Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

1 bitcoin to naira in 2009 vs. 1 bitcoin to naira in 2025 is an exciting topic, especially at a time like this. In 2009, 1 Bitcoin (BTC) was less than 1 USD (United States Dollars).

In its first exchange recorded that year, 5,050 BTC were exchanged for $5.02. Based on a simple calculation using that rate, the estimated value of 1 BTC was equivalent to $0.00099.

In the same year, the Naira to USD exchange rate was N148.91/$. Hence, 1 bitcoin to 1 naira in 2009 was equivalent to N0.147/1 BTC.

The story turned around in 2025, especially with the highest rise in the value of bitcoin in 2021. 1 bitcoin to naira in 2009 is no longer the same as 1 bitcoin to naira in 2025.

In 2025, 1 Bitcoin is now worth over ₦134 million, well above ₦100 million per BTC. Why is the difference so great in just a span of sixteen years, barely two decades later? And what could have caused or influenced this astronomical rise? Follow us on this exposition to learn more.

Bitcoin is a cryptocurrency, which means a digital asset that uses cryptography to control its creation and management rather than relying on central authorities. It was originally designed as a medium of exchange, but now it is considered a store of value.

Satoshi Nakamoto invented and implemented it, integrating many ideas from the cryptography community. Bitcoin’s rise began in the mid-2010s, when some businesses started accepting it in addition to traditional currencies.

On January 3, 2009, the Bitcoin network came into existence with Satoshi Nakamoto mining the genesis lock of Bitcoin, which had a reward of 50 bitcoins.

Also read: Bitcoin’s Big Update: Controversy Grows Over Bitcoin Software Update

We cannot talk about the difference between 1 bitcoin to naira in 2009 and 1 bitcoin to naira in 2025 without discussing the factor(s) which contributed to the rise of bitcoin. The rise of bitcoin is actually based on simple economics—the principle of demand and supply.

When there is a high demand and a low or limited supply, the prices start to rise to reduce the amount of supply that would reach the consumers, thereby making the goods more valuable and only affordable by a small percent of the population.

If the goods continue to be relevant and demand is constant, the prices will continue to skyrocket until they are akin to gold.

In the mid-2010s, when more businesses and organizations started to accept bitcoin as a form of currency, its demand rose, causing a pump in price.

Many people came to understand that bitcoin offers true ownership when compared to fiat currency (currency that banks print, such as the dollar, naira, pounds, etc.).

True ownership, in the sense that one has no control over a normal fiat currency. It has regulatory and control measures, is subject to ups and downs outside of one’s control, and the government can print and seize it.

Let us run through the chronicles of bitcoin’s rise and fall since its inception. The next section presents excerpts obtained from Investopedia in an article titled ‘Bitcoin’s Price History.’

Bitcoin had a price of zero when it was introduced in 2009. Its price jumped from its long-held level of $0.10 to $0.20 on Oct. 26, 2010. Before the year had closed out, it had reached $0.30.

In 2011, it started growing past $1, reaching a peak of $29.60 on June 8, 2011; however, a sharp recession in cryptocurrency markets followed, and Bitcoin’s price dropped, closing out the year at about $5.2

The year 2012 proved to be a generally uneventful year for Bitcoin, though it did increase by a few dollars; however, 2013 witnessed strong gains in price. Bitcoin began the year trading at $13, crossed $100 by April, then $200 by October.

The remainder of the year witnessed historic gains for Bitcoin. It crossed $1,000 in November and closed out the year at $732.2

Prices slowly climbed through 2016 to over $900 by the end of the year. In 2017, Bitcoin’s price hovered around $1,000 until it broke $2,000 in mid-May and then skyrocketed to close at $19,188 on Dec. 16.

Mainstream investors, governments, economists, and scientists took notice, and other entities began developing cryptocurrencies to compete with Bitcoin.

Bitcoin’s price moved sideways in 2018 and 2019, with small bursts of activity. For example, there was a resurgence in price and trading volume in June 2019, with the price surpassing $10,000. However, it fell to a closing price of $6,612 by mid-December.

In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin’s price burst into action once again. The cryptocurrency opened the year at $7,161. The pandemic shutdown and subsequent government policies fed investors’ fears about the global economy and accelerated Bitcoin’s rise.

