Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Wallet Africa, a revolutionary fintech company, is reshaping the way we think about financial services. Imagine having a single platform that streamlines all your financial activities, from sending money across borders to paying bills and even managing company expenses — Wallets Africa does just that and more.

Born out of a need to simplify financial transactions for both individuals and businesses across Africa, this fintech powerhouse is leading the charge in making banking and financial management effortless, secure, and accessible to everyone.

With a user-friendly interface and an array of versatile features, this company is not just about sending or receiving money; it’s about empowering people with the tools they need to seamlessly navigate the financial landscape.

Join us as we explore how Wallets Africa is not just participating in the fintech revolution but leading it, making comprehensive financial services a reality for people across Africa and beyond.

Wallets Africa is a pioneering fintech company with a mission to revolutionize the way financial services are accessed and delivered across Africa. The company was established in 2018 and is headquartered in Lagos, Nigeria.

As a leading provider of Wallets Africa financial services, the company is focused on breaking down the traditional barriers to financial inclusion, offering an array of user-friendly digital solutions.

This company aims to empower individuals and businesses alike, providing them with the tools to manage their finances efficiently, securely, and conveniently.

By leveraging cutting-edge technology, Wallets Africa seeks to simplify transactions, making banking services more accessible to the vast and diverse African population. This mission underscores the company’s commitment to fostering economic growth and enhancing the quality of life across the continent through innovative financial solutions.

What truly set this company apart is its user-centric approach, offering a wide array of financial services from mobile payments to international money transfers, and even virtual cards for online transactions. The ease of use, security, and versatility of Wallets Africa’s financial services make it a preferred choice for users looking for efficient, reliable financial solutions.

This platform’s integration of technology to solve real-world problems is at the heart of its uniqueness in the fintech landscape. This company has successfully democratized access to financial services, breaking down traditional barriers and making banking inclusive.

Its dedication to innovation and customer satisfaction ensures that Wallets Africa remains at the forefront of the fintech revolution, providing sustainable, evergreen solutions that respond to the dynamic needs of its users. In a continent where financial inclusion is pivotal to economic growth, is making significant strides in making financial services accessible to all.

Read Also – Paymob and Mastercard in Partnership to Advance Digital Payment Acceptance in MENA.

Wallets Africa is not merely a bystander in the financial sector; it’s an active participant in transforming how people interact with their finances. By leveraging technology, Wallets Africa is not just a participant in the financial sector; it’s a pioneer, pushing the boundaries of what is possible and democratizing financial services across the continent.

Here’s a deeper dive into how Wallets Africa is making waves and transforming financial services.

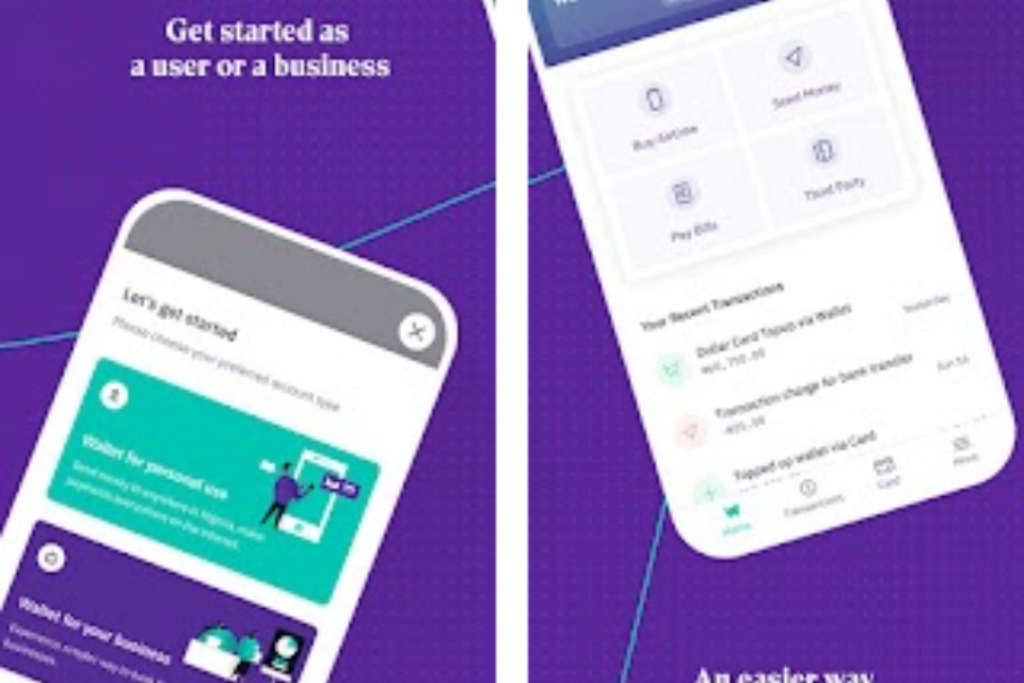

Digital wallets represent a foundational shift in how individuals and businesses manage their finances. With Wallet Africa, the digital wallet is not just a tool for financial transactions; it is an ecosystem that integrates various aspects of financial services into a single, user-friendly platform.

