Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

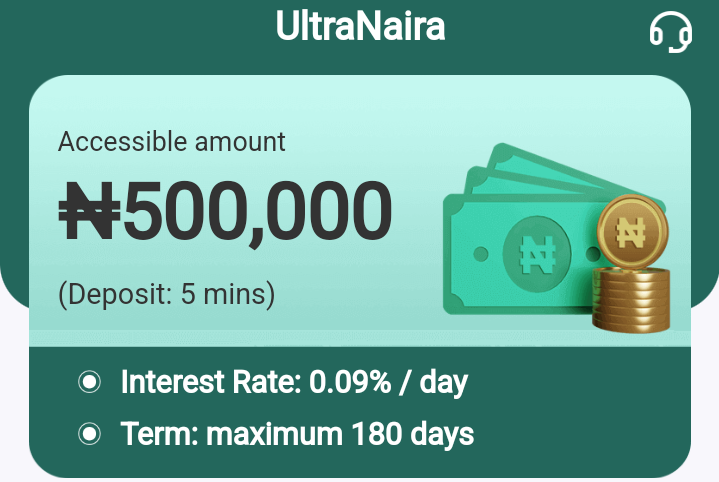

Nigerians can apply for easy online cash loans 24/7 with the Ultra Naira loan app. Since the loans are unsecured, little to no documentation is required, and security is not required.

With just your BVN number, you can apply for this loan online straight from your Android phone. However, as online loans have extremely high interest rates and should only be used in emergency situations, avoid using them to finance your lifestyle.

Although it is still relatively new, this loan application has accumulated over 10,000 downloads on Google Play and been met with mixed reviews. In order to generate credit scores for each borrower, it uses loan software to collect information about potential clients, such as phone logs, banking transaction alerts, and BVN.

A recent addition to the loan apps in Nigeria is the ultra Naira loan platform. Because of their quick loan distribution, simplicity of application, and—most importantly—low interest rate, naira loans have grown in favour with citizenry.

The app has been downloaded over 10,000 times while receiving mediocre reviews. It employs a lending program to acquire information about potential clients, including phone records, banking transaction alerts and BVN in order to compute the credit score for each borrower.

If you maintain your bank transaction messages and have no outstanding debts from other lending apps, you will be eligible for larger sums.

The definition of an ultra naira loan, the features that set this lending platform apart, and the application process will all be covered in this article. Some of the most common questions you could have will be addressed as we wrap up this post. Remain tuned and attentive.

see also – 70 Million Accounts in Danger of Being Blocked by Banks Because of NIN Linkage

The N30 that was charged to link your ATM card to your account will be refunded to your bank account after 7 to 12 business days.

Your application will probably be denied if you owe money to other creditors or have a history of making late payments because your BVN is linked to your credit score.

It is legitimate to use the Ultra Naira Loan App. The software is still relatively new in the Play Store, though. It does provide loans to consumers, however before submitting an online loan application, exercise caution. Make sure you check customer reviews before applying for a loan in Nigeria.

Neither the CBN nor any other Nigerian government agency has these loan applications on file. You cannot hold them accountable for poor customer service because they are in charge of your transactions.

The fact that it is available on the Google Play store does not ensure the security of any transactions performed there. When utilizing loan apps in Nigeria via the Play Store, you are in charge of your own security.

see also – All you Need to Know About the Gemini App in 2024

Rates and fees for loans

Loan amounts: N 5,000 to n 50,000

Service / Interest Fee: 2% – 35%

Maximum Annual Percentage Rate (APR), 66.21% – 2740.44%

Late fee: One-time fee of 8.8% of the outstanding amount

Minimum repayment period: 61 days

Maximum repayment period: 180 days

Here’s an example of interest calculation for a loan:

Principal: 100,000.00

Lender Interest: (APR: 30%)

Tenor: 4 Months

Annual Interest (: 100000 * 0.3) :30,000 Naira

Total Interest for 4 Months: 100000 *0.3 *4/12:10,000 Naira

Monthly Interest: 2,500 Naira

Monthly Repayment (principal and interest): 27,500 Naira

Total Repayment :110,000 Naira

As an example, the interest rate and tenure are lower if you borrow for the first time. By keeping good records and repaying the loan on time, you can increase your amount.

see also – Samsung Galaxy S24 Ultra Price in Nigeria, Kenya, and South Africa

There is a 2% daily penalty for loan repayments that are late. As a result, it’s critical to respect the deadline. If you pay back the loan on schedule, you’ll be able to apply for larger loans. Late repayments won’t get you qualified for larger loans or any other loan products.

