be able to find this information on the website or in-app without too much fuss. Be wary of applications that either keep this information in the dark or present it in incomprehensible ways.

Good reputation is expressed by being one of the best and trusted loan apps. Check online reviews, ratings, and testimonials to get a view of the reputation of the app. In addition, beware of any signs that something is off, such as complaints of hidden fees and poor customer service.

A good loan application ensures data security. Seek to know whether the application encrypts your personal and financial information. You should also check whether the application complies with relevant data protection regulations.

One of the best-authorized loan apps provides flexible repayment terms that work for you. Prefer applications that can offer multiple alternatives for repayments, such as on a weekly or monthly basis. Avoid applications charging exorbitant rates in case of late payment.

A reliable loan app is transparent and timely in its communication. Seek those that keep you abreast of the status of your loan and answer your questions promptly. Avoid apps that keep you in the dark or don’t respond to your messages.

A top trusted loan app obeys relevant regulations and laws. Look for apps licensed and regulated by relevant authorities. Avoid apps operating outside of regulatory frameworks.

A good loan application would have excellent customer support. Find those that offer multiple avenues for support, such as by phone, email, and even live chat. Avoid applications that leave you in suspense or that do not give useful support.

From these considerations, you will confidently pick the best trusted loan application that fits your needs and guarantees a secure, transparent way of borrowing.

Related – Loan Apps that Give ₦50,000 Instantly in Nigeria

Now that we know what a trusted loan app looks like, let’s take a peek at the top 5 most trusted loan apps to look out for in 2026.

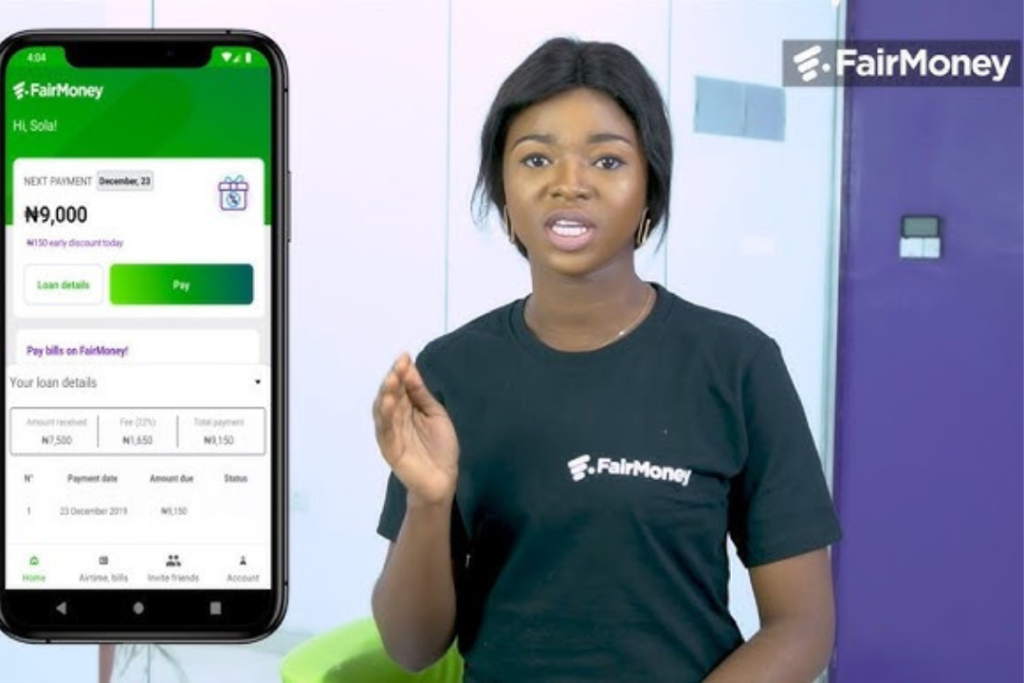

FairMoney is a digital bank and one of the well-performing lending platforms in the fintech space in Nigeria, offering a host of financial products that cut across personal and business loans to savings and investment services.

Having disbursed over 10,000 loans every day and with over 5 million users enjoying banking, savings, and investment services, FairMoney is helping the average Nigerian take control of his life and-most importantly-his finances.

