Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Do you want to know more about the best Buy Now, Pay Later (BNPL) startups in Africa for 2024? Are you curious about how BNPL is transforming the way Africans shop, making high-end products like phones and other accessories more accessible?

Africa has seen a meteoric rise in the Buy Now, Pay Later (BNPL) trend in recent years.

BNPL has become a popular alternative financing option that increases consumer access to products, while a significant proportion of the continent’s population remains unbanked or under-banked.

This payment method’s popularity is surging, and a lot of African businesses are seizing the chance to enable customers to purchase things on flexible terms.

This article explores the top BNPL platforms such as Keza Africa and CD Care, and how they’re changing the retail landscape across Africa.

Related Also: 10 Best BNPL Platforms in Africa for Buying Phones

BNPL is a payment solution that allows customers to make purchases and pay for them gradually—often in interest-free installments.

The concept is straightforward: purchasers can spread out their payments over a few weeks or months to ease the financial strain on them rather than having to pay the entire sum at once.

This payment method offers many African customers a lifeline, making otherwise expensive products affordable.

BNPL is altering consumer purchasing habits in Africa, a region with low credit card use and little disposable income.

BNPL allows customers to purchase expensive goods with flexibility, including phones, electronics, and even clothing. Customers no longer need to wait months to build up money to obtain the things of their dreams.

Africa’s BNPL market is expanding quickly. The size of the global BNPL market was predicted to be USD 6.13 billion in 2022 and is expected to increase at a compound annual growth rate (CAGR) of 26.1% from 2023 to 2030, according to current studies.

Although precise statistics on Africa are few, the trend—which is being pushed by the growing digitalization of financial services—is becoming more and more prevalent in important economies like South Africa, Kenya, and Nigeria.

Read Also: Easy Ways to Buy Gift Cards in Nigeria 2024

Many African startups have embraced the BNPL model, offering unique platforms that cater to the continent’s diverse needs. Below are some of the top BNPL players in 2024.

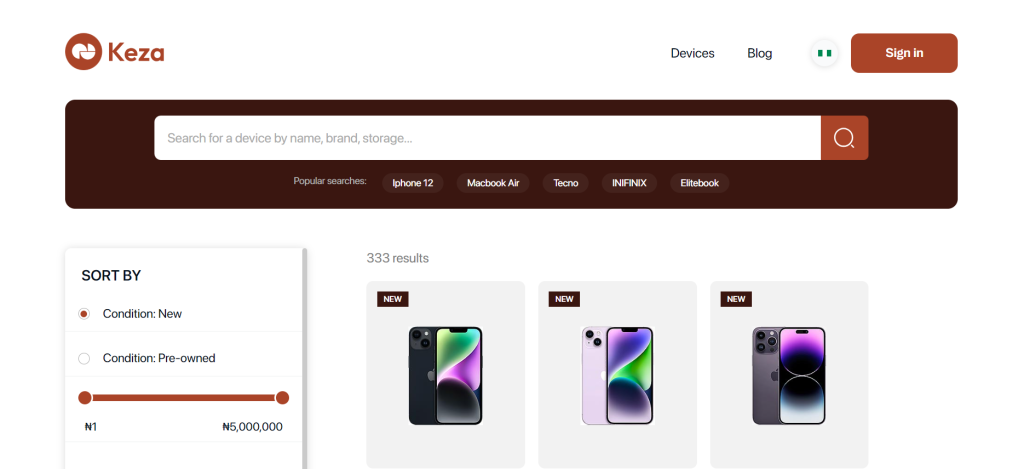

Keza Africa is a rising star in the African BNPL space. The platform enables consumers to buy a variety of products, from electronics to fashion, and pay for them in installments.

Currently, Keza Africa offers multiple payment plans, letting customers select the installment options that best fit their budget. This platform streamlines the purchasing process and appeals to both shoppers and sellers.

Keza is a darling among African customers and one of the top BNPL startups in the continent thanks to its excellent customer service, simplicity of use, quick approval, and easy payment options. Its collaborations with neighborhood merchants expand its market penetration and help it stand out in a crowded field.

