Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Buying a new smartphone can be a big investment, and not everyone has the cash on hand to make that purchase. But what if there was a way to get the phone you want now and pay for it over time?

In an age where smartphones are not just a luxury but a necessity, EasyBuy is emerging as a game-changer for many users. Imagine wanting the latest smartphone but being held back by budget constraints? That’s where EasyBuy steps in, revolutionizing the way we acquire our gadgets.

With the promise of buy now, pay later, it offers instant smartphone loans that empower users to get their hands on their desired devices without the immediate financial burden. This innovative approach is not just about getting a new phone; it’s about enabling access to technology for everyone.

By using buy now, pay later apps like EasyBuy, customers can spread the cost over some time, making smartphones more accessible than ever. It’s a win-win: users enjoy the perks of the latest technology, while EasyBuy ensures everyone can stay connected, regperiodardless of their immediate financial situation.

Let’s delve into how EasyBuy is changing the landscape for smartphone buyers, making cutting-edge technology within everyone’s reach.

Easybuy is a Palmcredit (a popular consumer loan platform) subsidiary that provides financial assistance (loans) to those looking to purchase smartphones. A typical “Buy Now, Pay Later” app.

You may attest to the fact that smartphones are quite pricey nowadays. If you have any doubts, please go for a walk around the nearest market.

EasyBuy, on the other hand, allows you to buy any smartphone and pay it off whenever you choose.

Yes, don’t lower your mobile device standards due to a lack of finances when Easybuy is always ready to assist you. Let’s find out how EasyBuy works.

See this: How to Backup your WhatsApp on iPhone and Android in 2025

To begin, you must understand that EasyBuy’s instant smartphone loans are for people who wish to buy mobile devices but do not have the finances.

Here’s a practical example of how Easybuy operates. Assume you want to buy a smartphone for N50,000 but do not have enough money.

You approach Easybuy for their services, produce the relevant documentation to prove your trustworthiness and eligibility, and then deposit 30% of N50,000.

That is, you must have N15,000 with you while Easybuy completes the payment (70%). You can then repay the 70% in instalments as needed (typically between three and six months).

To be qualified for an EasyBuy mobile financing loan, you must meet the following criteria:.

See this: How to Attend & Host a Space Session on X Twitter Without Stress

The trend of buy now pay later apps is on the rise, capturing the attention of many smartphone users who crave affordability and flexibility in their shopping habits.

These apps have revolutionized the way we approach purchases, offering a convenient alternative to traditional payment methods. Amid this competitive landscape, EasyBuy emerges as a standout option.

What sets EasyBuy apart is its focus on instant smartphone loans. While other buy now pay later apps offer a broad range of products, EasyBuy understands the essential role smartphones play in our daily lives.

Recognizing this, they’ve tailored their service to ensure customers can upgrade or obtain new smartphones without feeling the immediate financial burden.

The appeal of buy now pay later apps like EasyBuy lies in their ability to spread out the cost of big-ticket items into manageable payments, without the added pressure of high interest rates. This is particularly attractive for individuals looking to keep up with the latest technology without depleting their savings.

By focusing on smartphones, EasyBuy not only provides a valuable service but also caters to the ever-growing demand for accessible technology.

Also, Read – Google Voice and Other Legal Phone Number Generator Apps for Ghana

If you’re looking to upgrade your smartphone but find yourself a bit strapped for cash, an instant smartphone loan might be the solution you need.

EasyBuy is a popular platform that offers such financial services, allowing customers to purchase smartphones on credit and pay back over time.

Here’s a step-by-step guide on how to secure an instant smartphone loan from EasyBuy:

The first step is to locate an EasyBuy representative. Easybuy has connections and affiliations with numerous phone companies in Nigeria.

As a result, Easybuy agents may be found at a wide range of smartphone outlets. They are all dressed in the official Easybuy uniform (blue branded T-shirts), making them easy to identify.

An Easy Buy agent will go over the requirements with you to ensure that you qualify for the loan.

Some questions and details will also be asked, and the agent will take note of your response.

In any smartphone store affiliated with the EasyBuy program, the agent collaborates with the staff. So, once you’ve chosen your smartphone and agreed on the pricing, you’ll be redirected to the Easybuy agent.

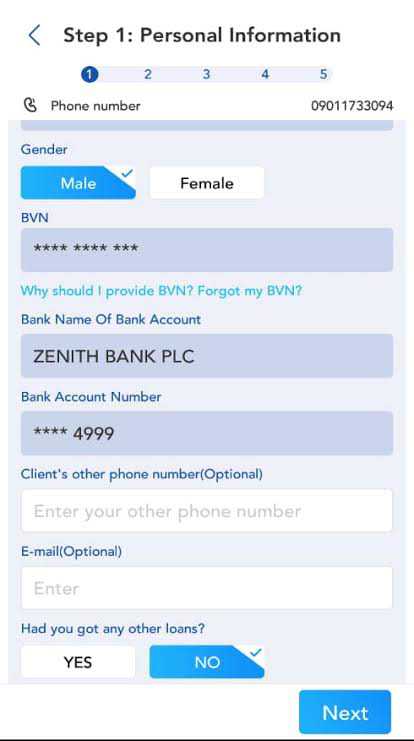

The next step is to register on the Easybuy portal. The agent will be in charge of these stages, and the information you provided previously will be used for the loan application.

Your photo will also be taken during the application process. You may also be invited to speak with another EasyBuy headquarters agent (by phone).

Here, you will be requested to pay at least 30% of the phone’s cost. To purchase a mobile phone priced at ₦40,000, an initial deposit of at least ₦12,000 is required.

