Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

GTBank has many loan products in Nigeria to satisfy personal and business needs. Money can be lifesaving, especially during rough times, and GTBank is at the tip of your fingers through the bank’s mobile app.

If you’re looking forward to knowing how to borrow from GTBank, you’re just in the right place.

The questions, “How can I borrow money from GTBank?” and “How do I borrow money from my GTB account?” are frequently asked.

The good news is that you can complete it online, and it’s quite simple.

With the GTBank app, you can borrow money directly from the comfort of your home or anywhere else, provided you have internet access.

This guide will walk you through these steps to ensure you have access to the funding you need quickly and easily.

A detailed explanation of how to borrow money from GTBank is given in the article.

You may be a new customer or do not know how to use their loan services; we have covered you in this piece on how to borrow money from GTBank. Let’s get started!

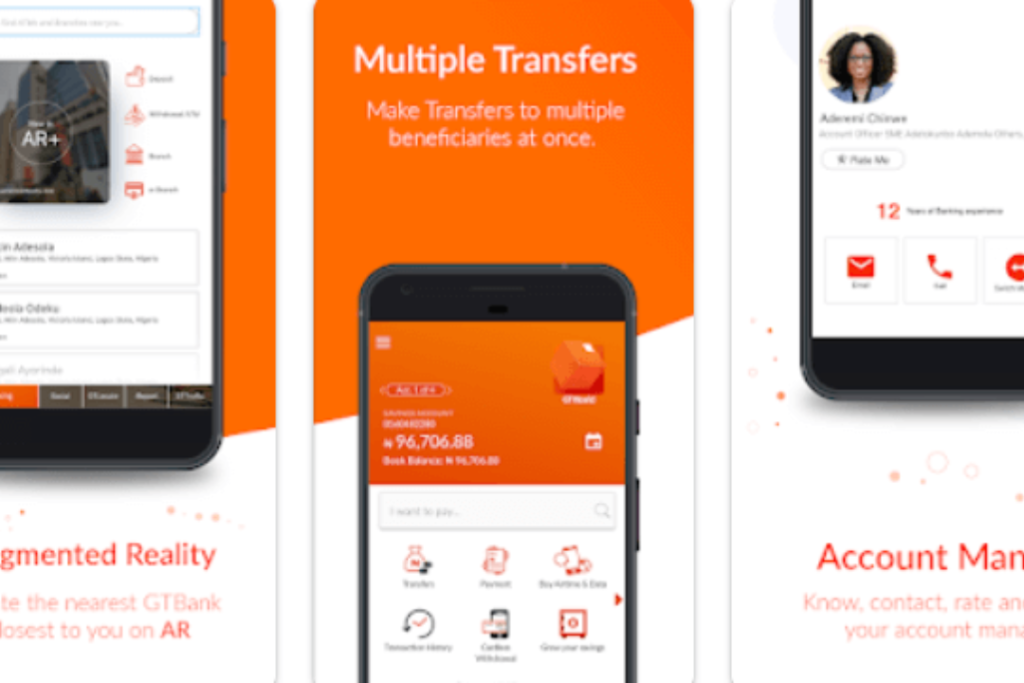

The GTBank mobile banking app is built to give users an organized channel to access many loan facilities, covering all financial needs.

Using the app, customers can request a personal loan, salary advance, or other credit facilities from any location without physically going to the bank.

Due to the app’s user-friendly interface, the application process involved in knowing how to borrow money from GTB is easy, thus convenient for customers to bank on the go.

Digital banking makes it easier and faster for users to borrow money with GTBank.

The app makes it easy for those bothered about borrowing money from GTB. Many times, people ask, how can I borrow money from GTBank?

The answer is that access to loan services has been seamlessly integrated with the app at every point.

Whether it be about how to borrow money from GTBank online or how to borrow money from GTBank App, all of these needs are covered under the GTBank App, the single comprehensive solution for financial support directly from your mobile device.

Read Also – Latest Update on How to Get your GTBank SWIFT Code, Sort Code, and IBAN Code for International Money

Requirements to borrow money from the GTBank App differ depending on the type of loan one intends to retrieve. However, to obtain a loan from the GTBank App, you are usually expected to have the following:

GTBank reserves the right to further request documentation or information from you:

This may vary depending on the loan type and your circumstances. You may, therefore, need to contact GTBank for the most current and up-to-date requirements for this.

