Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Let’s talk about USSD codes — they’re one of the best things to happen in banking! With these short codes, doing basic banking has become super easy for everyone, no matter where you are or what kind of phone you use.

USSD (which stands for Unstructured Supplementary Service Data) lets you manage your money without going to the bank. You don’t need internet or a smartphone — just a simple phone and a few easy codes.

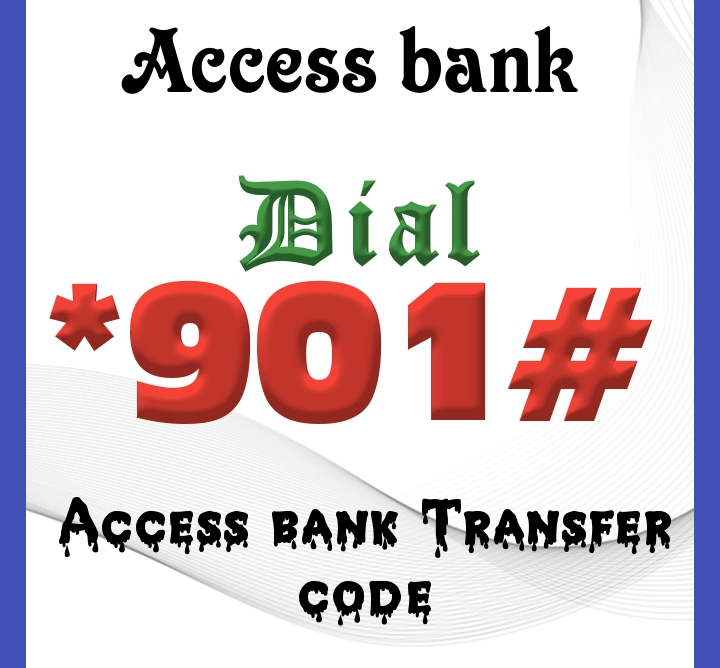

In this article, we’ll focus on Access Bank USSD codes — like how to send money, pay bills, and more.

So, if you’ve been searching online for Access Bank transfer codes, you’ve come to the right place. Let’s jump right in!

USSD, or Unstructured Supplementary Service Data, is a protocol utilized within Global System for Mobile Communications (GSM) networks to facilitate real-time communication between mobile devices and servers.

Similar to Short Message Service (SMS), USSD allows users to send text messages, but it operates differently. Unlike SMS, which is a store-and-forward service, USSD establishes an instant connection between the user’s phone and the network or server.

USSD codes are sequences of characters, often initiated with an asterisk (*) and terminated with a hashtag (#), that users input on their mobile devices to trigger specific actions or retrieve information.

These codes are typically short and easy to remember, making them accessible to users with feature phones as well as smartphones.

The versatility of USSD extends beyond simple messaging. It enables users to access a wide range of services directly from their mobile devices, including mobile banking, network configuration, customer updates, marketing surveys, callback services, order confirmations, and coupon and voucher distribution.

One of the key advantages of USSD is its real-time nature. During a USSD session, users interact with menus and receive responses almost instantaneously, as long as the communication line remains open. This ensures prompt and efficient communication, particularly for time-sensitive transactions like banking and service requests.

Moreover, USSD does not require users to install any applications on their devices since the applications run on the network itself. This accessibility makes USSD services available to all subscribers immediately upon deployment, without the need for additional downloads or installations.

Understanding USSD codes is crucial for anyone who values convenience and efficiency in mobile communication. Whether you need to check your bank balance, top up airtime, participate in marketing surveys, or make payments, USSD codes offer a quick and reliable way to access these services directly from your mobile device, regardless of their capabilities.

See this: Top Effective Methods to Transfer WhatsApp Data from Android to iPhone in 2025

Access Bank Transfer Codes offer customers unparalleled convenience and flexibility in managing their finances. With these codes, Access Bank customers can execute various transactions effortlessly, from transferring funds to making bill payments, all with just a few taps on their mobile devices.