Applying for an Easy Buy loan allows you to:

The interest rate varies with each repayment term. Before making a decision, be sure you validate it.

This is the final step in obtaining a phone loan from Easy Buy in Nigeria. You will be asked to supply the names and phone numbers of four people in your immediate circle. These individuals

Here’s a tip: Notify them before applying for the loan, and ask them to put in a good word for you.

After applying for the Easybuy loan, please sure you pay on time. Failure to do so may cause embarrassment since the loan firm will call those four people to tell them of your inaction.

You should read this: Whogohost Rebrands as GO54

The EasyBuy instant smartphone loan normally lasts between three and six months. As a result, Easybuy offers two different payback plans.

There are a few repayment alternatives for Easybuy loans.

Read Also – How to Pay for your DStv Subscription via Mpesa in Kenya 2025

The interest rate on an EasyBuy loan depends on the repayment plan you select. Easybuy’s repayment plan normally ranges between 6% and 9% every month.

You pay 9% for the three-month payback plan and 6% for the six-month payment plan. Using our earlier illustration:

For a 3-month repayment plan

For a 6-month repayment plan

By offering instant smartphone loans, EasyBuy has significantly impacted the way people purchase smartphones, blending convenience with financial flexibility. Let’s delve into the multifaceted benefits of using EasyBuy for smartphone purchases.

One of the key advantages of EasyBuy is its seamless financing solution. Unlike traditional credit options that come with lengthy and complicated approval processes, EasyBuy provides instant smartphone loans.

This means that you can walk into a store or browse online, choose your desired smartphone, and complete the purchase with financing in place within minutes. This hassle-free approach not only saves time but also significantly reduces the paperwork and the wait associated with loan approvals.

With EasyBuy’s buy now pay later structure, you’re not required to pay anything upfront. This feature is particularly beneficial for individuals who may not have immediate access to the total amount required for a high-end smartphone.

Instead of waiting months to save up for a phone, EasyBuy enables you to own one immediately, thereby ensuring you’re not left behind in leveraging the latest technology due to financial constraints.

Flexibility is at the heart of EasyBuy’s service offering. Recognizing that everyone’s financial situation is different, EasyBuy provides a range of payment plans.

These plans allow customers to choose how much they want to pay monthly, depending on their budget and financial comfort. Such flexibility ensures that customers can enjoy their new smartphones without the stress of financial strain.

For individuals looking to build or improve their credit score, using EasyBuy can be advantageous. By consistently making your payments on time, you demonstrate financial responsibility.

Over time, this responsible borrowing and repayment behavior can positively impact your credit score. Hence, EasyBuy doesn’t just facilitate your immediate smartphone needs but also contributes to your long-term financial health.

You may need to read this: How to Know if Your Phone Has Been Tapped (Full Guide)

In the fast-paced world of smartphones, where new models are launched frequently, keeping up can be financially daunting. EasyBuy empowers you with the ability to always stay on top of the latest technology.

Since the financial burden is spread out, you can upgrade to the newest smartphones as they hit the market without the financial pinch typically associated with outright purchases.

Lastly, the convenience offered by EasyBuy and similar buy now pay later apps cannot be overstated. The entire process from application to approval and payment is streamlined and can often be completed from the comfort of your home or on the go.

This level of convenience, combined with the other benefits mentioned, makes it an appealing option for many.

Also Read – How to Take Screenshots on all Android Phones

EasyBuy, a leading name in the buy now, pay later sphere, has significantly revolutionized the smartphone market. With its innovative approach, it offers instant smartphone loans, making high-end smartphones accessible to a wider audience.

The beauty of EasyBuy lies in its simplicity and efficiency, allowing consumers to purchase smartphones instantly without the immediate financial burden. This has opened up a plethora of opportunities for people who previously found the cost of cutting-edge smartphones prohibitive.

Furthermore, as one of the pioneering buy now, pay later apps, this company has set a high standard in the market, promoting consumer empowerment and financial flexibility.

The ease of obtaining smartphones, without having to pay upfront, has not only boosted smartphone sales but has also fostered digital inclusion.

By breaking down financial barriers, EasyBuy is enabling more individuals to stay connected with the latest technology. In essence, EasyBuy’s impact on the smartphone market is profound, democratizing access to technology for a broader segment of the population.

EasyBuy is transforming the way we purchase smartphones, epitomizing the power of buy now, pay later (BNPL) platforms. By providing instant smartphone loans, EasyBuy empowers users to acquire the latest devices without the upfront financial burden.

This service, accessible through the buy now, pay later apps, not only simplifies the buying process but also democratizes access to technology. Users can enjoy the convenience and flexibility of spreading payments over time, making high-tech gadgets more accessible to a broader audience.

In essence, EasyBuy is not just a platform; it’s a gateway to technological empowerment, ensuring that the newest smartphones are within reach for everyone.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

EasyBuy partners with various smartphone brands, offering a range of models from budget to high-end. The available options may vary based on current inventory and partnerships.

Yes, early repayment is usually allowed. Customers who wish to pay off their loan before the agreed period may contact EasyBuy’s customer service to arrange an early settlement. In some cases, this might reduce the overall interest paid.

Missed payments may result in late fees, and consistently missing payments can affect your credit score and your relationship with EasyBuy. It’s important to communicate with EasyBuy’s customer service team if you’re facing financial difficulties to explore possible solutions.

Approval times can vary, but EasyBuy aims to offer quick decisions to applicants, sometimes within minutes or hours of application submission, depending on the verification process.