Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Loan apps in Nigeria have revolutionized the way people get financial assistance. They are a game-changer, offering a lifeline to those who urgently require funds. These digital platforms are known for their convenience, providing loans at your fingertips with attractive interest rates. This article explores some of the top loan apps.

FairMoney is one worth mentioning. It’s a fast and reliable Android app available in Nigeria and India. You can borrow amounts ranging from ₦1,500 to ₦500,000 with repayment periods of 61 days to 1 year. The interest rates are between 2.5% and 30%. It’s popular too, with 3 million customers relying on it for loans. You can find it on the Google Playstore.

Aella Credit is another loan app that offers a range of loan sizes, from around ₦1,500 to ₦1,000,000. The specific loan amount you can get depends on various factors. The repayment period typically lasts for a month or three months, but it may vary for each individual. A cool thing about Aella is that they reward borrowers who repay their loans on time by giving them cash back on the interest paid.

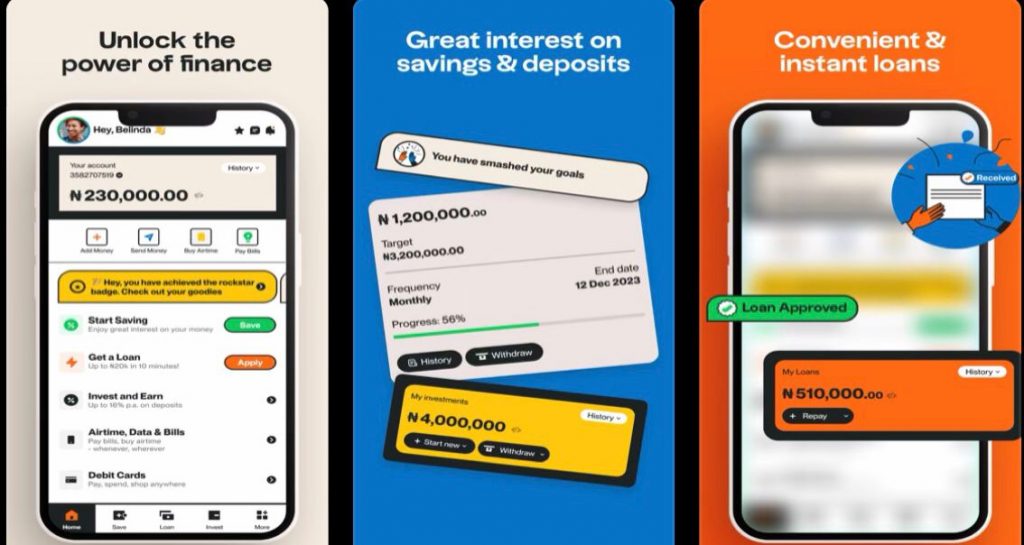

It’s Nigeria’s first fully digital bank, designed to help you make the most of your money. With over 14,000 reviews and a rating of 3.8, the ALAT App allows you to transfer, save, and pay bills automatically. One of the great features is that you can request instant loans with no collateral and no paperwork. It’s super easy to use and process. Plus, you can create a free virtual dollar card for online payments and convert naira to dollars whenever you need to. The interest rate for ALAT loans ranges between 29% and 30%.

Okash, which falls under the umbrella of Opay, is a major player in the digital loan app market. It allows you to get instant loans of up to N500,000. The interest rates offered by Okash range from 10% to 30% per month. The app not only provides loans but also offers various services like money transfers, bill payments, and online shopping. On the Google Play Store, Okash has an impressive 4.4-star rating with over 5 million downloads.

Now, let’s talk about Palmcredit. With the Palmcredit app, you can easily borrow money online. All you need to do is apply for an instant loan with a flexible repayment plan and a favourable interest rate. PalmCredit offers loan limits ranging from ₦10,000 to ₦300,000, and you can choose a repayment period between 91 days and 365 days.

Renmoney has a rating of 3.7 out of 5 stars from over 2,000 users. With Renmoney, you can borrow up to ₦6,000,000 without needing any collateral. The repayment period ranges from 3 to 24 months.

For example, if you take a loan of ₦2,000,000 with a 12-month tenure, your monthly repayment would be ₦214,667. By the end of the 12th month, you would have paid back a total of ₦2,567,000.

These loan apps typically have specific terms and conditions regarding late repayments. If you fail to repay your loan on time, you may be subject to late fees, increased interest rates, or even negative impacts on your credit score. It’s crucial to make your repayments on time to avoid any penalties or complications.

The specific eligibility criteria may vary slightly between the different loan apps, but there are some common requirements you’ll typically need to meet. These may include:

1. Being a Nigerian citizen or resident.

2. Having a valid bank account.

3. Meeting the minimum age requirement (usually 18 years of age or older).

4. Providing valid identification documents.

5. Demonstrating a reliable source of income or employment.

It’s important to note that each loan app may have its own additional criteria or variations, so it’s always a good idea to review the specific requirements of the app you’re interested in.