Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

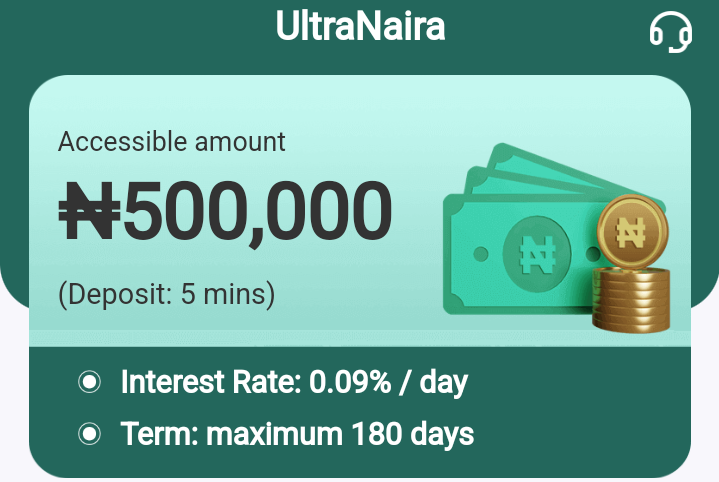

Ultra Naira is one of the latest loan apps in Nigeria, offering Nigerians quick and easy access to cash loans online; anytime, anywhere. The platform is designed to provide unsecured loans, meaning you don’t need collateral or lengthy paperwork to apply. All you need is your BVN and an Android phone to get started.

Since its launch, the app has been downloaded over 10,000 times on Google Play. However, user reviews have been mixed, reflecting both the benefits and concerns that come with online lending.

To determine your loan eligibility and credit score, Ultra Naira collects certain data from your phone, including banking transaction alerts, phone logs, and your BVN.

In this article, we’ll explain what the Ultra Naira loan app is all about, highlight its key features, and guide you through the loan application process. We’ll also answer some of the most common questions you may have.

See also – 70 Million Accounts in Danger of Being Blocked by Banks Because of NIN Linkage

Follow the following steps to download the Ultra Naira loan app to apply for the loan:

The N30 that was charged to link your ATM card to your account will be refunded to your bank account after 7 to 12 business days.

Your application will probably be denied if you owe money to other creditors or have a history of making late payments because your BVN is linked to your credit score.

See also: Full List of Blacklisted Loan Apps in Nigeria

It is legitimate to use the Ultra Naira Loan App. The software is still relatively new in the Play Store, though.

It does provide loans to consumers, however before submitting an online loan application, exercise caution. Make sure you check customer reviews before applying for a loan in Nigeria.

Neither the CBN nor any other Nigerian government agency has these loan applications on file. You cannot hold them accountable for poor customer service because they are in charge of your transactions.

The fact that it is available on the Google Play store does not ensure the security of any transactions performed there. When utilizing loan apps in Nigeria via the Play Store, you are in charge of your own security.

See also: 21 Loan Apps That Will Give 500k Loan to First Timers in Nigeria

Here’s an example of interest calculation for a loan:

As an example, the interest rate and tenure are lower if you borrow for the first time. By keeping good records and repaying the loan on time, you can increase your amount.

See also: Best Loan Apps with Low Interest Rate in Nigeria

The following are the requirements you have to meet to qualify for the Ultra Naira loan:

There is a 2% daily penalty for loan repayments that are late. As a result, it’s critical to respect the deadline. If you pay back the loan on schedule, you’ll be able to apply for larger loans. Late repayments won’t get you qualified for larger loans or any other loan products.

If you fail to make your payments on time, First Central Credit Bureau will receive a report about you. You can be placed on a blacklist by the First Central Credit Bureau, which would make it more difficult for you to get loans from other lenders.

See also: Loan Apps that Give ₦50,000 Instantly in Nigeria

The following are some insightful pointers to increase your chances of having your Ultra Naira loan application approved:

Please be aware that since Ultra Naira loan app, not much is known about its dependability or customer support.

It is imperative that you carry out extensive study and due diligence prior to submitting your loan application.

See also – Naira’s Unending Fall: Nigerian Authorities Ban Access to Crypto Exchanges

The Google Play store users who wrote these reviews about the Ultra naira loan app.

The worst loan application I’ve ever seen, according to obomate Odimabo: “I borrowed 3200 to pay 4100 yet I was credited 2870 to pay 4387; I don’t know how or why it happened that way.

When they called me on the phone, they sounded quite unpleasant. I used the loan app to make my payment before it was due, however the transaction failed even though my account was debited. To threaten me, they resorted to WhatsApp.

As far as I’m concerned, it’s the worst loan app, wrote Jennifer Marcus. I’ve used you before, and you offered me a loan option that I didn’t choose. After I filled out the required form, I received notice that I would be receiving $20,000 to repay $20,000, but instead I got a notice for $14,000. 1 star is what this app deserves.

“This is clearly a fraudulent loan application,” Idris Asimi remarked in a message. Before downloading the app, I read the user reviews, but I had no idea they would continue to defraud me.

On your home page, you stated that you charge 1% per day and that for my initial request, you will lend me $2100 for 7 days. For a week, interest on #2100 will be $147. I then applied for a loan. You sent #1470 in place of #2100 and demanded that I pay back #2270, which was not stated on your application when I applied.

The advantages of a ultra Naira loan include the following;

Despite being a fantastic app, the following are the cons of Naira loan;

See also: Top 8 Easy Loan Apps in Nigeria

Ultra Naira Loan App is a mobile application that provides quick and convenient access to loans for individuals in Nigeria.

You can download the Ultra Naira Loan App from the Google Play Store for Android devices. Simply search for “Ultra Naira Loan” and follow the installation instructions.

First, download and install the app. Then, create an account and complete the loan application form by providing necessary personal and financial information. Finally, submit the application for review.

Yes, you must be at least 18 years old to apply for a loan through the Ultra Naira Loan App.

Typically, you’ll need to provide proof of identity (such as a valid ID card), proof of income (such as bank statements or payslips), and sometimes proof of address.

The loan approval decision is usually provided within a short time after submitting your application.

The loan amount you’re eligible for depends on factors like your income, credit history, and repayment capacity. Ultra Naira evaluates these factors to determine the maximum loan amount you qualify for.

Yes, Ultra Naira considers various factors when reviewing loan applications, not just credit scores. Even if you have a low credit score, you may still be eligible for a loan based on other criteria.

You can not be wrong with a ultra Naira loan. It is one of the relatively easy and fast loan disbursement apps in Nigeria.

Everything you need to know about this loan has been explained above. Yes, the ultra Naira loan app is worth the try!

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech