Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Opening an online Co-operative Bank account in Kenya is now one of the easiest things you can do without ever stepping into a banking hall. Using your phone, internet connection, and some personal details, you can do it within minutes and access bank services forthwith.

Opening a bank account today in Kenya is almost an imperative. Whether you are looking for a place to keep cash safe, where you receive your pay, for payment processing for business, or for accessing loans, Co-operative Bank has simplified it for you.

This guide will walk you through all that step by step. You’ll know what documents you need, the type of accounts available—student accounts, business accounts, or personal accounts—and a step-by-step guide on how to open your account online. After reading through, you’ll be confident in choosing the appropriate account that suits your lifestyle and financial goals.

Yes, you may apply for an online co-operative bank account in Kenya. Co-operative Bank has ventured into full-scale digital banking. They offer a welcoming online platform and mobile app that allow you to apply for an account without visiting a branch.

The process is easy. You enter your personal details, upload your necessary documents, and pay the first deposit via mobile money or card. The bank verifies your details and, on approval, you are issued your confirmation and guidance on how to access mobile banking and ATM services.

This online option is ideal for busy people, students, entrepreneurs, and those who do not want to go through the hassle of physical queues.

Read Also – How to Open an Equity Bank Account Online in Kenya | Full Guide

Let us consider the requirements prior to going through the step-by-step process of opening an online co-operative bank account in Kenya. You will require the following documentation and information ready:

It’s also important to note that some co-operative banks in Kenya may have additional requirements, such as a minimum opening balance or a reference from an existing customer. Be sure to check the specific requirements of the bank you’re interested in before proceeding.

Also Read – How to Open a CDS Account in kenya online

Now that we’ve covered the benefits and requirements, let’s take a look at the steps on how to open a co-operative bank account online in Kenya:

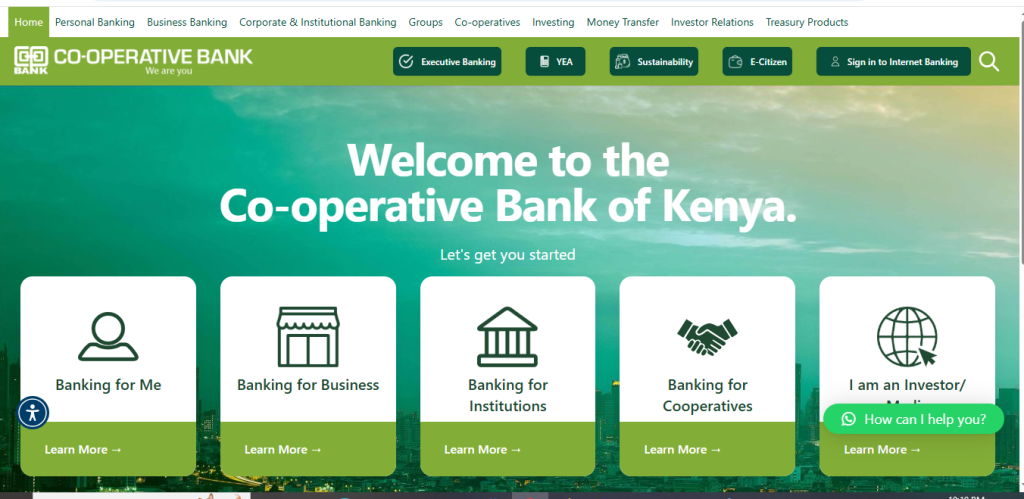

Start by visiting https://www.co-opbank.co.ke/ or downloading the Co-operative Bank mobile app from Google Play Store or Apple App Store.

Find and click on the ‘Open an Account’ link or button on the home page or app menu. You will be redirected to an online application form that will guide you in opening your account.

Choose the account type most suitable for you. For instance, Classic Account if this is your first account.

Once you’ve completed the application form, you’ll be required to upload the necessary documents, including your national ID, KRA PIN certificate, and proof of address. Make sure these documents are clear and legible, as they will be used to verify your identity.

Read Also – How to Open Dollar Account in Nigeria Online | All You Need to Know

Some accounts will charge you a minimum if you open your account. Pay with mobile money or deposit to the bank account provided.

Recheck the details you’ve submitted, then apply.

Your application and documents will be processed by the bank. When all is okay, you’ll be sent confirmation by SMS or email with your account number and online banking details.

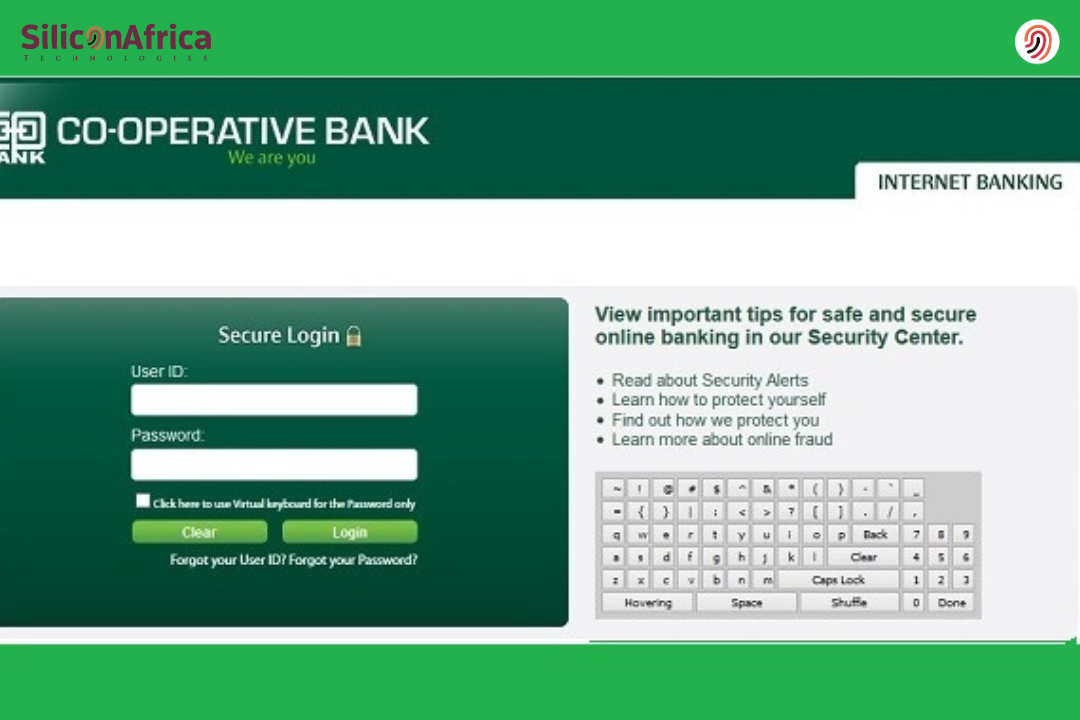

Log into your online platform or mobile application, key in your PIN, and you are good to go! You can now deposit money, withdraw, pay bills, and transfer cash with ease.

It is simple to open your Co-operative Bank account online.

Also Read – How to Open an Opay Account in Less Time – Full Guide

Co-operative Bank gives you more than the stereotypical one-size-fits-all. Here are the ones to know, especially when you’re surfing the internet:

Convenient and adaptable: deposit or withdraw any amount, obtain statements, a cheque book.

Opening balance Ksh 5,000 (or Ksh 10,000 for companies/saccos), monthly fee Ksh 300, ledger fee Ksh 35 per entry.

Best for salaried income earning. No opening and operation balance, no maintenance charges. You get a debit card (Ksh 600), loans, cash advance, asset financing.

Saving with fringe benefits. No opening or maintenance charges. Daily calculated interest, paid quarterly. One withdrawal per quarter. No debit card, statement every six months.

For the youth or those very young. Parent opens for those under 18 years. ID of Guardian and KRA PIN, birth certificate of child, Ksh 500 opening fee, optional Ksh 600.

Read Also – How to Open an M-Pesa Account in 2025

For the vibrant youth (18-30 years). No opening or operating balance, Ksh 600 for debit card, internet banking, reduced cheques.

High-end option for business individuals/executives. ID, KRA PIN, one referee, Ksh 50,000 opening balance, retain Ksh 400.

For small hustles or business owners. Low fees: ID, KRA PIN, Ksh 550 opening, debit card, low ledger charges, access to business loan.

For business owners. Three tiers: bronze, silver, gold depending on size of business. ID, KRA PIN, Ksh 500 opening.

Best suited for savings groups and chamas. Registered group: registration documents, signatories, IDs, KRA PINs, opening balance of Ksh 2,000. No operating balance, no deposits, mobile banking for free, group loan facility

Also Read – How to Open a Stripe Account in Nigeria 2025

Congratulations! You have successfully opened your co-operative bank account online in Kenya. Here are some tips and tricks to help you get the best out of your account:

By following these simple tips and tricks, you will be able to manage your co-operative bank account online in Kenya with ease.

Yes. Foreigners can open their accounts using a valid work or residence permit and passport.

Yes. Co-operative Bank uses encrypted secure platforms to secure your details.

Yes, but you might be requested to visit a branch for additional verification.

Opening an online Co-operative Bank account in Kenya is no longer a branch-only task. All you need is your ID, KRA PIN, phone or laptop, and familiarize yourself with the co-operative bank account products in Kenya that suit your plans.

Whether it is how to open a cooperative bank account in Kenya for your salary, savings, chama or hustle, the process is lucid, simple and secure.

Select the right account for yourself, get eligible for opening a co-operative bank account, press a few buttons, and enjoy banking at your hometown in Kisumu, Kileleshwa, or even grandma’s kitchen.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.