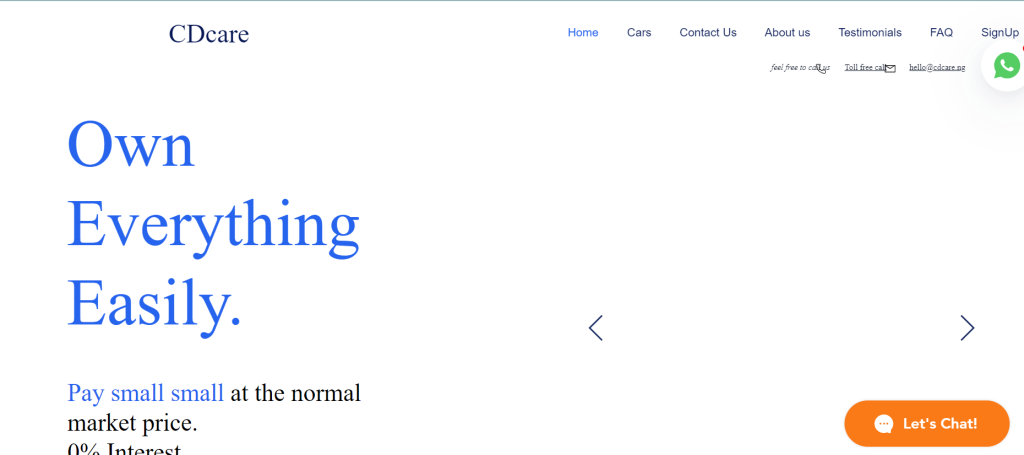

Another standout African BNPL startup is CD Care established in 2020 by Oluwatobi Odukoya and Ayodeji Farohun. This BNPL platform has carved out a niche in helping consumers purchase phones and electronics without making payments upfront.

Customers of CD Care can select a product, pay a small deposit, and divide the remaining amount into monthly installments. The platform has gained particular popularity among consumers who are trying to find inexpensive ways to purchase expensive devices like smartphones.

The ease of use, accessibility, simplicity in tracking installment payments, and variety of device possibilities of CD Care make it a standout start-up. It is becoming more and more popular, particularly with phones like the newest Android and iPhone models.

Also See: 15 Best Cryptocurrencies to Buy in September 2024

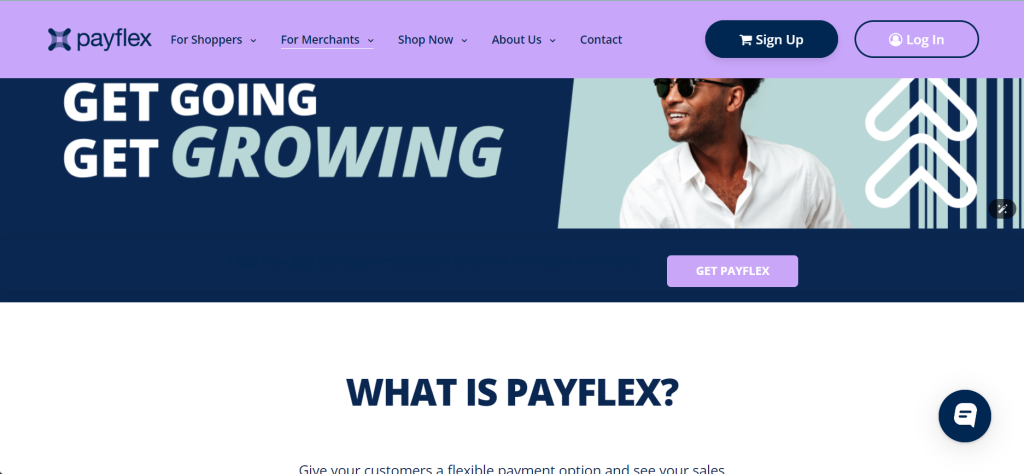

Payflex, another major player in the field of Buy now, pay later. Founded in 2017 and based in Johannesburg, South Africa, Payflex’s game-changing model allows customers to split payments into four interest-free installments, making it popular for online shopping.

Its 5-year search growth is 119%, indicating a steady increase in popularity. With the support of $500K in funding from a corporate round, PayFlex has amassed approximately 25,000 happy customers’ ratings on Trustpilot.

PayFlex has a positive effect on both customers and businesses, as seen by the 30% boost in sales experienced by its users. It is the preferred BNPL choice in the area because of its consistent and dependable service.

South Africa’s Mobicred is a game-changer in the BNPL scene. Mobicred was founded in 2013 and offers consumers access to credit for online purchases.

Consumers can apply for a revolving credit facility, which they can use at thousands of participating retailers and partner merchants.

You can use your Mobicred account to spend whatever you recoup by making a single monthly payment for all of your purchases with a revolving credit limit.

Mobicred, with a heavy emphasis on e-commerce, has assisted South African consumers manage their finances while boosting sales for online retailers. Currently, Mobicred has over 4,000 merchants.

Originally starting as a digital bank, Carbon has evolved to offer a wide range of services, including BNPL. Today, Carbon has become a leading BNPL platform in Nigeria that allows consumers to buy items online and pay later.

Customers can make purchases and pay over time, either in-store or online, with Carbon’s BNPL option, which was established in 2016. For convenience, customers can divide their payments into four instalments at 0% interest.

