Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Life throws curveballs, and sometimes you need cash fast. Online microfinance loans in Nigeria are a quick way to get money in an emergency.

Forget waiting around at a traditional bank. People are using these online loan platforms for things like school fees, keeping their businesses stocked, doctor’s bills, and rent.

It’s easier than ever to find microfinance banks that offer loans with easy repayment plans and not a ton of requirements.

Because there are so many companies offering these loans, you have more choices and can find what works for you.

You can apply through a mobile app or website and get the cash pretty quickly, which makes dealing with money problems a bit less stressful.

So, let’s check out the online microfinance scene in Nigeria: how much you can borrow, what the interest rates are, and why they might be a good fit for you.

Basically, it’s a small loan you can apply for on your phone or computer, without going to a bank. They’re mostly for business owners, traders, employees, or anyone who needs money quickly for personal or business stuff.

Most of these microfinance banks know people want cash fast. That’s why they use online platforms to process applications and send money within hours or a couple of days.

The best part? It’s easy to get. A lot of Nigerians who can’t get loans from regular banks can now get money through these online services because they don’t ask for as much.

Related – Loan Apps that Give ₦50,000 Instantly in Nigeria

Microfinance banks in Nigeria have different loan options to fit what you need. Here’s the lowdown on some of the usual types:

Right now, there are a ton of online microfinance loan apps in Nigeria. They’re perfect if you need cash without putting up any stuff as collateral. Great for business, emergencies, or just everyday needs. All they need is your BVN and bank info.

Here’s a look at 15 of the top options, with what they offer, who can apply, how it works, the good and bad, and some tips.

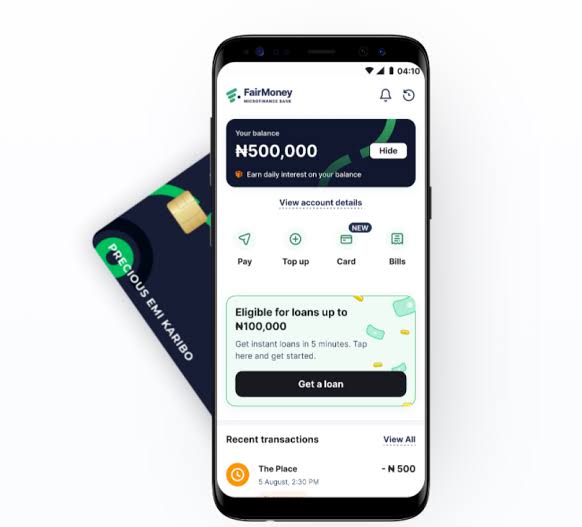

FairMoney is a fully online bank that gives out loans pretty fast – from about ₦1,500 to ₦3,000,000. They send the money straight to your bank account in under 5 minutes, and you don’t need collateral or a bunch of paperwork.

Interest and Terms: The rates are per month, and the loan terms can be from a couple of months to a couple of years. If you’re doing well, you can borrow more or extend your loan.

Eligibility: You need to be over 18, live in Nigeria, have a BVN and bank account, use an Android phone, and make at least ₦1,000 a month. If it’s your first time, they’ll give you a smaller amount, but it can increase as you pay back.

How to Apply: Download the app, sign up with your phone and BVN, connect your bank, and see what you’re approved for. If you like the offer, accept it and they’ll send the money.

The Good: It’s super fast, you don’t need someone to guarantee your loan, and you get free transfers and savings.

The Bad: The rates can be high if you’re seen as a riskier customer, and there are late fees.

Best For: Emergencies or boosting your business. Pay back early to get access to bigger loans.

Also Read – FairMoney USSD Code For Loan And Transfer in Nigeria with FAQs

Renmoney specializes in personal and business loans with reasonable rates, up to ₦1M+, with flexible terms for people with a steady income.

Interest and Terms: Rates are monthly, and the loan terms can be from a few months up to a year. They don’t charge a lot of fees.

Eligibility: You need a BVN, bank statements, and proof of income. The application is done mostly online.

How to Apply: Upload your documents through the app or website, get approved in a few hours, and they’ll transfer the money to your bank.

The Good: Good rates and larger amounts for people they trust.

The Bad: It’s slower than other apps, and you need to prove you have a steady income.

Best For: Getting money for a medium-term goal.

