Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Navigating the financial environment can be intimidating, especially when considering loans. Do not be alarmed since Absa has introduced a game changer, the Absa Loan Calculator.

This loan calculator simplifies the Absa loan application process and puts the power of calculation in your hands. Whether it’s a personal loan, a mortgage, or vehicle financing, this calculator is meant to eliminate all uncertainty from the planning process.

With a few clicks, you may get an estimate of your monthly payments, interest rates, and repayment conditions, allowing you to make an informed financial decision with confidence. The Absa Loan Calculator eliminates the need for tedious manual computations and instead provides convenience.

In this article, we will learn how the Absa loan calculator works, so that you can confidently manage your finances. Are you prepared to move on? Explore other options and streamline your Absa loan application today.

The Absa loan calculator, which is available on their website, is a valuable budgeting tool. It allows you to estimate your monthly loan payments and determine how much credit you feel comfortable managing. Though there may be subtle variations by locale, the overall notion remains the same.

You enter the loan amount and payback duration, and the calculator returns an approximate monthly payment amount. This might be a great starting point for budgeting before submitting a formal loan application.

You should keep in mind that this calculator simply provides an estimate. The exact interest rate and loan terms you receive may likely fluctuate depending on your financial situation and creditworthiness.

Related – KCB loan calculator: How it Works

The features of the Absa Loan Calculator are as follows:

The Absa Loan Calculator allows you to enter the amount you want to borrow. The tool is especially useful when you know exactly how much you want and want to know how much you have to pay back over a set length of time.

The loan term option in the Absa Loan Calculator allows you to choose a payback time that is convenient for you. This function may be valuable in determining a manageable monthly payback that fits your budget, as well as in helping you organize your finances appropriately.

The Absa Loan Calculator allows you to enter the interest rate that has been quoted for your loan. This function allows you to compare loan choices from several lenders and determine which one gives the best interest rate for your needs.

The Absa Loan Calculator’s monthly repayment estimate indicates how much you will have to return each month. This function aids in determining if a borrower can afford the loan or whether the monthly repayment amount is within one’s means.

The total cost of credit, which you can calculate using the Absa Loan Calculator, will give you an estimate of how much you will have to pay throughout the life of the loan. This function can assist you in calculating the entire cost of borrowing, allowing you to make more informed decisions about whether or not to accept a loan.

The Absa Loan Calculator also allows you to enter the amount that you want to pay off your loan early. This feature might help you figure out how much less interest you’ll pay if you pay off your loan early. It can also help you determine whether it is financially advantageous to pay off your loan early.

To assess the likely costs of borrowing, Absa uses a loan calculator on its website. Utilize it for these purposes:

It is usually suggested to use this tool for budgeting and informed borrowing decisions.

Read Also – Loan Calculator and How to Use it

The essence of the Absa Loan Calculator is not too complicated. This can be explained in terms of the following formula:

PMT = P * r * (1+r)n / ((1+r)n – 1)

In this formula, PMT represents the monthly payment amount, P stands for the loan amount, r is the interest rate and n denotes the number of months in the repayment term.

To calculate a loan amount using the Absa Loan Calculator, you would enter your desired monthly repayment amount, interest rate, and repayment term into the calculator, and it would solve for P in the above equation.

The Absa Loan Calculator can be used to compute a variety of loan types, including:

Individuals can obtain personal loans without collateral for a variety of purposes, including debt consolidation, home renovation, and unexpected needs. A calculator is useful in calculating monthly payments based on loan amount, interest rate, and duration parameters.

Vehicle loans, often known as car loans, allow individuals to obtain financing for the purchase of a vehicle. This calculator helps users estimate monthly payments by taking into account variables like loan amount, interest rate, and payback term.

Mortgage loans are designed to finance the purchase of a property or home. A calculator calculates monthly mortgage payments by taking into consideration the loan amount, interest rate, repayment period, and additional charges such as insurance and taxes.

Loan calculators can help students estimate their monthly loan repayments by taking into account the loan amount, interest rate, and payback duration.

The calculator allows entrepreneurs and business owners to estimate repayments for various sorts of business loans, such as those used for startup capital, expansion, or equipment finance. The criteria analyzed include loan amount, interest rate, and repayment duration.

By providing significant insights into possible debt responsibilities, these calculators help consumers make informed borrowing decisions.

Also Read – Loan Amortization Schedule: A Simple Guide To Understanding It

The Absa loan calculator is simple and quick to use; it provides users with an estimate of their future loan repayments depending on a variety of characteristics. Absa provides this service to its consumers so that they can arrange their borrowing wisely. This is a comprehensive explanation of how to access the Absa loan calculator.

Launch your preferred web browser and navigate to the Absa website.

Once on the Absa homepage, look for the ‘Tools’ or ‘Calculators’ area, either in the main navigation menu or at the bottom of the page.

In the ‘Tools’ area, you will see a list of various financial calculators given by Absa; seek out the one labeled “Loan Calculator” or something similar.

Select the link or icon for the loan calculation tool. This action will direct you to the loan calculation page.

