Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

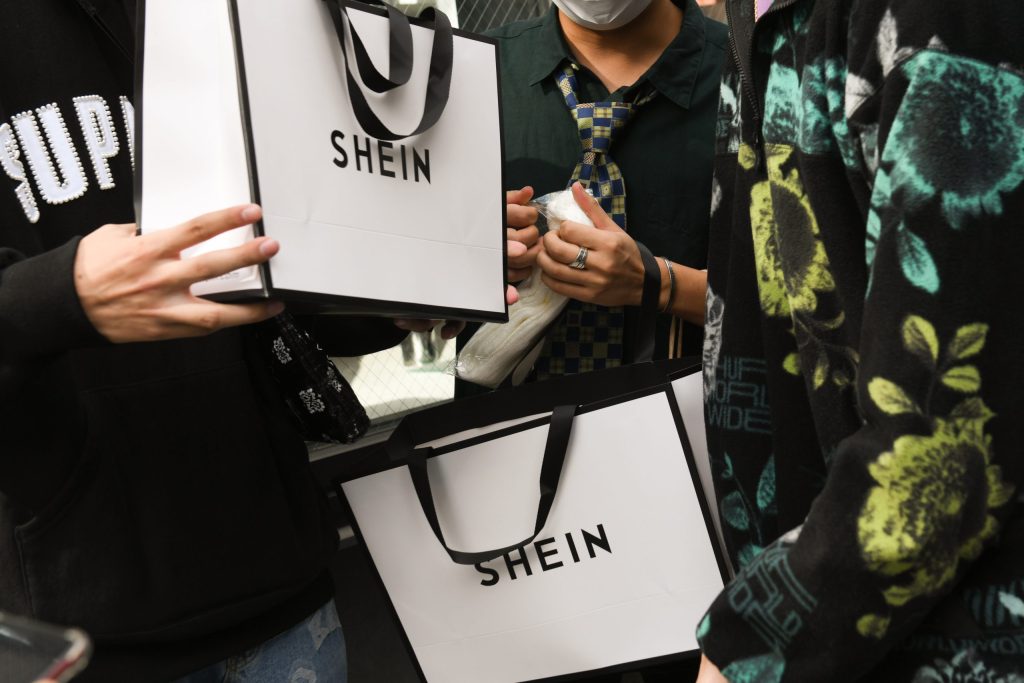

In a significant development that has sent shockwaves through the e-commerce industry, the South African Revenue Service (SARS) has issued a major setback to global e-commerce giant, Shein.

The move, which has far-reaching implications for the company’s operations in the country, highlights the ongoing struggle of international businesses to navigate the complexities of tax compliance in South Africa.

Shein, a Chinese-based e-commerce company, has been embroiled in a long-standing dispute with SARS over its tax obligations in the country.

The company, which has gained immense popularity globally for its affordable and trendy clothing, has been accused of evading taxes by misrepresenting its sales figures and failing to declare income earned in South Africa.

Also read: South African Uber, Bolt drivers to storm legislature to Protest Abuse from e-hailing Companies

In a bold move, SARS has taken the decision to issue a formal notice to Shein, demanding that the company pay a significant amount of back taxes and penalties.

The notice, which was served on the company earlier this month, has sent a clear message that SARS will not tolerate tax evasion and will take decisive action against businesses that fail to comply with tax laws.

The setback for Shein comes at a time when the company is already facing intense competition in the global e-commerce market.

The move by SARS is likely to further erode the company’s market share in South Africa, where it has been a dominant player in the fashion industry.

Read More: Nigeria’s Tax Agency Files Charges Against Binance for Tax Evasion

The dispute with SARS is expected to have significant implications for Shein’s operations in South Africa.

The company may be forced to scale back its operations or even consider exiting the market altogether if the dispute is not resolved amicably.

This could have far-reaching consequences for the company’s employees, suppliers, and customers, who rely on Shein for their livelihoods.

The dispute highlights the importance of tax compliance for international businesses operating in South Africa.

Companies that fail to comply with tax laws risk facing severe penalties and reputational damage, which can have long-term consequences for their operations.

Also read: With 39% Share, Showmax Becomes Africa’s Biggest Streaming Platform Ahead of Netflix

SARS has reiterated its commitment to ensuring that all businesses operating in South Africa comply with tax laws.

The agency has emphasized that it will continue to take decisive action against businesses that fail to comply with tax laws, and will work closely with international partners to ensure that tax evasion is not tolerated.

The setback for Shein is a significant development in the ongoing struggle of international businesses to navigate the complexities of tax compliance in South Africa.

The move by SARS sends a clear message that tax evasion will not be tolerated, and that all businesses operating in the country must comply with tax laws.

As the dispute continues to unfold, it remains to be seen how Shein will respond to the setback and whether the company will be able to resolve the issue amicably.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.