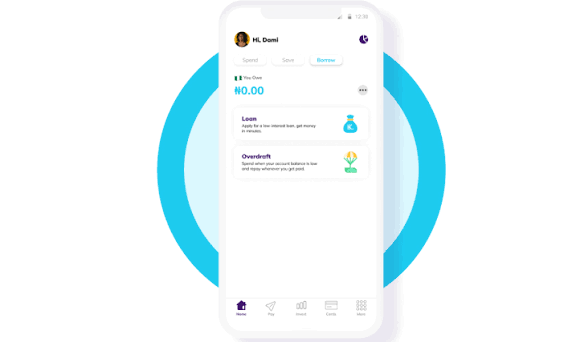

Kuda’s loans are like overdrafts, up to ₦150,000, and come with free banking perks.

Interest and Terms: It’s per day and flexible.

Eligibility: You need a Kuda account and transactions.

How to Apply: Request an overdraft in the app.

The Good: No fixed term and no other fees.

The Bad: The daily interest can add up.

Best For: Ongoing credit for users.

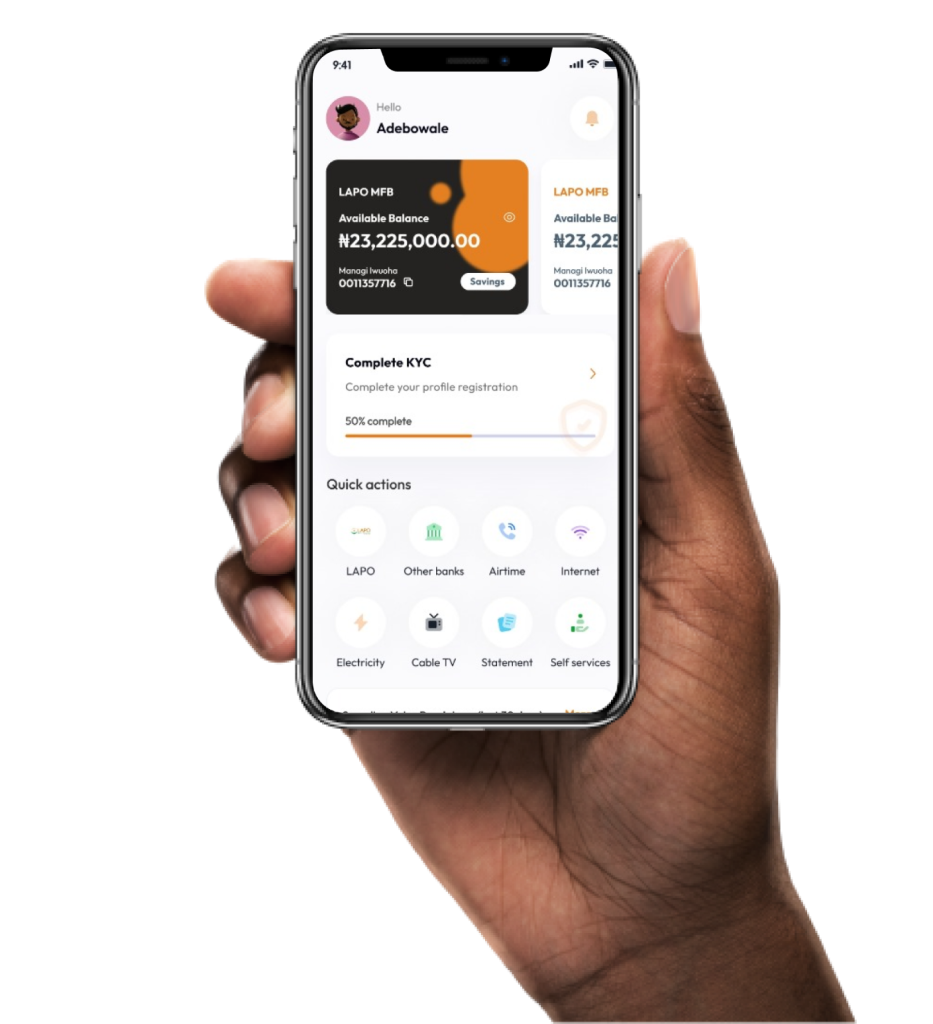

LAPO Mobile app offers group loans up to ₦500,000 for business owners.

Interest and Terms: Low, monthly, and for a few months to a year.

Eligibility: You need a BVN and group membership is optional.

How to Apply: Through the app or a branch.

The Good: Social lending safety net.

The Bad: Group liability risks.

Best For: Cooperative hustles.

Read Also – Loan Apps in Nigeria that Give Loans Without Credit Check

Spectrum is becoming a solid option for borrowers searching for an online microfinance loan in Nigeria because of its flexible loan structure and easy application process. The platform supports both individuals and small businesses with quick funding access.

Interest and Terms: Interest rates typically range between 3% and 7% monthly. Loan duration usually lasts between three months and one year. Consistent repayment improves borrowing limits.

Eligibility: You must be at least 18 years old, live in Nigeria, own a BVN, and have a stable income source.

How to Apply: Visit their website or partner platforms, fill out your application form, verify your BVN, and submit your details.

The Good: Fast processing and flexible repayment.

The Bad: New borrowers may receive smaller loan amounts.

Best For: People who need an instant online microfinance loan for urgent needs.

AB Microfinance is one of the most recognized microfinance banks that give loans in Nigeria, especially for business owners.

Interest and Terms: Rates range between 2% and 6% monthly. Loan repayment can extend up to three years depending on the loan size.

Eligibility: Applicants must run a business or have a stable salary, possess BVN, and maintain an active bank account.

How to Apply: Borrowers can Apply for microfinance loans through online channels or branch offices.

The Good: Higher loan limits and strong business support.

The Bad: Approval may take longer than digital-only lenders.

Best For: Business growth and expansion.

Mutual Benefits supports individuals and small enterprises seeking the Best online microfinance loan in Nigeria.

Interest and Terms: Monthly interest falls between 3% and 8% with flexible repayment plans.

Eligibility: Requires BVN, income proof, and valid identification.

How to Apply: Apply through their official website and submit required documentation.

The Good: Customer-friendly repayment structure.

The Bad: Loan approval depends strongly on income verification.

Best For: Small traders and startup owners.

Also Read – Best Loan Apps with Low Interest Rate in Nigeria

Advans Lafayette is popular among entrepreneurs looking for structured and reliable business financing.

Interest and Terms: Interest ranges from 2% to 5% monthly. Loan tenure can extend up to 36 months.

Eligibility: Applicants must own a registered business or show proof of steady employment.

How to Apply: Apply online or through physical branches with business or employment details.

The Good: Supports large business expansion.

The Bad: Requires more documentation.

Best For: Entrepreneurs seeking long-term business funding.

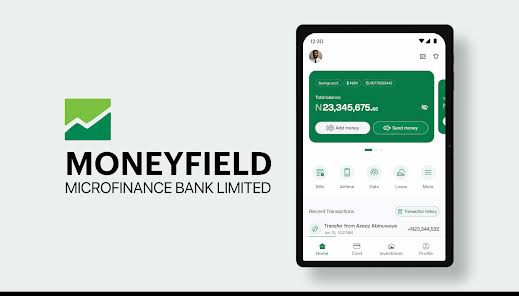

Moneyfield provides fast financial support for individuals and SMEs seeking an online microfinance loan in Nigeria.

Interest and Terms: Rates range between 3% and 7% monthly with flexible repayment plans.

Eligibility: Applicants must live in Nigeria, possess BVN, and maintain an active bank account.

How to Apply: Submit loan requests online or through branch offices.

The Good: Quick loan processing.

The Bad: Loan amounts depend heavily on credit score.

Best For: Personal and business financial emergencies.

Blue Ridge offers structured financial solutions for salary earners and business owners.

Interest and Terms: Monthly rates usually fall between 3% and 6% with repayment lasting up to 18 months.

Eligibility: Requires BVN, valid ID, and income proof.

How to Apply: Apply online or visit their branch office.

The Good: Reliable repayment structure.

The Bad: Not as fast as some instant lenders.

Best For: Salary earners seeking stable loan options.

Read Also – Where to Get Urgent Cash Loan Without Documents in Nigeria

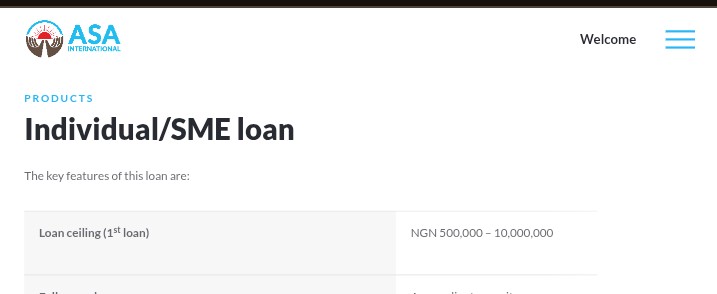

ASHA focuses on financial inclusion and supports low-income earners and traders.

Interest and Terms: Interest rates range from 2% to 6% monthly. Loan duration is usually up to 12 months.

Eligibility: Applicants must provide BVN and evidence of income.

