Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Banking shouldn’t be stressful. It should be quick, easy, and work even without an internet connection. That’s what GTBank’s USSD service is made for.

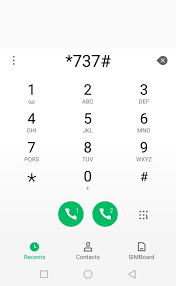

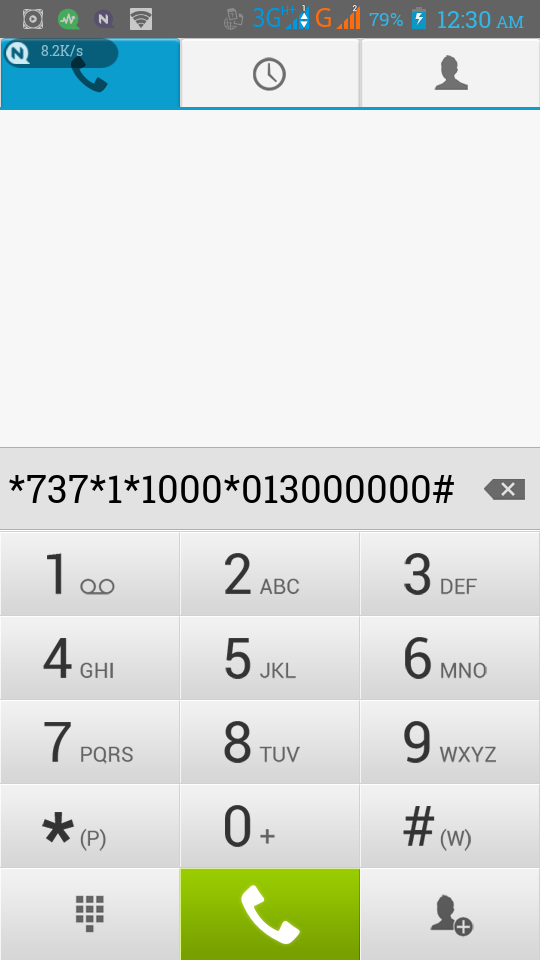

With the *737# transfer code, you can send money, pay bills, or check your balance in just a few seconds. But before you can enjoy these benefits, you need to know how to activate GTB transfer code.

If you’re good with technology or not. A student, trader, business owner, and even an older adult. We’ll explain all the different ways to activate the transfer code, with your ATM card or not. We’ll also show how to activate it using SMS or online.

By the end of this article, you’ll know exactly how to manage your GTBank account from your phone.

Activating the GTBank transfer code is the first step to enjoying easy and fast banking on your phone. With just a few simple codes, you can send money, check your balance, and do many other things; anytime, anywhere, even if you’re not in a big city.

Before you can activate the GTBank transfer code, make sure you have:

Step-by-Step Guide

Read: Fastest Place to Convert Crypto to Cash in Nigeria 2025

If you don’t have a GTBank ATM card, maybe because you just opened your account or lost your card, don’t worry. You can still activate your transfer code using an alternative method to verify your identity.

Steps to Follow

While the best way to activate the GTBank transfer code is by using the *737# code, some people ask if they can do it through SMS. GTBank does not allow full activation through SMS only, but SMS might be used during the process to help confirm your identity.

What you can do:

If you prefer using your phone or computer to manage your account, GTBank lets you set up or change your USSD PIN through their internet services, like the GTWorld app or the GTBank online banking website.

Steps to activate your GTB transfer code online

Once you activate the GTBank USSD code, it becomes a simple tool for doing everyday banking on your phone. The main code to get started is: *737#

Here are the most common ones:

While there may be a few limits to what you can do with GTBank’s USSD codes, the benefits far outweigh them. Here are some of the biggest advantages:

Also, read: How to check if someone is Sharing Your Data on GLO

GTBank’s USSD code (*737#) is fast and convenient, but like any service, it can sometimes have problems. Here are some common issues you might face and how to deal with them:

Even though the service works most of the time, a few things can go wrong:

The transfer PIN is the key to using GTBank’s USSD service. Without it, you won’t be able to complete any transactions. You normally create this PIN when you activate the *737# code, but you can also set it up or change it separately.

Steps

Guaranty Trust Bank, also called GTBank or GTB, is one of the top banks in Nigeria. It was founded in 1990 and is known for being modern, customer-friendly, and excellent at digital banking. The bank’s main office is in Lagos, but it also operates in other African countries and has a branch in the United Kingdom.

GTBank provides many services such as personal and business accounts, loans, online and mobile banking, and investment help. One of its most popular services is the *737# code, which allows customers to send money, check balances, buy airtime, and do other transactions easily, even without an internet connection.

The bank is trusted for being safe and easy to use. It also cares about giving customers a good experience and helping the community. Over the years, GTBank has won many awards for great service and strong financial performance.

If you’re having problems with activating your transfer code, you can easily reach GTBank through any of these options:

Related: How to Change Netflix Password | Step-to-step Guide

Yes. You can use it on any phone as long as the phone number is linked to your GTBank account.

You’ll need to update your GTBank records. Visit a GTBank branch or call GTConnect to update your number and reactivate USSD on the new SIM.

Yes. The daily USSD transfer limit is ₦100,000, but this can be increased through your GTBank app or by visiting a branch.

It’s highly secure. Every transaction is protected by your 4-digit PIN, which only you should know. Even if your phone is stolen, no one can access your account without your PIN.

Yes, but only if you’re roaming and still using your Nigerian number linked to your GTBank account.

Banking has changed such that you no longer need to stand in long lines, fill out forms, or rush to the ATM. With the GTBank USSD code, your phone can help you do almost everything you need from your bank. But first, you need to understand how to activate GTB transfer code to start using all these features.

If you haven’t activated your GTBank transfer code yet, don’t wait any longer. Just follow the easy steps in this guide and take charge of your banking anytime, from anywhere.

If you found this article useful, we’d love to hear from you! Drop your thoughts in the comments below. And don’t forget to connect with us on our social media channels for more tech tips and valuable content. Join our community and stay updated on all the latest insights!