Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In today’s fast world, one needs financial flexibility, mostly where last-minute expenses come in. If you happen to be in Nigeria and want a quick way to raise some cash, you will benefit from knowing how to borrow money from Opay.

Opay is among the highly downloaded mobile payment platforms designed to give users fast loan services right inside the app, ensuring access to funds whenever needed.

How to borrow money from Opay App is quite an easy process, even for those not tech-savvy. Be it sudden emergencies, payment of any bills, or extra money to get by, Opay gives a seamless borrowing experience.

In this article, we will guide you through how you can borrow money from Opay in Nigeria so that you are clear on everything.

By the end of this guide, you will have all the knowledge about the successful application for an Opay loan and how to get funds quickly.

So, let’s dive in to see how Opay can help you do this and make it easier on your wallet when managing financial needs with the best of ease.

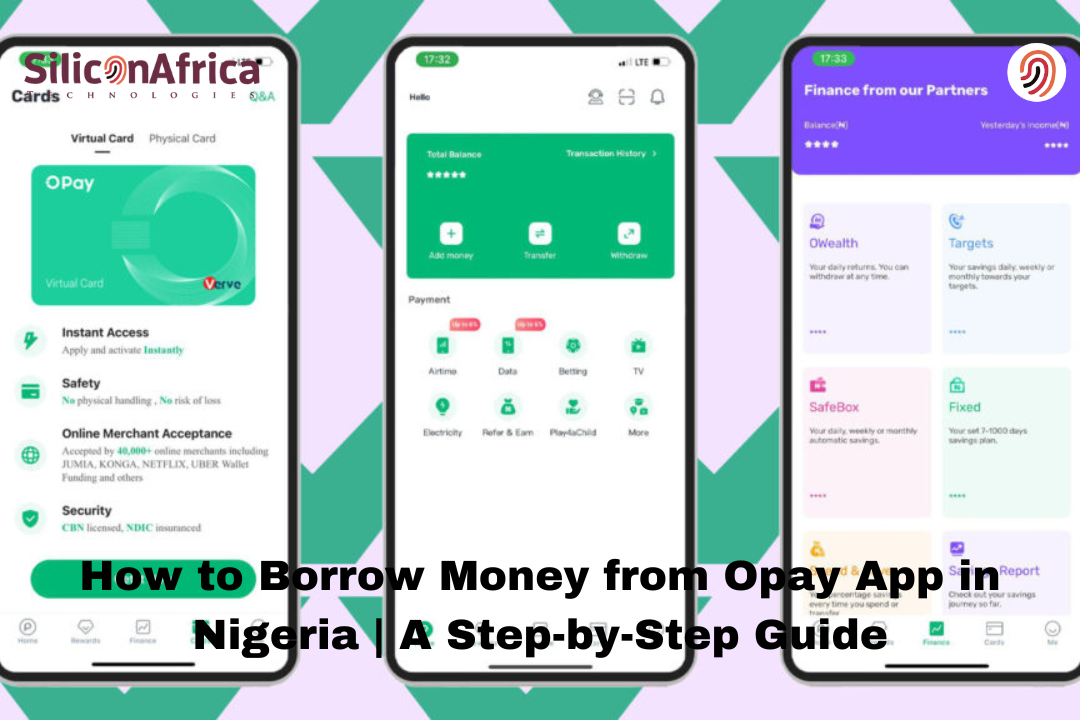

OPay is a wallet app through which one can send and receive money, buy airtime and data, pay bills, earn interest on one’s savings, borrow loans, and many more.

Their vision is to make financial services much more accessible and affordable for Nigerians and other Africans.

Among consumers of digital banks and microfinance banks, Opay is already well-known.

They are one of the go-to places for sending and receiving money, buying airtime and data, paying bills, saving or securing funds, and getting loans. Added to that are discounts, cashback, rewards, and coupons.

Opay functions by offering you a digital wallet on your mobile device. It gives you the ability to store money and make transactions of several kinds.

You can fund your wallet by linking your bank card or bank account. Also, you can fund it from the USSD code. Other OPay users or even agents may support you.

When you fund your wallet, you can start sending money to and receiving from any bank account for free, and make bill payments, utilities, purchase airtime or data and borrow money from Opay.

Read Also – How to Open an Opay Account in Less Time – Full Guide

The Opay app has speedy loans not collateralized, all internal to the app. You can obtain a loan from Opay through an account opening on their platform and then apply for a loan on the app.

You could borrow as much as N1 million from Opay at an affordable interest rate, depending on the loans obtained.

Opay helps users connect with top loan companies in Nigeria, making it easier to access low-interest loans without worrying about collateral.