If you fail to make your payments on time, First Central Credit Bureau will receive a report about you. You can be placed on a blacklist by the First Central Credit Bureau, which would make it more difficult for you to get loans from other lenders.

see also – How to Check JAMB Result with your Registration Number

The following are some insightful pointers to increase your chances of having your Ultra Naira loan application approved:

Document Preparation: Before beginning the application, make sure you have all necessary paperwork, such as your identification card and BVN, available.

Precise information: Complete the loan application form with precision and thoroughness. Your application may be delayed or hampered by any inconsistencies.

Examine the terms and conditions. Examine the terms and conditions of the loan carefully to prevent any surprises later. Recognise the interest rates, terms of repayment, and any additional costs.

Affordability: Only submit an application for a loan amount that you know you can pay back in full within the allotted term. Stress related to money might result from overextending oneself.

Please be aware that since Ultra Naira loan app, not much is known about its dependability or customer support.

It is imperative that you carry out extensive study and due diligence prior to submitting your loan application.

see also – Naira’s Unending Fall: Nigerian Authorities Ban Access to Crypto Exchanges

The Google Play store users who wrote these reviews.

The worst loan application I’ve ever seen, according to obomate Odimabo: “I borrowed 3200 to pay 4100 yet I was credited 2870 to pay 4387; I don’t know how or why it happened that way. When they called me on the phone, they sounded quite unpleasant. I used the loan app to make my payment before it was due, however the transaction failed even though my account was debited. To threaten me, they resorted to WhatsApp.

As far as I’m concerned, it’s the worst loan app, wrote Jennifer Marcus. I’ve used you before, and you offered me a loan option that I didn’t choose. After I filled out the required form, I received notice that I would be receiving $20,000 to repay $20,000, but instead I got a notice for $14,000. 1 star is what this app deserves.

“This is clearly a fraudulent loan application,” Idris Asimi remarked in a message. Before downloading the app, I read the user reviews, but I had no idea they would continue to defraud me. On your home page, you stated that you charge 1% per day and that for my initial request, you will lend me $2100 for 7 days. For a week, interest on #2100 will be $147. I then applied for a loan. You sent #1470 in place of #2100 and demanded that I pay back #2270, which was not stated on your application when I applied.

The advantages of a ultra Naira loan include the following;

Despite being a fantastic app, the following are the cons of Naira loan;

Ultra Naira Loan App is a mobile application that provides quick and convenient access to loans for individuals in Nigeria.

You can download the Ultra Naira Loan App from the Google Play Store for Android devices. Simply search for “Ultra Naira Loan” and follow the installation instructions.

First, download and install the app. Then, create an account and complete the loan application form by providing necessary personal and financial information. Finally, submit the application for review.

Yes, you must be at least 18 years old to apply for a loan through the Ultra Naira Loan App.

Typically, you’ll need to provide proof of identity (such as a valid ID card), proof of income (such as bank statements or payslips), and sometimes proof of address.

The loan approval decision is usually provided within a short time after submitting your application.

The loan amount you’re eligible for depends on factors like your income, credit history, and repayment capacity. Ultra Naira evaluates these factors to determine the maximum loan amount you qualify for.

Yes, Ultra Naira considers various factors when reviewing loan applications, not just credit scores. Even if you have a low credit score, you may still be eligible for a loan based on other criteria.

You can not be wrong with a ultra Naira loan. It is one of the relatively easy and fast loan disbursement apps in Nigeria.

Everything you need to know about this loan has been explained above. Yes, the ultra Naira loan app is worth the try!

You can check out other useful content by following us on X/Twitter: @siliconafritech.

Instagram: @SiliconAfricaTech.

Facebook: @SiliconAfrica