The emphasis is on reducing friction and making financial activities—from sending and receiving money to paying bills—accessible and straightforward.

The impact of Wallet Africa’s digital service extends beyond convenience. It is a significant step toward financial inclusion, allowing people with limited access to traditional banking services to participate in the economy.

This is crucial in regions where access to physical banks is challenging, making this company’s digital wallet a lifeline for both personal finance management and entrepreneurship.

The second pillar of Wallet Africa’s transformation of financial services is its focus on facilitating cross-border payments. In today’s global economy, the ability to seamlessly transfer funds across geographical boundaries is crucial. However, traditional methods often come with high fees, long processing times, and a lack of transparency.

Wallet Africa addresses these challenges head-on, leveraging fintech innovation to offer a cross-border payment service that is not only faster and more affordable but also more transparent. This service significantly impacts businesses, allowing them to expand their operations internationally without being bogged down by inefficient and costly financial transactions.

Wallet Africa’s approach to cross-border payments also reflects a broader trend in the fintech sector towards building a more interconnected and inclusive global financial system. By breaking down barriers to international money movement, Wallet Africa is helping to pave the way for a more robust global economy.

One of the ways Wallets Africa is revolutionizing financial services is through its seamless bill payments and airtime recharge capabilities. This company offers an evergreen solution that addresses the everyday financial needs of its users.

Customers can easily pay utility bills, such as electricity and water. They can also pay for cable TV subscriptions directly from their Wallets Africa accounts. This service eradicates the need for physical visits to payment centers. It thereby saves time and reduces the hassles associated with bill settlements.

Additionally, this company simplifies airtime recharge for its users. Whether for themselves or others, users can instantly top-up airtime across various network providers directly from their app or web platform. This convenience ensures that the company users remain connected without the need to visit physical stores or rely on scratch cards.

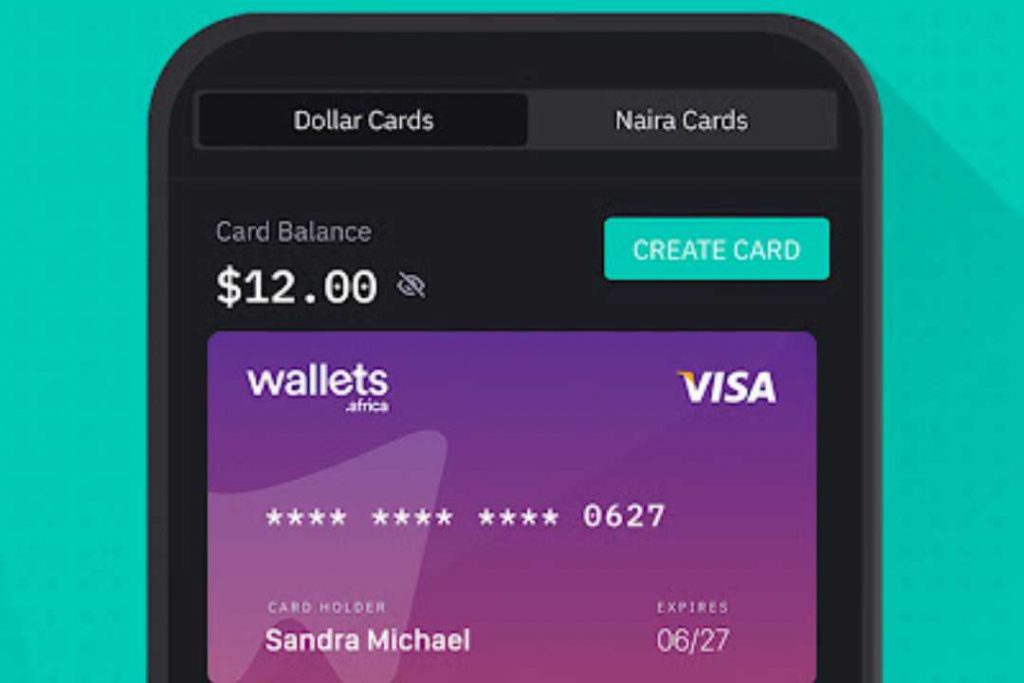

In today’s digital age, the demand for flexible and secure payment options is higher than ever. Wallets Africa addresses this need by offering both virtual and physical cards. These innovative products are redefining the shopping and transaction experience for users across Africa.

