Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

As the years go by, the number of FinTech companies in Nigeria keeps increasing as the FinTech sector continues to experience explosive growth.

With a population of over 200 million and increasing Internet users, the need for efficient and accessible financial services has never been more crucial.

This demand has given birth to some of the most innovative FinTech companies in Nigeria, whose effects have been felt in Africa and globally.

In this blog post, we discuss the top 6 FinTech companies dominating the Nigerian market in 2025 and their impact on the country’s financial landscape.

As we explore the top five FinTech companies in Nigeria, we will examine their business models, impact on the financial landscape, and role in driving financial inclusion.

Related Also: Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2025

Over the last decade, Nigeria has emerged as a FinTech powerhouse in Africa. The rapid adoption of mobile technology and a young, tech-savvy population have created a fertile ground for FinTech innovations.

From mobile payments to digital lending platforms, Nigerian FinTech companies are redefining how people manage their finances.

Over the last few years, Fintechs in Nigeria have left an indelible mark on the country’s economy. From making banking matters easy for the average Nigerian to impacting business, the FinTech industry has come to stay.

Here are a few reasons why FinTechs are a welcome development in Nigeria:

One of FinTech’s biggest contributions to Nigeria’s economy is financial inclusion. Before the rise of FinTech, many Nigerians had limited access to banking services.

Now, even people in remote areas can easily access financial services through their smartphones.

FinTechs have made it easier for SMEs to access loans and manage payments, significantly boosting Nigeria’s economy. Companies like carbon and Paystack are playing crucial roles in empowering these businesses.

Also, with FinTechs, small and medium enterprises (SMEs) can conduct business without worrying about delayed payments. Instant payment delivery has boosted the SME industry.

FinTech companies in Nigeria have become major employers, creating jobs for tech professionals, marketers, customer service representatives, and others.

As the sector grows, the demand for skilled workers rises, contributing to the country’s overall economic development.

Moreover, successful FinTech startups attract foreign investment, stimulating further growth and innovation in the tech ecosystem.

Nigeria has traditionally been a cash-driven economy, but FinTechs are reducing the reliance on physical cash by offering digital payment solutions.

With mobile wallets, online transfers, and QR code payments, businesses and individuals can complete transactions more efficiently and securely.

This shift not only boosts the formal economy but also reduces risks associated with cash handling, such as theft and fraud.

The rise of FinTech has introduced a wave of innovation in Nigeria’s financial services sector. Traditional banks, which once had a monopoly, now face competition from agile, tech-driven FinTech companies.

This competition pushes all players to innovate and provide better customer services, from faster loan approvals to personalized banking experiences. The overall result is a more dynamic and consumer-friendly financial industry.

Nigeria’s FinTech industry is so dynamic and innovative that companies are revolutionizing how Nigerians manage their finances and achieve greater financial inclusion.

Nigeria is now Africa’s top hub for FinTech innovation, holding the largest share of the continent’s FinTech startups. According to a 2023 report by Disrupt Africa, Nigeria accounts for 32% of all FinTech companies in Africa, with 217 ventures.

Also, in terms of FinTech funding ranking, Nigeria assumes a market-leading position, securing 41.6% of the US$3.6 billion raised by African FinTech ventures over the last decade.

Out of the 217 existing FinTech companies in Nigeria, here are the top 6

Flutterwave is the largest and one of the most influential FinTech companies in Nigeria.

Founded in 2016 by a team of African finance and technology experts from institutions like Standard Bank, PayPal, and Google Wallet, Flutterwave has become one of the fastest-growing payments companies globally.

Flutterwave’s technology allows businesses to make and accept payments from anywhere.

Its wide range of services, combined with its user-friendly platform, has helped it dominate the Nigerian market and across the African continent.

One of Flutter’s game-changing strategies is the provision of multiple Software Development Kits (SDKs )and plugins, and they allow businesses to use Flutterwave payments APIs to build customizable payment applications.

Flutterwave was recognized in the payment segment of the world’s top fintech companies by CNBC.