At the close on Nov. 23, Bitcoin was trading for $18,383. Bitcoin’s price closed at $28,993 on Dec. 31, 2020, increasing 416% from the start of that year.

Bitcoin took less than a month in 2021 to smash its 2020 price record, surpassing $40,000 by Jan. 7, 2021. By mid-April, Bitcoin prices reached new all-time highs of over $60,000 as Coinbase, a cryptocurrency exchange, went public.

Institutional interest propelled its price further upward, and Bitcoin reached a peak of $64,895 on April 14, 2021.

By the summer of 2021, prices were down by 50%, closing at $30,829 on July 19. September saw another bull run, with prices scraping $52,956, but a large drawdown took it to a closing price of $40,597 about two weeks later.

On Nov. 10, 2021, Bitcoin again reached an all-time high of $69,000 before closing at $64,921. In mid-December 2021, Bitcoin fell to a close of $46,211. The price started fluctuating more as uncertainty about inflation and the emergence of a new variant of COVID-19, Omicron, continued to spook investors.

Between January and May 2022, Bitcoin’s price continued to gradually decline, with closing prices only reaching $47,459 by the end of March before falling further to $29,000 on May 11.

This was the first time since July 2021 that Bitcoin closed under $30,000. On June 13, crypto prices plunged. Bitcoin dropped below $23,000 for the first time since Dec. 2020. Bitcoin then dropped below $20,000 by the end of 2022.

Fortunes changed for Bitcoin in 2023, which saw a stellar rise in the price of the cryptocurrency. Bitcoin opened 2023 at a price of $16,530. It rose consistently throughout 2023, ending the year at $42,258.

Interestingly, Bitcoin’s price trends appeared to mimic those of the stock market from Nov. 2021 through June 2022, suggesting that the market was treating it like a stock. It similarly followed this trend through most of 2023 and 2024.

In January 2024, the long fight for Bitcoin Spot ETFs came to a close after the SEC was forced by courts to review its denial of certain Bitcoin-related investment products.

Some brokerages swarmed the market and increased their holdings, while others, like Grayscale’s Bitcoin Trust (GBTC), experienced significant outflows at the onset.

The outflows from certain funds slowed going into March, settling the market somewhat. The marketwide rebalancing was likely because there were suddenly more options for investors to choose from.

Also read: 15 Best Sites to Buy Bitcoin in Nigeria: Best Crypto Sites

Bitcoin’s price climbed quickly after the fund approvals—in late February and early March, it once again breached $60,000, setting a high of $69,210 on March 6 and another of $70,184 on March 8.

On March 14, Bitcoin continued setting records, reaching $75,830 by mid-day on EXMO, a cryptocurrency exchange in Poland.

The excerpts above give comprehensive details about the rise and fall of bitcoin through the years. Bitcoin’s limited supply compared to its increasing demand is one of the reasons why 1 bitcoin to naira in 2009 is much different from 1 bitcoin to naira in 2025.

There are several factors contributing to the persistent fall in the naira. One of them is the fear of loss of investment. A lot of people are choosing the USD over the naira.

In an article, GT Igwe Chrisent, founder of online trading platform Truzact, said they have recorded more transactions.

“We have seen a surge in the USD savings we have in our vault,” Chrisent said.”

The information Chrisent provided shows that nobody wants to have a million naira worth $2,000 today and then tomorrow, the one million naira is now worth $1,500. So, everybody is basically trying to hedge against such unpredictable falls. No one wants to lose their investment to the fall in the naira value.

To better understand the conditions responsible for the fall of the Nigerian naira, let us explore some excerpts from one of The Cable Nigeria‘s articles.

In the article titled ‘Freed’ but Bound: Why Liberalising Exchange Rate is Bad for the Naira, one of their writers, Zuhumnan Dapel, delved into the factors responsible for the fall of the Naira and offered some insights on how to salvage the situation.

Deductions can be made from the excerpts as to the factors that contributed to the difference between 1 bitcoin to naira in 2009 and 1 bitcoin to naira in 2025. Check out the excerpts below:

Also read: How to Buy Bitcoin with Paytm Online Wallet in Nigeria

The fall of the naira is fast diminishing the international (purchasing power of the currency and consequently) buying strength of Nigerian residents.

