Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

The MTN MoMo app, provided by MTN Group, one of Africa’s biggest telecom behemoths, has revolutionized the field of digital payments.

Digital payments are now required in today’s fast-paced society in order to be convenient and efficient.

You may streamline your financial transactions by utilizing the MTN MoMo app by following this detailed instruction, which will take you step-by-step through the process.

Imagine being able to use the palm of your hand to send and receive money, pay bills, add airtime, and even withdraw cash.

The MTN MoMo app provides precisely that. Because of this application’s accessibility, security, and ease of use, it has become quite popular.

In this article we will examine how to use the MTN MoMo app in order to experience seamless transactions. Let’s dive right in.

Also read – MTN Signals Potential Data Price Increases in South Africa

Mobile money services debuted in Nigeria in March 2009, marking the inception of a transformative era. Since then, these services have witnessed exponential growth, catering to the evolving needs of users across the nation.

Recognizing the demand for seamless transactions beyond USSD codes, MTN Group, a telecommunications powerhouse, introduced the MTN Momo app.

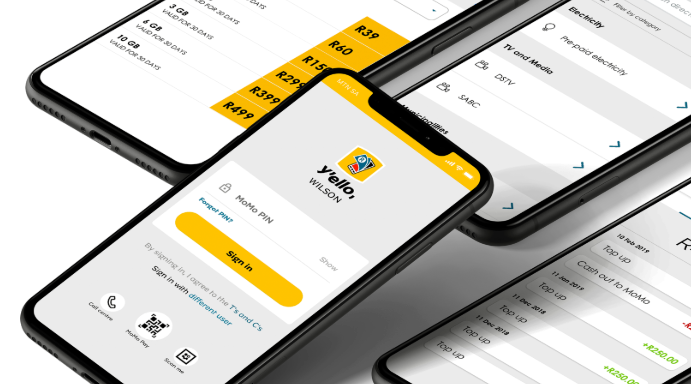

Designed to simplify mobile money transactions, the MTN Momo app offers users a user-friendly interface and enhanced convenience.

With this app, sending and receiving mobile money transactions becomes effortless, catering to a diverse range of preferences and needs.

Let’s delve into the functionalities of the MTN Momo app, exploring its features and capabilities to empower you in managing your mobile money transactions effectively.

Starting your journey with MTN MoMo couldn’t be simpler. Begin by downloading the app from either the Apple App Store or Google Play Store, tailored to your device.

Once installed, the account setup process will seamlessly guide you through each step. During setup, you’ll establish a robust PIN, crucial for securing your transactions.

Remember to create a PIN that’s easy for you to recall but difficult for others to guess.

With your account now set up, you’re empowered to explore the vast landscape of convenient digital payments.

Whether you’re sending money to friends and family, paying bills, or shopping online, MTN MoMo offers a secure and hassle-free experience.

Say goodbye to the inconvenience of cash and embrace the ease of digital transactions with MTN MoMo.

The design of the MTN MoMo app prioritizes simplicity, ensuring a user-friendly experience for all.

Upon logging in, the home screen presents essential information like your account balance, recent transactions, and easy access to key functions, promoting a seamless navigation experience.

From the main menu, users can effortlessly explore the app’s diverse range of features, including sending money, paying bills, and topping up phone credit.

With everything thoughtfully organized, users can navigate through the app confidently without feeling overwhelmed or disoriented.

Whether you’re a seasoned user or new to mobile money services, the intuitive layout and clear categorization of functions make using the app a straightforward and enjoyable experience.

The MTN MoMo app’s commitment to simplicity and accessibility ensures that managing your finances and conducting transactions is both efficient and hassle-free, empowering users to stay in control of their financial activities with ease.

Also read – US Signs Bill that Might mean a TikTok Ban

One of the main reasons people use the MTN MoMo app is to send money to friends, relatives, or anybody else. To accomplish this, just take these actions:

Utilizing the MTN MoMo app for bill payments is a breeze, offering a streamlined experience for managing your financial obligations.

Whether it’s purchasing goods, services, settling internet subscriptions, or covering utility bills, the app simplifies the entire process.

One of its standout features is the comprehensive payment history tracking, ensuring you can effortlessly monitor your financial commitments with ease.

Additionally, the app provides the option to set up recurring payments for monthly invoices, offering a convenient solution to avoid missed deadlines and late fees.

By leveraging this functionality, you can bid farewell to the stress of remembering due dates and mitigate the risk of incurring penalties.