Read Also: Key Fintech Trends in Nigeria from 2025 and the Outlook for 2026

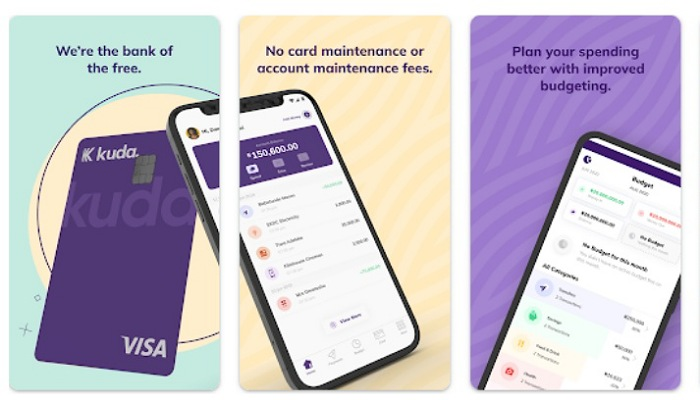

Kuda Bank, often called “the bank of the free,” is one of Nigeria’s most popular digital-only banks. This means that KUDA operates without a physical location. Because of this, it was listed in the Neo-banking category in the world’s top 250 FinTech companies.

Launched in 2019, KUDA offers a full suite of banking services, including savings, payments, and loans, all accessible via a mobile app.

With no monthly fees and the ability to offer better interest rates than traditional banks, KUDA has attracted a significant customer base, particularly among young Nigerians.

The bank’s seamless user experience and focus on financial inclusion have made it a standout in the Nigerian FinTech landscape.

It’s worth noting that KUDA is licensed by the Central Bank of Nigeria (CBN) and insures deposits through the Nigeria Deposit Insurance Corporation (NDIC).

See Also: How to Borrow Money from Opay App in Nigeria | A Step-by-Step Guide

PalmPay is another leading mobile payment platform that has quickly gained traction in Nigeria and is listed among the top FinTech companies in the payment segment.

Founded in 2019, PalmPay offers a wide range of financial services, including peer-to-peer money transfers, bill payments, credit services, savings, and airtime purchases.

What sets PalmPay apart is its user rewards system, where users earn cashback and bonuses for using the app. This model has helped PalmPay grow rapidly, as it appeals to a large demographic looking for affordable and efficient payment solutions.

PalmPay also provides a network of agents, allowing users to access services offline.

Also Read: How to Borrow Money from Kuda App in Nigeria | A Step-by-Step Guide

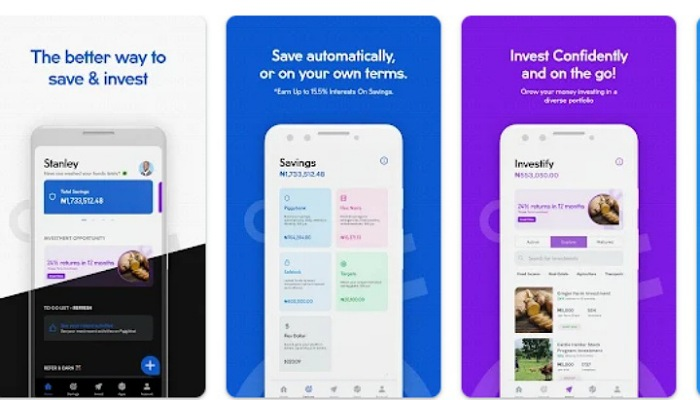

Piggyvest is a digital savings and investment platform listed in the financial planning category of the world’s top 250 FinTech companies. It is Nigeria’s leading online savings and investment platform, empowering users to save and invest smarter.

Launched in 2016, the platform allows users: individuals and businesses to set savings goals and automate their savings through the mobile app.

With Piggyvest, customers can choose to save small amounts of money periodically (Daily, Weekly, or Monthly) towards a specific target OR lock away funds for a specified time.

PiggyVest also offers investment opportunities, giving Nigerians a chance to invest in agriculture, real estate, and small businesses with high returns.

With features like “Safelock” for locked savings and competitive interest rates, PiggyVest is revolutionizing how Nigerians manage their money and build wealth.

You might want to see this: Digitalizing Saving: Piggyvest’s Journey into Becoming the Leading Savings and Investment App in Nigeria

MTN’s Mobile Money, commonly known as MoMo, is a digital wallet service designed to provide financial access to millions of Nigerians. As the largest telecommunications company in Nigeria, MTN leverages its vast network to offer MoMo to both urban and rural populations.