It does not matter which specific loan partner changes; the process of how to borrow from Opay remains straightforward.

Before you can borrow money from Opay, the following criteria must be met:

Fulfil the eligibility, and you can be sure that the chances of approval for a loan on OPay will rise.

Sit note: If you don’t meet the eligibility criteria for OPay, there may be additional requirements or further assessment of your eligibility.

Also Read – OPay Warns Customers About Fraud and Starts Checking Physical Addresses

You need to have an account to be able to lend from Opay. Setting up an Opay account will not require much time; it is easy. How to set it up is as follows:

Please note that there may be more requirements from OPay or their evaluations to prove your eligibility for a loan.

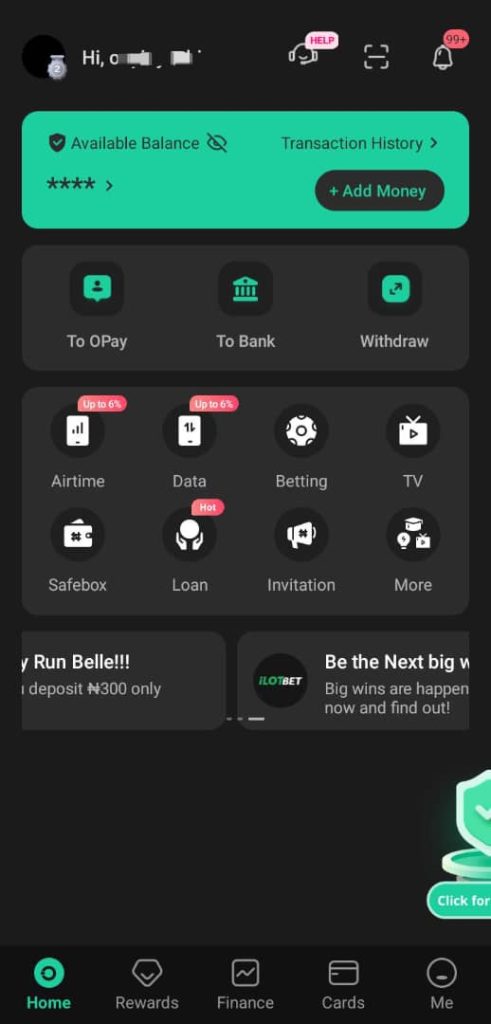

You can borrow money from the Opay app with ease once you follow these steps:

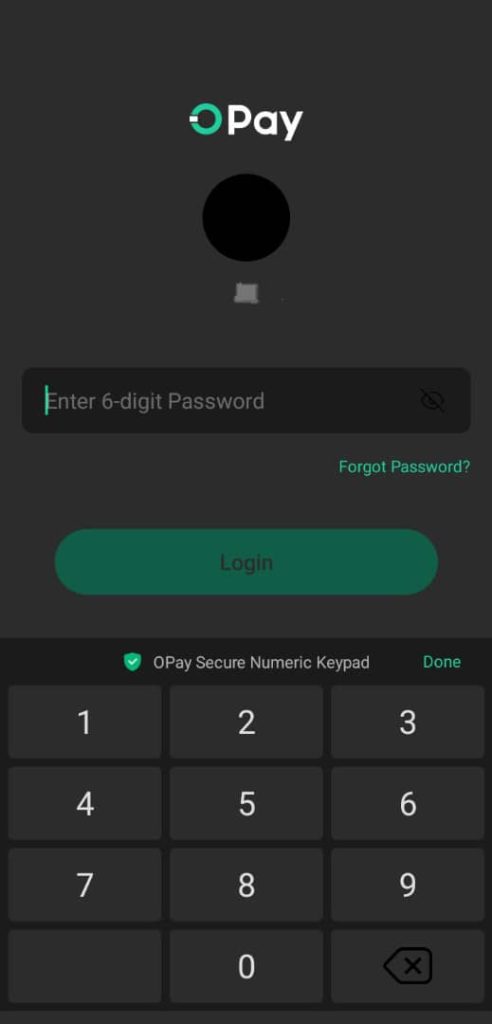

You must log in to your Opay account with your phone number and pin.