With the MTN MoMo app, managing your bills becomes not only hassle-free but also efficient, empowering you to maintain financial discipline effortlessly.

Also read – Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2024

The MTN MoMo app is a flexible tool with many attractive benefits; it’s not simply another mobile payment platform.

The MTN MoMo app has a number of extra features in addition to the essentials that improve its usefulness. You can buy data straight from the app or add more airtime to your phone.

The ability to withdraw cash makes it simple to get to your money when you need it.

You’ll be happy to hear that MTN MoMo frequently provides its customers with loyalty programs and incentives if you enjoy receiving rewards.

You benefit from other advantages in addition to the simplicity of digital payments.

When managing financial transactions, security and privacy are critical considerations. Strong security precautions are in place on the MTN MoMo app to protect your data.

Make sure you update your PIN frequently and keep it private. You can be confident that your financial information is secure.

The MTN MoMo app is crafted with user convenience in mind, offering a seamless and straightforward experience for all users.

Its intuitive design and easy-to-navigate interface ensure that even those unfamiliar with mobile money services can quickly grasp its functionalities.

From downloading the app to setting up an account and initiating transactions, every step is carefully guided with clear instructions, minimizing any confusion or frustration.

Whether you’re sending money to a friend, paying bills, or checking your transaction history, the app’s layout is designed for efficiency and accessibility.

Important features like payment history tracking and setting up recurring payments are readily accessible, empowering users to manage their finances with ease.

Furthermore, the app’s reliability and security measures provide peace of mind to users, knowing that their transactions are conducted in a safe environment.

With regular updates and improvements, MTN MoMo continues to enhance its user experience, ensuring that it remains a go-to choice for mobile money services in Nigeria and beyond.

You might also like – Latest Update on MTN MoMo Uganda Withdrawal Charges 2024

While the MTN MoMo app shares some similarities with traditional banking apps, such as the ability to check account balances, view transaction history, and make payments, there are also significant differences.

One key distinction is that MTN MoMo primarily focuses on mobile money services, providing users with a convenient platform to send and receive money, pay bills, purchase goods and services, and top up mobile airtime.

Traditional banking apps, on the other hand, offer a wider range of financial services, including savings accounts, loans, investments, and more complex financial transactions.

Additionally, MTN MoMo is often more accessible to individuals who may not have access to traditional banking services or prefer the convenience of mobile money solutions.

Its user-friendly interface and simplified processes cater to a broader demographic, including those in remote areas or with limited access to banking infrastructure.

Overall, while both the MTN MoMo app and traditional banking apps offer ways to manage finances digitally, their focus, scope of services, and target demographics may differ significantly.

Indeed, the MTN MoMo app is available for both iOS and Android users to download and use.

Indeed, for security reasons, transaction limitations are in place. Depending on your account type and location, these limits could change.

It is imperative that you do not divulge your PIN to third parties. Additionally, if your device supports it, be sure to enable biometric authentication and log out of your account while not in use.

Yes, you may use the app to generate a withdrawal code and take out cash from ATMs. To access your funds, just visit an ATM that is participating and follow the instructions displayed on the screen.

Yes, as part of its loyalty programs, MTN MoMo frequently provides its users with incentives and benefits. Make sure to keep an eye out for any current deals or promotions on the app.

You can download the MTN MoMo app from the Apple App Store for iOS devices or the Google Play Store for Android devices.

After downloading the app, open it and follow the on-screen instructions to create your account.

To send money, open the app and navigate to the “Send Money” section. Enter the recipient’s phone number, the amount you want to send, and confirm the transaction with your PIN.

To sum up, the MTN MoMo app is an effective tool that gives you complete control over your funds.

Its extensive range of functions, security measures, and easy-to-use design have made it an indispensable app for anyone trying to streamline their digital transactions.

With MTN MoMo, users can conduct financial transactions quickly and securely, even in areas with limited banking infrastructure.

Its simplicity and accessibility make it an invaluable tool for a broad demographic, empowering users to take control of their finances with ease.

As mobile money services continue to evolve, the MTN MoMo app remains at the forefront, offering innovative solutions to meet the diverse needs of users across Nigeria and beyond.

So why hold off? Experience the digital payment of the future by downloading the MTN MoMo app right now.

It’s time to start enjoying the efficiency and convenience you deserve. Accept MTN MoMo’s power and take command of your financial situation.

Interact with us via our social media platforms:

Facebook: Silicon Africa.

Instagram: Siliconafricatech.

Twitter: @siliconafrite.