For instance, as recently as 10 years ago, Nigerians schooling or buying foreign education services abroad in the United Kingdom needed roughly two million naira to pay a tuition of £10,000.

Today, they will need close to 20 million naira to pay the same school fees. A tenfold increase.

To liberalise a currency is to let the forces of demand and supply of the currency solely determine the value of the currency.

The technical term for this in economics is called “floating”. For instance, if Nigerians rush to buy the dollar more than Americans are rushing to buy the naira, the value of the dollar will go up at the expense of the value of the naira.

In other words, the value of the naira will fall. Similarly, if there is more demand for the naira by Americans and less demand for the dollar by Nigerians, the value of the naira will rise. It will become stronger.

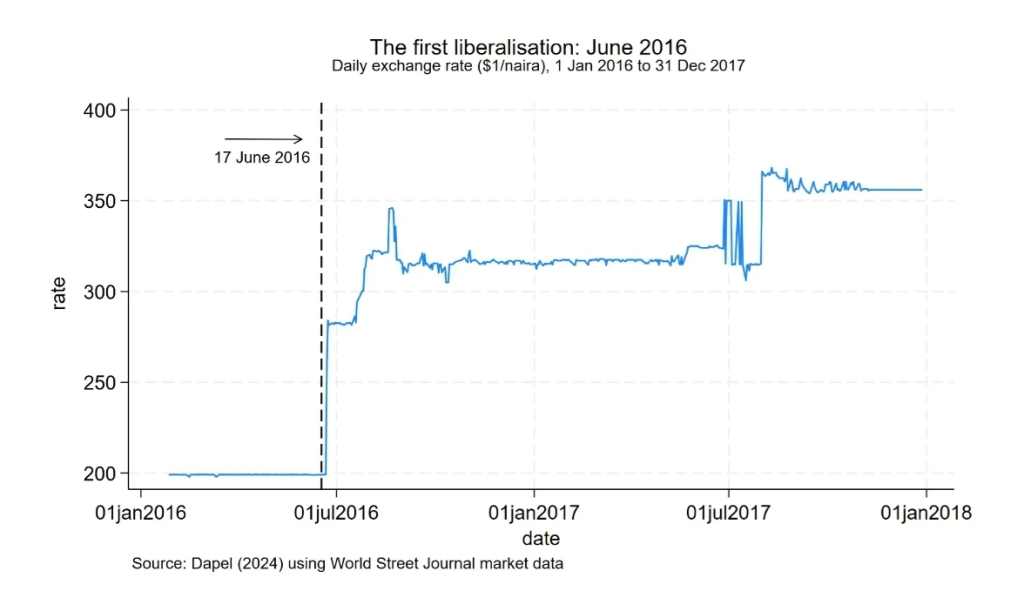

On 17 June 2016, the naira was ‘freed’ by the central bank. But the ‘freedom’ set the currency on a freefall such that within a few months, by the end of that year, it had fallen in value by 60 per cent against the US dollar (see the chart below).

Before this, the naira was pegged at 197 to the dollar. The sharp drop in the value prompted the apex bank to rescind its initial forex policy, thus intervening in the market to save the naira.

