Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

In today’s fast-paced world, it’s not uncommon to want financial assistance to meet a variety of non-public or professional obligations. Whether it’s unforeseen medical bills, college costs, home improvements, or debt consolidation, having access to a fee range can make a significant impact.

Recognizing the economic concerns that salary earners have, Zenith Bank, a well-known financial institution, offers tailored lending solutions to meet their specific needs. With a commitment to promoting financial security, Zenith Bank’s loan for salary earners is developed exclusively for earners like you.

This loan serves as a safety net, helping you cover short-term needs until your next payment. However, before you jump in and apply, you should first comprehend the Zenith Bank loan requirements and determine whether a specific Zenith Bank loan code is required.

In this article, we will go over all you need to know about the Zenith Bank Loan for salary earners, including eligibility requirements and application information. So, keep reading to discover if this loan is a good fit for your existing situation.

Salary earner loans, sometimes known as private loans, are financial products meant to help individuals fulfill their immediate financial needs. These loans provide a convenient way to have access to funds without demanding any collateral. Zenith Bank’s loan for salary earners is an excellent option for those looking for quick and hassle-free financing.

To be qualified for a Zenith Bank loan for income earners, applicants must meet certain criteria. Generally, candidates should be employees of legitimate organizations, government agencies, or multinational corporations. The financial institution may also require a minimum monthly profit and a strong employment history.

The loan amount and tenure granted are generally influenced by the applicant’s wages, creditworthiness, and compensation capabilities. It is important to note that the loan amount must be within a reasonable range to ensure affordability and ease of repayment.

Read Also – Titan Trust Bank: USSD Codes, Loans and Financial Services

Zenith Bank provides a variety of loan solutions tailored to the dreams of income earners, including:

These are some of the common loan alternatives available to customers, however, precise terms and conditions may differ depending on individual circumstances and the financial institution’s recommendations. It is recommended that you contact Zenith Bank right away to obtain accurate data and qualifying conditions.

Zenith Bank often offers loans to salaried individuals who meet certain requirements. The Zenith Bank loan requirements may also include the following:

This condition means that to obtain a loan, you will need someone who is already a major customer of the financial institution to vouch for you.

This figure, known as a guarantor, serves as a backup if you are unable to repay the debt. Having a guarantor who is a significant Zenith Bank customer ensures the bank that they have someone reliable who can step in if necessary.

Being duly registered indicates that your agency has completed the necessary criminal methods and office work required by Nigerian law to function as a valid organization.

This registration recognition reveals to the financial community that your commercial organization has been identified by the authorities and operates within the prison framework, which is critical in determining your commercial enterprise’s legitimacy and eligibility for loan consideration.

The demand for a letter of employment means that if you’re a profit earner seeking a loan, you’ll need to provide a record from your employer certifying your employment reputation. This letter normally includes information such as your position, pay, and length of employment.

The acronym BVN stands for Bank Verification Number. It’s a very specific identification number issued by the Central Bank of Nigeria to everybody with a bank account in Nigeria.

The BVN is a safety diploma designed to combat fraud and improve the security of banking transactions. When applying for a loan with Zenith Bank, your BVN is usually necessary.

This condition means that if you are a revenue earner applying for a loan from Zenith Bank, you must have been consistently collecting your income for the last six months.

This arrangement ensures that you have a consistent source of income for a short period, proving your ability to meet your loan repayment obligations. By validating your income payments for more than six months

Also Read – Sterling Bank USSD Code for Transfer and Loans

Zenith Bank’s loan code is *966#. This is the financial institution’s USSD code, which may be used to complete practically any banking transaction straight from your cell phone, including loan applications for revenue earners.

To apply for a Zenith Bank loan via USSD, dial *966*11# from your phone and follow the directions. You may be requested to provide your account type, PIN, and loan amount. Once you’ve submitted your application, the bank may respond within a few minutes.

If your application is approved, the loan amount may be credited to your Zenith Bank account instantly. You can then use the loan for whatever purpose you like.