Fairmoney also charges a fee on loan extension and default of loans. The customer should ensure they understand the true cost of credit.

Applying for a FairMoney loan is very easy. Here’s how:

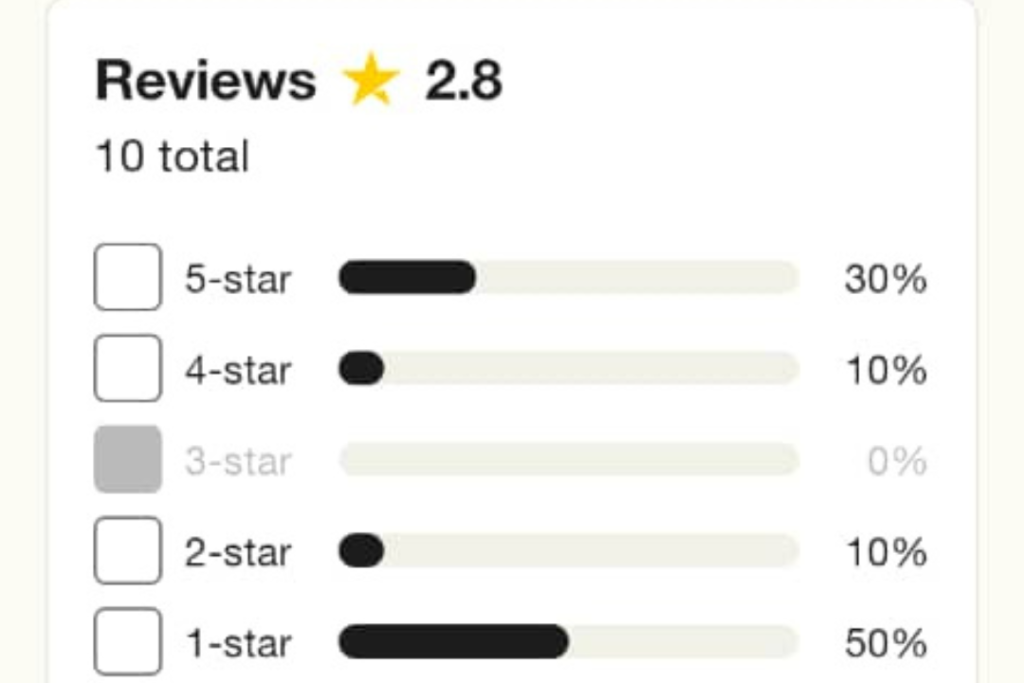

The average rating for Fairmoney on Trustpilot is 2.8/10. Positive reviews are mostly about how good Fairmoney’s savings and investment products are, while negative reviews refer to poor customer service and issues in transactions.

Fairmoney being a digital bank should maintain high standards of data security. The handling of personal information, especially sensitive financial data, is one aspect that Fairmoney must manage with utmost care.

Also Read – FairMoney USSD Code For Loan And Transfer in Nigeria with FAQs

CashX is a popular online lending platform that provides individuals with instant loans and it is widely known across Nigeria.

Through CashX you are able to borrow anywhere between ₦5,000 And ₦300,000, which sure is a sum that is enticing whenever you’re in a tight situation.

You need to be 18 years or older, to qualify for CashX Login, you must also have a mobile number and a bank verification number. You will be required to submit the proof of your identification and valid income as well.

CashX loan has mixed reviews wherein users have appreciated fast and straightforward application procedures, whereas the rest have been cribbing about the high rates of interest and the harassing mechanism of debt recovery.

CashX uses world-class data security and encryption techniques to protect the data you share with us. This app does not share your information with third parties unless it is for a dedicated business purpose, such as reporting defaulted loans to authorized credit bureaus.

Read Also – Loan Apps in Nigeria that Give Loans Without Credit Check

Palm Credit is a loan purposes application that gives money to its customers.

If you want a loan just in minutes with no insecurity, met by putting up some security items as a guarantee, then Palmcredit is the way to go.

The biggest advantage of Palmcredit is the extremely low interest rates that are attached to all its borrowings.

You simply have to download the Palmcredit app on your device via the Google Play store to get the loan.