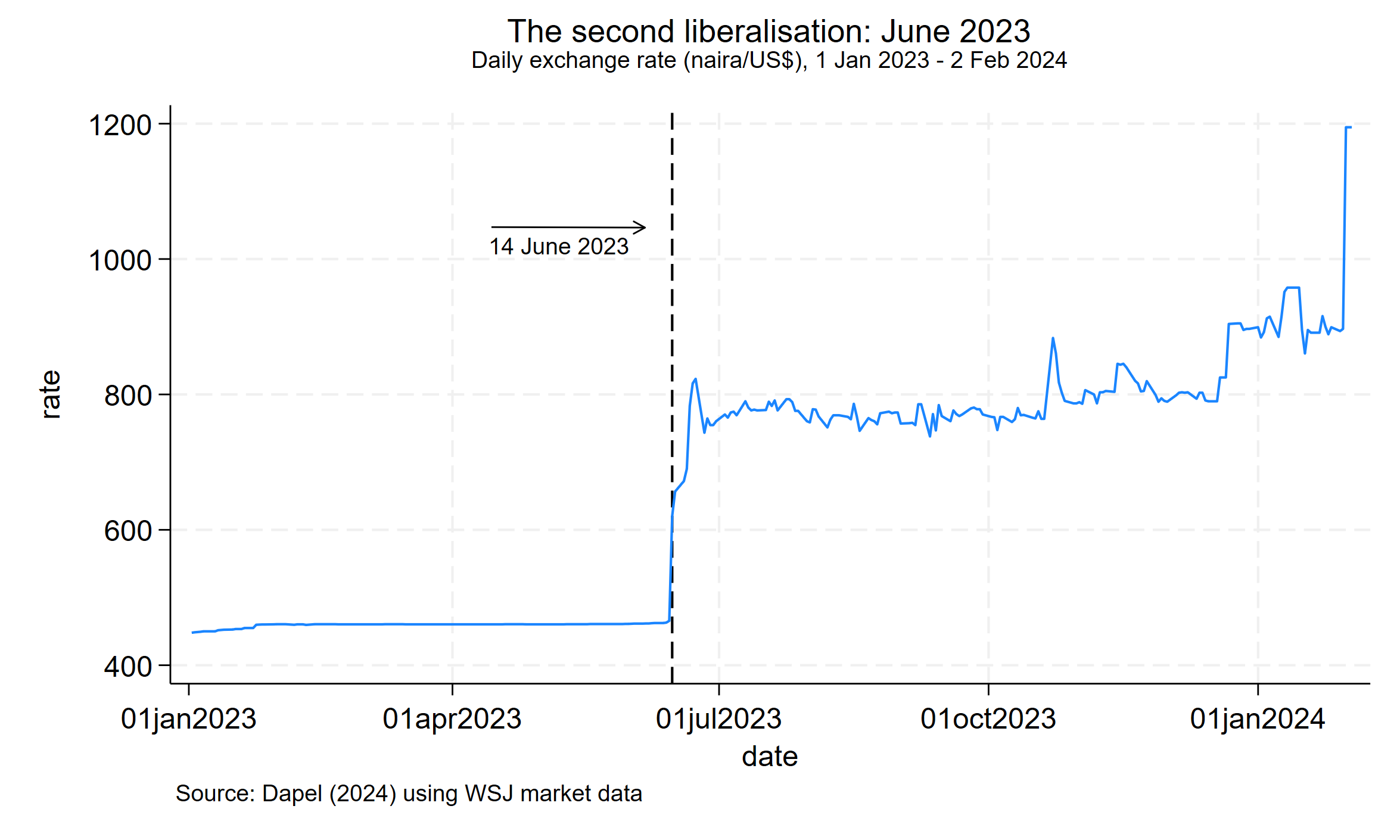

Seven years down the line, on 14 June 2023, the naira was yet again ‘floated’. This time around, after hovering around 400, the naira crashed to about 1200 naira to the dollar as of February 2024. See the graph.

Also read: How Can I Start Bitcoin Business in Nigeria in 2025

When the dollar is scarce – its demand greater than its supply – and you ‘float’ the naira exchange rate, you have automatically placed the naira on a glide path to losing its value.

There is no convincing economic justification for floating the naira in a dollar-scarce situation and a fragile financial system for some reason.

The naira cannot compete with the dollar. The United States of America, being the primary supplier of the dollar and as a world economic super-power, has more to bring to the international trade table or the world market stage than Nigeria.

Therefore, Nigeria letting its currency ‘float’ or roam about in search of its value in the international market is equivalent to inflicting self-damage.

The naira cannot compete with the currencies of world economic giants because these stronger economies, more than Nigeria, bring more economic value to the rest of the world.

For example, Nigeria’s daily crude oil output, the country’s major foreign exchange earner, is not sufficient to meet America’s two-hour oil consumption as the United States consumes approximately 20 million barrels a day.

Also, ‘floating’ a currency in an unstable monetary system opens the possibility of speculative attacks on the dollar. Dubious traders will get the dollar at an official rate and sell it through the black market at a whooping premium.