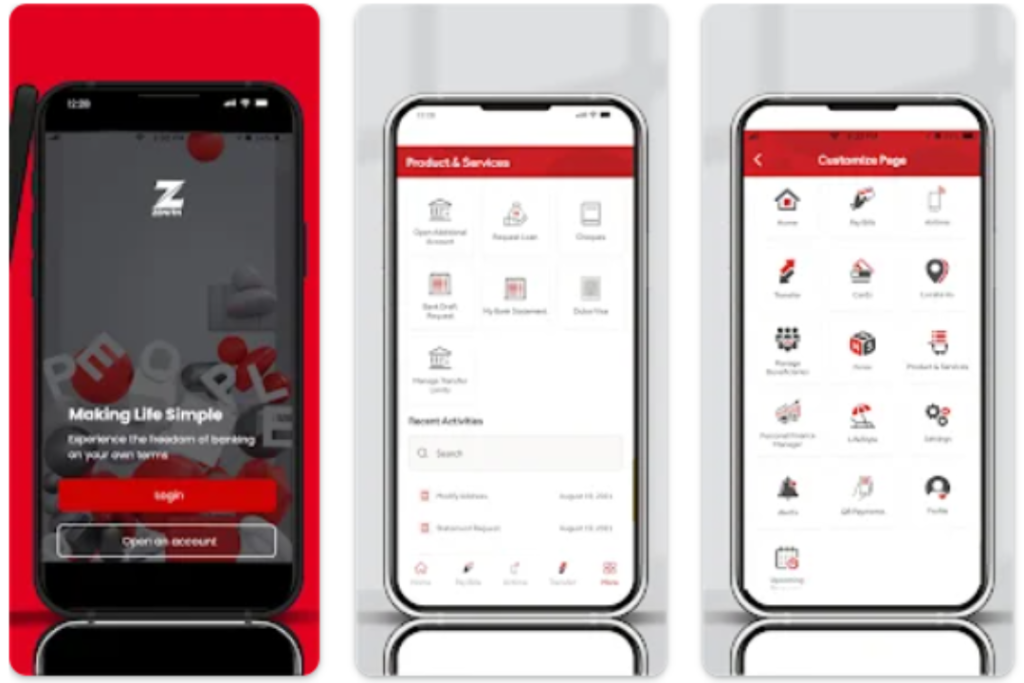

You can apply for a Zenith Bank loan for salary earners using a different approach. Either you apply in person at any Zenith Bank branch, or online via the Zenith Bank website or mobile app. You can also apply for the loan using Zenith Bank’s USSD Code. The following are the various application methods for Zenith Bank salary earners loans.

To apply for a Zenith bank salary-earning loan through the bank, complete the steps outlined below:

To apply for a Zenith Bank salary-earning loan via their website or mobile app, follow the steps outlined below.

If you want to apply for a Zenith Bank Salary Earners loan using the Zenith Bank USSD Code, follow the instructions below.

Read Also – Kuda Bank Introduces Loans for Salary Earners after Hitting New Record

The specific procedure for loan approval and disbursement at Zenith Bank can vary depending on the type of loan you apply for, but here’s a general idea:

The Zenith Bank provides competitive interest rates on its loans for salaried individuals, making it an appealing financing alternative. The interest rates vary based on the type of loan and the borrower’s creditworthiness.

The annual interest rate for Zenith Bank personal loans ranges from 18% to 28%, depending on the loan amount and the borrower’s creditworthiness.

Also Read – Boost Loans: how to Easily Apply

Zenith Bank provides convenient repayment options to ensure borrowers’ comfort and flexibility. Here is a step-by-step method to paying down your loan for salary earners:

Competitive Interest Rates: Loans salary-earning have competitive interest rates, making them more cheap and cost-effective than alternative borrowing solutions.

Zenith Bank provides loans for salary earners with reliable needs and quick access via their loan code. Zenith Bank keeps you covered for emergencies, investments, and private duties.

Obtaining the financial assistance you seek has never been easier, thanks to affordable interest rates and flexible payment alternatives. Don’t hesitate to find these loans today and take control of your financial future.

For further information and updates, leave a comment and follow us on social media: Facebook at Silicon Africa, Instagram at Siliconafricatech, and Twitter at @siliconafritech.

No, the salary earner loans are intended specifically for employees of reputable organizations, government organizations, or international agencies. Self-employed individuals may also discover other loan choices available at the financial institution.

Yes, you can apply for a loan even if you have an existing one. However, before accepting the new loan, the financial institution will evaluate your compensation potential based on your current financial responsibilities.

The loan approval process is typically efficient and rapid. After submitting a complete application with all necessary files, you should expect to receive a response within a few business days.

Defaulting on loan repayment may have serious consequences, such as a negative impact on your credit score and legal action by the bank. It is critical to meet your reimbursement responsibilities to maintain a healthy financial status.

Zenith Bank supports early loan repayment and does not impose prepayment charges. Repaying the debt ahead of time helps you keep interest rates low.