Wallets Africa’s virtual cards are designed for safe and seamless online transactions. Users can generate these cards within seconds through the Wallets Africa app, providing them with an immediate solution for online purchases, subscriptions, and bookings. These virtual cards, linked directly to users’ Wallets Africa accounts, offer an added layer of security, as they can be easily frozen or deleted if compromised.

For in-store purchases and withdrawals from ATMs, this company provides physical cards. These Visa-powered cards are accepted worldwide, giving users the freedom to access their funds and make transactions wherever they go. The physical cards also feature advanced security measures, including PIN and chip technology, to protect users’ finances.

In traditional banking systems, customers often face complex fee structures that are difficult to understand and predict. These can include hidden charges, high transaction fees, and unexplained account maintenance fees, among others.

Wallets Africa disrupts this model by implementing a transparent and straightforward fee structure, Wallets Africa presents its fees upfront enabling customers to have access to a detailed breakdown of any charges they may incur, whether it’s for transfers, withdrawals, or any other financial service the platform offers.

This approach ensures that customers are fully informed about any charges they may incur, without any hidden surprises. Moreover, Wallets Africa strives to keep these fees affordable, significantly lower than traditional banking charges, thus democratizing access to financial services for a wider audience.

Also Read – Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2025

Wallets Africa, as a pioneering fintech company, stands at the forefront of revolutionizing the financial services sector in Africa. By leveraging technology, this company is not only streamlining financial transactions but also making a substantial contribution to the continent’s economic growth.

Let’s explore how Wallets Africa, through its innovative financial services, is fostering a financially robust society.

At the heart of Wallets Africa’s contribution to economic growth is its commitment to financial inclusion. Traditional banking systems have left a significant portion of Africa’s population underbanked or unbanked.

Through its fintech solutions, bridges this gap by providing easy access to financial services via mobile devices. By democratizing access to financial services, this company is enabling individuals and small businesses to participate in the economic system, thereby boosting economic activity and growth.

One of the key features of Wallets Africa’s financial services is the simplification of transactions. The fintech platform allows users to perform a multitude of financial operations such as sending and receiving money, paying bills, and purchasing airtime.

This ease of transaction removes barriers to commerce, encourages consumer spending, and, as a result, stimulates economic growth. By providing a seamless transaction experience, this company is contributing to the efficiency of the market.

Small businesses are the backbone of Africa’s economy. Wallets Africa plays a crucial role in supporting this sector by offering financial tools that empower small business owners.

From facilitating easier payment solutions to offering straightforward business accounts, this company removes many of the financial hurdles small businesses face. By providing these essential services, the fintech company is helping small businesses thrive, thereby fostering job creation and economic stability.

Financial literacy is fundamental to a financially robust society. This company contributes to this through education on the use and benefits of its fintech solutions.

By understanding how to manage finances effectively using the company’s platform, individuals and businesses can make informed financial decisions, leading to better financial health and stability. This education is pivotal in creating a more economically empowered population.

Fintech companies like Wallets Africa are pivotal in showcasing the potential of the African market to foreign investors. By innovating and proving that financial services can be delivered efficiently on the continent, this company attracts foreign investment into the sector.

This not only boosts the fintech ecosystem but also contributes to the overall economic growth. This is by bringing in capital, creating jobs, and fostering technological advancements.

Read Also – Wallets Africa: The Fintech Company Transforming Financial Services

Looking towards the future, Wallets Africa, a leading fintech company, is poised for exponential growth. In an ever-evolving financial services sector, the company aims to expand its array of offerings, further cementing its role as a pivotal player.

The fintech landscape demands continuous innovation, and Wallets Africa is committed to staying at the forefront. They do this by leveraging cutting-edge technology to enhance user experience and accessibility. Their roadmap includes developing more inclusive financial services that cater to the unbanked and underbanked populations.

Furthermore, strategic partnerships and expansions into new markets are on the horizon, aimed at broadening their reach and impact. As they navigate the challenges and opportunities ahead, Wallets Africa’s dedication to providing secure, efficient, and user-friendly financial services remains unwavering.

Their vision for the future reflects a commitment to not only maintain but strengthen their position in the fintech industry, proving that the company is more than ready to adapt, innovate, and lead in an evergreen financial landscape

Wallets Africa represents a transformative force within the financial services sector, demonstrating the potent impact of fintech companies on modern banking and payment systems.

By providing a comprehensive range of financial services tailored to the needs of individuals and businesses across Africa, the company exemplifies how fintech is revolutionizing the way we manage, access, and think about our finances.

Yes, Wallets Africa prioritizes the security of its users.

While Wallets Africa primarily serves users within the African continent, it offers features that facilitate international transactions.

Wallets Africa operates with a transparent fee structure for its various services. This includes fees for transactions such as money transfers, card maintenance, and withdrawals, among others.

Users can apply for both virtual and physical debit cards through the Wallets Africa app.