Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

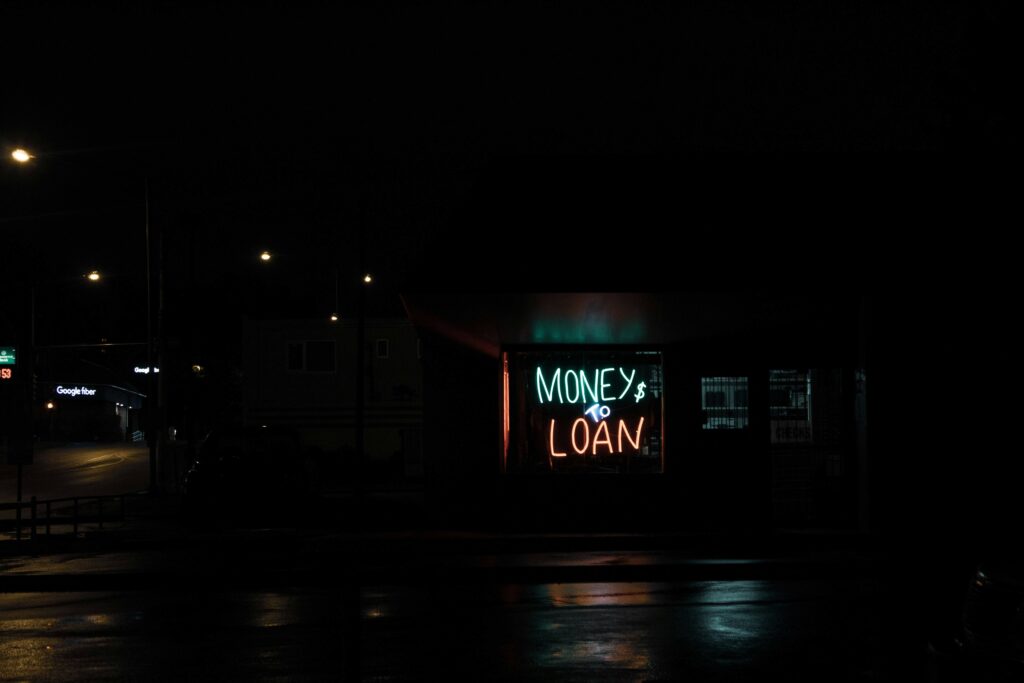

Can’t use loan apps because you don’t meet the requirements? Then fret not. The digital age has totally transformed how we live and accessing loans is one area that this change has greatly impacted.

At some point, we all need good collateral to get loans from banks. The requirements are sometimes over the top, and more depressing is the lengthy paperwork before you can be considered for the loan.

Sometimes, you go through these processes only to be declined or given high interest rates with unrealistic repayment plans.

But as time passed, loan apps emerged and are now giving commercial banks a run for their money. You no longer have to get in a queue to access loans.

In a bid to get your attention, these loan apps offer an array of competitive requirements, interest rates, and repayment plans. So if you search well, you will most likely find one tailored to your financial needs.

But the race doesn’t stop there; 23411 has emerged to challenge loan apps with a no-requirement system. You do not need to virtually upload any documents. And guess what? You do not need to download an app!

How is that possible? Keep reading as we unravel this loan option and how you can make the most of it.

The 23411 Loan works like the USSD code system, where users have easy access to loans directly on their mobile devices to their bank accounts.

This platform offers a solution for those seeking immediate financial assistance without the hassle of extensive paperwork or collateral requirements.

In a nutshell, you do not need to tender or upload any documentation before you get a loan. Once you dial the code, you get a response on how much you are qualified for. From here, you can easily get the loan.

Getting 23411 loans is unlike traditional loan apps. It does not have a dedicated mobile application available for download; that is, it is not a loan app. So how does it work?

The 23411 loan instead works through these simple steps:

Once you send this message, you will receive a response indicating whether your loan application has been approved. If approved, the requested loan amount will be disbursed promptly, ready to address your financial needs.

Why not use a regular loan app, one may ask? But there are some perks you can enjoy using the 23411 loan, which may not be feasible with known loan apps. These are the benefits you get to enjoy:

To apply for a loan through the 23411 platform, follow these steps:

In conclusion, the 23411 Loan offers a convenient and accessible solution for individuals in need of quick financial assistance. While it may have its limitations, such as a lack of comprehensive customer support and limited loan information, its simplicity and instant processing make it a viable option for many Kenyans facing urgent financial needs.