When you get to the loan calculator page, take a moment to familiarize yourself with the interface. In most circumstances, you will find input fields where you can enter loan amounts, interest rates, and loan terms.

Complete the necessary information accurately. This contains the amount you want to borrow, the interest rate on your loan, and the repayment duration (often in months).

After you’ve input all of the necessary information, double-check it to ensure accuracy. If necessary, you can change the values to observe how alternative loan amounts, interest rates, and repayment lengths affect your monthly payments.

The loan calculator will provide results when you enter the essential information and make any necessary adjustments. Normally, an estimate of your monthly repayment amount based on the information provided will be displayed.

By following the procedures outlined above, you will be able to easily access Absa’s loan calculator and utilize it to estimate your possible loan repayments effectively and comfortably.

Read Also – Meta Loan App: How to Download and Apply For a Loan

This is a step-by-step approach for obtaining an Absa loan, which may be completed smoothly with adequate planning and preparation. Here, we will describe the general loan application process at Absa, so you can complete it quickly.

Absa offers a variety of loan products online. Otherwise, you can visit a branch and speak with an expert loan officer.

Collect the essential documentation by Absa’s standards. This typically involves:

Make sure that all of the information on the application form is accurate and complete. Before submitting it, thoroughly check it for errors and omissions.

Online submissions are normally completed instantly, however, branch applications may take a few business days to process.

Absa will do a thorough review of your creditworthiness, income stability, and debt-to-income ratio. They may contact your employer or seek further documentation for verification purposes.

You will receive notification of the bank’s decision (approved or refused) via email or phone. If you are authorized, you will receive a loan offer with the terms and conditions.

Absa’s user-friendly loan calculator assists with making educated borrowing decisions. By entering the loan amounts and repayment time, you may get an overview of the prospective monthly installments.

This clarity encourages sensible financial planning by allowing you to select a loan that is within your budget.

It is a quick and straightforward solution to improve financial health and streamline the Absa loan application procedure. Take control of your borrowing journey with the Absa calculator!

If you find this piece helpful, kindly leave a comment and follow us on our social media handles for more updates.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

The calculator is simple to operate. You only need to enter the loan amount, the Absa interest rate, and the loan period (in years). You will then be given an estimate of your monthly repayments.

You can use the loan calculator to get an estimate of repayments for many sorts of loans, including personal loans, auto financing, house loans, and business loans.

Although it provides a close estimate of your monthly repayments, keep in mind that actual repayments may vary somewhat due to changes in interest rates and other costs.

Yes, you can use Absa’s loan calculator to compare various loan types. By entering alternative sums, interest rates, and terms, you can immediately examine how different configurations affect your monthly payments.

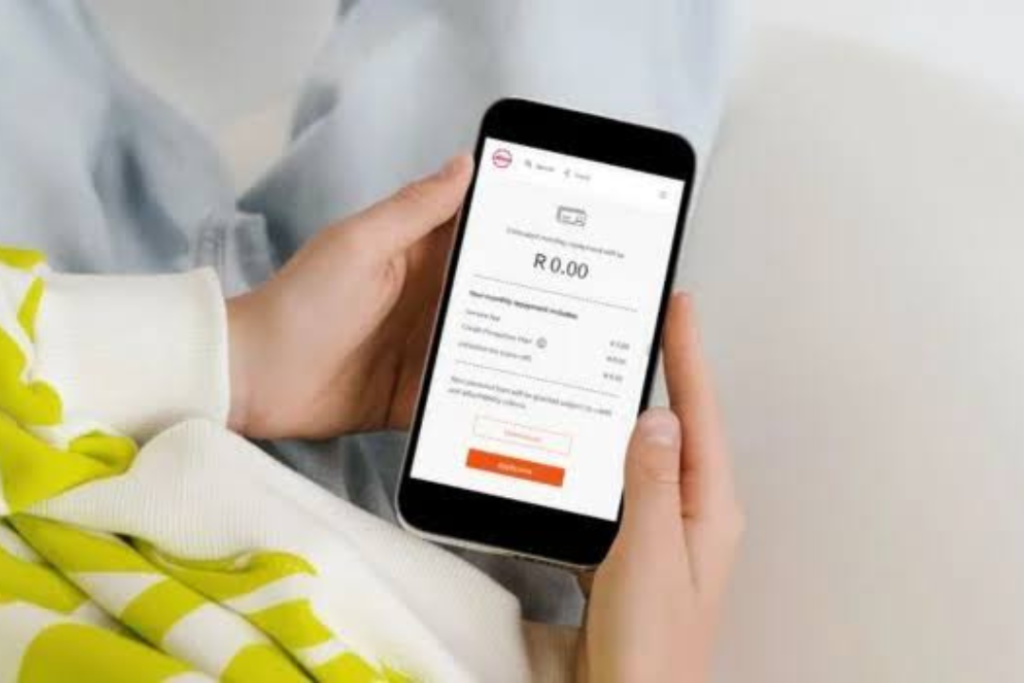

Yes, Absa’s Loan Calculator is mobile-friendly, allowing users to calculate loan repayments on the move. It can be accessed via the Absa mobile app or the bank’s website on your smartphone or tablet.