It is in this regard that the company has an app for smartphone users such that it is an absolute delight for them to get emergency cash and short-term loans.

To apply for a Palm Credit loan, you should have certain documents and fulfill the requirements:

PalmCredit loan reviews are mixed, with some customers praising the platform’s quick loan processing and flexible repayment terms, while others have expressed frustration with poor customer service, technical issues, and high interest rates.

Overall, while PalmCredit has its pros, it’s vital to pay great attention to the terms and conditions laid down by the platform before seeking their services.

PalmCredit is concerned about your security and privacy. Advanced encryption, secure servers, and data protection by the laws of Nigeria are followed. Your data will only be disclosed with third-party consent. PalmCredit is committed to keeping your information safe.

Also Read – Best Loan Apps with Low Interest Rate in Nigeria

Presently, Carbon is among the top-rated digital banks in Nigeria, with numerous loan products, savings accounts, investments, and other financial services.

Being one of the prominent digital financial organizations, Carbon builds niches within the fintech area and facilitates easier financial service solutions on their mobile application.

On Pissed Consumer, Carbon’s reviews give insight into customer experiences. Though there are not many in-depth reviews, the feedback is indicative of a mixed response to Carbon’s services.

Being a digital bank, Carbon is very keen on the security and privacy of user data. However, it should be clearly stated how user data is used for credit scoring and other purposes.

Read Also – Where to Get Urgent Cash Loan Without Documents in Nigeria

Branch Loan is the pioneering loan platform through which you get an instant online loan in Nigeria. This organization deploys data science in increasing access to financial services for millions of Nigerians.

The online platform offers instant loans that aid people in realizing their business and personal needs. This company operates in Nigeria, Kenya, Mexico, India, and Tanzania.

There are no origination or monthly fees, but there is conflicting information regarding late fees, with some indications of a 6% charge on outstanding loan repayments for some loans.

Branch has an average Trustpilot rating of 3.7 out of 5. The reviews are limited, but the available feedback suggests that users find the service fast and reliable.

As a digital bank, Branch must prioritize the security and privacy of its users’ data. The approach to credit scoring, which involves analyzing phone data, raises questions about privacy that need to be addressed transparently

Also Read – How to Apply For a Temporary Loan at Standard Bank in South Africa

When searching for the best loan apps, it is vital to find trusted loan apps that fit your needs. Since there are a lot of choices, it may be quite challenging to identify the top trusted loan apps.

However, there are some crucial things to consider before using these apps.

Read through reviews and understand the terms and conditions before downloading any loan app. Beware of those apps that promise unusually high loan amounts or extremely low interest rates; these might be scams, and you could end up losing your money or compromising your data.

Check the interest rate and fees that are imposed on the loan before applying. This, amongst them, the best loan apps, including Branch, Carbon, and FairMoney, are very clear with their fees and rates.

When using loan apps, you will need to provide personal and financial information. You should ensure that the app you use has strong data protection measures. Check for encryption and a data protection policy.

Be wary of those loan applications that do not offer you flexible terms for repayment. The best trusted loan applications have flexible options for repayment that suit your needs. Understand the terms of repayment before taking a loan.

If you know all these factors, you can safely and responsibly use loan applications. If you have proper knowledge, then you can get top-trusted loan applications that can meet your needs.

The application of loan on the apps are really very easy. Download the application, fill in the details on the registration form, and attach your ID card and bank statement to complete it.

After submission, the application is then approved or rejected by the application, and, upon approval, it disburses the amount.

Yes, loan applications do consider data protection by encrypting information, personal and financial, and by following data protection regulations.

You will face some penalties if you fail to repay your loan: probably late fees, an increase in interest rates. Your credit score may be affected negatively. It will be great if you can explain this to the customer support service of the app in case you are unable to repay your loan.

Looking at the best loan apps in 2026, here are some of the most trusted ones: FairMoney, CashX, PalmCredit, Carbon, and Branch.

They initiate this with their easy-to-use interface, flexible payment schedule, and with their security for data protection.

Research, find the perfect online loaning application that will suit you, and cut out most of the hustle associated with getting the money you so need. Only ensure you are always borrowing responsibly and paying on time.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.