Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Let’s face it: traditional loan programs may be lengthy and complex. Banks frequently require extensive office work and a waiting period that can feel like an eternity, especially if you need the money right away.

The Zedvance loan code provides a refreshing opportunity. Depending on your eligibility, you might be able to access a loan in a matter of minutes by entering a simple USSD code (Unstructured Supplementary Service Data) into your mobile phone. This new method makes Zedvance a suitable choice for those situations where a quick economic rise

Nigerians frequently rely on short-term loans to overcome economic gaps. If you’re looking for a quick, easy, and dependable way to borrow money, the Zedvance loan code could be your knight in shining armor.

This article delves deeply into the topic of Zedvance loans in Nigeria. We’ll explain what the Zedvance loan code in Nigeria is, how to use it to your advantage, and why you should choose Zedvance for your short-term loan requirements.

So, whether you’re new to the concept of code-based loans or you’ve heard the term Zedvance spoken around, this guide will provide you with all of the information you need to make an informed decision. Read on!

Zedvance Finance is an online lending platform in Nigeria that provides buyers with convenient and environmentally friendly loan options. As a subsidiary of the Zedcrest Group, a brand new-era economic solutions company.

Zedvance is dedicated to conducting business with honesty and following ethical commercial enterprise principles.

One of the company’s primary goals is to promote financial inclusion in Nigeria by providing access to credit to both salaried and unemployed individuals.

Zedvance Finance has established itself as an industry leader by following best practices and maintaining its commitment to openness and customer satisfaction.

Related – Haraka Loan USSD Code in Kenya

Zedvance serves as a link between borrowers and lenders, providing a streamlined method for obtaining short and clean loans in Nigeria. Their loan portfolio serves a wide range of needs, from short-term payday loans for unexpected expenses to income-based, honest loans for large sums with longer repayment terms.

They have upcoming offerings focused on small and medium-sized businesses. Here’s a breakdown of how Zedvance works:

Overall, Zedvance appears to be an accessible option if you require a short-term loan. However, keep in mind that these kinds of loans might often have high interest rates. It is best to carefully review the terms and conditions before applying for any loan.

The exact loan requirements for Zedvance will be determined by the type of loan you apply for. However, here is a breakdown of the general criteria you’ll most likely encounter:

While Zedvance states that credit checks are not always required, your application may still be refused due to factors such as a low credit score or late payments on past loans.

Read Also – Best Free USSD Loan Codes in Kenya

To get the Zedvance Loan app, follow the steps below:

Note: The Zedvance Loan app is now unavailable on the Google Play Store. As a result, customers will need to apply for a loan online.

To apply for a loan on the Zedvance platform, there are steps to follow:

Also Read – LAPO USSD Code: How to Activate and Use it

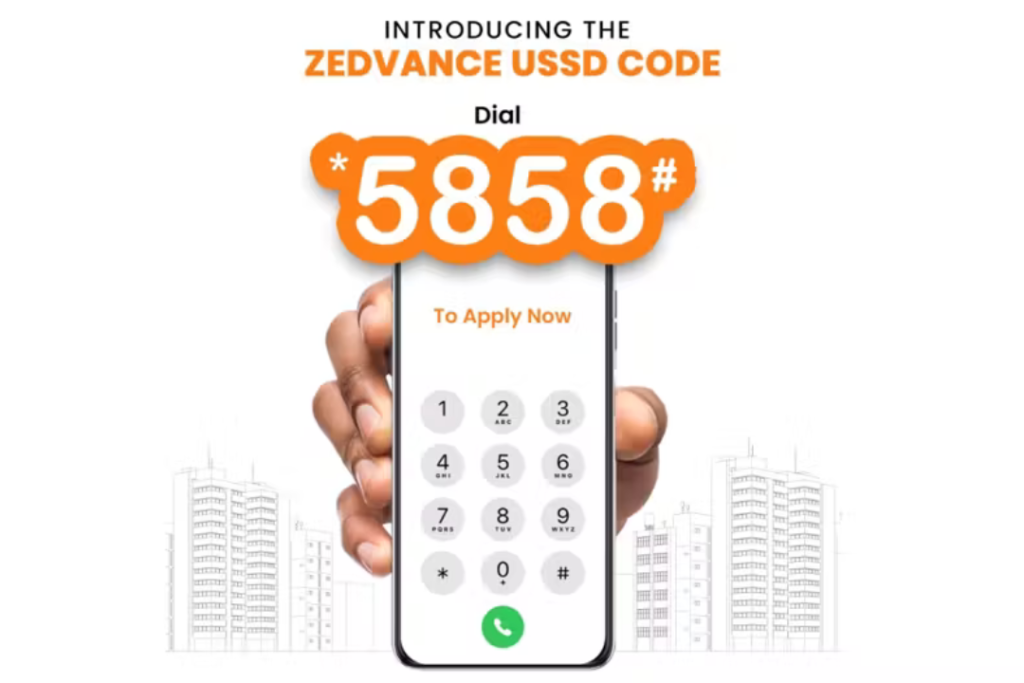

You can apply for a Zedvance loan by using the USSD number *5858# on your mobile phone. Here’s a quick guide for those who are concerned about the steps:

1. Dail *5858# from your phone. Check that the smartphone range you’re using is included in your Bank Verification Number (BVN).

2. When the menu appears, select the option to use for a loan (this may be a personal preference).

3. Select your preferred loan amount and payment term.

4. Instead of clicking “Accept,” carefully read and comprehend the loan terms and conditions.

5. Confirm the economic institution account where you want the loan to be allocated.

That is it! Zedvance takes pride in its quick turnaround time, so you should plan accordingly based on your utility speed.

Here are some other variables to keep in mind:

Some benefits of Zedvance loan include:

One disadvantage of the Zedvance loan is that its operations are now limited to Lagos, Nigeria. This means that persons residing outside of Lagos would no longer be able to utilize the lending options available through the platform.

Zedvance’s mortgage application method involves a significant amount of paperwork. Applicants may also find the system intimidating and annoying.

If you’re self-employed or a freelancer, proving proof of work may be difficult, as Zedvance requires extensive documentation.

Read Also – Shika USSD Code and Loan Application

Zedvance provides loan applications starting from ₦2,500 to N100,000, based on your credit score history. If you work in the public sector of the country, you may be eligible for a loan of ₦3,000,000.

Borrowers with a high credit score can borrow more money. If you pay off your loan on or before its due date, your loan limit will increase.

The interest rate varies according to the loan amount. Zedvance additionally charges a 3.5% interest fee and sends loan defaulters to the credit bureau.

The repayment period is flexible for debtors, ranging from 15 to 90 days for cheaper loan programs and up to 12 months for larger loan applications.

Lending systems will ban defaulters from receiving comparable loans, and even if they repay, obtaining the popularity of a loan may be difficult in the future.

Repaying a loan from Zedvance is a dependable method that provides excellent rate options. You can repay with cheques or direct debit mandates. If you prefer not to use cheques, you can pay directly into their account right away.

If you wish to return the loan through a financial institution transfer, you must contact them and seek his or her account information. As a reminder, contact them at least 72 hours before the deadline for your loan.

It is vital to note that portion bills are not permitted, and the charge length is agreed upon before the loan is allocated. If you need to trade the charge date, it is possible but may incur additional expenses, therefore you should contact Zedvance.

In the event of default, a 1% penalty on the installment amount is imposed for each day of default. If the default exceeds 30 days, more rigorous procedures can be implemented, and your default reputation can be reported to credit bureaus. As a result, repaying your loan on time can help you avoid unwanted consequences.

Also Read – Sterling Bank USSD Code for Transfer and Loans

There are several ways you can contact Zedvance about a loan:

Zedvance Loan Code in Nigeria provides a simple answer for those in need of quick cash assistance. By dialing the Zedvance loan code, you can quickly discover price ranges to fulfill your pressing needs.

This service bridges the gap between financial emergencies and timely responses. Remember to make prudent financial decisions based on your ability to pay them off.

Your feedback is greatly appreciated, so please leave a comment below. Stay up to speed with more valuable information by following us on our social media platforms: Facebook @Silicon Africa, Instagram @Siliconafricatech, and Twitter @siliconafritech.

If you meet the conditions, your loan application can be approved in minutes.

Your loan application with Zedvance cannot be confirmed until you provide your bank verification number (BVN) and the phone number associated with it.

If the records provided are incorrect or the relevant files are not submitted, your application will not be accepted.

Yes, dial the Zedvance USSD code *5858# and witness the technology in action.

Yes, you can contact them over WhatsApp to apply for a rapid loan.