Gone are the days of lengthy lines at the bank. Access Bank Transfer Codes empower users to take control of their financial transactions anytime, anywhere, without the need for an internet connection. Let’s uncover the simplicity and efficiency of Access Bank Transfer Codes, improving banking experiences for users in 2025.

Also read: 8 Illegal Digital Loan Companies in Nigeria You Should Avoid 2025

Access Bank Transfer Codes streamline the process of transferring funds between accounts, offering a hassle-free solution for customers. With just a few simple steps, users can initiate money transfers swiftly and securely.

By dialing the designated USSD code on their mobile devices, customers gain instant access to a menu of options tailored for money transfers and bill payments. From there, they can select the transfer option and proceed to enter the recipient’s account details and the desired amount.

Once the transaction is confirmed with the user’s PIN, the funds are swiftly transferred to the designated account, ensuring a prompt and efficient transfer of funds. With Access Bank Transfer Codes, sending money to family, friends, or business associates has never been easier.

The fact that you have a phone or an Access Bank account does not give you automatic access to the Access Bank USSD platform. You will be able to activate Access Bank USSD codes by following the requirements below:

After completing the process, you can activate the Access Bank USSD code by dialing *901# on your mobile phone and following the prompts displayed on the screen.

You will be prompted to enter your Access Bank account number, create a 4-digit Personal Identification Number (PIN), and confirm the PIN. Once completed, the USSD code will be activated, and you can start using it for various banking transactions.

Also read: Latest ways to Generate virtual NIN in Nigeria 2025

Activating the Access Bank transfer code is a simple process that customers can complete on their mobile phones:

Remember to keep your PIN secure and not share it with anyone. Also, ensure you have sufficient airtime on your mobile phone before using the USSD code, as network charges may apply.

Access Bank provides a suite of USSD codes designed to enable customers to conduct diverse banking transactions directly from their mobile devices. Here’s a compilation of some of these USSD codes along with their corresponding functionalities:

These USSD codes offer Access Bank customers a seamless and efficient way to manage their finances on the go, without the need for internet access or physical banking premises.

By dialling these codes and following the prompts, users can effortlessly conduct transactions, check balances, and perform various banking activities, enhancing their banking experience with Access Bank.

Also read: 7 Hot Tech Jobs in Global Demand 2025

If you suspect unauthorized access to your Access Bank USSD code, here’s how to block and unblock it:

Blocking Access Bank USSD Code:

Unblocking Access Bank USSD Code:

To unblock your previously blocked Access Bank USSD code, follow these steps:

While Access Bank Transfer Codes offer seamless banking experiences, users may encounter occasional issues that require troubleshooting.

Here are some common problems users may face and their corresponding solutions:

By following these troubleshooting steps, users can address common issues encountered while using Access Bank Transfer Codes and ensure a smooth banking experience.

Also read: Nigeria’s Top 10 Tech Brands in 2025

Yes, Access Bank may apply standard transaction fees for transfers and bill payments made through the USSD code. Charges vary depending on the transaction type and amount.

The daily transfer limit for Access Bank’s USSD code is usually up to ₦100,000. However, limits may vary based on account type and settings.

To pay bills, dial *901# and select the “Bill Payments” option from the menu. Follow the prompts to choose the bill type (such as electricity or cable) and enter the amount and other required details to complete the payment.

No, the *901# code is exclusive to Access Bank customers. Non-customers will need to open an Access Bank account to use the USSD banking services.

In conclusion, Access Bank Transfer Codes provide customers with convenience and flexibility in managing their finances. With these codes, users can initiate money transfers and settle their bills with ease, anytime and anywhere.

Whether it’s sending money to loved ones or paying utility bills, Access Bank Transfer Codes streamline the process. It eliminates the need for physical visits to bank branches or online banking platforms.

By leveraging Access Bank Transfer Codes, customers can enjoy a seamless banking experience in 2025.

If you found this piece useful, kindly drop a nice comment. Also visit and follow us on X @SiliconAfriTech, Facebook at Silicon Africa and Instagram at Siliconafricatech for access to other useful contents.