Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Financial surprises can occur at any time, leaving you scurrying for answers. In such cases, a Link loan may be a good solution. They offer quick and easy access to cash via their user-friendly mobile app, providing an alternative to traditional loan processes.

This document can help you navigate the Link Loan application and get approved. We will break down the entire process, from downloading the Link loan app to understanding the Link loan requirements.

Whether you need to pay an emergency auto repair or a pressing bill, this step-by-step guide will show you how to secure a Link Loan successfully.

By the end of this article, you’ll be well-prepared to manage the Link Loan application procedure, increasing your chances of receiving the necessary financial assistance. Let’s get started!

Link Loan is Nigeria’s leading loan app agency, providing a reliable and secure way to obtain rapid loans. This loan app is intended to give users a simple process for obtaining financial assistance.

With affordable interest rates and a commitment to excellent customer service, Link Loan has established itself as a trusted partner for people who require quick access to funds. Here’s how it works.

1. Download the Link Loan app, which is now available for Android smartphones.

2. Fill in the application form. This shouldn’t take more than a few minutes.

3. Link will check your information to determine your eligibility and loan restrictions. You will be promptly told of their preference.

4. If approved, you may select your desired loan amount up to your credit score maximum. This flexibility enables you to borrow exactly what you want.

5. Once authorized, Link will deposit the funds directly into your financial group account within five minutes, making it an ideal source of short-term funds for unexpected expenses.

6. Repay the loan within the specified time limit. Link emphasizes a user-friendly experience; therefore, reimbursement can also be completed through the app.

By consistently paying your payments on time, you maintain a positive reputation with Link and establish a track record. This permits you to apply for another loan whenever you need it, as long as your credit score is within your limit.

This eliminates the need to go through a complicated software process every time you seek a loan. Overall, Link Loan provides a brief, convenient, and undeniably reusable method for dealing with your budget in Nigeria.

Read Also – Wonga Loan and How to Apply

Link loan requirements typically include:

Here’s a more complete rationalization for downloading and installing the Link App, collectively with some warnings to bear in mind before borrowing:

Also Read: Boodle Loans: how to Apply

Link is a phone app-based carrier that provides quick and easy access to small loans. Here’s how you apply:

It is essential to be a savvy borrower. Here are some important factors to consider when applying for a Link Loan or any other type of loan:

By following these steps and taking these variables into account, you can increase your chances of being approved for a Link Loan that matches your financial needs.

Link boasts that their loans have cheap interest rates; however, the exact price depends on your creditworthiness. They indicate that the monthly interest and provider pricing range is between 1% and 3%, with an Annual Percentage Rate (APR) ranging from 12% to 36%.

Here are some crucial factors of Link Loans:

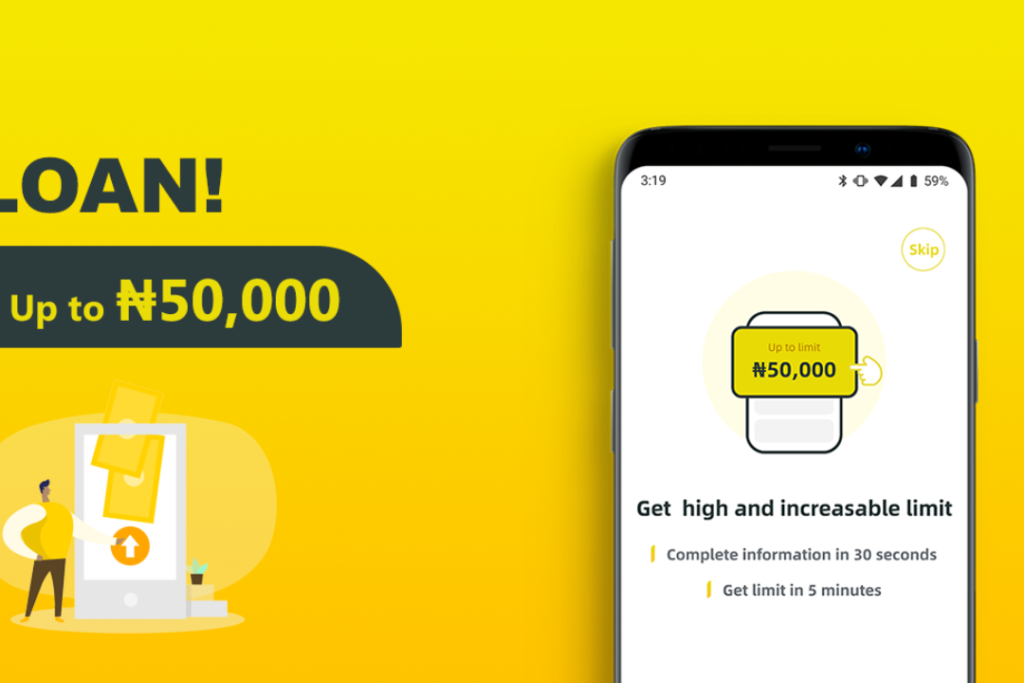

Links provides loans ranging from ₦2,000 to ₦50,000 Nigerian Naira.

You can select a payback term of three to six months (91 to 180 days). This provides some freedom in structuring your payments to fit your budget.

Link advertises its loans as having a cheap interest rate, but the actual fee is based on your creditworthiness as determined by its internal algorithm.

They show a 1% to 3% monthly interest charge, resulting in an Annual Percentage Rate (APR) of 12% to 36%.

Keep in mind that this is only an estimate, and your actual rate may be outside of this range.

Be sure to include any additional carrier fees noted at any time during the application process to get a complete picture of the loan costs.

Before finalizing a Link loan, thoroughly review the loan settlement. This file contains information about the actual interest rate you may be charged, the repayment schedule, and any relevant fees.

By carefully considering those factors, you may ensure that the loan is affordable and corresponds with your economic goals.

Read Also: Capfin Loan Application: how to Access Capfin Loan

Link provides automatic deductions on your due date, making reimbursement more convenient. This uses the bank card that you provided during your initial loan application. However, if you prefer greater freedom or encounter problems with automated bills, there are other choices available.

To explore alternative compensation techniques or for the most up-to-date statistics, consider these two options:

Link advertises a surprisingly rapid loan approval device, claiming that the entire loan application and approval can be completed in as little as 5 minutes. This total performance is appealing, particularly to those who are in desperate need of financial assistance.

It is important to note, however, that a variety of circumstances may influence how quickly your loan is paid off. In some cases, additional verification or a thorough review of your program may be required, resulting in a slight delay in receiving a choice.

Here’s a breakdown of what should have an impact on approval time:

Even though Link aims for a 5-minute approval window, it is generally prudent to factor in capacity exceptions.

Also Read: Finchoice Loan Application Online: how to Apply

What are the Link Loan App Benefits?

Here is a more detailed breakdown of the potential benefits and drawbacks of using the Link Loan App:

By carefully comparing the advantages and disadvantages, you can determine whether the Link Loan App is the best option for your specific situation. Remember that there are typically other solutions to economic desires.

Obtaining a Link Loan is a legitimate approach. Start by downloading the Link Loan app and filling out the utility form with proper information. Make sure you meet the Link mortgage requirements, which include a consistent income and a high credit score score.

Once you’ve published your application, wait for approval, which usually doesn’t take long. Remember to provide any additional files if requested. Following approval, the loan amount may be put into your account, ready to be used.

Feel free to leave a comment below and follow us on social media for more updates: Facebook at Silicon Africa, Instagram at Siliconafricatech, and Twitter at @siliconafritech.

Link objectives in a rapid, paperless manner. Typically, you will want to use your smartphone’s range and bank account information. They may also want access to your smartphone information to analyze your creditworthiness.

Link has a brief approval process. They put it up for sale approval within 5 minutes of receiving your application.

The loan amount will be determined by your creditworthiness and Link’s assessment. They do, however, provide a revolving credit score line, which means you may be able to reapply for a loan if you repay on time and have an available credit score.

The entire borrowing and repayment process is handled by the Link app. You must be able to access your repayment options and due dates within the app.