The increasing scarcity of the dollar and its growing demand in Nigeria are at the root of the collapse of the naira. Why is the dollar scarce in Nigeria? I have identified four contributing factors.

In eight years, between 2007 and 2014, Nigeria earned over US$340 billion in oil revenues. This figure has fallen to US$110 billion (more than three times) in the recent eight years between 2015 and 2012, thus, shrinking the nation’s capacity to pull in more dollars into its economic system.

In late 2015, the then government through the central bank activated capital control measures such as shutting out access to foreign currency withdrawals and imposing limits on how much cash Nigerians can withdraw using foreign ATMs.

These interventions did not pay off as the currency further depreciated. As a result, factories that could not obtain dollars to import raw materials and capital goods shut down and eliminated tens of thousands of jobs.

By mid-2016, the economy had fallen into a recession.

Foreign investors have been fleeing out with their dollars, draining the system of cash.

Within five pre-election and election years (2013-15 and 2018-19), a total of over US$100 billion was withdrawn from Nigeria through the financial services forex utilisation.

There is no guarantee that these dollars are coming back given that more foreign companies have recently exited the Nigerian market.

Fourth, the demand-pull effect. Rising inflation in Nigeria is affecting the portfolio behaviour of many income savers given that the rising cost of living weakens the future purchasing power of the local currency.

Instead of saving in naira, they prefer to save in dollars, thus pushing up the demand for the dollar. It has been alleged that Nigerians have US$30 billion in savings vainly sitting in their domiciliary accounts across domestic commercial banks.

The central bank recently quelled down a public rumour that it intends to convert these deposits from dollars to naira.

Another side of the dollar-demand effect is the rising exodus rate of Nigerians especially to Europe and North American countries.

According to World Bank numbers, Nigeria’s net migration pace has been progressively negative since 2014, implying that more people are leaving the country than are entering the country.

Tellingly, those relocating from Nigeria to other parts of the world add to the demand for foreign currencies to defray their resettlement costs abroad.

The excerpt above, though not exhaustive, thoroughly discusses some major factors that are responsible for the depreciation of the Nigerian Naira, which culminates in the astronomical difference between the value of 1 Bitcoin to naira in 2009 and 1 Bitcoin to Naira in 2025.

Also read: How to Convert Bitcoin to Naira? Your Complete Guide to Selling Bitcoin for Naira in 2025

Cryptocurrency has witnessed a 1100% rise in investors between 2022 and 2023. If you have been following the rise of Bitcoin and other cryptocurrencies in foreign market or the Nigerian market and you weren’t in on the deal from the beginning, you are wondering whether to jump on the train or quietly stay in the station and watch the train wreck.

Well, there must be thorough research on the advantages and disadvantages before you make your decisions. Most beginners end up losing their capital due to a lack of understanding of the intricacies involved in the cryptocurrency market. Will that cryptocurrency pump or will it fall?

Instead of relying solely on public opinion, one must also consider their investment goals, assess their risk tolerance, and acquire sufficient knowledge in that area before investing.

Also read: How to Buy Bitcoin in Nigeria With a Bank Transfer

The ridiculously astonishing disparity between 1 bitcoin to naira in 2009 and 1 bitcoin to naira in 2025 highlights a significant shift in global financial dynamics. While Bitcoin soared due to its limited supply and increasing demand, the Nigerian naira faced substantial depreciation, exacerbated by factors such as dwindling oil revenues and volatile forex policies.

The disparity underscores the transformative potential of cryptocurrencies like Bitcoin, offering autonomy, transparency, and a hedge against inflation amidst traditional financial uncertainties. However, it also underscores the risks, including volatility and regulatory challenges, necessitating informed decision-making and robust security measures for potential investors.

When dealing in the crypto market, understanding both the opportunities and risks is very important for navigating the market wisely.

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).

Bitcoin is a cryptocurrency, which means a digital asset that uses cryptography to control its creation and management rather than relying on central authorities.

Satoshi Nakamoto created Bitcoin in 2009, integrating many ideas from the cryptography community.

In 2025, the exchange rate for 1 Bitcoin is approximately ₦134 million, making it over ₦30 million higher than ₦100 million per BTC.