Carbon has established itself as a reliable platform for flexible payments in Nigeria because to its user-friendly software and expanding network of partner businesses. It is supporting national financial inclusion efforts.

Read More: The Most Funded African Startups in 2024

Founded in 2020 and based in Lagos, Nigeria, Zilla is a BNPL platform that helps customers pay for goods and services in easy installments. With an innovative approach, Zilla allows users to split payments over time, reducing financial pressure.

Since Zilla helps companies attract more clients who want flexible payment methods, merchants gain from improved conversion rates and sales figures.

In Nigeria’s e-commerce market, Zilla is especially well-liked since it gives both big and small retailers more control.

Lipa Later, founded in 2018, is a leading BNPL platform in East Africa, with headquarters in Nairobi, Kenya. The platform enables customers to purchase items and pay later in monthly installments, with a focus on electronics and household goods.

Because of its adaptable payment options, Lipa Later has gained popularity in Kenya, Uganda, and Rwanda, increasing consumer affordability and boosting retailer sales. Additionally, it has secured a leading position in the African market because to its strategy of financial inclusion and e-commerce integration.

Lipa Later’s quick growth is changing the BNPL market in East Africa.

Credpal, founded in 2018 in Lagos, Nigeria, is one of the best BNPL startups in Africa to bridge the credit gap in Nigeria and beyond.

Due to its substantial funding and partnerships with other retailers, this BNPL firm is now well-liked by Nigerians searching for flexible financing choices.

Customers can purchase a variety of goods and services now and pay for them later using the credit at the point-of-sale approach, which makes it simpler for them to control their expenditures.

You might want to see this: STEP Helps African Startups Connect with Community and Talent

Easybuy is another buy now pay later startup based in Nigeria focused on providing installment payment plans for smartphones and electronics.

Easybuy has emerged as a top choice for customers looking for cost-effective solutions to acquire the newest technology since its introduction in 2019.

Easybuy has made high-end phones accessible to more Nigerians without the burden of upfront payments thanks to its flexible repayment options.

Easybuy’s revolutionary approach in the BNPL ecosystem is its collaboration with phone stores.

Rayda, founded in 2021 in Lagos, Nigeria, is a rising BNPL platform that enables customers to buy products and services with installment plans.

This BNPL is well-known for its easy-to-use interface and seamless payment process, and it serves an increasing number of youthful, tech-savvy customers.

The platform helps businesses increase sales and customer engagement by providing flexible payment options that appeal to consumers with restricted credit options.

Editor’s Pick: Breega Introduces $75 Million Fund Aimed at African Startups

There are a lot of reasons why BNPL platforms are thriving in Africa. Some of the key factors include:

These factors combine to make BNPL a highly attractive option for both consumers and businesses across Africa.

The BNPL model is expanding, but there are obstacles in the way. The low incidence of financial literacy is a significant problem since it might result in improper handling of installment payments.

Concerns concerning interest rates and repayment periods are also brought up by the unregulated nature of certain BNPL platforms.

Amidst its challenges, for BNPL startups like CD care and Keza Africa, to succeed, they need to:

With BNPL emerging as a competitive alternative to high-interest loans from traditional lenders, the future of BNPL in Africa is bright.

Forecasts indicate that by 2024, BNPL payments in Africa are predicted to reach $15.5 billion, and by 2029, the gross merchandise value is anticipated to reach $19.5 billion.

On the other side, Yahoo Finance projects that Nigeria’s BNPL payments will increase by 17.2% annually.

On the other hand, Yahoo Finance predicts that BNPL payments in Nigeria are expected to grow by 17.2% annually.

BNPL is expected to play an increasingly more significant role in the retail ecosystem of the continent as internet penetration rises and more Africans go online. More firms that provide specialised services and target specific niches could be expected to enter the market.

In Africa, the BNPL model has already advanced significantly, giving customers additional options for how to shop and obtain goods.

BNPL startups are transforming the African e-commerce scene, with platforms such as CD Care and Keza Africa at the forefront of this movement.

There are countless opportunities for BNPL to expand as technology develops, bringing with it both problems and exciting potential for the future.

I hope you found this piece of information worthy. Please leave us a comment below.

You might want to check out some of our useful and engaging content by following us on X/Twitter @Siliconafritech, IG @SiliconAfricatech, or Facebook @SiliconAfrica

Cheers!

Platforms like Keza Africa and CD Care are the leading BNPL platforms in Africa. Their popularity can be linked to their flexibility and ease of use.

While BNPL is often used for electronics and fashion, some platforms also offer services for other goods and services.

Many BNPL platforms in Africa, such as Payflex, offer interest-free installment options.

Missing payments can lead to penalties, and some platforms may charge high fees for late payments.

They typically earn revenue through merchant fees and interest on missed payments.