MoMo allows users to send and receive money, pay bills, purchase airtime, access payments, e-commerce, insurance, lending and remittance services all through their mobile phones.

With its focus on reaching the unbanked and underbanked, MTN’s MoMo service plays a significant role in financial inclusion across the country, particularly in regions where access to traditional banking services is limited.

The mobile money service provides users with a secure and straightforward way to handle their financial transactions, eliminating the need for traditional banking methods.

Flutterwave remains the richest FinTech in Nigeria, with a valuation that exceeds $3.2 billion. Its cross-border payment solutions have attracted major international clients.

Though acquired by Stripe, Paystack still operates independently in Nigeria. Its annual revenue continues to grow, solidifying its position among the richest FinTechs.

Opay’s rapid expansion into multiple sectors has made it one of Nigeria’s fastest-growing and richest FinTechs, with its valuation now over $2 billion.

Paga’s consistent innovation has ensured its financial stability. Its ability to adapt to changing market needs keeps it among the top earners in the industry.

Carbon’s growth as a digital lender has seen its revenue soar, making it one of the most valuable FinTech companies in the country.

While Nigeria boasts of having the best and most high-performing FinTech companies, FinTech companies face several challenges as they navigate the rapidly growing industry. These challenges impact their growth and offerings.

The evolving regulatory environment presents a major challenge for Nigerian FinTechs. While the government generally supports innovation, there is still ambiguity around regulations for digital payments, lending, and cryptocurrencies. This uncertainty can hinder growth, as companies must constantly adapt to new policies or face penalties.

With the rise of digital transactions, cybersecurity has become a critical concern for Nigerian FinTechs. The threat of hacking, fraud, and data breaches puts customers and companies at risk.

FinTech firms must invest heavily in securing their platforms, which can be costly for startups.

Despite Nigeria’s increasing digital adoption, infrastructure limitations, such as unreliable internet connectivity and inconsistent power supply, pose significant barriers.

These issues affect the seamless delivery of financial services, especially in rural areas, where access to basic technology is still lacking.

While some Nigerian FinTechs have attracted significant investment, many still struggle to secure the capital needed to scale.

This is particularly challenging for smaller startups, which may struggle to compete with larger, better-funded firms in innovation and expansion.

Despite the convenience of digital financial services, there is still a level of distrust among some Nigerians for using FinTech solutions.

Many people prefer traditional cash transactions, and convincing them to adopt digital alternatives remains challenging, particularly in rural areas or among older populations.

The future of FinTech in Nigeria looks incredibly promising. Rapid advancements are already reshaping the financial landscape, and as digital adoption continues to rise, the FinTech sector is expected to grow even faster.

The Fintech’s Digital Investment market in Nigeria is projected to grow by 11.95% (2025-2028) resulting in a market volume of US$14.34bn in 2028 according to a report by Statista.

Nigerian Fintechs are set to experience:

As more Nigerians embrace digital banking, traditional banks are losing their monopoly. FinTech companies like Kuda Bank drive this change by offering fully digital services.

While the Nigerian government has been cautious about cryptocurrency, blockchain technology will undoubtedly play a major role in the future of financial services in Nigeria.

Artificial intelligence and automation are set to revolutionize financial services, with many Nigerian FinTechs already integrating AI into their systems for better customer service and fraud detection.

Read Also: See Also: CBN Orders Kuda, Moniepoint, OPay and Palmpay to Stop New Account Openings

Nigeria’s FinTech landscape is thriving, with several companies pushing the boundaries of financial services. The FinTech companies above are leading the charge in transforming Nigeria’s financial sector, each catering to different aspects of financial services and making banking more accessible, convenient, and affordable for millions of Nigerians.

I hope you found this piece of information worthy. Please leave us a comment below.

You might want to check out some of our useful and engaging content by following us on X/Twitter @Siliconafritech, IG @SiliconAfricatech, or Facebook @SiliconAfrica

Cheers!

Flutterwave is currently the largest FinTech company in Nigeria, with a valuation exceeding $3.2 billion.

FinTech has significantly improved financial inclusion, empowered SMEs, and made payments and banking more accessible nationwide.

Companies like Flutterwave, Opay, and Carbon are expected to continue their rapid growth in 2025 because of the increased demand for digital financial services.