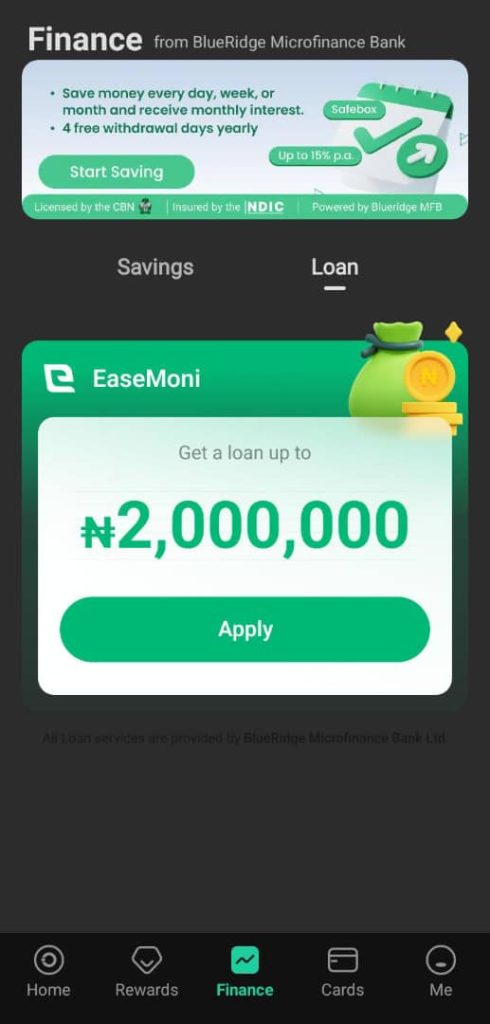

Click at the bottom of your homepage to see the “Finance” tab. Tap on “Loan”.

Opay has built several lenders to their service, hence you can choose from the three of them. In this case, either Okash or Easemoni, or whichever is available, download the app.

Fill up the personal information correctly according to what is stated to be required by the chosen lender. The kind of information commonly required will be your name, phone number, and address, among other personal details.

Decide upon the amount you wish to borrow. You can also get a pre-approved loan amount under your profile.

Before submitting the form, please carefully read the loan’s terms and conditions.

The lender then processes your application. You will be informed whether your loan request has been approved or rejected within the period.

In case of approval, the loan money shall be paid directly into your Opay wallet.

By these, one can securely and effectively borrow money from the Opay app and handle all their financial needs.

Read Also – How To Login On Opay With Email, Phone Number, Password

Sometimes, Opay may provide a USSD code to make things easier; however, such a feature is rarely offered in loan applications. If they do have such a feature provided, do the following;

Interest rates remain competitive in OPay Loans, and the repayment terms are flexible, making them very convenient while one borrows or repays the principal amount with interest.

Depending on the size and length of the loan, the interest could range from 5% to 15% of the principal. Repayment would range from some weeks to months. Always scrutinize the agreement that lays down the specific terms of a loan.

With OPay, you can get flexible borrowing that best suits your needs and budget. Make sure to always go through the loan agreement and understand the terms before putting a check on it.

The next thought process that would come to your mind after your loan is approved will be how to repay the loan on the due date. Different repayment options include:

If you have an available Opay balance, you might use it to repay your loan just by clicking the ‘repay’ button on the loan details page. Do this by following these steps:

This is the most convenient option: you do not have to log in to your Opay account to repay your loan.

All you do is link your bank account or debit card to your Opay account and authorize Opay to deduct the loan money from your account on the due date. To set up ADD, take these steps:

Late repayment on the due date may attract an extra charge, thus affecting your credit score.

Also Read – How to Delete Transaction History on Opay Easily

If you are getting continuous critical errors while wanting to borrow from Opay for any reason, here is what to do:

Be patient and calm when there are some issues; feel free to contact OPay for any assistance related to the issue.

Borrowing money from the Opay app in Nigeria can be very easy and convenient. Anyone can have the ability to be able to borrow an Opay loan with much ease whenever they need it, using this guide to point them in that order.

This makes the overall borrowing process seamless; the application’s user interface is friendly. Be it to get that fast cash to sort out an emergency or look for more in your pocket for those personal projects, then Opay has got your back. Just be qualified and follow the steps religiously.

We hope this guide helps on how to borrow money from Opay. If you have any questions or anything to share, please comment below. Don’t forget to follow us on social media for more useful tips and updates:

Facebook: Silicon Africa

Instagram: @siliconafricatech

Twitter: @siliconafritech

You can borrow money from Opay via the Opay app or simply dial the USSD code. You only need a registered Opay account, a valid BVN, and a valid ID card.

Yes, Opay offers loans to its users who meet the eligibility requirements. You can borrow up to N50,000 without collateral, no paperwork, and no guarantor.

You can’t borrow money from Opay if you don’t have a BVN. BVN is one of the requirements for Opay’s loan. It helps to verify your identity and prevent fraud.

The USSD code to borrow money from Opay is *955#. You can dial this code on your phone and follow the prompts to apply for a loan.

Up to N50,000 can be borrowed from Opay. The amount you can borrow depends on your credit score, deriving from the repayment history, transaction volume, and other factors.