How to Apply: Borrowers can Apply for microfinance loans through official online channels.

The Good: Affordable loan structure.

The Bad: Lower loan limits for new customers.

Best For: Small-scale traders and low-income earners.

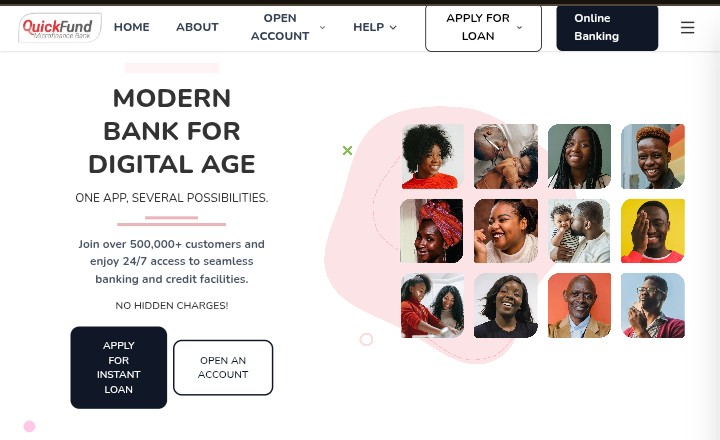

QuickFund is widely used for instant online microfinance loan services designed for emergencies.

Interest and Terms: Interest ranges between 4% and 9% monthly. Loan tenures are usually short-term.

Eligibility: Applicants must be 18 years or older with a BVN and bank account.

How to Apply: Register on their platform, verify your details, and accept the loan offer.

The Good: Very fast approval.

The Bad: Short repayment periods.

Best For: Urgent financial needs.

Mutual Trust is one of the reliable microfinance banks that give loans in Nigeria offering structured lending services.

Interest and Terms: Monthly rates range from 3% to 7% with flexible repayment plans.

Eligibility: Requires BVN, identification, and proof of income.

How to Apply: Submit applications online or through branch offices.

The Good: Reliable loan packages.

The Bad: Approval speed depends on documentation.

Best For: SMEs and personal loans.

Also Read – How to Apply For a Temporary Loan at Standard Bank in South Africa

Regent provides flexible financing for individuals and SMEs looking for an online microfinance loan in Nigeria.

Interest and Terms: Interest typically ranges between 3% and 7% monthly with repayment up to 12 months.

Eligibility: Applicants must have BVN, valid ID, and stable income.

How to Apply: Apply online or visit their branch.

The Good: Flexible loan structure.

The Bad: Loan limits may start small.

Best For: Personal and business funding.

TrustBanc is gaining attention among borrowers searching for the Best online microfinance loan in Nigeria.

Interest and Terms: Rates range between 3% and 6% monthly with repayment lasting up to 18 months.

Eligibility: Applicants must be 18+, possess BVN, and have stable income.

How to Apply: Register through their digital platform, verify identity, and accept loan offers.

The Good: User-friendly digital process.

The Bad: Late payment penalties apply.

Best For: Quick personal and business support.

Read Also – How to get an FNB Loan without Payslip

There are a lot of loan apps out there, but not all of them are safe. Stick to lenders that are licensed to protect your info and avoid scams.

They mostly use your BVN, phone activity, or bank transactions to decide if you’re eligible, so you don’t need physical stuff for most loans.

They’re fast, but interest rates can be different. Make sure you read the terms before you agree. Some apps give you better offers if you pay back early.

They need your BVN and a bank account so they can send you money and confirm who you are. Real lenders don’t ask for access to your photos, contacts, or messages.

Read Also – Can I Get a Business Loan Without Collateral in Nigeria?

It’s pretty easy to get a loan these days:

The money goes straight to your bank account. No need for paperwork or going to an office.

It can be approved in minutes or hours, depending on the lender. A lot of platforms use automated systems to review applications, so you can get the cash quickly after approval.

It depends! Compare interest rates, repayment plans, loan limits, and reviews. Pick a platform with clear terms and fair repayment options that work for you.

Yes! A lot of online lenders offer loans without asking for anything physical. They use credit scores and online data to decide if you’re eligible.

Late payments can mean extra charges, lower credit scores, and less chance of getting loans in the future. Some lenders might limit access to higher loan amounts until you clear previous loans.

With the rise of these online platforms, it’s easier and more flexible to borrow money.

Finding the best one means carefully comparing the terms and plans.

If you’re thinking about applying for a loan, remember to borrow responsibly. Paying back on time can help you get better credit and create a more stable financial situation.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.