You do not, in particular, have to register for the GTBank app just because you want to apply for a loan. Here is what you do:

Note

During your registration on this application, you might be asked to set up your GT eToken for an added layer of security. This standalone application will generate a code for authenticating your transactions.

You can activate the GT eToken app on your mobile phone using either your debit card details or an authorization code received by calling the GTConnect contact centre.

Also Read – USSD codes for GTB, FCMB, UBA, Access and Fidelity Bank

GTBank has several loan products on its mobile banking app. Below are the major loan products you can borrow:

Each loan comes with its conditions and requirements attached to it—interest rates, tenors, eligibility criteria, and so on. You can go ahead and apply for them right within the GTBank app.

Relax if you have a financial crisis and wonder how to borrow money from a GTB account in Nigeria. Below is a step-by-step process on how to borrow from the GTBank app.

The GTBank App must first be downloaded and installed from the Google Play or Apple App Store. Please look for the “GTBank App”, press the download link, and then give the program permission to install on your device properly.

After successfully downloading and installing the app, click “Register” and fill in your account number, BVN, among others. Follow through to create your username and password, then log in with the username and password.

Upon successful login, click the “Loans” icon on the dashboard. Select the kind of loan you wish to apply for: Quick Credit, Salary Advance, etc.

Input the amount you are borrowing and how long you will need to repay; select your payment schedule and fill in any other information as may be required.

Depending on the loan product you opted for, you must upload relevant documents such as a payslip, ID, or address proof. Fill in any other additional details that are required in your loan application.

Recheck and provide your loan details, then tap the “Submit” button to apply for a loan.

Now, be patient while it’s under review—a process almost instant, or at most, within minutes. Upon approval, the disbursed amount shall be reflected in your GTBank account.

Follow through to easily borrow from the GTBank App in Nigeria. Please borrow responsibly and remember to repay on time to avoid any problems.

Read Also – GTB USSD Code for Airtime, Transfer, & Mobile Banking

Different interest rates and different tenors of repayment apply to various loan types available on the GTBank app. The examples that follow shall be relevant:

Note: These examples are only two of the available options, and on the GTBank app, other loan products have varying interest rates and repayment terms.

Repaying your borrowed money through the GTBank App is as easy as borrowing from it. Here is what to do in detail:

Note: Repay your loan on time to avoid late fees and interest charges. In case of any issues or queries, you can contact GTBank customer support.

Also Read – How to Fund Bet9ja Account with USSD Code, ATM, Transfer, and GTBank

Encountering problems while trying to get a loan from GTBank can be frustrating. Here are some steps you can take to address the situation:

Pinpoint the exact problem you’re facing. Is your loan application rejected? Are there delays in processing? Understanding the specific hurdle will help you approach it better.

GTBank offers multiple channels to reach their customer service. You can call their helpline, visit a branch, or contact them through their website or social media platforms. Explain your situation clearly and provide any relevant details about your loan application.

Double-check that you meet all the eligibility criteria and have submitted the necessary documentation for the loan you applied for. You can find these requirements on the GTBank website under the loan section.

If the reason for rejection is unclear, ask for a detailed explanation from the bank representative. This can help you understand areas for improvement if you plan to reapply.

GTBank offers a variety of loan products. If you’re not eligible for one specific loan, explore if other options might better fit your needs.

With these steps, you can navigate how to borrow money from GTB without issues. Remember to stay calm and patient when problems resolving with GTBank or any financial institution.

The loan amount depends on the type of loan and the applicant’s creditworthiness, but it normally ranges from ₦10,000 to ₦5,000,000.

Loan approval in the GTBank app is usually instant or takes a few minutes. After accreditation, the loan amount is credited to your GTBank account.

You can pay off your loan early in the GTBank app without any consequences or expenses. Click on the “Repay” button and select the instalment amount.

If you default on your loan, the GTBank app can assess overdue fees and consequences. In addition, defaulting on your mortgage can negatively impact your credit score and make it harder to qualify for credit score entry into destiny.

Borrowing cash from the GTBank app is a trusted system that offers convenience and speed. This step-by-step guide explains exactly how to borrow money from GTB.

Whether you are asking, “How do I borrow money from GTBank?” or looking for information on how to borrow money from GTBank online, this guide covers it all.

With a few taps on your smartphone, you can access your funds without any hassle. Now that you know how to borrow money from GTB, why not try it today?

Do you have any questions or studies about the ratio? Leave a note below! Don’t forget to follow us on Facebook at Silicon Africa, Instagram at Siliconafricatech, and Twitter at @siliconafritech for more helpful suggestions.